The Finance Round-Up: December 3rd 2007

Posted by ilargi on December 2, 2007 - 11:07pm in The Oil Drum: Canada

Editorial Note from Stoneleigh: Round-Ups do not always make the front page at TOD. For access to all our work, please check the TOD:Canada site regularly. The last Finance Round-Up (November 29th) can be found here. We intend to publish them twice a week.

It’s not that I was wrong when I said we’d see the US economy propped up for one last good Christmas shopping season. It’s just that accountants, auditors and ratings agencies have started to feel so much heat, they’re afraid they’ll be left sitting all alone on the hot cinders around the tree, with a shaky conscience and nothing in their socks to start the new year but pink slips and indictments.

Today, in early December, it’s still possible that the worst decay remains buried till 2008, but we can’t be sure anymore. What we see is America’s largest mortgage lender, Countrywide, hanging on by a thread, while America’s, and the world’s, biggest bank, Citigroup, may be beyond redemption. After recent securities losses, and $40+ billion more predicted, Citi now admits to a $17 billion write-down on its SIV’s, which still leaves another $66 billion of braindead “assets”.

Ratings agencies are trying to stay afloat, and increasingly, in the face of congressional investigations, out of prison. To show their good will, they’ve started downrating companies, bonds, and all sorts of securities. This’ll likely be the end for many bond insurers. Is that so bad? Ambac carries $620 billion in structured paper, with $9 billion in cash. ACA insured $61 billion in assets, with $326 million in cash. Isn’t it just good riddance?

Well, Ambac are underwriters for paper issued by the likes of Countrywide, GMAC and Lehman Bros, and Ambac’s demise will drag down, way down, all the paper they insured, and the clients that issued it.

And it gets worse, with the forced sale of E*Trade’s mortgage-backed securities. E*Trade got $2.5 billion from Citadel, a hedge fund, under condition that they sell their MBS. Since nobody trades that stuff these days, for fear of finding out the true value, this sale is a rare glimpse behind the veil. The price they got is 11 to 26 cents on the dollar, a potential 89% loss.

Why is that important? It sets a new rule, law, value, for all remaining mortgage-backed securities, trillions of dollars “worth”, that remain in vaults all over the world. For all of them, it just got a whole lot harder, if not downright impossible, to get more than 11 cents on the dollar. Moreover, E*Trade was the only offer in the market when they had to sell. If more, and bigger, parties are forced to unload simultaneously, the price’ll go down, so says the free market.

E*Trade firesale seen hurting Wall Street portfolios

E*Trade Financial Corp's firesale of mortgage-backed securities has conjured up a new worst-case scenario for Wall Street's portfolio of subprime assets by knocking their value even lower.

Financial analysts on Friday said E*Trade got anywhere from 11 cents to 27 cents on the dollar for its $3.1 billion portfolio of asset-backed securities. The portfolio sale was part of a $2.5 billion capital infusion from a group led by hedge fund Citadel investment Group.

"The portfolio sale, one of the few observable trades of such assets, has very clear, generally negative, implications for the valuation of like assets on brokers' balance sheets," Credit Suisse analyst Susan Roth Katzke said.

The portfolios are hard to value because demand has dried up for them and the brokerages sometimes use their own models to put a value on the assets. Any rare actual transaction could have an effect on other brokerages' valuations.

Using what she called a simplistic analysis, Katzke estimated Merrill Lynch & Co Inc. could take a $9 billion after-tax hit to the valuation of assets underpinned by subprime mortgages. That estimate assumes the Merrill assets would be marked down to 26 cents on the dollar.

Goldman Sachs analysts said they were surprised by the size of the discount on the E*Trade portfolio because 73 percent of the assets were backed by prime mortgages, or loans to people with solid credit.

In contrast, Wall Street brokerages have taken billions of dollars of write-downs on assets underpinned by subprime mortgages. Escalating defaults on these loans to people with weak credit have roiled credit markets worldwide.

Citigroup investment bank analyst Prashant Bhatia said E*Trade actually received 11 cents on the dollar for its portfolio, if you factor in that the brokerage received $800 million in cash minus 85 million shares it issued. He said that implies Citadel's received stock compensation worth about $450 million, leaving E*Trade with only $350 million for its $3.1 billion portfolio.

E*Trade Marked To Reality - What Happens If Citigroup Is?

SIVs are off balance sheet assets partially owned by Citigroup. While Citigroup it may not have to provide funding, if those SIVs lose money Citigroup will lose money.

However, because those assets are off balance sheet, Citigroup does not have to mark those losses to market. Citigroup desperately does not want those SIVs on their balance sheet. Nor does Paulson, nor does anyone else who is involved in SIVs. Quite simply Citigroup cannot afford to have those assets on its balance sheet. That is how I interpret Citigroup's statement "Citigroup will not take actions that will require the Company to consolidate the SIVs."

[..]

This past week Citigroup gave up close to 5% of its equity in a panic move to shore up capital in return for a $7.5 billion in cash.But what happens when they need another $26 billion as Credit Suisse analyst Susan Katzke is suggesting? What happens if those level 2 assets were marked to market? What happens if Citigroup has to bring those SIVs back on to its balance sheet? What happens when Moody's, Fitch, and the S&P continue downgrading CDOs? What happens now that credit card losses are rising and commercial real estate is tanking?

To reduce further leverage by selling assets, Citigroup will have to mark any assets its sells to reality at a time when nearly all asset classes are under attack. Good luck reducing leverage.

Citigroup had $127 billion in equity "on paper" as of September 30th 2007 . The closer one looks at this the more suspect that equity is.

Some analysts fear that mainstream banks will be burned by a time bomb in the bond insurance business.

Wall Street banks aren't the only ones taking a drubbing these days. Bond insurers, which guarantee municipal bonds and operate in a sleepy corner of the fixed income world, also insured subprime mortgage-backed securities. As a result, shares of bond insurers like Ambac Financial Group, MBIA and ACA Capital have tanked.

Now ratings agencies are thinking about downgrading their debt. If that happens, the repercussions could be serious, not just for the bond insurers but also for the municipalities that issue bonds and the banks that underwrite them. Indeed, analysts speculate that problems in the municipal bond business could be the next shoe to drop on Wall Street.

If so, more ugly surprises may be in store for wary investors. As more mortgage-backed securities threaten to default, billions of dollars in additional losses could loom. Moreover, banks like Canadian banking giant CIBC and Britain's Barclay's, which many assume have dodged the worst of the bad-mortgage bullet, could be on the hook for insurance payments guaranteed by bond insurers (more on that later).

"It's like the perfect storm," said Kyle Bass, the managing partner with Hayman Capital, a hedge fund that scored big by shorting subprime securities. "The insurance industry is dealing with 10 hurricane Katrinas."

I came to this conclusion after a detailed analysis of Ambac's portfolio (at least what Ambac has made public, which was sufficient) covering exposure in the Structured Finance, Sub-prime RMBS and the Consumer Finance business

Six Degrees of Separation: Guess who Ambac insures!

Bank of America issued a report on the monoline insurers on July 30th, 2007 that states that ABK's RMBS exposure to troubled companies is limited to only 4 cos. with vintages primarily in the early years excluding two relatively well performing underwritings. Despite this, they failed to include in this caveat the consumer finance insureds:

- Countrywide: one of the worst performing portfolios in the industry

- GMAC: significant losses that GM has been forced to cover

- Indymac: shares more than halved in the last few months

- Lehman brothers: 2nd largest MBS house on the street

- Greenpoint Mortgage Funding is defunct

- Citimortgage (SIV king whose own mortgage portfolio is a mess)

- Accredited Mortgage Loan (bankrupt or close to it)

- Wachovia (just reported a billion plus writedown on mortgage assets)

- Countrywide Revolving Equity Trust/Alt-A trust

- Option One Mortgage Trust (nearly defunct due to mortgage losses)

- BofA, mulit-billion dollar mortgage asset writedown

- Newcastle – either out of business or close to it

These are the companies and exposure that I am familiar with, at first glance in the consumer finance portion of Ambac's portfolio, without any research. Just imagine if I took a real hard look at the insureds.

Now, using some common damn sense, would you think that the company that is insuring these guys' mortgage and finance products with 90x leverage may be having some problems that they may not be coming forward with. I have over 100 pages of proprietary analysis and calculations costing me weeks of analyst hours, that tell me Ambac may be out of business soon - but I really didn't need to do all of that math and research if I just glanced at the bullet list above.

Close an Eye and Short The Bond Insurers

In a prior post entitled Close Your Eyes and Short The Banks I said that the banks exposed to subprime backed mortgage bonds are all insolvent. So why would the bond insurers be any more solvent? We maybe able to carefully enter at an optimal chart point, but to what advantage? I have been in and out of short positions on Countrywide Financial (CFC) from the forties.

It would have been a lot easier and I would be a lot wealthier if I just went short and never looked at the chart. Before two days ago I never would of dreamed to think about shorting a ham and egg sandwich without a stop (and certainly not publicly). But ask yourself this: if the Street criminals cannot keep Countrywide (Bear Sterns) afloat what chance does Ambac or MBIC have?

And notice how lately the rating agencies have found a relatively small pulse with regard to issuing downgrades compared to the noise about it in the financial press. If you didn't know better wouldn't you think the agencies were just charging to the rescue? These credit rating agencies who had been breaking their necks to see no evil now come out and downgrade the same junk they knew was toxic while issuing AAA rating to them. So of course they are late to the party.

Moody's cuts or may cut over $100 billion of SIV debt

Moody's Investors Service on Friday said it cut, or may cut, its ratings for over $100 billion worth of securities issued by specialized funds known as structured investment vehicles.

Moody's pointed to continued decline in the value of the investments made by structured investment vehicles, or SIVs, in downgrading or issuing warnings for about $116 billion of their debt. Nearly $65 billion of securities issued by SIVs sponsored by Citigroup Inc., a major player in this market, were downgraded or put on watch for a downgrade, according to Moody's.

"The situation has not yet stabilized and further rating actions could follow," Moody's said in a news release. The ratings agency said it confirmed, downgraded or placed on review $130 billion of debt from SIVs, or roughly 42 percent of the SIV debt market.

SIVs are bank affiliates that raise cash by selling short-term debt and then buy longer-term and high-yielding securities, often tied to U.S. mortgages.

The Financial Fire Trucks Are Gathering

The real problem is not one of credit or even liquidity, but of confidence in the assets you are purchasing. If you cannot trust an AAA-rated piece of paper in a state-run money market fund, you get very concerned about where to put your money. Until the markets start offering investment products with full transparency and real guarantees for the higher-rated tranches, it is going to be difficult to restart the asset-backed security markets.

(And with credit insurers being threatened with a drop in their credit ratings due to inadequate capitalization for the mortgage guarantees they provided, even insurance is no longer seen as a solid back-up. That is a major fire truck parking next to the building, but one that is being ignored. Talk about a threat to the entire system.)

One encouraging thing to note is that large hedge funds are stepping in to provide liquidity and loans where banks and the usual markets cannot. Of course, they do this at a price. Abu Dhabi got 11% for its money for bailing out Citi, although they did agree to convert their debt into stock at higher prices than the current market price. But 11% for a few years guarantees them a total investment at what they must have considered an attractive rate.

Sovereign wealth funds run by countries now control $2.5 trillion. It is estimated that this will grow to $10 trillion within 5 years. They are going to be a major force in the markets. While some view this with alarm, others will note that the California pension funds are a sovereign wealth fund of sorts.

Finding Fraud: Fitch To Overhaul Ratings Process, Will Review Originators and Issuers

Fitch Ratings today issued a wide-ranging press statement that offered some analysis of the problems plaguing the RBMS and mortgage-related derivatives market, and dropped some bombshells on changing the ratings process.

First, Fitch noted that fraud is a bigger problem among recent subprime vintages than previously thought:… the extraordinarily high level of defaults encountered by the 2006 vintage cannot be explained by home price declines alone. It has become increasingly evident that loans originated with lax underwriting and higher instances of fraud can have a material impact on a securitization.

This will likely be reported as big news, but it really shouldn’t be — to those of us with any background servicing loans, and especially to anyone who has ever worked in default management, this has long been a known quantity. It’s been well known by most servicers for years that fraud, in a more traditional sense, is usually one of the key drivers behind default activity.

The difference here, of course, is that lax underwriting standards enabled fraud at levels large enough that it’s now being discovered by investors as if it were new; which is some ways, it is, because it’s now “material” to securitizations.

Innovating Our Way to Financial Crisis

How bad is it? Well, I’ve never seen financial insiders this spooked — not even during the Asian crisis of 1997-98, when economic dominoes seemed to be falling all around the world.

This time, market players seem truly horrified — because they’ve suddenly realized that they don’t understand the complex financial system they created....

....Credit — lending between market players — is to the financial markets what motor oil is to car engines. The ability to raise cash on short notice, which is what people mean when they talk about “liquidity,” is an essential lubricant for the markets, and for the economy as a whole.

But liquidity has been drying up. Some credit markets have effectively closed up shop. Interest rates in other markets — like the London market, in which banks lend to each other — have risen even as interest rates on U.S. government debt, which is still considered safe, have plunged.

“What we are witnessing,” says Bill Gross of the bond manager Pimco, “is essentially the breakdown of our modern-day banking system, a complex of leveraged lending so hard to understand that Federal Reserve Chairman Ben Bernanke required a face-to-face refresher course from hedge fund managers in mid-August.”

Foreclosures Aren’t the Result of ARM Resets…Yet

The national foreclosure rate has climbed steadily throughout 2007. While most reports attribute the bulk of the foreclosures to ARM resets, the reality is that more than half of the borrowers who are defaulting are still in their first year of the loan.

As bad as the crisis seems, it is about to get worse. A real wave of resets is on the way.

Bank of America Securities estimates that rates will reset on $362 billion worth of adjustable rate subprime mortgages in 2008. At the same time, resets will also occur on $152 billion worth of other loans with adjustable rates, such as Alt-A loans and jumbo loans (loans over $417,000).

The prediction is significant because the majority of the foreclosures documented to date are not the result of ARM resets but other factors like falling home prices and lax underwriting standards.

Rod Dubitsky, an analyst with Credit Suisse, recently stated that more than half of the foreclosures and subprime delinquencies in 2007 involved loans that did not yet reach a reset point.In other words, the majority of borrowers are not defaulting because of rising payments; they are losing their home because the initial payment is too much to handle.

Wells Fargo woes show breadth of mortgage meltdown

Here's more evidence that you can't call the mortgage crisis a subprime problem.

On Tuesday, Wells Fargo said it will set aside $1.4 billion for home-equity loans it expects to go bad in 2008 and 2009. What it didn't say in its news release was that these are not loans to borrowers with subprime credit scores.

"This was a prime portfolio," Wells Fargo spokesman Chris Hammond says.

The average FICO credit score for all Wells Fargo home-equity loans is 750, well into prime territory. The midpoint of all credit scores in America is 723. Only 40 percent of credit scores are 750 or higher. Subprime starts in the mid-600s and goes down from there, according to Fair Isaac, the company behind FICO scores.

Wells could not provide the average credit score for the loans it is writing down, but Hammond confirmed it's prime. What probably made these loans risky was not the credit score, but other features, such as no income documentation and high loan-to-value ratios.

The Next Dominos: Junk Bond And Counterparty Risk

Ilargi says: A recommended primer on CDOs, CDS, "high"-yield bonds and counterparty risk

Financial history doesn't repeat itself, but it often rhymes. Earlier this year, losses from subprime mortgages revealed that the financial markets had taken to excess a good idea in the real economy. A perfect economic environment allowed the alchemists in structured finance to apply massive amounts of leverage on low quality, securitized mortgages.[ii] When the first signs of softening in real estate prices surfaced, we learned that investors had taken on far more risk than anyone realized, and losses could not be contained.

The severity of the subprime debacle may be only a prologue to the main act, a tragedy on the grand stage in the corporate credit markets. Over the past decade, the exponential growth of credit derivatives has created unprecedented amounts of financial leverage on corporate credit. Similar to the growth of subprime mortgages, the rapid rise of credit products required ideal economic conditions and disconnected the assessors of risk from those bearing it.

The amount of outstanding corporate credit and leverage applied to it dwarfs the market for subprime mortgages. As such, the consequences of a problem in this arena may be far more severe than what happened in subprime. If we are going to experience the downside of another economic cycle, we may be in for a painful ride.

Deadbeat Developers Signaled by Property Derivatives

In the bond market, commercial property investors are about as creditworthy as U.S. homeowners with subprime mortgages. "Commercial real estate is a full-blown bubble that feels very much at a bursting point,'' said Christian Stracke, an analyst in London at CreditSights Inc., a fixed-income research firm. "There's a fairly toxic mix of factors at work.''

The seven-year rally in offices and retail properties ended in September when prices fell an average of 1.2 percent, according to Moody's Investors Service. Banks worldwide are holding $54 billion of unsold commercial mortgages, according to data compiled by New York-based Citigroup Inc. that includes fixed and floating-rate debt.

The benchmark CMBX-NA-AAA index of derivatives tied to the safest commercial mortgage securities rose to 102 basis points from 44 a month ago. It costs $102,000 a year to protect $10 million of bonds backed by property loans against default, up from $44,000 a month ago.

Sales of debt secured by commercial mortgages tumbled 80 percent to $3.9 billion in October from a year earlier, data compiled by Bloomberg show. New securities backed by loans on buildings will fall 50 percent in 2008 from $220 billion this year, Moody's said Nov. 2.

Real estate deals are coming apart at the fastest pace since September 2001, when the U.S. economy was shrinking, because banks are tightening standards for loans, said Robert White, president of Real Capital Analytics, a New York-based research firm.

About $15 billion of commercial property transactions of $10 million or more are under contract in the U.S., compared with about $70 billion at mid-year, White said. That's unusual because the number usually rises at year-end, he said.

King Says Asset Decline May Spark 'Credit Squeeze'

Bank of England Governor Mervyn King said there's a risk a further drop in asset prices will lead to more deterioration of credit conditions.

"Market fears about the possibility of further movements in asset prices might impair the balance sheets of the banking system in the U.S., which would lead to a classic credit squeeze,'' King told U.K. lawmakers today. "This is a risk rather than something that's actually happened yet.''

The world's biggest banks have written down more than $50 billion on credit-related losses and UBS AG, Citigroup Inc. and Merrill Lynch & Co. fired their chief executives. The Bank of England today joined the European Central Bank and the Federal Reserve in moving to stem a renewed rise in lending rates, offering banks emergency funds with longer repayment terms.

Borrowing costs have soared as banks hoard cash before the end of the year on concern losses from the collapse of the U.S. subprime mortgage market will spread, keeping lenders from offering money to all but the safest borrowers.

"The big area of concern in my mind is consumption,'' said Bank of England Deputy Governor Rachel Lomax. "It's the most important component of demand and it's most likely to be hit by tighter credit conditions.'' King said corporate investment and commercial property are his biggest concerns.

UK: Pleas for rate cut as interbank loans dive

The sterling interbank market has collapsed at the fastest rate in modern history, prompting pleas for immediate rate cuts from a chorus of top British economists.

Office for National Statistics data sourced to the Bank of England shows the volume of market loans in the banking system plunged from £640bn at the onset of the credit crunch in August to £249bn by the end of September, suggesting British lenders have been hit even harder than US banks in relative terms. Total sterling assets dropped from £3,244bn to £2,876bn.

"This is one hell of a shock to the financial system," said Professor Tim Congdon, a leading monetarist at the London School of Economics.

"A market that has taken 30 years to build has completely imploded in a matter of months. Lenders have been squeezed savagely. We've moved into a different era," he said.

Patrick Minford, a professor at Cardiff University, called for a three-quarter point cut, accusing the MPC of "standing idly by" as three-month Libor spreads rocketed by 75 basis points - a severe tightening of credit. "I regard the Bank's behaviour as highly irresponsible, neglecting a century of monetary teaching from Bagehot on. It is time for some sense to prevail. The Bank look like fools," he said.

ECB rate cut pleas grow as Euribor goes mad

A clutch of Europe's top economists have called on the European Central Bank to cut interest rates at its policy meeting next week, warning of severe downturn unless confidence is restored quickly to the banking system.

The concerns came as one-month Euribor spiked violently by 60 basis points to 4.87pc today, the sharpest move ever recorded. Italy's financial daily Il Sole splashed on its website that the Euribor had "gone mad".

The three-month Euribor rate used to price floating-rate mortgages in the Spain, Italy, Ireland, and other parts of the euro-zone rose to 4.77pc, near its August high and far above the ECB's 4pc lending rate.

Thomas Mayer, Europe economist for Deutsche Bank, said the authorities should take pre-emptive action to unfreeze the debt markets and reduce the danger that events could spiral out of control. "If they don't do anything, this could go beyond just a normal recession. With this credit crisis it could turn into a very uncomfortable situation, with a real economy-wide crunch that we cannot stop," he said.

"We're still seeing considerable stress in the European banking system, especially for smaller banks that can't get credit. I am afraid we could have another Northern Rock case," he said.

It emerged today that Germany's IKB bank had racked up losses of €6.15bn on subprime ventures, although it has been rescued by a pool of German banks.

U.S. Credit Crisis Adds to Gloom in Norway

Ms. Kuvaas is the mayor of Narvik, a remote seaport where the season’s perpetual gloom deepened even further in recent days after news that the town — along with three other Norwegian municipalities — had lost about $64 million, and potentially much more, in complex securities investments that went sour.“I think about it every minute,” Ms. Kuvaas, 60, said in an interview, her manner polite but harried. “Because of this, we can’t focus on things that matter, like schools or care for the elderly.”

Norway’s unlucky towns are the latest victims — and perhaps the least likely ones so far — of the credit crisis that began last summer in the American subprime mortgage market and has spread to the farthest reaches of the world, causing untold losses and sowing fears about the global economy.

Where all the bad debt ended up remains something of a mystery, but to those hit by the collateral damage, it hardly matters.

Tiny specks on the map, these Norwegian towns are links in a chain of misery that stretches from insolvent homeowners in California to the state treasury of Maine, and from regional banks in Germany to the mightiest names on Wall Street. Citigroup, among the hardest hit, created the investments bought by the towns through a Norwegian broker.

A Real Estate Bubble Where? It May Surprise You…

When I returned back home to Bulgaria in late 2004, people everywhere told me that real estate was definitely the best investment; I also heard that real estate is the safest investment — real estate prices never go down, right? Anytime I tried to object, people interrupted me and said that I was just citing textbook stuff that didn’t apply to Bulgaria; this wasn’t the time to be theoretical, but to make money in real estate.Average annual gains in previous years ran about 25-35%, and things were only going to get better. Bulgaria was to enter the European Union in 2007, so Western Europeans were on the verge of rushing to buy our real estate at sky-high prices, thereby making us all rich.

Everybody was convinced that real estate prices in Sofia, the capital of Bulgaria, would reach those of Prague and Budapest, which in turn were supposed to reach those of Rome and Berlin in the not-too-distant future. Everyone was investing in real estate — with borrowed money, of course. The smartest and most educated were buying two or more properties, using the first one as collateral for the second, and the second one as collateral for the third; they were the undisputed geniuses that invented the way to pyramid one financial asset on top of another. Many of them, however, had never heard of Charles Ponzi and Ponzi schemes.

Here is what the big picture looks like: The real estate bubble slope runs from the U.K. to Bulgaria. And here is the explanation. Early in the decade, the beginning of the bubble was in Great Britain. Weak German and French economies forced the European Central Bank to maintain abnormally low interest rates for many years.

This fueled real estate bubbles across the stronger Mediterranean economies (Spain, Portugal, France, Greece) and, later on, in Western Europe. These bubbles in turn spread across Eastern Europe, first in the Czech Republic, Poland, and Hungary, and later on in the Baltic countries (Latvia, Lithuania, Estonia) and the Balkans (Romania, Serbia, Bulgaria). For all practical investment purposes, the real estate bubble has not spared a single country in Europe.

The politicians were told that the euro would ultimately lead to a crisis. They did not care. Indeed, they saw the uses of pushing events to a head – as Romano Prodi candidly admitted as Commission president -- hoping for a “beneficial crisis” that would then enable Brussels to push its agenda, taking over parts of fiscal policy and establishing the beginnings of a debt union.

The euro was to be the midwife of the federal state. We will see about that. I suspect that it will be the midwife of disorder, leading to an existential crisis for the European system.

I don’t know when this will occur, but I suggest that Club Med’s loss of unit labour competitiveness against Germany since 1995 – 20pc for France, 30pc for Spain, and 40pc for Italy (Eurostat data) – has gone beyond the point of no return. We simply await a slow motion train-wreck.

It feels to me like the period from early 1991 to September 1992, when sterling and the lira were at last blown out of the ERM. You could see that the structure was unsustainable.

There is an interesting article in the Telegraph by Liam Halligan stipulating The credit crunch could crush the euro. Let's take a look:

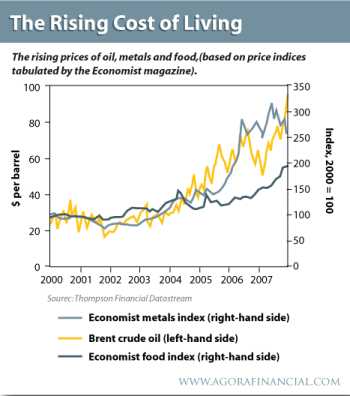

When buyers' access to credit is hobbled, it is right to ask just where the demand will come from to keep property prices firm. No wonder the latest Telegraph/YouGov poll reports two-thirds of voters now worry about a serious downturn. As the economic outlook worsens, of course, the case for a rate cut grows. The trouble is, as King points out, that with oil and food prices surging, inflation remains a "serious threat".

If credit is hobbled and consumers stop spending the idea that inflation remains a serious threat is mistaken. Furthermore, if consumers are indeed genuinely worries about a downturn, they will cause one by not spending. It is a change in sentiment that drives a downturn not a downturn driving sentiment.

[..]

The current credit crunch should be enough to convince anyone that inflation expectations are overblown. But it's not. I guess that is the way it simply must be.If everyone saw the threat (like Greenspan did in 2001), they would likely be wrong. Greenspan was ignoring ability and willingness of consumers to spend and ignoring rising asset prices that allowed it. Now that housing is collapsing, jobs are weakening, and consumers spending less, the talk is of rising inflation because of oil prices. That talk is misguided.

Housing bubbles exist in the US, UK, EU, as well as Canada. Those housing bubbles fueled demand for all kinds of goods and services as well as proving enormous numbers of jobs. Now that commercial real estate is slowing there is simply no source of jobs to pick up the slack.

The bubble in the US has popped and evidence is picking up that other countries will soon be following suit. When that happens and the ECB starts cutting, talk of the Euro becoming THE reserve currency will be exposed for the nonsense that it is. Nonetheless, the end of the US dollar hegemony is now in sight.

Where the Heck Is all the Cash?

As for savings accounts, none of it is actually in your account. Reserve requirement on savings accounts are zero. 100% has been lent out.

As for checking accounts, most of the money you think is sitting in your checking account simply is not there either. Less than a third of it is there. Based on the "win win" success of sweeps to date, the financial wizards think that none of it should be there.

So where's the cash? You tell me. Perhaps it's sitting in SIVs, mortgages, lent to hedge funds, in asset backed commercial paper ABCP, or for conservative banks sitting in short term treasuries.

All I know is that money isn't where most people think it is: In their checking accounts.

By the way, the real extent of the problem is far worse that appears at first glance because with the miracle of fractional reserve lending, money that was "borrowed into existence" was lent out over and over again.

This was not a problem until now. As long as asset prices are rising banks have plenty of capital to lend. But now that bank balance sheets are impaired there is a mad scramble for cash but there isn't much cash anywhere except of course China, Japan, and the oil states, all sitting on huge US dollar reserves and not knowing what to do with them.

In the end, Citigroup had to be bailed out by Abu Dhabi, an obscure country that no one had heard of until several days ago when Petrodollars Returned Home. Expect to see more cash infusions like that, because there is little cash to be found here.

The impending destruction of the U.S. economy

Paul Craig Roberts

If the subprime mortgage meltdown is half as bad as predicted, low US interest rates will be required in order to contain the crisis. But if the dollar’s plight is half as bad as predicted, high US interest rates will be required if foreigners are to continue to hold dollars and to finance US budget and trade deficits.

Which will Washington sacrifice, the domestic financial system and over-extended homeowners or its ability to finance deficits?

The answer seems obvious. Everything will be sacrificed in order to protect Washington’s ability to borrow abroad. Without the ability to borrow abroad, Washington cannot conduct its wars of aggression, and Americans cannot continue to consume $800 billion dollars more each year than the economy produces.

[..]

Japan and China, indeed, the entire world, realize that they cannot continue forever to give Americans real goods and services in exchange for depreciating paper dollars. China is endeavoring to turn its development inward and to rely on its potentially huge domestic market. Japan is pinning hopes on participating in Asia’s economic development.The dollar’s decline has resulted from foreigners accumulating new dollars at a lower rate. They still accumulate dollars, but fewer. As new dollars are still being produced at high rates, their value has dropped.

If foreigners were to stop accumulating new dollars, the dollar’s value would plummet. If foreigners were to reduce their existing holdings of dollars, superpower America would instantly disappear.

Dr. Roberts was Assistant Secretary of the US Treasury for Economic Policy in the Reagan administration.

AMF Chief Urges Gulf States to Drop Dollar Peg

The pressure on the Gulf Cooperation Council (GCC) countries is growing to drop their pegs to the tumbling US dollar with the Dec. 3-4 GCC Summit expected to take a decision on the matter in order to stop soaring inflation in the region.

The latest call for depegging from the dollar came from Jassem Al-Mannai, chairman of the Arab Monetary Fund (AMF), who urged the GCC states to lift their pegs to the dollar, saying revaluations would not solve the problem of rising inflation. Speaking at an economic seminar in Abu Dhabi, he advised the GCC that groups Saudi Arabia, Qatar, Bahrain, Oman, Kuwait and the UAE, to switch to a managed float or peg their currencies to a basket, including the euro, sterling and yen.

Mannai said there was no harm in linking GCC currencies with a basket of currencies as many countries have successfully adopted this monetary measure in the past. “There is no currency exchange system suitable for all ages and places ... In the past GCC economies were negligible and now they have to adopt polices that suit their economic progress,” he said.

Mannai called upon the GCC states to adopt an exchange rate based on a basket weighted on currencies of their main trade partners, including the euro, dollar, sterling and yen. The European Union is now the main trading partner of the GCC accounting for 35 percent of their foreign trade, followed by Asian countries 30 percent and the US 10 percent.

You either bail out the money markets with a flood of liquidity or you keep a lid on inflation. You can't do both, not according to history. And every so often, not least when you're bruised and beaten by a fearful credit crunch on one side and a hateful oil-price shock on the other, it seems you can't achieve either.Just ask Andrew Sentance at the Bank of England. In Tuesday night's speech, he 'fessed up to an inflationary mess that looks a little like this:

The US Federal Reserve, meantime, is also presumed to be targeting 2% annual growth in its Consumer Prices. But like the ECB, it's also pumping money into the New York credit market at a record clip. Can central bankers really have it both ways?

The US Fed is forever making short-term loans to the money markets. Adding liquidity is nothing unusual. The Fed offers money to the big New York banks in exchange for good-quality securities securities such as, say, US Treasury bonds or government agency debt. And it will lend money for anything between one day and two weeks or more.

On any one day, you might find the New York Fed making two, three or more of these loans. And between the start of 2001 and the end of last month, the average sum lent in each of these auctions was $6 billion. Since the start of this month, by contrast, each of the Fed's short-term liquidity auctions has averaged $10 billion. The quality of the collateral that the Fed is accepting when it makes these loans has changed dramatically, too.

The Treasury's missing minutes mystery

After a year and a half of stalling, the US Treasury finally complied with The Post's requests for information about The President's Working Group on Financial Markets - by delivering 177 pages of crap.

In essence, the Treasury's Freedom of Information officials said that the Working Group - affectionately nicknamed the Plunge Protection Team - doesn't keep records of its meetings.

How interesting and convenient!

Included in the 177 pages that the Treasury said responded to our request on the actions of The President's Working Group were 53 pages on which something was redacted - blacked out so that the discussion was unreadable.

Many of those 53 pages contained no words at all - just a big black blob.

[..]

So what's the Working Group up to? I suspect the group is ready to come to the rescue of the financial markets - even equities - in the case of a meltdown. And as I've said in the past, that would be a completely acceptable task as long as it remains a limited power that is used infrequently.But who decides when a rescue is needed? And if no records are kept, who is held accountable if The Working Group's power is abused?

.. the chance of abusing this presidential mandate - even for personal gain - is great whenever an organization operates in secrecy. And that's exactly how The President's Working Group is operating.

'Ho, Ho, Ho' may be 'Oh, No' for economy

Santa Claus may leave a recession under the tree this year, as economists worry that tighter credit standards will put the brakes on consumer spending in the new year. Consumers flashing credit cards have gotten the holiday shopping period off to a relatively good start since they pushed away from the Thanksgiving dinner table last Thursday.

ShopperTrak RCT Corp., which monitors sales at 50,000 retailers, estimates that total sales rose 8.3 percent to about $10.3 billion on Black Friday, the day after Thanksgiving. And online retailers are believed to have broken one-day records for traffic and sales on so-called Cyber Monday, as they logged in for more than $700 million in purchases.

But when their credit card bills start coming due early next year, consumers could face problems they haven't had to address in years, as the credit crunch puts a squeeze on additional spending going forward.

"We think this holiday shopping period will be a last hurrah for a while," said Mike Schenk, senior economist with the Credit Union National Association.

Fast & Sleazy - Schumer is on Mozilo’s A$$ Big Time

The honorable Senator Charles Schumer has a bone to pick with Angelo Mozilo and Countrywide Financial. It appears that he isn’t buying these BS press releases that have been coming out over the last couple months or so and he isn’t going to roll over and play Mr. nice senator–especially when this company was a HUGE contributor to the mortgage and housing crisis that we are seeing now.

What I am gathering based on the recent comments from the Senator is that he likens Countrywide to the mob and Mozilo as the crime lord. He might not be so far off.

Monday, Schumer was again on Mozilo’s a$$ for another shady deal involving the the Federal Home Loan Bank (FHLB) system for cash advances to stay afloat as other liquidity sources shun the company and the credit markets tank in general. Countrywide’s advances from the Atlanta-based FHLB bank had soared 81 percent, to a total of $51 billion.

That represents nearly 40 percent of FHLB Atlanta’s total advances, according to the bank’s latest SEC filing—a potentially dangerous level of exposure considering Countrywide’s track record in poor underwriting and predatory lending practices in recent years.

To secure its advances from FHLB Atlanta, Countrywide has posted $62 billion worth of loans as collateral. Schumer pointed out that there is adequate reason for worry that Countrywide’s collateral poses a higher risk than other banks.

Wow! I didn’t know that you could use “crap” as collateral! $62 billion of seriously questionable loans and the bank bought it? The due diligence that I have seen on behalf of our entire banking system has been a joke so far, and the comedy routine continues as Mr. Mozilo plays “hide the peanut” with our entire country.

Countrywide faces foreclosure probe

Countrywide Financial, the nation's leading mortgage lender, is facing a federal probe into its foreclosure practices, according to a published report.

The New York Times reported Wednesday that the U.S. Trustee, the federal agency monitoring the bankruptcy courts, subpoenaed its records to determine if two foreclosures in southern Florida represented abuses of the bankruptcy system by the lender.

The agency, a part of the Justice Department, announced an effort to move against mortgage servicing companies that file false and inaccurate claims in foreclosure cases.

[..]

The paper reports that Countrywide is not the only mortgage lender being accused of adding improper charges to loans made to people who have filed for bankruptcy protection.A recent study of more than 1,700 foreclosure cases by University of Iowa law professor Katherine Porter showed that questionable fees had been added to almost half of the loans she examined, the paper reported.

In one case, the court found that Wells Fargo (Charts, Fortune 500), another major mortgage lender, assessed improper fees and charges that added more than $24,000 to a loan, or 12 percent more than the court determined was actually owed.

The paper said that Porter found another lender, which it did not identify, had claimed that a borrower owed more than $1 million when in fact the true balance was only $60,000.

NY pension funds to lead Countrywide plaintiffs

A federal judge has named two New York pension funds lead plaintiffs in a series of investor class-action lawsuits accusing Countrywide Financial Corp, the largest U.S. mortgage lender, of inflating earnings and overstating its ability to weather the housing slump.

U.S. District Judge Mariana Pfaelzer in Los Angeles on Wednesday appointed New York State Comptroller Thomas DiNapoli, who oversees the New York State Common Retirement Fund, and the New York City Pension Funds as co-lead plaintiffs for five consolidated lawsuits, court records show.

She found that the pension funds, with a combined loss of "over $100 million," had the largest stake of any prospective lead plaintiff. The judge also said the funds had considerable experience in similar cases and accepted their statement that they planned to vigorously protect all plaintiffs' interests.

Crony-Capitalists Fiddle While Main Street Burns

Setting: Picture the Titanic shortly after it crashed into the iceberg. Imagine that its officers want to pretend to all its passengers and crew and investors that there is no serious damage because the giant floating Citi did not really hit an iceberg; it just hit a wall of worry. It will be able to right itself in no time at all as long as everyone remains calm. Even though the lavishly appointed ship is dangerously listing (stock price fading daily) it says it can stay afloat by an ingenious bailout plan. Everyone just needs to walk calmly to the dining room, collect a tea cup, and pitch in with the bailout.This is effectively what the U.S. Treasury has anointed as a game plan: Citigroup, the gargantuan and troubled bank, will be bailed out by virtue of all of its smaller competitors chipping in some money to a SuperSIV, a kind of Big Daddy Black Hole whose details are apparently too scary to release to the public. These are the very same competitors who lost market share to Citigroup because Federal regulators allowed it to grow fat and sassy by playing dirty, including collecting massive fees for hiding debt for bankrupt Enron, WorldCom and Italian dairy giant, Parmalat.

Fade to Citigroup Set: Inside Citigroup, it's business as usual. The ousted CEO, Chuck Prince, who had to own up to approximately $17 billion in write downs and Cayman Islands' black holes, is receiving a bon voyage package that includes a performance bonus of $12.5 million, salary and stock holdings of $68 million, a $1.7 million pension, an office, car and driver for up to five years. And Citigroup, clueless as to what its own assets are really worth, is putting out research recommendations daily to investors, advising them what other companies are worth. On November 16, it said it particularly likes bank stocks (those entities with billions of dollars of Citigroup toxic waste in their money market funds).

Citi cuts assets of sponsored SIVs by $17 billion

Citigroup Inc. said late Friday that it has reduced the assets of structured investment vehicles it advises by $17 billion in the past two months, as the banking giant tries to maneuver through this year's subprime thicket.

Assets in the SIVs sponsored by Citi have declined to $66 billion as of Nov. 30 from $83 billion at the end of September, a Citigroup spokesman said in an emailed statement.

"The funding strategy for Citi-advised SIVs remains unchanged from the disclosures in our third-quarter filing," he wrote. "We continue to focus on liquidity and reducing leverage."Moody's Investors Service said earlier Friday that it may downgrade the ratings of Citi's SIVs. The agency also cut ratings on several other SIVs Friday.

"In recent weeks, Moody's has observed material declines in market value across most asset classes in SIV portfolios," the agency said in a statement. "The situation has not yet stabilized, and further rating actions could follow”.

Aaron Krowne’s comment:

...."cutting" that $17 billion of exposure requires selling at a loss (probably steep) or bringing the risk back onto the bank's balance sheet. Citigroup still has a gargantuan $66 billion of SIVs, the remainder of which is being downgraded or (likely) soon will be, as the article mentions and as we reported earlier. The downgrades effectively mean there will be steeper-than-previously-assumed losses on that other $66 billion.

Florida: State stops leaders from ditching fund

Gov. Charlie Crist and other state leaders Thursday temporarily halted all further withdrawals from a state-run investment pool in hopes of keeping the fund from becoming the latest casualty of the ever-expanding maw of the subprime mortgage meltdown.

Even though the fund has consistently made money for local governments since it was created 25 years ago, those governments had pulled nearly $13.5 billion from the pool in the past two weeks, including $3.7 billion on Thursday morning.

The withdrawals were a reaction to news that a fraction of the fund's investment portfolio was downgraded because of the mortgage crisis.

To protect the remaining $15 billion in the investment pool, including $2 billion from Citizens Property Insurance - the largest single account left in the fund - the Florida State Board of Administration halted further withdrawals until at least Tuesday.

If the pace of recent withdrawals had continued, the state board could have been forced to sell the pool's troubled securities at a deep discount and left some governments with the losses.

Paulson's Plan to Punish the Public

If the mortgage crisis and housing bubble have taught us one thing, it should be to watch out for the unintended consequences of greed. Unfortunately, our nation's legislators and political appointees haven't learned that lesson. Recent plans for housing and mortgage bailouts generally run from dumb to dumber.

In short, bankers and loan-servicing outfits are going to lower interest rates on strapped borrowers so they don't lose their houses. How much, how long, and who qualifies are all still up in the air. No doubt, this will sound good to those folks who signed on for mortgages they can't actually afford.

It will also look good to politicians angling to score points before the next election, and to bleeding hearts everywhere. It will also look good to select mortgage-industry players -- like Countrywide Financial and Citigroup, which could really use a government-led bailout.

Unfortunately, this ill-conceived salve will ultimately punish the silent majority of Americans, people who didn't go out and make boneheaded financial decisions over the past half-decade.

There is a new spin at hand called the New Hope Alliance, described in this WSJ article . This approach is largely implausible for several reasons. Hundreds of billions in mortgages have been securitized into MBS (mortgage backed securities), and are not owned by the servicers mentioned in the article.

Changing the terms of mortgages in effect lowers the coupon on the security. This of course would have the effect of lowering the value of MBS. A MBS of say $1 billion might have an undetermined number of holders, and rarely if ever just one. How exactly does the New Hope Alliance secure the agreement of ten or fifteen MBS holders to lower coupons and terms.

This could include a foreign central bank or two, and most certainly foreign financial institutions. How exactly does the US Treasury apply “suasion” against a foreign firm? Credit insurance is also put on against default and against altered conditions. If somehow some MBS were restructured under new terms this would in turn trigger a wave of claims against the credit insurance written against this securities. Would the insurers (if even still around) agree to pay these claims?

This scheme as it applies to the mountain of MBS in the marketplace is just too much of a tangled web to ever be seriously implemented.

But of course we aren’t talking about serious here, but more about propaganda and spin to “restore confidence” in fictitious capital. The outcome of this deal are obvious from a mile away. Few if any MBS will be part of this program. Of course the major financial players have mortgages held as part of their portfolios.

A token number of these will be cherry picked to be included in this scheme, which will be announced with great fanfare and a big gearing manipulation of the market. The real hope of the New Hope Alliance is to ensnare Aunt Millie, and some foreigners, and use any bid to dump securities on them. This one especially has slimy and tawdry written all over it.

China's Wealth Fund Seeks to Stabilize Equity Markets

China Investment Corp., the nation's $200 billion sovereign wealth fund, signaled it may invest in stocks rocked by subprime mortgage defaults.

"CIC wants to be a stabilizing force in the international capital markets,'' Chairman Lou Jiwei told a conference in Beijing today. He then cited a "recent example'' in which a similar fund invested in a financial institution with subprime losses, without identifying the two parties.

Abu Dhabi Investment Authority this week agreed to buy a $7.5 billion stake in Citigroup Inc., helping the biggest U.S. bank by assets to bolster capital eroded by credit-market losses. China Investment, which began operations in September, was set up to help improve returns on China's $1.46 trillion of reserves.

"The steady stream of sovereign wealth funds buying distressed assets tells us there is a buyer of last resort out there,'' said Robert Rennie, chief currency strategist in Sydney at Westpac Banking Corp., the fourth-largest Australian bank. He said that will encourage investors to buy higher-yielding assets.

State-run investment funds will grow to $7.9 trillion in combined size from $1.9 trillion now as currency reserves climb in countries including China and Russia, Merrill Lynch economists wrote in a report last month. Abu Dhabi's investment followed purchases by U.A.E. fund Dubai International Capital LLC in companies including London-based HSBC Holdings Plc, Europe's biggest bank by market value.

Don't Bail Out Fannie and Freddie

With portfolios of almost $3 trillion, capital of $65 billion, and no obvious end to the fall in home values, the continued solvency of Fannie Mae and Freddie Mac has to be in question. Last week, Freddie shocked Wall Street with a quarterly loss of over $2 billion, and in their subsequent discussion with analysts, Freddie's management indicated more and larger losses could be expected.

Fannie reported a somewhat smaller loss a few weeks earlier, and most likely it will continue along the same path on which Freddie is now embarked. Since no one can predict where the bottom of the housing market may be, it is important to recognize that a loss of, say, 3% on portfolios of $3 trillion would easily wipe out what is left of their capital.

H.R. 1427, the Federal Housing Finance Reform Act, gives the regulator of these government-sponsored enterprises important new powers, including authority to wind down the GSEs in an orderly way in the event of insolvency. Without that power, Congress will have no choice but to bail out the institutions -- possibly with as much or more taxpayer money than it used to bail out the S&L industry only 15 years ago.

Fannie and Freddie are chartered by Congress through special legislation, and they are not covered by the bankruptcy laws, by state laws governing corporate insolvencies, or by the laws relating to the liquidation of insolvent banks. In fact, there is very little that their regulator, the Office of Federal Housing Enterprise Oversight (OFHEO), can do in the event that their losses mount to the point that they become insolvent.

U.S. government, banks finalizing rate-freeze plan

The U.S. Federal government and leading financial institutions are finalizing details of a plan that would extend low introductory rates offered to some borrowers who took out adjustable rate mortgages, according to reports.

The plan, being hammered out between the Treasury Department and a number of large mortgage lenders, would include subprime mortgage borrowers, the Wall Street Journal reported Friday, citing unnamed sources familiar with the negotiations. The report said the gist of the plan was to extend the low introductory rates on home loans made to borrowers who will have trouble meeting higher reset rates.

Under one scenario, the extension of lower rates could run as long as seven years, the report said. About two million adjustable rate mortgages are scheduled to reset to higher levels over the next two years.

Hank Paulson and Sheila Bair are spearheading an effort to freeze interest rates on adjustable rate loans:

U.S. Treasury Secretary Henry Paulson is negotiating an agreement with lenders to stem a surge in foreclosures by fixing interest rates on loans to troubled subprime borrowers, according to people familiar with a meeting he led yesterday.

Bair is from FDIC, and she has been advocating rate freezes for adjustable rates for quite some time. Maybe she realizes what the implications are for FDIC if a lot of these loans go bad

Paulson and Bair can certainly make a solid economic argument that the investor and lender stands to lose the entire loan amount (or get a property they don’t want), and a partial loss through an interest rate extension is better.

That assumes these interest rate resets will be the sole driver of foreclosures moving forward. Given that these policymakers couldn’t even see this obvious problem as of 6 months ago, I have a hard time believing they have the situation under control with this piecemeal approach. In fact, this problem is so large that it will probably wallop the entire Bush administration and the next one that follows them.

The problem is not just about interest rate resets. It’s also about recession, job losses, too much supply, ridiculously unaffordable home prices, and rising interest rate spreads as well. I can imagine that foreign investors will be too eager to provide the money to offer low-interest 30 year loans to these same defaulting borrowers. If the credit market stress is revealing a clue, it’s that Hank Paulson and Sheila Bair have no clue.

Bernanke hints of further rate cuts

Federal Reserve Chairman Ben Bernanke on Thursday hinted that another interest rate cut may be needed to bolster the economy. The worsening credit crunch, a deepening housing slump and rising energy prices probably will create some "headwinds for the consumer in the months ahead," he said.

Bernanke said he expects consumer spending will continue to grow and suggested the country can withstand the current problems without falling into a recession. But he indicated that consumers could turn more cautious as they try to cope with all the stresses.

The odds have grown that the country could enter a recession. A sharp cutback in consumer spending could send the economy into a tailspin. Against this backdrop, Fed policymakers will need to be "exceptionally alert and flexible," Bernanke said.That comment probably will be viewed as a sign the Fed may lower interest rates when it meets on Dec. 11, its last session of the year. "Bernanke is leaning in the direction of a rate cut," said Brian Bethune, economist at Global Insight.

Twice this year the central bank has trimmed rates to keep the housing collapse and credit crunch from throwing the economy into a recession. Those cuts came in September and late October.

In the October meeting, Bernanke and his Fed colleagues signaled that further cuts might not be needed. Since then, however, financial markets have endured more turmoil. The housing slump has deepened, consumer confidence has plummeted and consumer spending "has been on the soft side," Bernanke said in a speech Thursday night to business people in Charlotte, N.C.

The Bernanke Put and the Last Legs of the Stock Market Sucker's Rally

To take a longer and more analytical perspective notice that typically a sucker's rally always occurs at the beginning of an economic slowdown that leads to recession. The first reaction of markets to a flow of bad economic news is usually a stock market rally based on the belief that a Fed pause (like the rally following the August 2006 Fed pause) and then possibly easing will rescue the economy.

This rally always ends up being a sucker's rally as, over time, the perceived beneficial effects of a Fed ease meet the reality of the investors realizing that a recession is coming and that the effects of such a recession on profits and earnings are first order while the effects of the Fed easing on the economy and stock market are - in the short run of a recession - only second order.

That is why we had several sucker's rallies this fall every time the Fed eased rates or surprised markets with greater easing than expected or signaled to markets that it would ease ahead (as on Wednesday).

Fed says 12% of subprime ARMs delinquent, 7% in foreclosure

The Federal Reserve Bank of New York on Friday said 12 percent of U.S. subprime adjustable-rate mortgages were delinquent by 60 days or more through August 2007.

Seven percent of these kind of loans were in foreclosure during that period.

Delinquencies and foreclosures for adjustable-rate mortgages classified as Alt-A were lower. Of the Alt-A ARMs, 3 percent were delinquent for 60 days or longer through August, while 2 percent were in foreclosure during that period.

Home foreclosures soar 94 percent: RealtyTrac

Home foreclosure filings in October edged up 2 percent from September but at 224,451 were a whopping 94 percent higher than a year earlier, real estate data firm RealtyTrac said on Thursday.

The figure, a sum of default notices, auction sale notices and bank repossessions, was down from a 32-month peak in August however, RealtyTrac, an online market of foreclosure of properties, said in its monthly foreclosure market report.

RealtyTrac said the national foreclosure rate was one filing for every 555 U.S. households in October.

FDIC: Provisions for Loan Losses Failing to Keep Pace with Delinquencies

The FDIC’s Quarterly Banking Survey for the third quarter, released today, covers quite a bit of ground on the mortgage markets; but perhaps the most telling is a section in the report that says loss coverage ratios are the thinnest they’ve been in nearly 15 years — in spite of nearly historic increases in loss provisions.

Insured banks and thrifts set aside $16.6 billion in loan-loss provisions during the quarter, the most since the second quarter of 1987, and the second-largest quarterly loss provision ever reported by the industry. Third-quarter loss provisions stood at $9.2 billion, 122.4 percent more than the industry set aside in the third quarter of 2006.

And yet it wasn’t remotely enough — from the report [emphasis added]:

The industry’s reserves for loan and lease losses increased by $5.7 billion (7.0 percent) during the quarter, as insured institutions added $5.9 billion more to reserves in loss provisions than was removed by charge-offs. The growth in reserves was the largest quarterly increase in 18 years and caused the industry’s ratio of reserves to total loans and leases to increase for the third quarter in a row. However, the increase in reserves failed to keep pace with the sharp rise in noncurrent loans. As a result, the industry’s “coverage ratio” declined from $1.21 in reserves for every $1.00 of noncurrent loans to $1.05 during the quarter — the lowest level for the coverage ratio since the third quarter of 1993.

Morgan Stanley may face $5.7 billion Q4 writeoff: report

Morgan Stanley may face a fiscal fourth-quarter write-down of as much as $5.7 billion for mortgage-related losses, CNBC television said on Friday.

The pretax amount is $2 billion higher than the amount the Wall Street company said it will write down for mortgage-related trading losses in September and October. Morgan Stanley's fiscal fourth quarter ends this month.

On Thursday, Zoe Cruz was ousted as Morgan Stanley's co-president. Several analysts have said her departure is related to the mortgage losses.

At the risk of seeming naive, just how is it that some holdings can be 'off balance sheet' ? What meaning does a balance sheet have if it doesn't include all the factors? I assumed that the Enron debacle had put some serious curbs on this practice, but it defies my logic how companies can have some cards on the table and others off.

Seems like the US government is doing the same thing with military spending being off its sheet too. The more I see of the financial system's workings, the more I see its unravelling being a good thing - except that it probably won't be fixed but just reinitiated under a different name. Whatever happened to Arthur Anderson Inc - did it become Abstrivia or some such?

There are many shades of Enron in the current situation. You would think that lessons would have been learned, but apparently not. Keeping assets off balance sheet - in SIVs for instance - has been a very common practice in recent years.

And that is a big part of the problem. Its been " but mom everyone else is doing it" for so long that the curruption and deception has pretty much come to be tragically expected by so may people and institutions. John

Thanks ilargi you really lined 'em up.

The commercial real estate situation post by mish the other day was one of the most worrysome I have read.

Commercial Real Estate Market Is Imploding

http://globaleconomicanalysis.blogspot.com/2007/11/commercial-real-estat...

It also does a lot to lay out the case for deflation for those who do not understand how that works.

P.S. I know you already did this but I just wanted to point to it as a must read.

Cheers

Thanks Stoneleigh for your efforts in collecting all these stories.

Regarding 11 cents on the dollar, I am hearing that many firms have kept ahead of this carnage, and have written the toxic stuff down almost to zero (Goldman actually has made money on this event by buying credit default swaps). I think the finance part of this is nearing an end, though there may first be a spiral with some firms going under. But I'm not hearing there exists much leverage involved in these securities. 800 billion subprime is alot of money - but its not levered 100-1 like LTCM was. If there is large leverage somewhere I will stand corrected, but that doesnt seem to be the case.

However the impact on the economy is the bigger story in my opinion and is just starting to be felt, via less consumer spending, tightened lending standards, and fewer GI Joe toys with the Kung Fu grip for christmas. We are headed into a recession for sure. Which then creates positive feedback mechanisms, and potentially a new round of unwinds. Thats when we'll see how much leverage and resilience is in the financial system.

Actually Ilargi did this one.

A spiral of positive feedback, with successive rounds of unwinding, is exactly the problem we're facing IMO. The peeling away of each successive layer destabilizes the one beneath it, hence the subprime crisis is already moving on to Alt-A and beginning to encompass prime lending as well. With most of the residential real estate defaults still ahead of us, and a commercial real estate debacle to add to the mix in the not too distant future, we will indeed see how resilient the financial system really is.

Nate,

I'm not sure what you're trying to say here. Yes, Goldman has presented profits, but they're the only one, and there's lots of questions about those gains. Lunch with Bernanke and the PPT? I don't know which firms would have written down losses to zero, but they're not the Wall Street ones, other than what we have reported here.

HSBC is the only one that put $45 billion in SIV waste on the balance sheet, de facto writing down everything to zero. For all others it's obvious they're trying to hide most for now.

Which may not be that crazy: If Citi would write down its $83 billion SIVs in one fell swoop, the market could panic. (There's also the fact that Citi can't afford to put it where the light shines). Still, writing it down in steps doesn't make it a healthy company. SIVs are but a small part of Citi's trouble.

What you mean by "the finance part of this is nearing an end", once more I don't know; far as I can see it's all finance, and at the very least hundreds of billions of losses remain to be swallowed.

As for the notion that there's not much leverage involved in "these securities", maybe I don't understand what you mean. The whole game is about leverage, every mortgage, and every other available asset, has been used to borrow money against. That's why we have derivatives and securities: offload the loan from your books, so you can use it as collateral for the next.

The Norwegians, as we said here last week, are a prime example. They had $80 million, and invested 8 times that, all leverage, and all lost. And I don't think for a second that they're an exception; if anything, they're more prudent than most others. They were simply the last-to-come Ponzi suckers. I predict these people will be held up as an example soon of the honorable way to deal with the fallout.

As I said in the intro, bond insurer Ambac carries $620 billion in structured paper, with $9 billion in cash. That's leverage. Citi supposedly has $2.2 trillion in assets, with, as Mike Shedlock said, $127 billion in equity (much of which is doubtful). It's not all 100-1, but do you really believe that in this increasingly fractional theater, LTCM was some kind of weird abberation?

The very fact that the BIS confirms $516 trillion in derivatives outstanding, growing at a rate of 24% per year, tells me differently. If just 20% of that is found to be less than AAA perfect, Wall Street and Threadneedle are endangered species.

This is not just another downtrend, or some sort of cyclical move. This could become Weimar, where cigarettes were currency, because money had no value anymore. Only, this time it won't be through inflation. In that respect, Shedlock agrees with Stoneleigh and me.

@ilargi

If not inflation, then... deflation? How does money lose value under deflation? Seems to me it gains value in that case.

The BIS statistics are available here

http://www.bis.org/statistics/derstats.htm

(see Table 19 "amounts outstanding of OTC derivatives...")

and they do list $516 trillion in "notional amounts outstanding" but the "gross market value" is only $11 trillion. I don't know how they value the derivatives, but this seems to indicate the $516T figure exaggerates the threat.

Also, the derivatives are in various areas, only notional $42T are in credit default swaps (of the $516T). The majority is in interest rate contracts of $347T, the rest in forex, commodity, and equity contracts.

I think it's the other way around. And obviously the keyword, once more, is leverage. If it's true that underlying value is just $11 trillion, while outstanding derivatives total $516 trillion (don't forget the 24% growth rate, that's even scarier than the total number), then every dollar of "real" value has been used to issue almost $50 dollars of credit. And every year $12 more borrowed dollars are added to that credit. The total outstanding will be $640 trillion a year from now if the rate remains the same..

If that doesn't scare you, you're a brave man. It might, however, simply mean that a 2.1% overall market loss can wipe out all underlying equity. I know that's a theoretical approach, since some assets have more strength than others, but if enough fails up at the same time, it's not an impossible option.

But for sure if, say, 20% of derivatives blow up, you have a potential $100 trillion problem. New home prices in the US fell 13% this year, nudge nudge wink wink.

Citadel also had a substantial investment in Etrade before this happened. Etrades portfolio was primarily in the lower tranches of the CDO market - you can look at the graph of the ABX BBB or BBB- tranches and they have been trading at 20 cents on the dollar - this transaction will not 'set new rule, law, value' for the whole market because it doesnt represent the whole market.

And Citibank is going nowhere. They have taken huge losses already and the Saudi Prince infusion of capital did look a little desperate - but I'm hearing that was more to maintain the dividend as is than a plea to stay afloat.

Don't get me wrong - this is a bad crisis and some of the insurers may go under - but trillions? The entire market is only a couple trillion. The only way there could be trillions lost is if 25% of ALL homeowners defaulted in US. Im not saying that has zero possibility, just that its most definitely not the meat of the distribution.

It wouldn't surprise me at all if that, or worse, happened over the next few years. An awful lot of people live a couple of paychecks away from financial difficulties, and how many of those will lose their jobs in the coming recession? People have very little margin for error at a time when the best laid plans of mice and men (so to speak) are about to be upset.

In addition, we haven't yet seen the effect of real estate problems on the horizon in Europe and Canada, which will also feed into the global banking system.

Actually what I meant to say was the only way trillions would be lost is if 25%+ of ALL homeowners defaulted AND had their home values go to ZERO, but my dog was barking so I hit send without previewing.

Theres a difference between a real estate default or markdown and a house worth nothing. If subprime home owners cant pay the mortgage there is a default - say on a $300,000 home that they put up $20,000 and got $280,000 mortgage -if there is 20% property price correction, the homeowner goes belly up (and probably already was), loses his/here 20k, the house is now worth $240,000 so the ENTIRE value of this portion of the CDO gets marked down from 280,000 to 240,000 - sure the lower tranches might go to 10 cents on the dollar but the higher ones will hardly be touched.

During the Depression, some of the best farms in the country were offered at auction and received no bids. If the money supply crashes this time, what are typical poorly-built energy-hogging suburban residences likely to be worth? It's not like the property could be expected to produce an income or a livelihood the way a depression-era farm would have done once liquidity returned.

It wouldn't surprise me at all if properties ended up being worth less than the cost of the materials it took to build them, given that the expansion of suburbia has been a huge exercise in negative added value. I expect property prices to fall by at least 90% on average over the next 10 years or so, with the resulting price being less affordable than today's high prices due to the lack of credit under depression conditions.

Where I live and bank(two banks). My bank has never done subprime loans. They make many loans to farmers and landowners here. All my loans in the past were backed up by my farm.

Its also a locally owned bank and we all know each other very well.

Back in the depression this is what I was told. The banks had all these loans and didn't want to foreclose. A localwoman who had quite a bit of money came and brought up all those loans very cheaply.

She then went to each holder of the loan and told them "I will not foreclose on you. Stay here and do what you always do. When times get better then come see me and pay off your loans."

This is what happened to many folks here. It might happen again but in my case I have now came to the position where I own my own land and dwelling. Granted its not the size my farm once was but its sufficient.

The only loan I have is on my HD motorcycle and one credit card. The CC people can go to hell if TSHTF and the bank can have the motorcycle if they wish to.

Otherwise no one can take my land. There will be plenty of land around me if TSHTF and it was once mine. It might once more be mine if there is a big dieoff and we turn to squatting once more.

But my bank is fairly secure. All the farmers loans are backed by land, which is a very good collateral.

Will land become cheap? Its really only what someone is willing to pay for it, in the end, as I have found out thru many auctions,some of them mine. Its more likely to be what one can defend. Or take. Or squat on. Yet you have more rights to defend what is legally yours , if the posses ride once more as they did in the not too distant past.

I can see posses coming back into their own once more. How else can people expect justice? How else can they survive without some form of law enforcement and with no energy I don't see 911 and all the other facets of law enforcement being able to function.

airdale

I wouldn't go quite as far as 90%, but a return to the classic three times gross average wage is inevitable. How much undershoot remains to be seen, but in the longer run almost all current houses are worthless anyway. However, most of the supposed value of the housing stock is in the land value. What happens to the perceived value of urban land is a good question. My guess is that the old will huddle in the cities and the young will head for the hills.

Are cities a good idea or just a social inevitability?

Hi Petrosaurus, want to guess what you would have to pay me to buy a suburban house where all I could grow was hungry?

CR,

I'll get back yo you on the Arabs buying up China's US Treasuries. My net access is still limited, which is kind of a relief in a way. Still, doing this new Round Up was about it for the weekend. Btu I haven't forgotten the question.

Ilargi,

Thanks for the memory, something I seem to be getting very short of these days. Of course, judging by these days, that might be a useful asset. And thanks, of course, for all the work you guys have been doing and with limited net access to deal with as well!

Hi again Petrosaurus,