The Finance Round-Up: November 29th 2007

Posted by ilargi on November 29, 2007 - 9:12am in The Oil Drum: Canada

March is when we realize that the dollar doesn't come back

Arlington Institute issues a Financial Alert based on M·CAM Analytics

The Chinese currency wild-card may become relevant far sooner than expected. An effort by China to convert its $1.4 trillion U.S. Treasury holdings into euros is not viable for many reasons -- not the least of which is the European Central Bank's inability to absorb such an event.

When February comes, the Chinese are going to do something as they will have to decide what the exposure is going to be with the treasury. As I see it they have to just dump the treasury. They only keep it because they can use it -- they have 43% direct/indirect of US treasuries so they'll dump them on the market.

OPEC price with the whole fluctuation of oil futures presages the event. They are going to run the price of oil as high as they can get it on the dollar, while buying US treasuries from China with the money. When the dollar does collapse, they'll flip denominations.

The wild card is long about March when the OPEC cuts spot oil off the dollar to the euro. One can look at the current oil price at close to $100/barrel and fail to see that, as this premium price is currently turning around and investing in a weakening dollar, the effective price (less the dollar investment hedge) is probably closer to $50/barrel than the spot price reflects. Currency problems will change the game -- they are financially structuring themselves to take the hit.

When we can't afford to buy oil commodities on a spot market -- it compounds the problem however the consumer that Saudi Arabia ships to is liquid (China). In the US it is a big problem. There is still a market for oil; it just changes.

When you come out of Straits of Hormuz, turn left.

continued from above the fold

The next shoe to fall is consumer credit

The reason why this problem is the second shoe to fall (subprime mortgage collapse was the first shoe) is because consumer credit has a different foreclosure frequency than traditional mortgage credit. December is when the maturity of the giant buyout of the economy moves.

By December, you'll have a second round of charge offs based on consumer credit. The real big problem -- when you foreclose on consumer credit, people stop buying things. When people stop buying things, we don't have a tertiary way to pump liquidity into the market. People won't have extra cash from their paychecks and won't have capacity on their cards.

"The estimates are out. There will be at least $400B in the first round of charge offs in the CDO market. We're not going to be done with the subprime mortgage when the CDOs fall. Therefore we will have an insolvency problem with the banks that are mentioned above.

This is the kiss of death of a privately held Federal Reserve."For the Federal Reserve to function, its stakeholder banks (like JP Morgan Chase) must remain viable and liquid. When one of them, or any major bank in the U.S. (like Bank of America, Citibank, Wells Fargo, Bank of New York, Washington Mutual, etc.) is impaired or ceases to exist, the architecture of the Fed's capacity to respond to systemic challenges is unsustainable. If the banks have no money, they can't pump liquidity into the market. Taking half of a trillion dollars out of market in a single distressed write down becomes problematic. The US banking system does not have the liquidity to take the hit.

The actual solvency of the Federal Deposit Insurance Corporation is relatively indecipherable due to the fact that their treasury management processes (and the risks of their own investment strategies) are not uniformly disclosed with sufficient transparency. The FDIC was set up for isolated problems with a few bad banks but is NOT prepared to "insure" the system in an industry-wide crisis.

The actual liquidity reserve of the "insurance" that Americans view as their safety net is 1/100th the actual exposure of outstanding deposits. The actual coverage ratio for the Bank Insurance Fund (BIF) fell below 1.25% in 2002, the same year that less stable credit practices were adopted by America's leading banks.

The funny part is that the Federal Government will be on holiday when all of this happens. There will be no one to put freeze actions and moratoria on actions. The only way you stop the cataclysm is to put together civil actions on deposit withdrawals.

Our Diseased Monetary Bloodstream

What has happened this fall is that the presence of bad debt in the economy has been established. However, bad debt is in hiding. Who is hiding it? “Nobody alive is above suspicion!” One bank can no longer trust another in accepting an overnight draft. Maybe the other feller is trying to pass on bad debt. True enough, banking is based on trust. But if you are not allowed to test debt, or to spot bad debt through demanding payment in gold, then trust is not justified. All debt becomes sub-prime. Why should a client trust his bank, if banks cannot trust one-another?

Thus, then, my answer to the question “why gold?” is that the gold corpuscles fight incipient leukemia in the nation’s monetary bloodstream. It’s not that withdrawing them causes sudden death. But it inevitably causes death in the long run. A rather painful and ugly death.

The proof, if one is still needed, that the removal of gold corpuscles from the monetary bloodstream ultimately leads to cancer, is the exploding derivatives market. Its size has exceeded the $500 trillion mark. Compare this with the annual GDP of the U.S. at about $ 14 trillion. Worse still, the derivatives market is growing at a pace of 40 percent per annum, roughly doubling in size every other year. This is cancer, which mainstream economists and politicians want you to ignore.

The Greatest Heist of the Century: Stealing and Mortgaging the United States’ Future

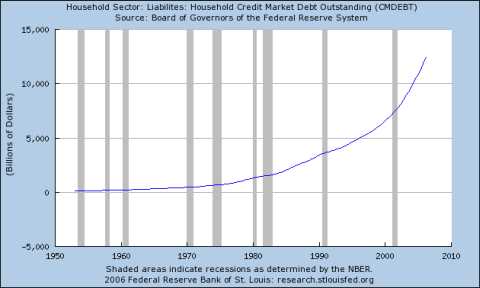

It is becoming commonplace to hear negative news regarding the housing market. Dollar signs get thrown around in conversations with no real practical sense for the public to grasp the magnitude of the problem. HSBC for example announced that they are pumping $35 billion into their ailing SIVs to avoid a fire sale of assets. You must ask yourself, why are large institutions so frightened about putting assets onto the market? The so called mark to market fear that many structure finance players are trying to avoid at all costs. These short term bailouts are only pausing the inevitable. At a certain point the curtain will be removed and most suspect that the wizard isn’t so powerful after all.I’ve been contemplating this and think that we need to examine multiple areas of the economy to realize that this housing market is merely a symptom a larger epidemic. There have been many articles pointing out the fallacy in assuming that the current credit crunch was caused simply by subprime loans. In fact, after reading this article you’ll realize that the majority of this nation is subprime; that is, there is no realistic way that we will ever pay off our debts.

Do you notice something? Given that energy is a large part of our consumption, it is hard to believe the data that is being dished out. And what of housing? Incredibly the government uses owners equivalent of rent to factor in housing prices. Well we all should know by now with the often quoted 70 percent of Americans own their home figure that we should examine mortgage payments as a true indicator of true cost of housing since the majority own.

[..]

But of course these two things would show inflation running at a much higher rate so we don’t want to do that. Inflation is a silent tax. For some reason politically people are happier being told that no taxes will be raised while the green dollars in their wallet (if they still carry any) are slowly shrinking in purchasing power. No wonder why monetary policy isn’t taught in high schools. The public would understand the slight of hand the government is dishing out and they would demand restraint on spending.Given the spending binge this past weekend it is becoming more apparent that many Americans are using shopping as a sedative to facing the brutal facts. Like Social Security, the time is running out to right this ship before it is too late. Either way we will have some tough decisions ahead of us.

Pathology of debt

Part 1: Banks as vulture investors

Vulture restructuring is a purging cure for a malignant debt cancer. The reckoning of systemic debt presents regulators with a choice of facing the cancer frontally and honestly by excising the invasive malignancy immediately or let it metastasize through the entire financial system over the painful course of several quarters or even years and decades by feeding it with more dilapidating debt.

But the strategy of being your own vulture started with Goldman Sachs, the star Wall Street firm known for its prowess in alternative asset management, producing spectacular profits by manipulating debt coming and going amid unfathomable market anomalies and contradictions during years of liquidity boom.

The alternative asset management industry deals with active, dynamic investments in derivative asset classes other than standard equity or fixed income products. Alternative investments can include hedge funds, private equity, special purpose vehicles, managed futures, currency arbitrage and other structured finance products. Counterbalancing opposite risks in mutually canceling paired speculative positions to achieve gains from neutralized risk exposure is the basic logic for hedged fund investments.

Is it growing demand and tight supply, or merely rampant speculation that has pushed crude to record highs?

It's hard to gauge the amount of money investment interests - as opposed to refiners or airlines or people who actually use oil - have in the oil markets. The government tracks contracts held by what it calls "commercial' and "non-commercial" users, but it lumps investment banks in with the commercial side.

Either way, the amount of investment money in oil is certainly large.

It's been rumored Goldman Sachs has over $80 billion in the market, although the investment bank declined comment for this story. Its influence is so big, traders refer to the day of the month when the bank sells the current month contract and buys the future month as the "Goldman roll" due to its effect on price. When Goldman last month told its clients to sell oil when it approached the mid-90's, crude lost over $3 in one day.

Goldman is of course not the only one. Morgan Stanley, which also declined comment, has reportedly bought facilities to store oil. Hedge funds, pension funds, commodity-centered mutual funds, insurance companies - all have gotten in on the act.

"Just the multiple [contract] turnovers in the futures markets has a cost of its own," said Judy Dugan, research director at the Center of Taxpayer and Consumer Rights. Dugan, echoing recent sentiments by oil company executives themselves, said there's no fundamental reason why oil prices should be anywhere near $100 a barrel.

"There's no inability to buy oil, this is not 1981," she said.

Fed to Inject $8 Billion to Lubricate Economy

Seeking to reassure banks amid the continuing credit crisis, the Federal Reserve said yesterday that it would provide $8 billion in funds to ease concerns about lending during the holiday season.

The $8 billion — essentially a low-interest loan to the nation’s banks — will be issued Wednesday and repaid Jan. 10. The 43-day loan period is the longest in three years for this type of year-end injection. While it is not an unusual step for the Fed, the injection usually takes place later in the fourth quarter and involves a smaller amount. In 2005, the last time the Fed issued year-end funds, it issued 28-day repurchase agreements for $5 billion, starting Dec. 8.

Wall Street’s reluctance to lend can be intensified during the holiday season, as consumers demand more money for spending and banks look to close out their yearly balance sheets with a generous amount of capital and investments in safe-haven securities like Treasuries.

This year, anxiety about the ailing credit market has made banks more hesitant to provide their peer institutions with overnight loans, a crucial component of the nation’s economic bloodstream.

“Many large institutions are reluctant to let money go, even for overnight lending purposes,” said Bernard Baumohl, managing director at the Economic Outlook Group. “They prefer to hold onto the cash.”

Report: Foreclosures Will Sap U.S. Cities

Metro Areas Face Billions Of Dollars In Lost Economic Activity Next Year

Rising foreclosures will lead to billions of dollars in lost economic activity next year in major U.S. cities, but homeowners and financial institutions have the ability to work together to contain the effects, said a report released Tuesday.

The report was compiled for a conference of U.S. mayors in Detroit. The mayors hope to create policy recommendations to help address the nation's housing crisis.

Prepared by forecasting and consulting firm Global Insight, the report said weak residential investment, lower spending and income in the construction industry and curtailed consumer spending because of falling home values will combine to hold back the nation's economic activity.

"The wave of foreclosures that has rippled across the U.S. has already battered some of our largest financial institutions, created ghost towns of once vibrant neighborhoods - and it's not over yet," the report said.

The biggest losses in economic activity are projected for some of the nation's largest metropolitan areas. New York is expected to lose $10.4 billion in economic activity in 2008, followed by Los Angeles at $8.3 billion, Dallas and Washington at $4 billion each, and Chicago at $3.9 billion.

The report estimates U.S. gross domestic product growth in 2008 will be 1.9 percent, coming in about $166 billion - or one percentage point - lower as a result of mortgage problems. GDP is the value of goods and services produced and is considered the best barometer of the country's economic fitness.

The report also projects property values will decline by $1.2 trillion in 2008, due in part to the foreclosure crisis, with drops in home prices across the U.S. averaging 7 percent. And it said the loss of property, sales and real estate transfer taxes will hurt local and state governments.

Rising Rates to Worsen Subprime Mess

The political efforts are aimed at keeping the U.S. economy out of a housing-triggered recession. The Mortgage Bankers Association estimates that 1.35 million homes will enter the foreclosure process this year and another 1.44 million in 2008, up from 705,000 in 2005.

The projected supply of foreclosed homes is equal to about 45% of existing home sales and could add four months to the supply of existing homes, says Dale Westhoff, a senior managing director at Bear Stearns. This is a "fundamental shift" in the housing supply, says Mr. Westhoff, who believes that home prices will drop further as lenders "mark to market" repossessed homes.

Foreclosed homes typically sell at a discount of 20% to 25% compared to the sale of an owner-occupied home, analysts say. Lenders are eager to unload the properties, and the homes tend to be in poorer condition.

Ilargi says:

Foreclosed homes may typically sell at a 20% to 25% discount, but these are obviously not typical times. There are today far more homes for sale than in “typical” times, and there are far fewer borrowers. What’s also fast becoming “typical” is that sales of foreclosed homes drag down the value of neighboring properties. The foreclosure sales set the ”new” values. And the number of these sales increases fast.That puts the 20% to 25% discount in a chilling perspective.

Homeowners' big question: How low will prices go?

Eric S. Broida wants to trade up. He has been eyeing a multimillion-dollar house near his Pacific Palisades home and thinks it might be a bargain. Eventually, that is.

The 4,600-square-foot house has languished on the market for six months. The sellers have cut the asking price several times, slashing it from $4.6 million to $3.6 million. When the price falls by an additional $400,000 or so, Broida will be ready to pounce.

"There is nowhere to go but down from here," said Broida, a leasing broker for office space. "I know it in my gut." Few would argue. Southern California home prices have fallen for five straight months, according to data released this month, and are now down 12% from their peak last spring and summer.

For most of this decade, skyrocketing home values were a frequent topic whenever people gathered along soccer sidelines or at backyard barbecues. But the conversation has taken an about-face, noted Jeff Vendley, a Ventura mortgage broker who is trying to sell two Oxnard town houses he bought in 2004 and 2005.

Now, he said, people are wondering, "How low we can go?"

No one knows how severe the slump will be, but economists and real estate experts interviewed by The Times, and who were willing to make predictions, said prices could fall 15% to 25% before turning back up. Most said values would continue falling through at least next year, and some thought the market wouldn't reverse course until 2010.

That could translate to big declines for home buyers who bought at the peak of the market, which various measures place in late 2006 or early 2007. For example, a home that sold for $800,000 in 2006 could fall to $600,000 over the next two years.

Housing woes have domino effect

If you haven't yet felt the impact of the nation's credit crisis, just wait. Chances are, you won't have to wait long.

So far, the turmoil may feel a bit remote for average people: Failed mortgage lenders. Gargantuan write-downs by banks. Foreclosures for people who couldn't really afford the mortgages they got. What about the rest of us? Are we in danger? No one knows for sure, but quite likely, yes.

As the credit crisis seeps into farther-flung corners of the economy, more of us will find it harder — and costlier — to borrow money. The value of the funds in our retirement accounts could shrink. People with subpar credit will likely find it more difficult to qualify for auto and home-equity loans. Even consumers who make the cut may need higher credit scores and more documentation.

Even the $2.5 trillion muni bond market hasn't escaped the credit crunch's damage. Muni bonds are issued by cities and states to raise money for projects such as schools, highways and airports. Historically, they've been relatively safe investments because it's rare that governments default on their debts.

But worries about the companies that insure hundreds of billions of dollars in muni bonds are rippling through to muni bonds and rattling investors. The insurers, which have exposure to risky mortgages, could see their credit ratings reduced. If that happened, the muni bonds they guarantee would be downgraded, too. Cities and states would find it harder to raise money. Projects would be delayed. Taxpayers could face higher taxes.

Home prices falling everywhere: S&P

Down 4.5% nationally over past year, Case-Shiller says

Home prices fell in September in all 20 major cities covered by the Case-Shiller price index, even in cities that had been holding up before the August freeze in mortgage markets, Standard & Poor's reported."There is no real positive news in today's data," said Robert Shiller, chief economist at MacroMarkets LLC, and the co-developer of the index. Shiller said it's nearly impossible to forecast when the market could turn around. Listen to more comments from Shiller.

For the national Case-Shiller home price index, prices fell 1.7% in the third quarter compared with the second quarter, and were down a record 4.5% in the past year. It was the largest quarter-to-quarter price decline in the 20 years covered by the index. For the first time in this housing cycle, prices in all 20 cities dropped from the previous month, with the biggest declines in the former bubble cities of Miami, Phoenix, San Diego, Las Vegas, Los Angeles and Tampa.

For the 20 cities, prices fell a record 4.9% year-over-year. Meanwhile, prices were down 5.5% year-over-year in the original 10-city index, the largest drop in the 10-city index since 1991. The last time prices fell so much, it took more than eight years for home prices to return to their peak level.

"We judge the recent decline in home prices to be the beginning of an extended decline," wrote Drew Matus, an economist for Lehman Bros., who said prices would probably fall 15% from peak to trough nationally.

Mixture of Greed and Need Keep Reviving Debt Products After Excess-Fueled Crashes

Do CDOs have a future? Given the massive losses on collateralized debt obligations this year, the fate of these formerly lucrative investment products looks grim.

CDOs have caused problems before but nothing like this. They are responsible for nearly $50 billion of write-downs at major Wall Street firms, and have precipitated the ouster of Citigroup boss Charles Prince and Merrill Lynch's Stan O'Neal. And CDOs are at the center of the credit storm ravaging global financial markets.

How did such a potentially toxic product get so out of hand? If handled correctly, CDOs can serve useful purposes. For example, one species, collateralized loan obligations, or CLOs, buys loans from banks, giving them capital to make more loans.

To fund the purchase of the loans, the CLO issues debt, which offers higher returns than traditional bonds. That is usually because the combined face value of the loans it buys is greater than the face value of the debt it issues. CLOs have performed well for a decade or more. So it seemed natural for Wall Street to extend this model to other types of assets.

The trouble is, every time investment banks did so, excess soon took over. In the late 1990s, they rolled out deals backed by manufactured-housing debt -- loans to trailer parks, essentially. Others stuffed with high-yield bonds lured investors until 2001.

Both types subsequently crashed. In the aftermath, investors complained about bad structures, overselling and ratings-company incompetence -- the same things investors believe caused today's subprime-mortgage CDO meltdown.

Bank of America Takes Lead in Backing 'SuperSIV' Fund

Bank of America Corp., the nation's second-largest bank, will lead efforts by Citigroup Inc. and JPMorgan Chase & Co. to convince smaller competitors to help finance an $80 billion bailout of short-term debt markets.

The campaign starts this week with New York-based Citigroup and JPMorgan in supporting roles to Charlotte, North Carolina- based Bank of America, said two people with knowledge of the matter, who didn't want to comment publicly before the plan is formally announced.

The "SuperSIV'' fund, backed by U.S. Treasury Secretary Henry Paulson, would buy assets from so-called structured investment vehicles, whose $300 billion of holdings include corporate and mortgage debt in danger of default. Analysts including Richard Bove of Punk Ziegel & Co. have criticized the proposal because it may saddle new participants with losses created by their bigger rivals.

“Why should we put something on our balance sheet that is going to result in further writedowns?'' is how most contributors will respond, Bove said in an interview. “The job of the Treasury isn't to go out and defraud investors.''

Bank of America, Citigroup and JPMorgan, the three largest U.S. banks, want the SuperSIV fund in place by year-end because some SIVs haven't been able to trade, people familiar with the fund said. BlackRock Inc., the biggest publicly traded U.S. money manager, probably will manage the fund, said a person with knowledge of the plan.

Abu Dhabi to Bolster Citigroup With $7.5 Billion Capital Infusion

Citigroup Inc., seeking to restore investor confidence amid massive losses due in credit markets and a lack of permanent leadership, is receiving a $7.5 billion capital infusion from the investment arm of the Abu Dhabi government.

In exchange for its investment, ADIA will receive convertible stock in Citigroup yielding 11% annually. The shares are required to be converted into common stock at a conversion price of between $31.83 and $37.24 a share over a period of time between March 2010 and September 2011. The investment, which came together in about a week, is expected to close within the next several days.

Citi is paying a higher interest rate than companies that borrow on the high-yield, or junk-bond, market; currently they pay roughly 9% for straight bonds. Typically, convertible bonds pay lower interest rates than straight bonds, although a particular bond's structure could affect the interest rate paid.

Abu Dhabi Deal Raises Questions About Citigroup's Health

Questions Raised

- Is Citigroup prepared for the mortgage mess to get far worse?

- What about losses on the consumer side as we slide into a severe recession?

- What happens when commercial real estate tanks?

- What happens when Citigroup needs another $7.5 billion, then another after that?

- When does the dividend get cut? (Citigroup denies that it will)

- Is Citigroup so bloated that it can afford another massive jobs cut?

- If not, then what business units have to be sold to downsize to the new number of employees?

Selling a 4.9% stake in the company is a step that is not taken lightly. Nor is another round of massive layoffs. All things considered however, Monday's news reports on Citigroup raise more questions than they answer. The one thing we do know for certain is that Citigroup was (and likely still is) severely capital restrained. On November 5th I said Citigroup Is Fighting For Its Financial Life. It still is.

Citigroup spurns Bank America overture: report

Citigroup Inc got a call from a prominent investment banker suggesting a merger with Bank of America Corp as it was dealing with billions of dollars in mortgage-related losses and the departure of Chief Executive Charles Prince, the Wall Street Journal reported Wednesday in its online edition.

Citigroup's board dismissed the informal approach as "totally out of hand" and no discussions have taken place, the Journal said, citing a source familiar with the matter. Bank of America, meanwhile, said it never authorized a formal proposal to Citigroup, according to the Journal.

Massive Job Cuts Expected At Citigroup

Citigroup, Wall Street’s largest financial services firms, is planning its second round of large-scale layoffs in less than a year.

People with knowledge of the matter have described the pending job reductions as "massive" and "large." The total number could reach as high as 45,000, these people estimate.

45,000 jobs, should it come to that, is one heck of a lot of jobs. I doubt most of those employees could find jobs quickly, at the same salary, or the same benefit levels.

Nonetheless, this is just a down payment on what's to come. Other financial institutions are sure to follow suit.

Another rate cut from the Fed is coming. It will do no more good than the last 3 did, but Bernanke will try anyway. Nothing like heading into a recession with rates already as low as 4.25 or possibly even 4.00%.

Don't expect any mortgage relief. Rates are still higher than a year ago and that does not even factor in credit standards that have tightened significantly.

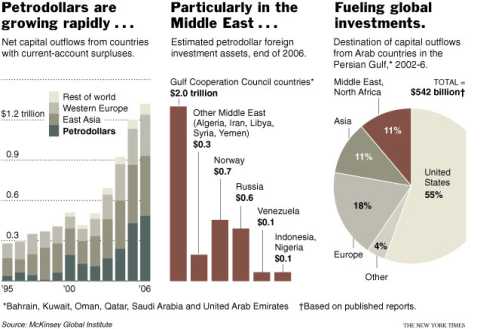

It should now be clear that Citigroup squandered tens of billions of dollars over the years buying back stock at inflated prices. The irony is that as petrodollars return home, foreigners get to buy in at an effective price in the mid-20's.

This is the price the US has to pay for the our spending sprees over the last seven years financed by China, Japan, and the oil producers. And what do we have to show for that spending spree? The answer is a sinking US dollar, neglected infrastructure, and a housing boom gone bust. Given that foreign dollar reserves eventually have to come home, this deal is just a token down payment for what's to come.

On a side notes, I was asked this morning if foreign buying would support stock prices. The answer is that it won't. For every buyer there is a seller so "buying" never drives up prices except on the day of an IPO. Sentiment (willingness to take on risk and speculate) drives stock prices, not "buying". That sentiment is clearly waning.

The party is over. The US now must face the consequences

In years past, when the U.S. fell on hard financial times foreign wealth was nil and the U.S. was stuck to work through the problems alone, holding onto its assets until the economy came roaring back. This time is much different and the moons have aligned to put the U.S. on the auction block. A real estate fall, a dollar plummet, foreign wealth at record levels and now a rapidly declining stock market has all the ingredients to make one heck of a spicy global wealth transfer pie.

U.S. currency has declined over 30% this year alone and domestic buyers are nowhere to be found. Now, however, it seems the U.S.' white knight has arrived and the U.S. will gladly accept the international community's assistance in working out its problems. Of course, this comes at a price and that is a transfer of this wealth at an incredible discount.

Ilargi says:

In the following quote from the same article, Quint Tatro at Minyanville grabs the bull by the balls:“If a foreign currency has increased in value against the U.S. dollar by 30% and a corporation like Citigroup has fallen by 45%, is it too simple to assume that this equity is being transferred for 25 cents on the dollar or a 75% discount?”

But not so fast, look at the next article, by Mark Bloudek, also at Minyanville.

When I look at this deal it is quite interesting. First of all, it must be understood that this is effectively an equity deal because of the mandatory conversion provision. From the limited information I have been able to retrieve, it seems that Citigroup (C) is selling just under 5% of the company for approximately $5.7 bln. Why is it not the $7.5 bln that it is getting from the investors? Because Citi will have to pay interest on the $7.5 bln for just over two years, which will come out to approximately $1.8 bln. $7.5 - $1.8 = $5.7.

By my estimate, Citigroup has basically issued restricted equity (to be officially issued in two-plus years) at a price per share around the mid 20's when you take into account the 11% interest it is paying on the $7.5 bln. Additionally, Citi does get the benefit of using $7.5 bln now instead of only getting $5.7 bln now (if it had just done a straightforward equity deal), while paying $1.8 bln over the next two-plus years in interest.

All in all, this deal is a tough deal for Citi in my opinion because it smells like desperation. But don't be confused about the 11%. It is clear since the deal has mandatory conversion prices that the 11% interest rate is basically a discounting mechanism for the conversion price, which is why I say the equity was effectively issued in the mid 20's. It also must be noted that doing a convertible may have certain tax advantages for Citi instead of doing a straight equity deal in the 20's.

What Is "Subprime"?

Tanta explains, thoroughly

The main impact of subprime lending on the overall mortgage business was the take-out function. As subprime lending grew, you saw better “performance” of prime or near-prime mortgage portfolios.

This was not because subprime lending did away with the traditional default drivers of job loss, illness, divorce, or disorderly conduct; it was because loans in that kind of trouble had a place to go besides foreclosure. Prime lenders could and did congratulate themselves on their low foreclosure rates as if it were a matter of their superior underwriting skills, but that involves a high degree of naiveté.

It’s really important to understand this issue, because it gets to the heart of the “contagion” thing. It is not that subprime delinquencies are “spreading” to prime loans as if some infectious agent were in play.

It’s that the drain got backed up: when subprime lenders go out of business, or investors won’t buy subprime loans, there is no place for the inevitable prime delinquencies to go except foreclosure. Prime delinquencies become “visible” because they don’t move out of the prime portfolio via refinance into the subprime portfolio, where we “expect” to see them.

What does it mean that HSBC is moving their SIVs to their balance sheet?

Let's start with the structure of an SIV (Structured Investment Vehicle). First an SIV has investors - like hedge funds or wealthy individuals - who invest say $1 Billion in the SIV (the equity). Then the SIV issues commercial paper (CP) and medium-term notes (MTN) that pay slightly higher rates than similar duration paper. The typical SIV, according to Fitch, uses 14 times leverage, so in our example the SIV would sell CP and MTN for $14 Billion.

Now the SIV invests this $15 Billion ($1 Billion equity and $14 Billion borrowed) in longer term notes. The idea is simple: borrow short, lend long, hedge the interest rate and credit risks - and the profits flow to the investors in the SIV.

So what does a bank like HSBC have to do with this? Usually the bank sets up the SIV, attracts the investors, manages the SIV for a fee - and there was always the appearance that the SIV CP was backed by the bank - perhaps allowing the CP and MTN to pay lower interest rates.

So what is the problem? Some SIVs invested in asset backed paper, backed by home mortgages. Even though the SIVs almost always invested in the highest tranches (with no losses to date), the market value of these assets has fallen recently (not a news flash). This means that the investors in the SIV (the equity) have taken paper losses on their $1 Billion investment.

To be successful, you must portray an image of success. One good way to appear successful is by appearing to be popular. The more in demand you seem, the more in demand you’ll be. This is true in many aspects in life and is evident in the stock market as well. If a company doesn’t have many available shares on the open market, it seems like an in demand and sought after investment. Share prices will certainly go up.

Many corporations will do anything to improve their stock price. Instead of going about this the natural way, many are simply buying back their own shares in a way to reduce the supply on the open market. This seems like it would make sense, but the strategy does not always pan out.

One of the worst cases was that of Ambac, which borrowed money to buy back shares right before it collapsed. While the company was buying back its own shares right before the price fell, the CEO and former CEO were able to dump millions of dollars worth of shares just before the collapse.

Freddie Mac to Sell Stock, Cut Dividend

Freddie Mac halved its dividend and unveiled plans to sell $6 billion of preferred stock to bolster the mortgage investor's finances in anticipation of more losses, the company said Tuesday.

Freddie Mac, chartered by Congress to buy home loans from mortgage lenders, is the nation's No. 2 buyer and guarantor of home loans. It will sell $6 billion of a special class of stock. The money raised through this sale will be used to buttress the company's balance sheet "in light of actual and anticipated losses," Freddie Mac said in a statement.

The offering of preferred stock and the halving of the dividend were expected after Freddie Mac last week posted its biggest quarterly loss ever -- $2 billion in the third quarter -- and warned that it may need to curtail its business unless it can raise fresh capital. The loss, due in large part because Freddie needed to set aside $1.2 billion to account for mortgages gone sour, far outstripped what Wall Street was expecting.

If sales of debt, the dividend cut and other actions aren't sufficient to keep the company's capital levels above government-mandated minimums, Freddie Mac said it may consider other measures such as limiting its growth, reducing the size of its mortgage investment holdings or issuing new stock.

The bad news last week sent Freddie Mac's shares skidding 28.7 percent, the largest decline since its shares have traded in public markets. It also sent a shudder through the mortgage market since Freddie's loss was even larger than the $1.4 billion quarterly deficit of Fannie Mae, its bigger government-sponsored competitor.

Analysts noted that Freddie Mac's holdings of securities backed by high-risk subprime mortgages -- the loans targeted to borrowers with tarnished credit records that succumbed to a wave of defaults starting earlier this year -- greatly exceed those of Fannie Mae. The remedies Freddie Mac is undertaking could add to the strain on the slumping housing market, analysts say, an outcome that would be sharply at odds with its government-mandated mission to keep money flowing to lenders.

Fannie Mae and Freddie Mac have traditionally been a key source of funding for banks and other mortgage lenders by purchasing mortgages they originate and then packaging them for sale to investors. Industry experts say a reduced role by either could ripple across the entire housing market.

Wells Fargo Plans $1.4 Billion Charge on Loans

Wells Fargo & Co. is absorbing $1.4 billion in losses on home equity loans that borrowers have stopped repaying amid a deepening real estate slump that's turned into a financial sinkhole.

Until Wells Fargo disclosed its projected losses late Tuesday, the San Francisco-based bank had suffered relatively little damage in a mortgage meltdown that had already battered other major U.S. lenders.

"Clearly, this is a disappointment because (Wells) had been seen as better managers of credit than many other big banks," said RBC Capital Markets analyst Joseph Morford. "But now they have a big blemish on them, too."

Like several of its peers, Wells Fargo will take its lumps in the fourth quarter by recognizing $1.4 billion in pre-tax losses, with most of the trouble concentrated in a bundle of high-risk home equity loans that the bank intends to purge from its books.

[..]

The first hint of Wells Fargo home equity trouble surfaced last month when the bank reported it lost $153 million on the portfolio in the third quarter, from $27 million at the same last year.Wells Fargo's chief executive, John Stumpf, spooked investors even further two weeks ago when he described the current real estate slump as the worst since the Great Depression and reiterated earlier projections that the bank's home equity losses would continue to rise next year.

Wells Fargo's $1.4 Billion Loan Loss

Wells Fargo & Co., the second-largest U.S. mortgage lender, said late Tuesday that it will set aside $1.4 billion during the fourth quarter to cover higher losses on home-equity loans caused by deterioration in the real-estate market. The special reserve covers an $11.9 billion portfolio of loans that the bank originated or acquired through indirect sources such as mortgage brokers, according to the bank.

'We believe it's prudent to further tighten our standards, to stop acquiring new loans in these segments and to manage the portfolio as a liquidating, nonstrategic asset' said John Stumpf, CEO Wells Fargo.

In one word this is what John Stumpf, CEO Wells Fargo is describing: deflation. There is simply no other word for it. Deflation is a decrease in money supply and credit. Wells Fargo is liquidating (cutting its losses in existing credit), while tightening lending standards for new credit.

Perhaps new credit at Wells Fargo exceeds the decrease in existing credit for a while, but the trend is clear and that trend is not just about Wells Fargo. Capital impairment is everywhere and capital impairment is going to restrict the ability of banks to lend whether Bernanke or anyone else likes it or not.

Citigroup raised capital at 11% interest in a desperation move to restore its balance sheet yet it is presumably offering prime loans at 7.5%. How long can this keep this up?

Bernanke and everyone else who is focused on capacity utilization, oil prices, the US dollar, wheat, or food at the local grocery store are simply focused on the wrong things. The correct focus is on the ability and willingness of banks to lend, and the ability and willingness of consumers and businesses to borrow.

Everything else is a sideshow.

Why $900 Million Helped Less Than 100 People Refinance

Eight states, including Massachusetts, Maryland, Ohio, and Pennsylvania, have pledged a collective $900 million towards the foreclosure crisis since the beginning of this year according to a Boston Globe report. The money was meant to help people refinance out of unaffordable loans, but things aren't working as well as planned. A Globe survey found the raised cash has actually helped less than 100 people refinance.

The reason the bailouts aren't working is simple: many people are beyond help. The state programs aren't set up to provide distressed homeowners with money directly. (Thank goodness.) Homeowners that qualify for a refinance are sent to a recommended lender.

The lender sets up the refinance and then sells the loan to the state housing finance agency--this way it is the state taking the risk, not the lender.

The problem is that most applicants do not qualify for a refinance. A majority owe more on their home than it is worth and the rest have destroyed their credit by getting behind on their mortgage payments.

Don't look now: Here comes the recession

Even with a boost from holiday spending, the U.S. economy looks shaky, thanks to slumping housing prices, Wall Street woes and debt-laden consumers. How bad could it get?

The cash registers were ringing on Black Friday, but make no mistake: American consumers are jittery, and seem all but certain to push the U.S. economy into recession.

After years of living happily beyond their means, Americans are finally facing financial reality. A persistent rise in energy prices will mean bigger heating bills this winter and heftier tabs at the gas pump. Job growth is slowing and wage gains have been anemic. House prices are sliding, diminishing the value of the asset that's the biggest factor in Americans' personal wealth. Even the stock market, which has been resilient for so long in the face of eroding consumer sentiment, has begun pulling back amid signs of deep distress in the financial sector.

The latest evidence of the long-awaited consumer retrenchment: Chic discounter Target last week reported a weaker-than-expected third quarter, as sales of higher-margin apparel and home goods slowed. Starbucks reported for the first time that customer traffic in its stores declined in its latest quarter compared to a year earlier. Wal-Mart shares hit a six-year low in September after the retail giant posted another wan sales increase.

Are Prices Rising or Falling? You Bet!

First, the basics: China is a big country in Asia with a big pile of cash - $1.4 trillion of it. Most of this currency features pictures of dead U.S. presidents. The USA is a big country in North America that emits these dollars, and uses them to buy things it cannot afford and doesn't really need.

Meanwhile, Americans owe more dollars than ever before. Until 1980, debt as compared to GDP never surpassed 150%. Now it is 330%. Many people are finding it hard to pay their debts. And many leveraged bets made on this debt are now going bad, reducing the availability of cash and credit generally. So, back to our views:

On the one hand...the world is awash in paper money. So much of it is gushing into the world economy that prices notably of oil and gold can only float up higher. And, the dollar, of course, is doomed by inflation. It will be dragged down by the weight of its own numbers.

On the other hand, the world is caught in a credit crunch. The days of reckless lending are over. Assets real and imagined are falling in value, prefiguring a major drop in prices across the board. The housing industry got nailed first. Then, property prices headed down. Finance was next. And then technology. And now stocks, generally, are in retreat...with much further to go.

Week after week, more losses are announced. The latest tally by Goldman Sachs estimates total losses at $400 billion from the subprime debacle, with a total of $2 trillion of cash and credit sucked out of the financial system. Leverage works in both ways, it turns out. When credit is expanding, a deposit of $10 million can be levered into a $100 million gamble. When it is contracting, a $10 million loss reduces the supply of credit by as much as $100 million.

The drop in the dollar and the drop in housing prices have already cost Americans trillions in implied wealth. It's money that is going, not coming. Says the Economist Intelligence Unit: "The main risk to the world economy is a deflationary spiral in asset prices."

Oil Producers See the World and Buy It Up

Flush with petrodollars, oil-producing countries have embarked on a global shopping spree.With a bold outlay of $7.5 billion, the Abu Dhabi Investment Authority is about to become one of the largest shareholders in Citigroup.

The bank had already experienced the petrodollar’s power this month when another major shareholder, Prince Walid bin Talal of Saudi Arabia, cleared the way for the ouster of its chief executive, Charles O. Prince III.

The Dubai stock exchange, meanwhile, is negotiating for 20 percent of a newly merged company that includes Nasdaq and the operator of stock markets in the Nordic region. Qatar, like Dubai a sheikdom in the Persian Gulf, might compete in that deal.

In late October, Dubai, which has little oil but is part of the region’s energy economy, bought part of Och-Ziff Capital Management, a hedge fund in New York. Abu Dhabi this month invested in Advanced Micro Devices, the chip maker, and in September bought into the Carlyle Group, a private equity giant.

Experts estimate that oil-rich nations have a $4 trillion cache of petrodollar investments around the world. And with oil prices likely to remain in the stratosphere, that number could increase rapidly.

The Holiday's Shopping Season Can't Stop the Coming 'Severe Recession'

The real danger may not be lead in the toys but another type of lead in our heads that leads to denial on the part of millions that we can go on with addictive, well-cultivated, crazed consumption habits.

Bill Bowles writes about this on his CNI blog:

"The problem is that many of us have been force-fed with a diet of nothing but passive, uncritical consumptionism; indeed, we are addicted to the stuff; breaking such powerful habits is what this is all about; it's about getting people to think critically again about what's going on and why and what, if anything, we can do about it."Bowles also ties this cultural affliction sometimes known as affluenza back to our dependence on a media system that won't really allow other voices to be heard:

"It would be an understatement to say that the world has changed almost beyond recognition in the past two decades. We appear to have re-entered the age of the dinosaur, gigantic creatures stomping across the planet, 'guided' by pea-sized brains. So ... we have increasing concentrations of powerful media -- media that is actually an entire raft of processes critical to the survival of capitalism -- either in the hands of vast corporations or the state (which in any case is now openly in bed with the big corporations) ..."

The Economy: Consumers' Gloom Thickens

When it comes to U.S. consumers, it's important to remember that what they tell survey-takers, and what they actually do, are often two very different things. The Nov. 27 release of the Conference Board's closely watched consumer confidence survey posted an even bigger November drop than economists had expected, indicating rising gasoline prices, housing market woes, and credit-market worries may be taking their toll. And yet the report comes on the heels of data showing robust retail sales for the Black Friday holiday shopping weekend, and probably for the month as a whole.

But while consumers' gloomier mood may not be showing up in spending figures, it is quite evident in key housing sector reports. The S&P/Case-Shiller home price data for September and the third quarter overall, released Nov. 27, showed a more troublesome acceleration in the pace of price declines in the housing market.

NetBank says to liquidate in bankruptcy

NetBank Inc., which became the largest U.S. bank to fail in 14 years when it filed for bankruptcy protection two months ago, said on Monday it expects to liquidate its assets.

In a regulatory filing, the Internet bank said it intends to file a Chapter 11 reorganization plan that will "describe the liquidation of assets." It said it expects shareholders will receive nothing for their holdings.

NetBank, based in Alpharetta, Georgia, filed for protection from creditors on September 28 with the U.S. bankruptcy court in Jacksonville, Florida, after losses had mounted from mortgage defaults and what the U.S. Office of Thrift Supervision called "failed business strategies."

Subprime cards' high fees can add to debt troubles

After incurring debt problems, Rosemary Potter of Pinon Hills, Calif., decided this year to try to repair her credit. She didn't qualify for a standard credit card, so she signed up for what's called an Imagine Gold Card, hoping to use it to raise her credit score.

It didn't turn out as she'd hoped. For a modest $300 credit line, she was hit with a $150 annual fee, plus late fees and over-the-limit fees. After she'd had the card a few months, her credit score was still blemished, so she canceled it. "I'm staying away from credit cards now," Potter, 57, says.The credit crunch has made it harder to get loans, especially for those with bruised credit. To fill that gap, a breed of credit cards, often called subprime — and some critics call predatory — has increasingly sought out consumers. These cards offer only a slight amount of credit, yet charge steep fees. Among their targets: young adults with little credit history and families struggling to climb out of debt.

In the first half of this year, direct mailing of such cards jumped 41% over the same period in 2006, according to Mintel International Group, a research firm. Millions of consumers are being hurt, says a new report on subprime cards from the National Consumer Law Center, which has another name for them: fee-harvester cards.

One such card offers a credit limit of just $250. Yet applicants automatically get socked with a $95 program fee, a $29 account set-up fee, a $6 monthly participation fee and a $48 annual fee — a total of $178, the report said. Available credit left for the user: a scant $72.

Average Briton is now £33,000 in debt

Families are stretched to the limit of their borrowing capacity, with personal debt having almost doubled since the turn of the century, an independent report warns today.

The average adult now owes £33,000 through mortgages, credit cards and personal loans compared with £17,000 in 2000, the international accountancy firm PricewaterhouseCoopers claims.

As borrowers default on their debts in growing numbers and banks and building societies try to recoup their losses, annual fees on credit cards will become standard, the report says. These would equate to up to £30 a year.

Despite the prospect of annual charges and higher interest rates on monthly bills, many people are likely to have to use their credit cards more often to meet the rising cost of mortgage repayments.

The report comes as families prepare for Christmas, when the average adult takes on more debt than at any other time of the year.Further pressure will be applied next year when more than a million people see their discounted fixed-rate mortgage deals end, the report predicts. They face an average rise of £140 on their monthly repayments.

The report delivers a bleak warning about the level of consumer borrowing in Britain, which now stands at more than £1.3 trillion.

The point of the whole thing is that “The era of ‘peak gold’ has arrived”, which is truly momentous, because it means that the “easy to get at” gold has been gotten to, and the rest of the gold left in the earth is harder to get to, and thus the rate at which gold is being discovered, has collapsed when compared with the old days, which is just like the collapse in new discoveries of oil, which is where you get the phrase “peak oil”, and they both have crucially to do with how a rising demand growth curve and a falling of supply growth intersect at that place called Lonely Street. Oops! Sorry! That’s Elvis Presley! I mean, falling supply and rising demand intersect at that precise point that is scientifically referred to as “Expensive like you wouldn’t freaking believe!”

And since everything from fuel to fertilizers to plastics to medicines to everything you can name under the sun is made from oil, then you are going to see inflation in prices like you will not freaking believe, which means that the currency will buy less per unit like you will not freaking believe, which means that people are going to be hungry and broke and miserable and rioting like you will not freaking believe.

Bank CDO Losses May Reach $77 Billion, JPMorgan Says

Losses on collateralized debt obligations at the world's biggest banks may double to $77 billion, JPMorgan Chase & Co. analysts predict. Losses marketwide on CDOs linked to U.S. mortgages will reach about $260 billion, the New York-based JPMorgan analysts, led by Christopher Flanagan said in a report.

Merrill Lynch & Co., Citigroup Inc. and other banks that underwrote the so-called structured finance CDOs have already taken losses of at least $47.2 billion, a tally that also includes other holdings aside from CDOs. Questions about the extent of writedowns have caused investors to flee bank stocks and bonds and has kept interbank lending rates from matching declines in yields on short-term U.S. government debt.

"One of the benefits of securitization is the offloading and global distribution of risk,'' the JPMorgan analysts wrote. "Ironically, this is now a capital markets hazard, since no one is sure where subprime losses lurk.''

Structured finance CDOs repackage asset-backed debt including subprime-mortgage bonds and other CDOs into new securities with varying risks. CDO sellers including Merrill, Citigroup, UBS AG and Deutsche Bank AG are taking losses on the "super-senior,'' or safest, pieces of the CDOs (!!!), according to JPMorgan. Writedowns on that debt should be between 20 and 80 percent, the analysts wrote.

HSBC bails out investment funds

HSBC Holdings PLC, Europe's largest bank, said Monday it will bail out two troubled funds it manages by transferring about $45-billion (U.S.) of their assets onto its balance sheet.

HSBC said it will also inject $35-billion into the two funds, Cullinan Finance Ltd. and Asscher Finance Ltd., in a move that will clarify responsibility for the funds and prevent liquidation of their assets.

The funds are "structured investment vehicles" or bank-sponsored businesses that sell short-term debt but have been operated off the bank's balance sheet.

The moves are another symptom of a global credit crisis which has forced up the cost of short-term lending.

Ilargi says:

HSBC wrote down its CDO’s to zero. As I saw someone write: that should make the math easier for analysts looking at other banks’ CDO’s.

The Stealth Public Bailout of Reckless “Countrywide”: Privatizing Profits and Socializing Losses

The letter by Senator Schumer questioning the $51.1 billion that Countrywide borrowed from the Federal Home Loan Bank system (specifically the Federal Home Loan Bank of Atlanta) has finally revealed the little dirty secret - that was known only to a few insiders and was noticed on this blog a month ago – that Countrywide, the largest US mortgage lender, has received a massive stealth public bailout that has put at severe risk taxpayers’ money.

Here is Countrywide - the premier poster child financial institution of the reckless and predatory lending practices of the last few years – getting in severe financial trouble because of its rotten lending practice in subprime, near-prime and prime mortgages – and whose CEO Mozilo is under SEC investigation for potentially illegal activities – now receiving a massive $51.1 billion of public bailout money with little official supervision of such lending.

Mozilo is under investigation for his accelerated sales of Countrywide stock under a 10b5-1 plan. Mozilo has made more than $100 million on stock sales this year, while Countrywide shares collapsed more than 50%.

As the Schumer letter correctly points out the collateral against this $51 billion loan is mostly toxic waste subprime garbage whose market value is now much lower than the face value of such mortgages; so $51 billion dollar of taxpayers’ money has been put at risk with garbage as collateral for it.

China wins from credit crunch fallout

Towards the end of September, a group of the world's most powerful bankers met for an emergency summit on the credit crunch which, days earlier, had threatened to topple Northern Rock, Britain's fifth-biggest bank.

All those present knew about the extraordinary scenes on the UK's high streets as thousands of savers queued for days to withdraw more than £10bn of their savings in the country's first run on a bank since Victorian times.

But while banking and investment executives elsewhere in the world had watched the TV pictures with a sense of horror, those who gathered in the spartan meeting room 5,700 miles from London had another word at the forefront of their minds: opportunity.

For this was not London, New York or Frankfurt, but Shanghai. And the senior officials from communist China's central bank who had convened at the People's Bank of China that day knew that the crisis in the global financial markets had served only to hasten the transfer of economic power from Europe and the US to Asia.

Slowdown has arrived, according to latest Fed Beige Book

The economic slowdown has begun, according to the Federal Reserve's latest report on conditions across the country released Wednesday. The economy continued to grow, but at a reduced pace, according to the report, known informally as the Beige Book.

The glut of available homes for sale is keeping downward pressure on house prices and construction activity. No turnaround is on the horizon until well into 2008, contacts said. Two of the few bright spots were manufacturing and tourism which benefit from the weaker dollar. The report found soft retail sales, pessimism about the holiday season and concern that goods are piling up on shelves.

The financial market turmoil is impacting the market for credit. Business loans are down and standards for consumer loans are up. Not wanting to dwell on the weak bank sector, the report separated out "nonfinancial services" as an area of strength. Demand for legal services increased.

Japanese Stocks Fall on Concern Investment Losses Will Spread

Japanese stocks fell, led by Sumitomo Mitsui Financial Group Inc., after Wells Fargo & Co. announced a $1.4 billion pretax charge tied to increased losses on home equity loans. Shares also declined after U.S. consumer confidence fell more than expected in November and housing prices dropped the most since at least 1988, pointing to weaker demand in Japan's biggest overseas market.Fast Retailing Co. and Mitsubishi UFJ Financial Group Inc. slid after Japan's government lowered its assessment of the job market for the first time in three years.

"It looks like the trend for growing subprime-related losses at U.S. financial institutions is here to stay,'' said Kiyoshi Ishigane, who helps oversee $61 billion in assets at Mitsubishi UFJ Asset Management Co. in Tokyo. "Japanese banks have declined because of weak domestic demand and as wages and employment stalled.''

Norwegian investment house Terra Securities declares bankruptcy

Oslo-based investment house Terra Securities ASA declared bankruptcy Wednesday after national regulators moved to revoke its license for failing to inform Norwegian townships of the high risks of their U.S. investments.

Four small townships in northern Norway had been embroiled in a conflict with Terra over losses, saying the brokerage failed to inform them of the high risk of 451 million kroner (US$82 million, €56 million) in investments placed through the American financial giant Citibank.

All four of the townships had borrowed money against expected future income from municipal hydroelectric plants, and invested in complex funds in part based on risky subprime mortgages in the United States. A sharp decline the U.S. subprime market would have forced the townships to invest even more money under the terms of their contract.

Florida School Fund is Rocked by an $8 Billion Pullout

Florida local governments and school districts pulled $8 billion out of a state-run investment pool, or 30 percent of its assets, after learning that the money- market fund contained more than $700 million of defaulted debt. Orange County, home of Disney World, removed its entire $370 million from the pool on Nov. 16, two days after the head of the agency that manages the state's short-term investments disclosed the defaulted debt in a report delivered to Governor Charlie Crist.

The State Board of Administration manages about $42 billion of short-term investments, including the pool, as well as the state's $137 billion pension fund. Almost 6 percent, or $2.4 billion, of its short-term investments consist of asset-backed commercial paper that has defaulted. Those holdings include $425 million in Axon Financial, a structured investment vehicle, or SIV, according to state records.

About $19 billion remained in the pool this week after the unprecedented wave of withdrawals, which came after the State Board of Administration reported its holdings of downgraded debt to Crist at a Nov. 14 public meeting of his cabinet in Tallahassee. The disclosures followed a month of inquiries by Bloomberg News to Florida officials. "Knowing other people were pulling out, and that word was spreading, we looked at the potential for a run on the pool," said Orange County's Moye.

Should the withdrawals continue, Florida's pool may have to consider filing for bankruptcy protection, says John Coffee, a securities law professor at Columbia Law School in New York. "A bankruptcy could handle these kinds of problems if they feel they'll become insolvent,'' he said.

Bank of Canada urged to extend liquidity provisions

As financial institutions around the world start to account for their exposure to the spreading subprime mortgage woes and the slowing U.S. economy, the cost of short-term borrowing has shot up again. Both the European Central Bank and the U.S. Federal Reserve indicated yesterday that they fear liquidity will dry up further, as financial institutions and companies need cash at fiscal year-end.

Both central banks issued statements assuring banks and markets that funds would be available to get companies over the end-of-year hump."The ongoing process of risk appraisal and re-pricing in financial markets could be more protracted than previously expected and could have a broader impact on financial markets and the economy," ECB vice-president Lucas Papademos said in a speech. In Canada, however, there's been no such action, despite signs of liquidity trouble.

The Bank of Canada intervened in the overnight market yesterday, injecting $715-million to defend its key interest rate. It has been intervening regularly and heavily over the past two weeks as credit spreads have widened, prompting analysts to wonder whether August's credit turmoil is making a comeback. But the Bank of Canada's action stops there.

Moral Hazards And Fed Actions: Mike Shedlock

I just finished reading the complete speech by Fed Vice Chairman Donald L. Kohn on Financial Markets and Central Banking.

Kohn is disingenuous at best and a blatant liar at worst with that speech.

The Fed claims to seek "price stability" but idly stands by ant lets bubbles expand to amazing proportions. Then after the bubble pops, all of a sudden the Fed claims to be concerned about "innocent bystanders". For starters, the only innocent bystanders are those who sat the bubble out. Everyone else was greedy, perhaps even willing participants to fraud.

The truly innocent were hurt many ways: They were robbed by the Fed's inflationary policies, they received inadequate interest for their cash savings, and property taxes soared while incomes did not. Those on fixed incomes suffered the most. On the other hand, the enormously wealthy benefited the most.

So let's be honest here. The Fed does really not care about those who were hurt. If it did, it would not have let the conditions that fostered this bubble brew as long as it did. The Fed is only concerned about a credit crunch that is affecting bank profits and bank's ability to lend.

That unfortunately is the harsh reality. Even if you choose not to believe that, the Fed's asymmetric actions are a moral hazard in and of themselves. By acting only after bubbles break rather than taking aim at the conditions that foster bubbles (loose credit standards fostered by setting interest rates too low), the Fed has an active policy that is guaranteed to bail out reckless lending institutions whenever they make mistakes.

And when market participants think they are going to be bailed out by the Fed, all kinds of ridiculous risks are taken. Now in a so called effort to protect the "innocent bystanders", those innocent bystanders are about to be punished a second time.

The only way to stop this cycle of bubble blowing is to abolish the Fed. There is only one candidate with that on his platform and that person is Ron Paul. I support Ron Paul.

Another great roundup, thanks. The deflationary trend seem to be gaining strength with every roundup. Those holding out for the hyperinflation scenario may wind up awfully disappointed. This thing could take years to play out. Maybe decades. I just can’t get Japan out of my mind.

goritsas,

Regarding the line where you say the deflationary trend seems to be gaining strength.

Do you believe that the US$ will increase in value and purchasing power going forward? What will reverse the macro trend that has been in place since 1913?

Regards,

Gunga

I think it will, albeit temporarily. A credit implosion would make actual currency far more valuable for a while - cash is king in a deflation. Historically, credit has only been available for those wealthy enough not to need it. The recent years of easy credit have been a huge aberration that is about to end IMO, and without access to credit, people will have to rely on savings as their cushion. Those with liquid savings (who manage not to lose them in a bank run over the next couple of years) will then be very much better off than those who don't. Those without will have no margin for error in a credit crunch.

Domestically, deflation should cause the value of money to rise relative to goods and services, due to a firesale of assets such as occurred in the Great Depression. Internationally, the dollar should rise temporarily relative to other currencies as the dumping of low grade debt sparks a flight to quality, from which short term US treasuries should benefit. It's not possible to say how long a dollar spike would last. A rally could be fairly short and sharp - my WAG would be lasting several months - but we'll have to wait and see.

I agree with your logic and I don't mean to mince words but I think it is very important for people to get it right if we are to protect our families finances. I would like to suggest that a dollar spike as you decribe is more of a temporay break in the macro trend and not a change from an inflationary environment to a deflationary environment.

Perhaps a deflationary pause within a long term inflation.

Regards,

Gunga

Yes...Hyperinflation with a deflationary pause on systemic collapse.

Then G*D help us.

What about inflation in food (milk,grain,meat etc), energy and oil? As these are globally traded, it is possible that prices for these items could continue to inflate on Chinese demand even in the middle of a deflationary collapse in asset prices.

The extra money supply created during the expansion was mostly channeled into assets, so the deflationary effect sould also be seen mostly in assets. If will also show up in discretionary goods. But people don't have as much leeway to cut back on food and fuel. The drop in US demand for these items may be more than offset by increasing demand from BRIC economies.

You could have inflation affecting essential goods while deflation affects discretionary goods and assets.

The problem here is the use of terminology which means different things to different people. To me - following the Austrian school - inflation and deflation are monetary phenomena. If the money supply is increasing, we have inflation and if it decreasing then we have deflation. By this definition it is not possible to have both at once.

What you are describing is the movement of prices, which often follow changes in the money supply, but not always if other factors are at play. If the money supply were suddenly doubled while all else stayed the same, you would expect prices to double eventually as well, but all else does not necessarily stay the same.

For instance, increases in the M3 of some 13% per year in recent years have not ignited a wage/price spiral due to global competition keeping a lid on both wages and the prices of manufactured goods. Wages have stagnated, while cheap plastic tat from China has fallen in price. Stagnating wages set against a backdrop of rising monetary inflation means that wages are falling in real terms. Falling prices for manufactured goods against the same backdrop mean that prices have been crashing in real terms.

Similarly, prices can rise against a backdrop a falling money supply, which means they would be going through the roof in real terms. This could well happen to oil and food after an initial price collapse, as there are many circumnstances that could hit supply as hard as deflation will hit demand. You could indeed see food and energy prices rise while asset prices continue to fall, but calling it inflation and deflation confuses the issue.

ShadowStats says M3 is approaching 16% and seems to be accelerating. Yet it seems like deflation ought to already be happening and measurable, given the freeze up of the various securities related to real estate mortgages in the States. Is this simply being compensated (and then some) by adding money and/or credit elsewhere? How does this work, what is M3 and when and how does it end?

M3 is a measure of broad money, but not broad enough to capture the full scope of the credit expanion we've seen in recent years (derivatives and all). The money supply in broadest terms has effectively been increasing far faster than M3 would suggest.

In other words, M3 is only part way up the inverted pyramid of credit. The credit contraction we've seen this year has not proceeded down to that level yet. I would argue that it will in the new year, whereupon credit contraction will become much more noticeable to ordinary people, in terms of their personal access to credit being curtailed.

Is this 'broader' money supply the $80T number I have seen a few times that presumably refers to the products of mainly hedge funds that lever relatively small pools of, say, mortgages into mortgage backed securities? And, if so, is it safe to say that this broad supply of credit is officially deflating or is it just not inflating as quickly as it was before?

well, the derivatives market is currently valued at $516 trillion by the Bank of International Settlements (the central bankers' central bank). Most of that was money pulled out of thin air, and destined to return to where it came from IMO. I would say by the broadest definition of money supply, we are already seeing deflation. As it works its way down the inverted pyramid, it will rapidly become more apparent.

Gotcha. Austrian terminology it is.

itulip.com refers to this as ka-poom theory:

A rapid deflation caused by a credit crunch followed by frenzied inflation as central banks attempt to prop up asset prices.

Though I suppose that's just a cute name for a crack-up boom.

I'll just read the roundups and let you do the replies. :)

The trick is going to be to nail the timing of that spike, and then go all in physical gold.

Curious, wouldn't you be a little late to 'buy in' then?

No, when the dollar peaks the price of commodities will collapse before taking off on the moonshot.

If it doesn't it doesn't, if I have to be stuck in one thing I probably rather be stuck in physical FRN's if living in the US at the time.

This approach might be very different and vary by location if not in the US. Odds are that living in Canada would be about the same, they most likely will somehow peg the currencies within a narrow window at some point.

Some people that want to put a lot of time and energy into it can likely profit from fluctuations between now ant then, but unless one really needs the profit it is much safer just to kick back and wait it out. The whole thing just smells like a trap right now. A trap to suck ALL liquidity out of the markets.

Don Corleone was a boy scout compared to these guys.

This is exactly what I'm expecting to happen.

A lot of variables. But possible definitely.

However, a risky play.

Collapse of commodities isn't necessarily a fundamental move. A price retreat would be a given...but collapse.

Got ring side seats.

Well, the corrupt clowns at Fed and Treasury consider a 10% drop in their people's stock holdings a collapse that needs to be bailed out by rate cuts.

One would expect the price to temporarily drop much more then that as positions need to be covered in a liquidity trap.

Exactly how much or when is hard to say, especially when the markets are constantly interfered with.

Mushashi

I would´t wait to go into gold. This is not 1929 when we had gold backed currencies. This time after 1971 we for the first time in history have ALL currencies in the world as fiat.

I have read stories around the world that physical gold already is somewhat scarce for retail investors. When TSHTF gold could be instantly unavailable for ordinary people and shoot to outer space in price. Don´t count on a big dip in the goldprice as other assets like real estate and equities collapse. THIS TIME COULD BE DIFFERENT to earlier deflation crashes.

Even if the goldprice dips, you HAVE IT when it rebounds upward.

Edit: It would not bother me if the goldprice would dip in a deflationary collapse, because i still have the same amount of ounces i had before the collapse. And it has been an infinite yoy to exchange the soon to be worthless paper money to gold markers.

Well that´s my take, and i am already fully invested in gold and silver. So far i have gained nicely in value of my investments.

I think people who look at gold, etc look at PAST cycles.

I think (as I said below because of PO etc) this may be the end of "Cycles" for a time.

Also, how many people on earth? What if only 1 out of every 1000 wanted an ounce of Gold or Silver for the heck of it, There ain't enough in the world.

This is not your father's Commodity Cycle.

I think you agree with me with your comment, though it was not straight forward.

Be as it will, we surely have interesting times ahead. We are in unchartered waters.

That might not make it very useful as money but I would think it would make it valuable, no? Of course if you could find me a few magic beans, have I got the cow for you ... but that's another story, eh?

I can see your line of reasoning, and note that I mentioned that location would change strategy.

There are a number of legal and tax issues that may come into play in the US.

To the extent that gold can be acquired physically in small personal transactions I could see holding some now to cover the other side.

Musashi

I really don´t know how this will play out. I have thought a lot about this, and read a lot of sites about this shit.

After all, i took the decision to exchange all of my savings to PM:S. I don´t think i will loose much.

I don't know either. I'm not a formally trained economist like others here, more like a nomad that spent much of his life living in "interesting places" all over.

I would expect the Scandinavian countries to be very good places to be based on a number of different criteria.

But sometimes one can go quite a way with bad cards played right, as long as one doesn't go all in with a losing hand and stays in the game.

As credit contracts this will reduce inflationary pressure causing assets to be re-priced, downwards. And there is an awful lot of credit out there that’s going to contract. Holders of cash will benefit from these falls in prices. I’d probably be cash heavy at this point as well as having a pretty big lump under the mattress, just in case Northern Rock isn’t a one off.

If you’re asking about the dollar versus everybody else, I couldn’t answer you. I don’t see the dollar being displaced from its role as reserve currency because there are no obvious replacements. The U.S. is still resource rich and filled with capable and intelligent people able to creatively respond to the crisis at hand. I wouldn’t be inclined to write them off just yet.

Thanks ilargi - It frustrates me to no end that the average joe has no clue how bad it is let alone how this came about.

I have in mind to put together a retro-fit, aftermarket kit for the board game MONOPLY.

It is in essence THE FEDERAL RESERVE structure, complete with income tax.

Maybe this will allow people to see how destructive and controlling it is.