The Energy and Environment Round-Up: September 29th 2007

Posted by Stoneleigh on September 29, 2007 - 8:15am in The Oil Drum: Canada

The Alberta royalty review continues to generate a predictable response from an industry which has seen costs rise more rapidly than prices in recent years. Even though Alberta’s take is comparatively low, Encana has announced it will withdraw $1 billion in investment if the new royalty recommendations are accepted by the province.

Elsewhere on the energy scene, Alberta looks to expand both wind and nuclear power, while Ontario reactors’ inability to deal with an unexpected spell of warm weather during maintenance outage season made electricity imports necessary.

Globally, questions are increasingly raised over the global warming effects of both ethanol production and hydro-power dams.

In environmental news the drought in Australia and the Ukraine has led to record wheat prices and concerns over feeding the world's poor. The Arctic warms ever more rapidly, for some an opportunity to exploit new resources, rather than a problem. If warming continues to accelerate, it just might become an 'insurmountable opportunity'.

In the 10 days since a provincially appointed panel dropped its bombshell report recommending that Alberta play hardball with the oilpatch, work inside Calgary's office towers has turned from planning growth to assessing damage and even eyeing an exodus........"Everybody is holding their breath right now," said Hal Walker, a long-time provincial Tory and real-estate developer who is critical of the review process. "All bets are off."....

....Deutsche Bank highlighted the escalating risk of investing in the province: "Risk, risk and risk, and there's risk. Above all, be warned about risk," it said.

As out of character as the panel recommendations seem in business friendly Alberta, observers say it has big support in rural Alberta and in Edmonton, areas that believe they have suffered the downside of the oilsands driven boom, while not reaping enough of the benefits.

Alberta Angles for Bigger Share of Oil Receipts as Futures Soar

Alberta, once a refuge from the world's resource nationalists, could soon join them.

Last week's long-awaited review of the province's oil and gas royalty system proposes a new tax, linked to rising oil prices, and higher royalty rates. These and other measures, if implemented, would put an extra 20%, or C$2 billion ($2 billion), a year in Alberta's treasury coffers.

The review comes after an extensive investigation into whether Albertans were getting their fair share of the profits from their province's vast resources. They aren't, the panel entrusted with the task concluded, and they haven't for quite some time.

"I don't know how you define fair share, personally. I wouldn't have used those words," Tim Hearn, chief executive of Imperial Oil Ltd. (IMO), said. "I could argue that this is the worst time to make changes." Imperial is a subsidiary of Exxon Mobil Corp. (XOM).

Two days after the recommendations were released, oil futures hit an all-time high, nearing $84 a barrel on the New York Mercantile Exchange. While falling U.S. crude inventories and threatening storms in the Gulf of Mexico, not Alberta's revenue grab, spurred prices higher that day, oil's broader bull run has been underpinned by the perception of tightening global supplies. These supply worries came to the fore after countries such as Russia and Venezuela, the oil industry's hope for massive new reserves, restricted access to their resources and forcibly raised their stakes in lucrative projects. While Canada's shift isn't as radical, it underscores the temptation oil prices present to countries known for their stable fiscal regimes.

The Canadian oilpatch has blasted a study that claims Albertans don't get a fair share of the province's oil wealth, saying the "flawed" report is wrought with inaccuracies and its recommendations will exacerbate Western Canada's drilling crash.

"We simply do not feel the cost data used for part of the report was accurate, for the oilsands or the conventional side," said Pierre Alvarez, president of the Canadian Association of Petroleum Producers (CAPP).

The comments yesterday from Mr. Alvarez and CAPP mark the first formal response to the "Our Fair Share" report, released last Tuesday by a special, Alberta government-appointed panel.

Shares of Canadian oil companies, particularly players with oilsands plans, have suffered in the study's wake as investors gauge the prospect of a royalty hike in what has traditionally been seen as Canada's most business-friendly province.

In a note to investors titled "Damage Assessment -- Is It Time to Buy?" UBS Securities Canada Ltd. said the handful of Canadian oil companies it covers have collectively lost $13-billion in market value in the last week, and that oilsands pureplays have fallen 7%, on average.

RBC Capital Markets said if the royalty proposal is accepted in Alberta, it expects Saskatchewan and British Columbia to also review their respective royalty regimes, likely resulting in hikes in those two provinces as well.

Cdn. Oil Sands joins call for restraint in royalty rises

A third major oil sands executive says Alberta could potentially charge higher energy royalties, but that current proposals on the table go too far and could damage the industry.

In an interview with The Globe and Mail, Marcel Coutu, chief executive officer of Canadian Oil Sands Trust, which holds the biggest stake in Syncrude Canada Ltd., said yesterday that there is "room for a review" of Alberta's royalty rates.

"I have a huge amount of faith that the [provincial] government continues to want to create incentives for oil sands investment and not kill the golden goose," Mr. Coutu said. "I am very confident that the government will make the right call, which isn't a wholesale acceptance of the recommendations but some form of compromise ... A burden must be chosen that will optimize the eventual value of this resource."

EnCana to cut $1-billion if royalties rise

In the latest salvo in a thundering barrage of industry criticism, Canadian natural gas and oil sands giant EnCana Corp. says it will slash its investment in Alberta by up to 40 per cent or $1-billion next year if the province fully implements recommendations to sharply boost royalties contained in a recent review by an independent panel.

"If the Royalty Panel's recommendations are adopted in full, many of Alberta's new and emerging resource plays will simply not be economically viable," EnCana chief executive officer Randy Eresman said in a news release issued before stock markets opened Friday.

"These new plays would have formed the foundation for the future of Alberta's natural gas production. Even without that future gas production growth, under the recommended changes EnCana's royalties on Crown lands would effectively double, assuming current gas prices. We will have no choice but to slow down our Alberta-based activity and move investments to other areas in Canada and the U.S. that are more economically attractive. As a further consequence, Alberta natural gas production will continue to fall."

Premier urges calm in wake of EnCana warning

EnCana Corp.’s warning it will cut $1 billion in investment from Alberta should a maximum royalty boost be adopted had Premier Ed Stelmach urging calm today.

The energy giant said it was “serving notice” that it would slash 30 to 40% of up to $3 billion in its capital plans in Alberta next year if recommendations of a royalty review panel were fully implemented.

Rather than being tantamount to blackmail, EnCana spokesman Alan Boras said the statement was simply spelling out the wider consequences to the Alberta economy should the company take such a step.

“We feel it’s important people have an understanding — it’s information,” said Boras, adding a 20%, or $2 billion hike in the royalty-take industry-wide would impact businesses from drilling contractors to restaurants.

A maximum royalty boost “wouldn’t cut into EnCana’s profits ... it would make many of our future opportunities in Alberta un-economic,” said Boras, whose company last year posted Canada’s largest corporate profit in history — $6.58 billion.

Report finds Alberta still a bargain, even with higher royalties

Higher oil sands royalties could cut 13 per cent of the value from current and planned projects around Fort McMurray, but Alberta would remain one of the cheaper places to do business in the world even with more money going to government, according to research by British energy consultancy Wood Mackenzie.

Of 100 fiscal regimes around the world analyzed by Wood Mackenzie, money paid to government in the oil sands is ranked as the 11th-most generous system for industry. Should higher royalties and taxes be instituted, the ranking would fall to 44th, still in the top half.

Royalty change could devalue oilsands by US$26B: report

The Alberta government would knock US$26-billion from the value of 28 major projects in operation and under development in the oilsands if it accepts the recommendations of a panel to substantially increase royalties and taxes, international energy research firm Wood Mackenzie said in a report released Tuesday.

"Some of these projects aren't particularly robust in their economics, and the question then becomes, are these proposals too tough?" Derek Butter, head of corporate analysis, said in an interview from Edinburgh. "They might slow down or shelve some of these projects in the long term and negate the benefits that the Alberta government is seeking through near term increases in royalties."

The U.K.-based expert on global energy fiscal terms said it tested the impact of the royalty changes on 15 projects already in operation, six under development and seven under potential future development. Their combined value of US$200-billion would decline by 13% if the recommendations are accepted and assuming all move forward. If some are shelved, the negative impact would be even greater, the firm said.

Suncor, Syncrude may feel less pain from royalties increase

The two oldest and biggest oil sands miners might escape part of the burden of increased royalties in Alberta, a fact that has been lost amid the tumultuous public discussion since a major report last week recommended that the provincial government get more money from the energy business.

Suncor Energy Inc. and Syncrude Canada Ltd. have individual royalty deals with the government of Alberta, which sets the two oil sands giants apart from the rest of the industry that operates under what's called a generic royalty regime in the oil sands. Suncor and Syncrude, in fact, will likely pay far lower royalties starting in 2009, regardless of how much Alberta decides to hike royalties in general.

Even though Suncor Energy dropped a lawsuit against the province over differing interpretations of a royalty agreement last year, the company still maintains its Firebag project is an expansion of its existing operations.

The issue was thrust into the public eye when a panel appointed by the province recently recommended raising some royalty rates paid by oilsands projects.Suncor’s Firebag in-situ operation was at the focus of the lawsuit filed July 2004. Suncor sued the province for $250 million over proposed future royalties from the Firebag project, north of Fort McMurray. While Suncor viewed Firebag as an expansion, the province argued the $500 million operation was a new, standalone project, and therefore subject to an individual royalty regime. Suncor maintained such a designation would cost the company millions.

Premier Ed Stelmach has promised a response to the Royalty Review Panel's recommendations by mid-October. Before the provincial government acts, however, it needs to answer a question that the controversy over the panel's report risks obscuring:What would it do with the extra money?

The yo-yoing of provincial spending in Alberta as fossil fuels boomed and busted in the 1970s, 1980s and 1990s underlines this question's importance. It is all very well for the report to emphasize that Albertans own their sub-soil resources. The fact is they can only exercise their rights as owners through their provincial government. While the ways the province might use these extra dollars --further increases in provincial programs, tax relief in other areas, or saving to prepare for a leaner future-- was not part of the panel's mandate, they matter greatly for the report's ultimate larger impact.

Those who recall Alberta's misadventures with its Heritage Fund and its deep fiscal retrenchment of the mid-1990s will know that Alberta has always had trouble handling resource revenues adeptly. Experience since the mid-1990s provides a fresh lesson. In successive budgets since 1996, the provincial legislature has voted spending increases averaging less than 2% annually. But the final figures for each fiscal year showed actual spending increases averaged almost 7%. These chronic overruns had a huge cumulative effect. Rather than the cumulative spending increase of $4.5-billion anticipated in budgets, provincial spending ballooned more than $15-billion over the period. The cumulative overrun of $10.5-billion is equal to all of the province's budgeted health care spending last year.

While all Canadian governments have had trouble living up to their budget commitments over the past decade, the record of Alberta's legislative assembly is uniquely bad. The tendency for resource revenues to outpace projections, and for in-year or end-of-year spending surprises to absorb most of the extra money, has been a driving force behind this breakdown of fiscal accountability. The 2007 budget anticipated no less than a 12% jump in spending for the current fiscal year -- even before overruns, that would make provincial spending almost double what it was at the beginning of the decade. Raising the province's take from the energy industry by one-fifth, as the panel recommends, amid an energy boom will add fuel to the fire, increasing the prospects for yet another sizeable overrun -- and for a painful mix of tax hikes and spending cuts as demographic pressures and the resources boom's inevitable fade squeeze Alberta's budget in the years ahead.

Weak US Dollar Central to Oil Price Boom

The weak dollar's leading role in oil's ascent to record highs is partly due to a tide of financial flows into commodity investments but also reflects a shift in the greenback's relationship with crude.

The dollar has traditionally influenced the price of oil and other commodities, including gold and base metals, which are mostly priced in the currency and usually move to compensate for changes in the its value....

...."After a generation on the sidelines, the dollar has re-emerged as an upside risk to oil prices," Lehman Brothers said in a research note.

An influx of hedge funds, banks and other financial institutions into the commodity markets in the past few years has also had an impact on oil/dollar moves, analysts say.

"You have more financial players today that are trading oil and commodities and they will play more of those micro-relationships," said Olivier Jakob of oil consultancy Petromatrix.

French nuclear power giant proposes Whitecourt plant

There's international competition to build Alberta's first atomic power station as France's nuclear energy conglomerate courted support Monday for a plant site at Whitecourt.

Eager official encouragement greeted Areva Canada president Armand Laferrere, who trekked to the town 150 kilometres northwest of Edmonton armed with plans freshly approved by the Paris head office of his firm's parent company.

"We think it would be a great thing for our community," Whitecourt Mayor Trevor Thain said.

He predicted at least 75 per cent of local voters will back an atomic power project in a civic referendum that he plans to hold as development plans firm up in the future.

As race for oil-rich Arctic heats up, Inuit stake their claim, too

But since August, when a Russian submarine placed a flag on the seabed at the North Pole, the Arctic has been high on the world's diplomatic agenda. Five nations are now racing to claim new territory in the central Arctic Ocean, where climate change is expected to open up valuable new shipping routes, oil fields, and mineral deposits.

The region's indigenous people, the Inuit, want a say in how territorial claims unfold.

"We must develop, for the sake of my people and the world at large, a formal international process focusing on the Arctic that includes indigenous people having meaningful voices," Aqqaluk Lynge, president of the Greenland chapter of the Inuit Circumpolar Council (ICC) told an international gathering of politicians, scientists, and religious figures here earlier this month. "Or [else] we might just get washed away in the melting ice."

In Canada, our electricity systems operate like little islands, isolated from the world around them, oblivious to innovation and insulated from the real economy by regulators that administer prices. Our horizons extend as far as our power monopolies, and their government masters, permit.

The United Kingdom, in contrast, is no island. It is plugged into the real world, for better or worse. As it turns out, the real world has generally been, and remains, the better place to be.

Electricity prices are dropping in the United Kingdom, and have been all year. British Gas -- last year one of the country's priciest providers -- cut its gas prices 17% and its electricity prices 11% in March and saw 900,000 customers switch to it by May. Not satisfied, it cut electricity prices another 6% in June, making it now one of the United Kingdom's least-expensive power providers.

Among the other major power companies, Powergen and Scottish and Southern Electric dropped power prices by 5%, while Npower dropped them by 3%. The cuts are not about to end, despite foot-dragging from private companies reluctant to part with their profits. With new gas supplies from the North Sea, Belgium and elsewhere beginning to flood into the U.K. market, the downward pressure on prices is expected to last until 2012. The United Kingdom's independent regulator, Ofgem, has been helping prices drop, not by imposing regulatory power but by urging consumers to switch to energy suppliers providing better prices. "Our research shows that a big price gap has opened up, leaving EDF Energy and Scottish Power customers paying over £100 [$203] a year more for their energy for remaining loyal," Ofgem's chief executive announced in June. "Competition is all about customer power --any supplier that tries to buck the market by not lowering their prices or failing on service risks an exodus of customers."

Record high temperatures put an unexpected strain on Ontario's power grid yesterday, made worse by the fact that six of the province's 16 nuclear reactors were offline for maintenance.

The shortfall in nuclear power, equal to a third of Ontario's overall nuclear capacity, or about 3,700 megawatts, meant the province was unable to meet its own power demands and was left highly dependent on electricity imports from the United States and Quebec.

"And these aren't necessarily economic imports," said Terry Young, spokesperson for the Independent Electricity System Operator, which manages supply and demand on the provincial grid.

Young called yesterday's hot weather – it reached a high of 33C, surpassing the previous record of 28.3C set in 1958 – an anomaly that coincided with the start of outage season, typically in the spring and fall when Ontario Power Generation and Bruce Power take reactors offline for scheduled maintenance when power demands are expected to be low. Three coal-fired units and one natural gas unit were also offline, he added....

....Tom Adams, an independent energy analyst in Toronto, said it's an example of how inflexible nuclear power can be during times of unexpected need. The inability to bring the reactors back online to meet unusual demand doesn't just drive up imports; it also creates a need for backup facilities such as the Lennox Generating Station along the eastern shore of Lake Ontario.

Alberta Ends Cap on Wind Power, Sees Expansion

Alberta will lift a cap on the amount of wind-generated electricity on the provincial grid, a move aimed at kick-starting about C$6.6 billion of planned projects, industry officials the western Canadian province said Wednesday.

Scrapping the limit of 900 megawatts will help the booming province achieve a long-term goal of boosting wind-power's percentage of generation to 10 percent to 15 percent from the year-end 2007 estimate of 4 percent, Energy Minister Mel Knight told reporters.

The Alberta Electric System Operator put the cap in place last year over concerns that sporadic supplies of electricity produced by wind-powered turbines could damage the grid.

King Coal? - CBC Radio's The Current, September 25, 2007 (Part 3)

The only thing dirtier than coal itself is the bad press surrounding it. Collapsing mines, proven health risks, environmental destruction… it's a dirty resource the world is supposed to be weaning itself from.

But coal and the mines from which it comes remain pretty attractive to many countries. Thanks to an increase in demand from such places as China, some say the industry is digging itself out of its bad rep, and undergoing a sort of renaissance.

Swiss mining company Xstrata is spreading $15 million dollars to see if it's worth opening a coal mine in Donkin, N.S. Is it a potential economic windfall, or an unsustainable disaster-in-waiting?

That's precisely the question for the people of Donkin. Despite Nova Scotia's rich mining tradition, there hasn't been much good news lately. But if Xstrata gives the go-ahead in 2008, the area can expect 275 new full-time jobs.

Dan Kahlbenn is a third generation Cape Breton coal miner -- his career began when he was 18 years old and lasted 24 years until the last underground coal mine shut down in Nova Scotia in 2001. Since then he has been working in places such as Fort McMurray and the Northwest Territories. Away from his wife and children.

But Dan is back in Cape Breton, employed with 18 other miners to explore the viability of a new coal mine in Donkin. For him and many other Cape Bretoners, a return to coal, means a return of a different kind.

Yucca nuclear dump structures moved after fault-line study

Engineers made plans to move some structures at the Yucca Mountain nuclear waste dump after rock samples indicated a fault line unexpectedly ran beneath their original location, an Energy Department official said Monday.

Allen Benson, a spokesman for the U.S. Department of Energy in Las Vegas, said adjustments to the project were made in June.

"In the spring we discovered the true course of the Bow Ridge fault line. As a result we moved locations several hundred feet" to the east, he said. "That's why we do studies, to come up with information to make the repositories safer."

Big Potential And Challenges for Biofuels

Biofuels offer Africa the chance to supply itself with alternative energy sources, and also to become a major supplier of these sources for developed markets. Yet, challenges -- from creating the relevant infrastructure to competition for biofuel crops from food markets -- remain.

"There is huge room for exploitation of clean sources of energy at a time when the entire world is confronted with global warming," said Salvador Namburete, Mozambique's minister of energy.

Brazil Ethanol Boom Belied by Diseased Lungs Among Cane Workers

A doctor at the hospital diagnoses Silva with lung fibrosis, a scarring of the lungs that often afflicts cane cutters, according to the labor inspector's report. He may die if he keeps cutting cane, the report says.``I don't know if I can keep going much longer, but I want to try,'' says Silva sprawled across a gurney in the small hospital. ``I can't return home without any money.''

Silva is a foot soldier in an army of 500,000 workers who toil from March to November stooped over in the tropical sun harvesting sugar cane to make ethanol in Brazil. The Latin American country is the world's largest ethanol exporter.

When Henry Ford was experimenting with car engines a century ago, he tried ethanol out as a fuel. But he rejected it—and for good reason. The amount of heat you get from burning a litre of ethanol is a third less than that from a litre of petrol. What is more, it absorbs water from the atmosphere. Unless it is mixed with some other fuel, such as petrol, the result is corrosion that can wreck an engine's seals in a couple of years. So why is ethanol suddenly back in fashion? That is the question many biotechnologists in America have recently asked themselves.

The obvious answer is that, being derived from plants, ethanol is “green”. The carbon dioxide produced by burning it was recently in the atmosphere. Putting that CO2 back into the air can therefore have no adverse effect on the climate. But although that is true, the real reason ethanol has become the preferred green substitute for petrol is that people know how to make it—that, and the subsidies now available to America's maize farmers to produce the necessary feedstock. Yet such things do not stop ethanol from being a lousy fuel.

Jane Goodall Says Biofuel Crops Hurt Rain Forests

Primate scientist Jane Goodall said on Wednesday the race to grow crops for vehicle fuels is damaging rain forests in Asia, Africa and South America and adding to the emissions blamed for global warming.

"We're cutting down forests now to grow sugarcane and palm oil for biofuels and our forests are being hacked into by so many interests that it makes them more and more important to save now," Goodall said on the sidelines of the Clinton Global Initiative, former US President Bill Clinton's annual philanthropic meeting.

As new oil supplies become harder to find, many countries such as Brazil and Indonesia are racing to grow domestic sources of vehicle fuels, such as ethanol from sugarcane and biodiesel from palm nuts.

The United Nations' climate program considers the fuels to be low in carbon because growing the crops takes in heat-trapping gas carbon dioxide.

But critics say demand for the fuels has led companies to cut down and burn forests in order to grow the crops, adding to heat-trapping emissions and leading to erosion and stress on ecosystems.

'Green' fuel worsens global warming

Most crops grown in North America and Europe to make a "green" alternative transport fuel actually speed up global warming because of industrial farming methods, says a report by Dutch atmospheric chemist Paul Crutzen, who won a Nobel prize in 1995 for his work on the hole in the Earth's ozone layer.

The findings could spell special worries for alternative fuels derived from rapeseed, used in Europe, which the study concluded could produce up to 70 per cent more planet-warming greenhouse gases than conventional diesel.

The report suggested scientists and farmers focus on crops needing little fertilizer and harvesting methods that were not energy intensive in order to produce benefits for the environment.

Products exported, but the pollution stays

A new study into the root causes of greenhouse gases has found that nearly half of Canada's industrial emissions in 2002 were created in the production of exports....

....Greenhouse-gas emissions from the production of goods and services sent to international markets surged 49.9 per cent to 264,358 kilotonnes - a rise that is largely the result of globalization and better access to world markets, according to the report.

"We absolutely cannot relax our guard against ecological and environmental security problems sparked by the Three Gorges Project," he said."We cannot win passing economic prosperity at the cost of the environment," Xinhua news agency quoted him as saying.

The problems included landslides caused by erosion on the steep hills around the dam, conflicts over land shortages and "ecological deterioration caused by irrational development", he said.

Senior engineer Huang Xuebin told the forum that landslides were a "severe threat to the lives of residents around the dam".

Some landslides had caused waves several metres high that further damaged surrounding shores, he said.

Other officials warned that the quality of drinking water for residents was being affected.

The BBC's Quentin Somerville, in Shanghai, says that the admission comes with China's government increasingly worried that environmental damage is leading to growing political unrest.

China admits Three Gorges dam danger

After 15 years of construction the controversial project has affected a 600km stretch of the country’s largest river, with local officials complaining of increased landslides and a profusion of algal blooms along the length of the reservoir.

The flow of the Yangtze above the dam has been reduced from 2 metres per second to 0.2 m/s, causing the sediment in the river’s famously muddy water to settle on the riverbed.

Local governments are faced with huge and growing problems just to keep the dam operational and warn that increased silting could make parts of the river impassable for shipping transport, negating one of the main rationales for the dam in the first place, according to Jean-Louis Chaussade, chief executive of Suez Environment, who met with local officials in recent months.

Unfettered dumping of industrial wastewater and the submergence of numerous toxic factories when the dam was first built have added to the problems of a project that involved the forced relocation of 1.3m people.

China's hydropower may be global warming time bomb

China is scrambling to build massive hydropower dams to curb pollution and slake its thirst for energy, but scientists warn that reservoirs can also worsen global warming by emitting a powerful greenhouse gas.

Methane, which traps heat much more efficiently than carbon dioxide, is produced by plants and animals rotting underwater and released when that water rushes through hydropower turbines.

In a country that is already the world's top hydropower generator and aims to more than double capacity, dams could raise methane emissions by around 8 percent, recent research shows.

Beneath Booming Cities, China’s Future Is Drying Up

Hundreds of feet below ground, the primary water source for this provincial capital of more than two million people is steadily running dry. The underground water table is sinking about four feet a year. Municipal wells have already drained two-thirds of the local groundwater.

For three decades, water has been indispensable in sustaining the rollicking economic expansion that has made China a world power. Now, China’s galloping, often wasteful style of economic growth is pushing the country toward a water crisis. Water pollution is rampant nationwide, while water scarcity has worsened severely in north China — even as demand keeps rising everywhere.

China is scouring the world for oil, natural gas and minerals to keep its economic machine humming. But trade deals cannot solve water problems. Water usage in China has quintupled since 1949, and leaders will increasingly face tough political choices as cities, industry and farming compete for a finite and unbalanced water supply.

One example is grain. The Communist Party, leery of depending on imports to feed the country, has long insisted on grain self-sufficiency. But growing so much grain consumes huge amounts of underground water in the North China Plain, which produces half the country’s wheat. Some scientists say farming in the rapidly urbanizing region should be restricted to protect endangered aquifers. Yet doing so could threaten the livelihoods of millions of farmers and cause a spike in international grain prices.

Wheat Reaches Record as Ukraine Limits Exports After Drought

Wheat futures in Chicago rose to a record, extending the rally for a sixth day, after Ukraine said it will restrict grain exports and as importers buy more of the commodity, boosting demand for U.S. supplies....

....The U.S. has projected global inventories will fall to the lowest in 26 years.

``The supply situation is critical,'' said Louise Gartner, owner of Spectrum Commodities in Beavercreek, Ohio. ``There are few things you can substitute for wheat. You can always use other grains for livestock feed, but not as a food grain.''

Wheat prices climb to new high

Wheat prices climbed to record levels yesterday after the International Grains Council predicted that inventories in the five biggest exporting countries will drop to a 34-year low. Corn and soybean prices are also on the move. And that doesn't bode well for consumers when they go to grocery stores this winter.

The December contract for wheat on the Chicago Board of Trade (CBOT) traded as high as $9.4675 (U.S.) a bushel yesterday before settling back to close at $9.33.

Karl Kriese, senior vice-president of Peregrine Financial Group Canada Inc., said a technical "buy" signal was flashed 18 weeks ago when grain stood at $5.01 and the price has since soared amid "unbelievable momentum."

A number of factors are behind the recent increase in wheat prices, not the least of which is the drought in Australia, a major wheat producer. "Australia is experiencing a severe drought," Mr. Kriese said. "I just took a look at the satellite photos yesterday and there isn't a cloud over the entire continent."

Dry conditions in other wheat-producing countries including Canada have added to the problem. Ukraine, for example, has just said it will curb exports for five months beginning Nov. 1.

Australia: $150,000 to leave the land

Farmers battling to survive the drought will be offered grants up to $150,000 to walk away from their land under a $714 million federal aid package.

Describing the drought as the worst in Australia's history, Prime Minister John Howard has also promised grants up to $20,000 to irrigators in the Murray-Darling Basin, the extension of "exceptional circumstances" aid to more farmers and businesses and counselling for stressed families.

The $714 million is to be spent over two years and will take federal drought aid to farmers to $2.8 billion since 2001.

Defending the size of the package, Mr Howard said: "As a nation we can afford it".

The package was welcomed by the National Farmers Federation as an "unprecedented response to an unprecedented crisis in Australia".

In a sharply worded letter to his Victorian counterpart, South Australian Premier Mike Rann accuses John Brumby of threatening the viability of the entire Murray-Darling Basin agreement.

"We believe the Victorian Government's uncompromising position is not in the national interest," Mr Rann writes.

Mr Brumby immediately hit back, saying Victoria would not agree to a contingency plan to share water with South Australia.

At stake is a critical reserve of water, which could be needed for South Australia next year if the drought does not break.

Mr Rann warned yesterday that Mr Brumby's position could see Adelaide's "water supply being significantly compromised", a claim disputed by Mr Brumby, who said "there is no immediate threat to Adelaide's water supply".

"It is completely unacceptable to expect Victorian irrigators to give up 200GL of water for what might or might not be required next autumn in South Australia," he said. "What the commonwealth wants is to take 200GL of water, worth up to $300 million on the open market, from Victorian irrigators without compensation and give it free to South Australia for next year."

As hopes for heavy rain in southeastern Australia fade, the Victorian Government is looking at further tightening its four-stage system of household water restrictions.

Australia Beef Crisis Hits as Drought Decimates Wheat

Record high grain prices have thrown Australia's A$4 billion (US$3.5 billion) beef cattle industry into disarray, emptying feedlots, cutting cattle saleyard prices and triggering price rises for domestic and exported beef.

The world's biggest beef exporter by value and the second-biggest exporter by volume, parts of Australia's beef industry have begun to shut down after feed grain prices doubled since June because of the decimation of crops by drought.

"Supplies of quality beef onto the domestic market and to export markets are going to start reducing quite substantially," said Malcolm Foster, president of the Australian Lotfeeders Association.

"It's very bad. There wouldn't be a feedlot making money now," he said. Australia has 700 feedlots.

Australia's wine industry ravaged by drought

The price of Australian wine is predicted to soar as the country's crippling drought threatens to halve next year's grape harvest.

The worst drought in more than a century is threatening to put hundreds of grape growers out of business and to force the ripping out of vineyards across the country....

....The Murray and Darling rivers are so depleted that some farms in the region have been told they can only take 10 per cent of the water they would normally use to irrigate their crops.

Winemakers React to Global Warming by Taking to Hills

Miguel Torres SA's vineyards have survived bombs and plagues of parasites in the past 137 years. Now, the eponymous head of Spain's largest family-owned winemaker says he's facing a new threat: global warming.

``We are moving into cooler areas of Catalonia, which has the great advantage of having the Pyrenees 200 kilometers from here,'' Miguel A. Torres, 64, says in an interview at Mas Rabell de Fontenac, a 14th-century farmhouse near the company's headquarters in southern Catalonia. ``We have already planted vineyards successfully that we can use in the future.''

The fourth-generation vintner has planted vines a kilometer (0.6 miles) above sea-level in the Pyrenean foothills near Tremp, northern Spain: four times higher than the main winery. Torres plans to buy more land in cooler areas, and is spending 10 million euros ($13.6 million) to cut his company's emissions of carbon dioxide, the main greenhouse gas.

Torres aims to adapt to rising temperatures that scientists and vintners say may change Europe's 16 billion-euro winemaking industry, with growing belts moving uphill and north. While northern areas, like England, stand to gain, Mediterranean nations such as Spain, France and Italy, the three largest producers, will need to adjust.

Africa: Food production to halve by 2020

Food security in Africa is likely to be "severely compromised" by climate change, with production expected to halve by 2020, according to climate change experts.

The projections are contained in a report launched last week in London by the Intergovernmental Panel on Climate Change (IPCC), which was followed by an experts' panel discussion.

"The discussions concluded that Africa is likely to be the most affected [by climate change] partly because of the increasing aridity in the north [the Sahel] and Southern Africa: and these are the most populous parts of the continent," said Martin Parry, the co-chair of the IPCC’s working group which authored the report. He also listed the lack of technology available to adapt to environmental change as increasing the region's vulnerability.

About 25 percent of Africa's population - nearly 200 million people - do not have easy access to water; that figure is expected to jump by another 50 million by 2020 and more than double by the 2050s, according to the report.

Over 95 percent of Africa’s agriculture depends on rainfall, according to the UN's Food and Agriculture Organisation (FAO). "Models indicate that 80,000 square km of agricultural land in sub-Saharan Africa currently deemed constrained will improve as a result of climate change. However, 600,000 square km currently classed as moderately constrained will become severely limited," said the FAO.

Africa flooding spreads, 22 countries hit: UN

More than 800,000 people are now affected by torrential rains in those three countries alone, compared to around 700,000 recorded last week, according to data from the UN humanitarian coordination office.

OCHA said last Friday that an estimated 1.5 million people in 18 countries had been affected since the worst downpours in 30 years started sweeping the continent in August.

Rising sea levels would submerge third of Bangladesh

A one-metre rise in sea levels would submerge a third of Bangladesh and displace millions, the head of the country's military-backed government has warned.

Fakhruddin Ahmed, speaking on Monday at a climate change summit at the United Nations in New York, called on richer nations to help poorer countries tackle global warming.

"Today we are confronted with the difficult reality that the phenomenon of climate change is not a myth and that its impacts are no more a conjecture," the state-run BSS news agency quoted Fakhruddin saying.

"I speak for Bangladesh and many others who are on the threshold of a climate Armageddon, foretold by increasingly violent and unpredictable weather patterns".

"A one-metre sea level rise will submerge about one-third of the total area of Bangladesh thereby uprooting 25 to 30 million of our people," Fakhruddin said.

Arctic thaw may be at "tipping point"

A record melt of Arctic summer sea ice this month may be a sign that global warming is reaching a critical trigger point that could accelerate the northern thaw, some scientists say."The reason so much (of the Arctic ice) went suddenly is that it is hitting a tipping point that we have been warning about for the past few years," James Hansen, director of NASA's Goddard Institute for Space Studies, told Reuters.

The Arctic summer sea ice shrank by more than 20 percent below the previous 2005 record low in mid-September to 4.13 million sq km (1.6 million sq miles), according to a 30-year satellite record. It has now frozen out to 4.2 million sq km.

The idea of climate tipping points -- like a see-saw that suddenly flips over when enough weight gets onto one side -- is controversial because it is little understood and dismissed by some as scaremongering about runaway effects.

Arctic Heat Wave Stuns Climate Change Researchers

Unprecedented warm temperatures in the High Arctic this past summer were so extreme that researchers with a Queen's University-led climate change project have begun revising their forecasts. "Everything has changed dramatically in the watershed we observed," reports Geography professor Scott Lamoureux, the leader of an International Polar Year project announced yesterday in Nunavut by Indian and Northern Affairs Minister Chuck Strahl. "It's something we'd envisioned for the future - but to see it happening now is quite remarkable."

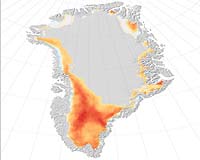

NASA Finds Greenland Snow Melting Hit Record High In High Places

Microwave data from the Special Sensor Microwave Imaging radiometer was used to create this image of the 2007 Greenland melting anomaly which reflects the difference between the number of melting days occurring in 2007 and the average number of melting days during the period 1988 - 2006. Credit: NASA/Earth Observatory.

A new NASA-supported study reports that 2007 marked an overall rise in the melting trend over the entire Greenland ice sheet and, remarkably, melting in high-altitude areas was greater than ever at 150 percent more than average. In fact, the amount of snow that has melted this year over Greenland could cover the surface size of the U.S. more than twice.

Multiple Studies Reveal Dire Meltdown in Arctic

A new study examining satellite measurements of the winter sea ice covering the Barents Sea (located north of Scandinavia) over the past 26 years has shown that the ice edge has recently been retreating in the face of rising sea surface temperatures, said study leader Jennifer Francis of Rutgers University.

Her research, detailed in a recent issue of the journal Geophysical Research Letters, showed that the warming waters in the Barents Sea—which have risen about 3 degrees Celsius since 1980—are to blame for the reduction in winter ice cover. Two factors contribute to the warming of the Barents Sea: warming Atlantic waters funneled in by the Gulf Stream and solar heating of the open ocean as ice melts in the summer, both of which make it harder for new ice to form in the winter.

The latter factor, known as the ice-albedo feedback, has been predicted by climate models and works like this: As ice melts in the summer, the open ocean warms up as it absorbs the solar radiation that the ice would normally reflect back to space; as global temperatures rise, more ice melts, so the ocean absorbs more heat, and less ice re-forms the next winter, which just keeps the cycle going.

Francis says that this retreat of the winter ice edge is "another piece of evidence that the ice-albedo feedback is appearing in the real world and not just in the model world."

Warming linked to 'unprecedented' algae growth in Arctic lake

Global warming is believed to be softening the harsh Arctic environment, causing the algae population in Canada's northernmost lake to spike over the past two centuries, researchers said Wednesday.

The team, led by Laval University scientists Warwick Vincent and Reinhard Pienitz, found aquatic life in Ward Hunt Lake, located on island north of Ellesmere Island, increased 500-fold during the period.

The changes occurred at a speed and range "unprecedented in the lake's last 8,000 years," the researchers said in a statement.

And, they say, the likely culprit is "climate change related to human activity."

Antarctica's Dry Valleys are among the most desolate places on the planet. Here, no plants cling to the slopes, no small mammals scurry among the scree. The freeze-dried landscapes, with their rocks chiselled by the wind, seem utterly lifeless. When Captain Scott first chanced upon their craggy peaks and troughs in 1905, he labelled them the "valleys of the dead".

Now, a little more than a hundred years on from Scott's exhibition, US scientists have discovered that the icy landscapes may not be so barren after all. Microbiologists from New Jersey have chanced upon tiny frozen organisms that have remained alive for millions of years, embedded in some of the oldest ice on the planet.

Dr Kay Bidle of Rutgers University, who was part of the research team, extracted DNA and bacteria from ice found barely metres beneath the surface of a Dry Valleys glacier, and, remarkably, claims to have grown the bacteria in a lab. "This is by far the oldest ice in which we have found encased microbes, cultured them and formed a growth," he says.

Vaclav Havel: The planet is not at risk. We are

The effects of possible climate changes are hard to estimate. Our planet has never been in a state of balance from which it could deviate through human or other influence and then, in time, return to its original state.

The climate is not like some kind of pendulum that will return to its original position after a certain period. It has evolved turbulently over billions of years into a gigantic complex of networks, and of networks within networks, where everything is interlinked in diverse ways.

Its structures will never return to precisely the same state they were 50 or 5,000 years ago. They will only change into a new state, which, so long as the change is slight, need not mean any threat to life.

Larger changes, however, could have unforeseeable effects within the global ecosystem. In that case, we would have to ask ourselves whether human life would be possible. Because so much uncertainty still reigns, a great deal of humility and circumspection is called for.

We can't go on endlessly fooling ourselves that nothing is wrong and that we can go on cheerfully pursuing our consumer lifestyles, ignoring the climate threats and postponing a solution.

UN: Thirty-five years to half-extinction

At the United Nations' climate change conference this month, experts painted a grim picture for the future of our planet. If humans don't act within the next 5 to 10 years, they warned, not only will we cause the extinction of many of the world's vital species, but in the end, we will be wiped off the earth ourselves.

"The entire web of life is on the verge of catastrophe," said Dr. Stuart Pimm from the Earth Institute at Columbia University. "If things continue, in as little as 35 years half of all species of life will be extinct." Perhaps the scariest aspect of this prediction is that nobody knows what the consequences will be. "Billions of people could die because of decreased biodiversity," Pimm warned.

As much as humans may try to keep a distance from nature, our impact on the natural world can't be denied. "The last mass extinction event was caused by an asteroid," Pimm recalled. "Now it is being caused by homo sapiens."

Paulson calls for emissions cuts

Hank Paulson, US Treasury secretary, warned on Thursday that the world would face “very, very bad outcomes” in the coming decades if nothing was done to reduce carbon emissions.

“There’s a huge scientific predicate that if we don’t do things today, we’re not going to be able to avoid the possibility of some very, very bad outcomes 30 or 40 years from now,” Mr Paulson told an audience at the Clinton Global Initiative, where he was introduced as an “ardent conservationist” by journalist Tom Brokaw.

His comments coincided with a meeting hosted by President George W. Bush in Washington among the top greenhouse-gas-emitting nations, who are collectively responsible for more than 80 per cent of global emissions.

Why we must harmonize the global climate-change response

In Washington today and tomorrow, the United States is playing host to the Major Economies Meeting on Energy Security and Climate Change, an initiative based on the fundamental premise that climate change is a generational challenge that requires a global response.

This meeting is the first in a series of gatherings that will include 17 of the world's major economies, developed and developing, as well as the United Nations. Combined, the participating countries represent 85 per cent of the global economy and 80 per cent of global carbon dioxide emissions. Canada will be participating and we look forward to its contribution.

Ottawa signs on to rival emissions pact

Prime Minister Stephen Harper used a United Nations conference aimed at saving the Kyoto Protocol as a backdrop yesterday to announce that Canada would join a rival climate change pact.

Hours after urging all countries to cut greenhouse-gas emissions by 50 per cent in any successor to Kyoto, Mr. Harper told reporters Canada would become the seventh member of the Asia-Pacific Partnership, a group nicknamed the anti-Kyoto partnership by some environmentalists....

....The Asia-Pacific Partnership, created last year by Australia, China, India, Japan, Korea and the United States, has been criticized for lacking the mandatory targets contained in Kyoto.

Canada will join a small coalition of countries that have spurned calls for mandatory pollution-reduction targets to fight climate change despite producing more than half the world's emissions....

....Canada's membership in the Asia Pacific Partnership is likely to turn heads in an arena where the country has already been singled out for casting doubt on the Kyoto accord.

Harper at odds with UN boss over plans to control emissions

UN Secretary General Ban Ki-moon called the meeting in the hope of reviving a UN-led campaign aimed at thrashing out a successor deal to the strict Kyoto Protocol, which expires in 2012.

But a sign Canada will further distance itself from the UN process came when Harper told reporters his government had received an invitation to attend the next meeting of the Asia-Pacific Partnership -- an agreement involving Australia, China, India, Japan, South Korea and the United States that allows the countries to set their own goals, but has no enforcement mechanism.

The Prime Minister's Office simultaneously issued a statement saying the invitation, made by India for an October meeting, was a "signal for joining" the group.

"One of the reasons it's important for Canada to participate in the Asia-Pacific Partnership is because these are the major emitters of the planet," Harper said. "These are the people we have to get involved in an international protocol, or we won't have such a protocol."

The move will come as a disappointment to Ban, who had opened the UN summit by saying the world body was the "appropriate forum" for negotiating global action.

Just about every article I read about US energy outlook ends up saying something like " Not to worry because we have all that Canada oil sand deposits to fall back on".

It really seems like that is the party line but it doesn't look to me that it could ever play a significant roll.

Stoneleigh,

The link "Suncor, Syncrude may feel less pain from royalties increase"

is broken.

Thanks, fixed it.

Hi Stoneleigh,

Thanks, and found your post above of

Wheat prices climb to new high particularly startling.

Here is a bit more on that concerning fallow land in Europe:

http://news.bbc.co.uk/1/hi/world/europe/7014999.stm

A decrease in reserve food production capabilities and a future need for increased FF fertilizers to make up for the loss of fallow..

I don't want to add to your work load Stoneleigh, but sometime would you feature the peaking of food production, or possibly find someone to speak on it?

I'd love to run an article like that - I'll see what I can do.

In the meantime, the best read on this subject IMO is Dale Allen Pfeiffer's (spelling?) little book called Eating Fossil Fuels. It puts the problem in very stark terms. I especially liked the comparison between Cuba and North Korea.

I always think reading foreign analyses on the US economy is interesting. I was looking for some articles on what to expect starting the 4th Qtr this Monday and came across this:

The Australian Business: Americans watch greenback fall

41

thanks for the articles.

a side note, not a criticism by any means: the Round-Up this week, and likely in the future as well, is divided into two parts: finance and earth/energy.

your articles look to be in the less appropriate one for their subject matter.

Ah...right...I just posted in the most recent one. I hadn't even noticed Stoneleigh splits these...thanks.

Here's another good one and really highlights the risks at stake here...the US and Britian losing their status as World Financial Leaders to Asia.

The Australian Business: US and Britain ward off consequences of debt-driven consumer boom

Here's one more for a lazy Sunday. Next week has some important data coming out:

Bloomberg: Unemployment May Rise, Factories Slow: U.S. Economy Preview