The Finance Round-Up: September 28th 2007

Posted by Stoneleigh on September 27, 2007 - 1:54pm in The Oil Drum: Canada

This is a Finance Round-Up by ilargi. An Energy and Environment Round-Up will follow over the weekend.

Et tu, Canada?

There's a country just south of here that pretends to be the world's richest economy, but in reality seems headed for the Halliburdened poorhouse. Et tu, Canada? Depends on where you look.

The papers' front pages show Prime Minister Stephen Harper, knowing there's no opposition left to speak of, though he leads a minority Cabinet. Stephen, too stiff to even play golf, shuffling the greens with Tiger Woods for a photo-op. Then a broad media smile: an alleged record federal budget surplus ($13.8 billion). To top it off, the new King of Nadamaskakas magnanimously hints at tax cuts. Little detail: it's $35 per person per year, less than 10 cents per day. But it sounded good at first, right, tax cut? Bienvenue à la politique.

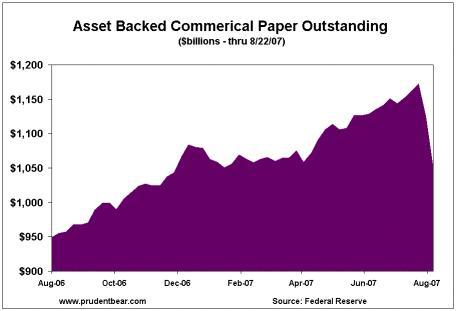

In the finance pages, a different take: lax laws have allowed trusts, funds and your pet parakeet to issue non-bank commercial paper (ABCP), to the tune of $40 billion (bank ABCP: $80 billion more). On August 16, the biggest gamblers tried hard to change this from short-to long term debt. Turns out, that won't fly: nobody can even figure out where it is or what it's worth. Caught in their own trap.

Québec's massive Caisse de Dépot pension fund holds $20 billion worth of it, a sizable chunk of their $240 billion portfolio, and that's just their domestic toilet paper. Our advice: Keep the day job. Till you're, like, 95. Your pension has been gambled away.

About that federal budget surplus: Canada's federal debt is $467 billion. Which, to our untrained eye, means the term "budget surplus" is the victim of acute and intense inflation. Harper actually said on TV that the surplus will be used to pay off the debt. On our untrained calculator, that would take, at the current rate, a negligible 33.8 years, or until 2041, providing no new debts are incurred, and inflation stops dead in its tracks. But we kid you not, at the moment of writing this, Harper's on TV, saying he does this for future generations.

To finish off this sunny newscast, while TD Bank raves about the tar profits, despite royalty reviews, Big Oil has launched the first lawsuit against Canada under NAFTA law. We'll see much more of that, soon, as in the Alberta royalty revision plans. Send your kids to law school.

We hear this on the News...

Prime Minister Stephen Harper came to Toronto today to reveal the size of the latest federal budget surplus, which totalled $13.8 billion for the 2006-07 fiscal year that ended on March 31.

The surplus was higher than predicted by the Conservatives. Harper said it was a sign of the health of the Canadian economy, which has now produced enough tax revenues to keep Ottawa from running a budget deficit for 10 consecutive years....

....Under the Tax Back Guarantee, this would translate into tax savings next year of about $35 for the average taxpayer....

....He hinted that the Conservatives, in addition to the Tax Back Guarantee, would like to bring in across-the-board income tax cuts in the federal budget next spring, if possible.

The national debt now stands at $467 billion.

The Canadian dollar remained stronger Thursday after the federal government announced a larger-than-expected surplus and as a weak U.S. home sales report sent the greenback lower against other global currencies.

The loonie, which had vaulted back above parity earlier, traded at 99.79 cents (U.S.) from Wednesday's close of 99.58 cents after rising above parity earlier.

The Canadian government estimated the surplus swelled to about $14-billion in the last fiscal year, far greater than the $9.2-billion forecast in the last budget.

Toronto's housing market continued to set records throughout the summer, with the price of a typical two-storey home rising nine per cent to $523,320.

Royal LePage Real Estate Services' (TSX: RSF.UN) third-quarter survey of the national resale housing market found home prices in major Canadian cities continued rising strongly.

Dodge warns of inflated housing market

Bank of Canada Governor David Dodge is raising a red flag about housing prices in Canada, saying that increasingly loose lending rules may be helping overheat the country's real estate market.

While Mr. Dodge did not draw any direct parallels with the subprime mortgage crisis that has gripped the economy of the United States and sparked a credit crunch around the world, he signalled that his long-standing concerns about mortgages with increasingly easy terms have not been addressed.

"One worries about the structure of the mortgage market, that we may be actually aiding, facilitating a rise in the price of houses that is really not warranted," he told reporters after a speech in Vancouver.

In his comments to reporters yesterday, Mr. Dodge further warned that housing prices outside of the fast-growing cities of Western Canada may be rising too quickly.

TD report says Alberta boom will continue to bloom, no bust in sight

Alberta's boom will continue to bloom and the bust is nowhere in sight, according to a new report by the TD Bank on the province's economic future.

The report by two TD economists says there are plenty of warning signs on the horizon, but they are not enough to signal the traditional boom-and-bust scenario that has plagued oil and gas producers in the past.

The warning signs include a drop in natural gas prices and drilling output levels, as well as a slowdown in sales of home and consumer goods. But even those aren't enough to stifle the strength of Alberta's economy.

...but scratch the surface and the news is not so reassuring.

Credit crisis 'made in Canada'

By June this year, Canada's ABCP [asset-backed commerical paper] market was about 10% of the size of the market in the United States, although the overall U.S. financial system is proportionately far larger than Canada's.

When concerns surfaced in August about the underlying assets in ABCP -- many of which have included troubled mortgage loans in the U.S. -- some owners of ABCP were caught off guard. Owners of ABCP were under the belief that they could convert it to cash or another similar product at the end of 30 or 60 days but instead were left holding the product.

Canadian investment bank Coventree Capital Inc. became one of the first major victims of the global credit crunch when it was unable to trade the ABCP it was holding because of the general seizing up of credit markets around the world.

Following Coventree's collapse, Canadian non-bank owners of $40-billion of troubled asset-backed commercial paper -- pension funds and corporate treasury departments -- were forced into an unprecedented joining-of-forces known as the Montreal Accord to try to salvage their holdings.

If the Montreal Accord does not result in a long-term agreement on how to resolve the issues in Canada's non-bank ABCP market by an Oct. 15 deadline, there could be a carryover effect on the demand generally for ABCP, said Blackmont's Mr. Smith.

"Failure to fully restore investor confidence levels could reduce demand ...which could restrict the future ability of banks to manage capital," he said.

Mr. Smith calculated that Canada's big six banks are on the hook for total liquidity facilities worth $135-billion.

Stalemate threatens Montreal rescue plan for ABCP

With the deadline for an agreement less than a month away, hopes of success for a plan to rescue about $40-billion of illiquid asset-backed commercial paper are growing steadily dimmer, sources say.

Under the so-called Montreal proposal, the frozen commercial paper would be converted into longer-term floating-rate notes, thereby providing holders with a way to get their money back. But now the major banks and investors behind the plan are finding their progress slowed and even blocked by hurdles they never imagined when the plan was launched in August.

"A bunch of issues is making this incredibly complex," said a senior executive close to the discussions.

"No one ever anticipated the events that led up to this. This was a very lucrative market and now everybody's looking after their own interests."

Simply put, the source said, the only way for the logjam to end is for the federal government to step in and take control. If that doesn't happen, the consequences for the Canadian economy could be dire, he said.

Committee organizing ABCP rescue begs for more time

A committee of investors formed to oversee a restructuring plan for about $40-billion of illiquid asset backed commercial paper is asking for more time to get the job done.

In a statement this morning, Purdy Crawford, the chair of the committee, said, "Given the highly complex process and the significant number of stakeholders involved, a successful restructuring cannot be completed by mid-October in respect of all of the affected conduit trusts."

Canada's market for asset backed commercial paper seized up in early August after being hit by fallout from the subprime mortgage crisis in the United States....

....The committee said it aims to arrive at a solution that will be "fair and equitable" to the various players and at the same time avoid value destruction from a firesale of assets.

The repercussions of the turmoil in the US subprime mortgage market are increasingly being felt around the world. What was initially thought to be a problem confined to a US credit market segment has increasingly transformed itself into an erosion of investor confidence in credit quality in general and, in some countries, concerns about the reliability of the banking sector.

The most obvious symptom of eroding confidence is the alleged "liquidity crisis." The term "liquidity" usually denotes the possibility to buy or sell a financial asset at any one time without causing noticeable changes in the price of the product being bought or sold. Market participants speak of "illiquidity" when it is no longer possible to sell financial products, or if selling is possible only at greatly diminished prices....

....In addition, concerns about credit risks have made investors increasingly unwilling to refinance maturing asset-backed commercial paper (ABCP) issued by so-called "conduits".

The latter were established largely by banks to open up new financing opportunities. Banks took on the role of "sponsors," that is providing conduits with credit enhancement or liquidity support or both.

If ABCP issuing conduits draw down on their liquidity support, banks as principal providers of liquidity need to provide money either from their own internal resources or through borrowing from the money and capital markets. So in the current period of market strain, various banks' funding needs have increased because of their liquidity commitments vis-à-vis conduits.

The $40-billion restructuring of the ABCP market is the biggest workout attempted in Canada, exceeding such high-profile blow-ups as Olympia & York Developments Ltd., Air Canada and Stelco Inc. Stelco alone took two years, two months and two days to fix.

The legal complexities facing Purdy Crawford and the committee that has been struck to solve the crisis is daunting. It's folly to think it can be done in 60 days. If this were a baseball game, it'd be two out in the top of the first.

Workouts like Stelco and Air Canada involved a single corporate empire. The third-party ABCP workout resembles a Cecil B. DeMille film, with a cast of thousands. One lawyer notes there could be as many as 40 trust structures alone, each of which has a weighty trust indenture that must be reviewed, and assets that must be dissected before anyone knows their legal options.

Toss into the mix those who issued the paper, those who created the investment conduits, those who provided liquidity, the SWOP providers, and dozens of companies holding suspect notes and it makes a highly volatile situation. And the information void: After almost 60 days, most noteholders don't know what they're holding.

Adding to the complexity is the fact the conduits holding the questionable paper aren't companies. They're trusts, so corporate law doesn't apply. That means seeking protection under the Companies' Creditor Arrangement Act, a commonly used device to secure an orderly workout, doesn't apply.

Subprime Panic Freezes $40 Billion of Canadian Commercial Paper

On Baffin Island in the Arctic Circle, Baffinland Iron Mines Corp. almost missed its window to ship provisions to workers before winter arrives. The delay came not from the weather, but from a sudden freeze in the market for short-term debt 2,000 miles south in Toronto.

Baffinland ran short of funds to pay for food, fuel and drilling equipment after investing in commercial paper that borrowers couldn't repay. Without the money, the company had to arrange an emergency line of credit before shipping lanes froze over.

``We have 200 people to keep alive,'' Chief Executive Officer Gordon McCreary said in an interview in Toronto. ``Our lifeline to getting critical materials to the north'' was the C$43.8 million ($43.8 million) invested in commercial paper, he said.

The Canadian cash crunch that started with defaults on subprime mortgages in Southern California and Florida has hurt more than 25 companies that invested in commercial paper, including Sun-Times Media Group Inc. and Canada Post, the nation's mail service. Baffinland has 95 percent of its cash in Canadian commercial paper, debt that is due in 364 days or less.

Investors fled Canada's asset-backed commercial paper, paralyzing the C$40 billion market for debt that carried the highest credit ratings, after losses from home loans to people with poor credit histories roiled global credit markets.

Bank of Canada steps back into the market

Just two days after the Bank of Canada said it no longer saw a need to be involved in smoothing the global credit crunch, the central bank has injected almost $1-billion into the market.

Data on the central bank's website show it injected $985-million this morning.

It's the first time in almost a month that the Bank of Canada has injected liquidity....

....The last time the central bank conducted special operations was on August 16, with $370-million.

This morning's liquidity injection coincides with a press conference in Montreal, in which a committee of investors charged with resolving the standstill of $35-billion in Canadian asset-backed commercial paper announced it would ask for an extension.

The committee had arranged a 60-day standstill, which comes to an end on Oct. 15.

Douglas Porter, deputy chief economist at BMO Nesbitt Burns in Toronto, thinks there may be a link between the central bank's action and the ABCP situation.

“I suspect it is related to concerns about the commercial paper market,” he said. “I think what this shows is that there is still an issue here. The credit markets have not gotten back to normal by any means.”

ABCP credit crisis spells big trouble for Caisse

This time, the controversy comes by way of reports that the Caisse holds between $13-billion and $20-billion of the $35-billion in now illiquid non-bank asset-backed commercial paper (ABCP) gathering mould in Canadian accounts. If it's true, this is a problem of the Caisse's own making. It is not out of place to ask whether an obsessive focus on returns - beating rival Ontario Teachers is job one at the Caisse - isn't at the root of it all.

The Caisse spent its first 40 years juggling a dual, though unofficial, mandate. It invested Quebeckers' pension savings to get the highest return possible, but also to promote the development of the provincial economy. Sometimes that meant accepting a lower return, or even none at all, to help a francophone entrepreneur start an empire.

BMO says market can't roll over 100% of commercial paper

Senior Canadian bank executives are acknowledging that problems in Canada's non-bank asset backed commercial paper market have spilled over into the market for bank sponsored ABCP as many observers had feared.

Karen Maidment, the chief financial officer at Bank of Montreal said some banks have been unable to roll over all their paper....

....Toronto-Dominion Bank chief investment officer Rob MacLellan said part of the problem is that some investors are unable to differentiate between the bank and non-bank form of the paper.

S&P cuts BCE and Bell bonds to 'junk' grade

Standard & Poor's downgraded BCE Inc. and Bell Canada bonds into 'junk' territory yesterday in a move that was widely expected by bond watchers.

The rating agency lowered BCE and Bell's long-term corporate credit rating to "BB-", a non-investment-grade rating, from "A-," an investment-grade rating, in order to reflect the pile of debt the company is on the verge of absorbing as part of its proposed privatization plan.

Bell has said it plans to borrow about $34.4-billion to finance the $52-billion leveraged buyout, a deal led by the Ontario Teachers' Pension Plan.

Oil, gas trusts would see junk rating: report

Despite solid balance sheets, most of Canada's oil and gas income trusts would be assigned a junk rating from Standard & Poor's, the rating agency says in a new report.

The analysis of 27 pure upstream oil and gas income trusts -- by and large the entire Canadian energy trust sector --concludes the majority would be given speculative-grade ratings of "B" and "BB" if assigned credit ratings, despite being relatively under-levered compared with similar-sized corporate piers....

...."This is, however, offset by increased reinvestment risk and less flexibility to defer capital spending without having an immediate effect on production and unit cash costs."

S&P also said reliance on acquisitions to spur continued growth is a source of credit weakness among Canada's oil and gas trusts....

....Ms. Dathorne cited the mature nature of the group's asset base, the commonly used growth-through-acquisitions strategy and large cash payouts made by the trusts to unit holders as factors that figured prominently in the assessment.

Oil giants taking Canada to court

Exxon Mobil Corp. and Murphy Oil Corp. have served notice they plan to sue Canada under the North American free-trade agreement in connection with the Hibernia and Terra Nova oil projects, saying Ottawa is breaking the treaty by forcing them to spend a bigger percentage of research cash in Newfoundland.

It's the latest friction in strained relations between global oil companies and the government of Newfoundland and Labrador over how much they should pay to tap the province's offshore petroleum riches.

The two firms, which are required to give Canada 90 days notice under NAFTA, say they intend to file suits seeking a combined total of $50-million in damages from Ottawa.

Libor’s value is called into question

“The Libor rates are a bit of a fiction. The number on the screen doesn’t always match what we see now,” complains the treasurer of one of the largest City banks.

Such criticism is, unsurprisingly, rebuffed by those who compile the index each day. However, it highlights two other trends that have emerged in the money markets in recent weeks.

One of these is a growing divergence in the rates that different banks have been quoting to borrow and lend money between themselves.

For although the banks used to move in a pack, quoting rates that were almost identical, this pattern broke down a couple of months ago – and by the middle of this month the gap between these quotes had sometimes risen to almost 10 basis points for three month sterling funds.

Moreover, this pattern is not confined to the dollar market alone: in the yen, euro and sterling markets a similar dispersion has emerged. However, the second, more pernicious trend is that as banks have hoarded liquidity this summer, some have been refusing to conduct trades at all at the official, “posted” rates, even when these rates have been displayed on Reuters.

“The screen will say one thing but people are actually quoting a different level, if they are quoting at all,” says one senior banker.

ECB Lends 3.9 Billion Euros to Banks, Most Since 2004

The European Central Bank lent 3.9 billion euros ($5.5 billion) at its penalty rate, the most in almost three years, suggesting credit markets are still unable to meet banks' borrowing needs.

The three-month London inter-bank offered rate for euros rose to 4.79 percent today, a six-year high, from 4.73 percent, according to the British Bankers' Association. The increase shows that the fallout from losses on subprime mortgages is still making banks reluctant to lend to each other. The U.S. commercial paper market shrank for a seventh straight week as a Federal Reserve interest-rate cut failed to ease credit concern.

``It's likely that money markets are going to be in a state of shock for some time to come,'' said Stuart Thomson, a bond fund manager at Resolution Investment Management in Glasgow, Scotland, which manages $60 billion. ``No one knows where the bodies are buried.''

Central banks’ actions fail to calm money market

The European Central Bank faced a fresh surge in demand for liquidity on Tuesday when it allocated weekly refinancing funds at an average of 4.29 per cent, the highest spread over the minimum bid rate for almost five years.

The unexpectedly strong appetite suggests the ECB is again facing difficulties bringing interest rates in line with its 4 per cent main rate. Tuesday’s auction bids totalled €369bn compared with its estimated “benchmark” requirement of €157bn.

The pattern is likely to trigger unease among policy makers since it suggests the mood in the global money markets remains nervous, irrespective of the emergency actions taken by central banks in recent days.

The Bank of England will on Wednesday conduct an auction of £10bn worth of three-month money, the first of four weekly sales designed to help lenders, and this is expected to provide another key indication of how badly the banks need cash.

U.K. Commercial Banks Sit Out BOE Money-Market Sale

U.K. commercial banks sat out the Bank of England's three-month money auction, avoiding the taint of borrowing at a penalty rate two weeks after the government was forced to bail out Northern Rock Plc.

The result may mean banks are finding it easier to borrow money after market interest-rates fell today to the lowest since the start of the credit-market slump. At the same time, economists cautioned that institutions may have shunned the sale on concern a bid would fuel speculation they are in financial difficulty.

``Either the system is stabilizing, or the individual institutions were fearful of the stigma attached to using the facility,'' said Nick Parsons, head of market strategy at National Australia Bank in London. ``You can't tell which.''

Only £4.4m left to protect UK's bank deposits

Britain's deposit protection scheme currently holds funds of just £4.4m, it emerged yesterday as banks warned that consumers face sharp price rises to pay for the Chancellor's plans to offer a £100,000 guarantee....

....However, in the event of a major failure it would have no choice but to impose a huge levy on the rest of the industry, which some observers warn could severely dent its profits.

Northern Rock, for example, held deposits of £22bn before plunging into crisis caused by its announcement that the Bank of England had agreed to provide an emergency financing facility.

The scheme currently covers a person's first £2,000 on deposit and 90 per cent of the next £35,000. Senior bankers say plans announced by the Chancellor, Alistair Darling, that would improve the payout to provide consumers full protection on deposits up to £100,000 will impose a huge funding cost to the industry.

U.K. Banks Will Reduce Credit to Companies, BOE Says

U.K. banks will reduce the supply of credit to companies ``significantly'' in the fourth quarter as they tighten loan conditions and respond to higher market borrowing costs, the Bank of England said.

The central bank said its new quarterly survey of lenders showed a net 49.3 percent expect to cut credit supply in the next three months compared with 20.2 percent in the previous quarter. The figure tracks the percentage of lenders forecasting tighter lending conditions subtracted from the number who see looser terms. The responses were collected from Aug. 20 to Sept. 13.

Commercial lenders' reluctance to extend credit raised the cost of borrowing between banks to a nine-year high Sept. 11, forcing Northern Rock Plc to seek emergency funding and prompting a run on its deposits. Tighter lending terms may crimp business investment, adding to the case for lower interest rates.

Critics have attacked the board for promising to maintain the payout despite drawing on £2.9bn of emergency funds from the Bank of England simply to keep the business running.

In addition, the Treasury has underwritten several billions of pounds of Northern Rock's debt – putting taxpayers' money at risk.

Northern Rock is believed to have now bowed to pressure from the Financial Services Authority and the Treasury not to make the payment.

The bank is likely to dress up the decision as a dividend deferral by promising to pay shareholders once the funding crisis is over. However, bankers and economists say it will technically be bust without the Treasury guarantees and that shareholders were unlikely ever to see the dividend.

Andrew Clare, professor of asset management at Cass Business School, said: "Had the Government not stepped in, there would be no dividend and no company. I'm sure it wasn't the Government's intention for the dividend to be paid."

Northern Rock Woes Could Hit German Investment Funds

Like financial institutions in the US, Northern Rock had been re-selling mortgage debt to investors for years, in the form of exotic financial instruments bearing confidence-inspiring names like Granite, Dolerite and Whinstone.

Among those investing in such securities were German investment funds, who were attracted by their generous interest rates. According to its half-year report, funds offered by the Deutsche Bank subsidiary DWS Investments have stakes in Granite, while Allianz Global Investors has funds with investments in Granite and Dolerite.

"All of these securities are suffering," Dominique Linder, an expert on asset-backed securities at Allianz, told SPIEGEL. Because Northern Rock is still responsible for processing interest revenue from the sold mortgages, "investors are now afraid that there could be disruptions there," Linder said.

Fall-out at the top reveals French finances in freefall

A deepening crisis in French public finances has exposed a growing rift between President Nicolas Sarkozy and his Prime Minister, François Fillon.

M. Fillon, criticised at the weekend for saying that the French state was "bankrupt", is believed to be pushing for an "austerity" programme to reduce public spending.

He has at least partially aligned himself with the European Central Bank governor Jean-Claude Trichet and other EU governments who are anxious about President Sarkozy's relatively cavalier attitude to European Union rules on public debt.

Euro's rise breaking the bank for Sarkozy

It's a classic ploy of any businessman on the skids: Blame the bankers. "I could have saved the company but the banks pulled the rug from under me" is the standard whine and something like that has been heard in Paris over the past year, reaching a crescendo in recent weeks.

The euro has risen to a record high against the U.S. dollar and its appreciation against the greenback, yen and Chinese yuan is causing French President Nicolas Sarkozy to foam at the mouth. His grand plan to revive the French economy with pump-priming tax cuts is being undermined by a strong currency and high euro interest rates.

The banker in question is Jean-Claude Trichet, the European Central Bank president, who sneers at the French President and lambastes France for its reckless spending. Mr. Sarkozy wants the central bank to pay more attention to other factors, such as currency rates and the general state of euro zone economies when it sets interest rates, rather than its relentless focus on inflation, which led the bank to raise its benchmark rate eight times to 4 per cent since 2005.

The wages of financial innovation

It is a cliché to attribute the Crash of 2007-08 to the woes arising from the subprime lending in the US. It broke out within days after the meeting of the US Federal Reserve on August 7.

Fear seized credit markets, bred risk aversion and liquidity froze. Warriors (read, investment bankers) who could shuffle billions of dollars across computers in seconds in what was described as “statistical arbitraging” were scurrying for liquidity to bolster the value of their assets.

More than fear, it was the distrust of the value of the assets held by their peers that curdled cash flows....

....There is an uneasy calm prevailing among bankers. It is equally unclear how or how soon the assets tangles may be resolved or who would bear the costs. Central banks, including the venerated ones, are clueless. Sadly, “Recent events show that financial innovations meant to distribute risk can end up multiplying instead in ways neither regulators nor investors fully understand.” (The Wall Street Journal, August 7, 2007.) Avinash Persaud has analysed it more trenchantly: “Securitisation has in fact led to more concentrated behaviour. It raises, not lowers, systemic risk.” (Economic and Political Weekly, August 25, 2007.)

This crisis is quite different from what the world had witnessed in the past. It cannot be solved by pumping more and more money unless the Augean mess is cleaned up.

The bursting of the sub-prime mortgage bubble — strikingly reminiscent of the dot-com excesses of the 1990s — could well be a tipping point. In both cases, financial markets and policy makers were steeped in denial over the risks. But the lessons of post-bubble adjustments are clear. Just ask economically stagnant Japan. And of course, the United States lapsed into its own post-bubble recession in 2000 and ’01.

Sadly, the endgame could be considerably more treacherous for the United States than it was seven years ago. In large part, that’s because the American consumer is now at risk. Consumption expenditures currently account for a record 72 percent of the gross domestic product — a number unmatched in the annals of modern history for any nation.

This buying binge has been increasingly supported by housing and lending bubbles. Yet home prices are now headed lower — probably for years — and the fallout from the subprime crisis has seriously crimped home mortgage refinancing. With weaker employment growth also putting pressure on income, the days of open-ended American consumption are likely to finally come to an end. That will make it hard to avoid a recession.

Signing up a new credit card customer: $58. Buying off Congress: $8.5 million. Keeping Americans in hock for life: priceless....

....A "preferred customer," according to one MasterCard vice president, is someone with a "taste for credit" who's "willing to make minimum monthly payments—forever."

Put simply, the U.S. is on sale.

So whether it goes into stock exchanges or private-equity firms such as Carlyle Group, that money's looking for a home. See related story.

Yes, Americans have balked at a number of transactions in recent years, most famously the aborted Cnooc Ltd. acquisition of Unocal in 2005 and the Dubai Ports deal in 2006.

The ability of politicians to oppose those kinds of transactions is weakening, however, given that they're the ones voting to spend more money than comes in to pay for the pork-barrel projects that get them re-elected.

The good news is that the U.S. is an attractive place to invest, given the size of the market and the relatively simple regulatory regime, particularly compared with Europe.

Politicians may not like it, but they're unlikely to do anything meaningful about it, unless they suddenly decide to stop living like subprime borrowers and clean up their balance sheets.

Capital spending softens in August

"The orders and shipments data signal a slowing in business capital spending ... as a result of the distress in credit markets and the deteriorating outlook for the U.S. economy," wrote Sal Guatieri, an economist for BMO Capital Markets.

Further writedowns expected for US banks

‘I think we all realise that more write-downs are coming. The sub-prime market has not been around for very long, so valuations are difficult. The banks have tried to be honest, but we just don’t know which tranches of sub-prime still have to come in and which bits will be bad,’ said Ralph Cole, a fund manager at Ferguson Wellman Capital Management.

Reaching accurate valuations for debt instruments has become so tricky because the market for such securities has crashed and banks can no longer mark instruments to the market price. Instead, banks have to use complex formulas to generate mark-to-model valuations, which are vulnerable to error and subjectivity.

Merrill Lynch May Write Down Assets by $4 Billion

Merrill Lynch & Co., the third biggest U.S. securities firm, may record losses of as much as $4 billion on fixed-income assets, resulting in the lowest quarterly earnings in almost six years, Goldman Sachs Group Inc. analyst William Tanona said....

....All five of the biggest U.S. brokerage firms have grappled with declines in the value of asset-backed securities and corporate loans on their books as surging losses on subprime home loans made investors leery of risky investments.

Call to split US credit ratings agencies

Credit ratings agencies need to separate their rating and advisory functions because of conflicts of interest in their relationship with Wall Street, the newly appointed head of a high-level government advisory panel said on Wednesday.

Eric Mindich, who was named on Tuesday as head of a private sector group advising the White House, said investor confidence in the ratings agencies had been “severely damaged” and that their business model had inherent “serious conflicts”.

SEC Looking Into Ratings Conflicts

The Securities and Exchange Commission is examining credit-rating firms to see if they were "unduly influenced" to inflate ratings for some mortgage-backed securities, SEC Chairman Christopher Cox said in testimony Wednesday to the Senate Banking Committee.

"The examinations are well under way, and we'll almost certainly report back publicly" on findings, Mr. Cox told reporters after the Senate hearing.

SEC examiners are focusing on whether rating firms were pressured by Wall Street investment bankers who package and sell securities backed by residential mortgages. Mr. Cox said regulators also are looking at whether rating firms were impartial in rating mortgage-backed securities and followed procedures for managing conflicts of interest.

Congress gave the SEC new authority last year to inspect and discipline rating companies, such as Standard & Poor's, a unit of McGraw-Hill Cos., and Moody's Investors Service, a unit of Moody's Corp. Regulators are on the lookout for abusive or anticompetitive practices and measures to guard against potential conflicts, but aren't authorized to question rating firms' methods or results.

Moody's, S&P Answer Critics Over Bond Calls

Rating firms play an integral role in the mortgage market. Homeowners borrow from mortgage bankers, which often resell the loans to Wall Street firms. The loans get bundled and repackaged as part of securities that are evaluated by the rating firms and then sold. The rating firms help investors understand the risk of these bonds defaulting by putting a rating, such as a stellar triple-A, on the bonds.

Some of those ratings have come into question as the firms have downgraded hundreds of previously highly rated securities, contributing to the turmoil in credit markets as investors dumped downgraded securities and refused to step in and buy securities on the market.

"We're very nervous right now," says Richard Metcalf, director of corporate affairs for the Laborers' International Union of North America, which advises pension funds. "We'll be much less likely to invest in these types of products if we're not assured we're getting an honest and independent rating."

Some have questioned if the rating firms are independent from the Wall Street firms that issue bonds and pay for their ratings. Mr. Metcalf says he wants rating firms to disclose more about their business practices, much like accounting firms did with the 2002 Sarbanes-Oxley law.

Moody’s alters its subprime rating model

Rating agency Moody’s is changing the way it rates complex debt products backed by US subprime mortgage bonds to reflect mounting losses in the stricken market.

The changes come as the major rating agencies have come under fire for granting high ratings to such complex mortgage securitisations, amid signs of looser lending standards and slowing house price appreciation.

These so-called collateralised debt obligations have suffered precipitous drops in market value and downgrades to several notches below their initial ratings as late payments and defaults on the underlying mortgages have exceeded the agencies’ initial expectations.

Moody’s has responded by making its rating model more conservative to reflect these higher losses. The rating agency has also broadened its definition of subprime mortgages to include other less risky mortgages previously classified by the rating agency as “midprime” – meaning that such mortgages will be subject to higher loss expectations than previously.

The changes are the latest in a string of updates to CDO rating models by Moody’s and rivals Standard & Poor’s and Fitch, as subprime mortgage losses have continued to accelerate for home loans originated in 2005 and 2006.

SEC complaint alleges Freddie Mac engaged in scheme to misrepresent earnings to investors

Mortgage finance company Freddie Mac will pay $50 million to settle federal charges that it fraudulently misstated earnings over a four-year period.

The Securities and Exchange Commission announced the settlement Thursday. Freddie Mac neither admitted nor denied wrongdoing in the accord but did agree to refrain from future violations of the securities laws.

Dollar Trades Near Record Low Versus Euro on New-Home Sales

The dollar traded near a record low against the euro as a larger-than-forecast drop in new-home sales led investors to increase bets that the Federal Reserve will cut borrowing costs a second time this year.

``The housing picture doesn't bode well for the dollar,'' said Brian Taylor, chief currency trader in Buffalo, New York, at Manufacturers & Traders Trust, which has $50 billion in assets. ``The new-home-sales number is just another piece of evidence.''

New-Home Sales Tumble to 7-Year Low

New-homes sales tumbled in August to the lowest level in seven years, a stark sign that the credit crunch is aggravating an already painful housing slump.

Sales of new homes dropped by 8.3 percent in August from July, the Commerce Department reported Thursday, driving down sales to a seasonally adjusted annual rate of 795,000 units. That was the lowest level since June 2000, when sales clocked in at a pace of 793,000.

Housing Slump to Last Beyond 2008, Fannie's Mudd Says

Fannie Mae Chief Executive Officer Daniel Mudd said the housing slump will last beyond next year, dragging down home prices and increasing credit losses at the largest provider of financing for U.S. mortgages.

``We don't think we hit a bottom until the end of '08 and then we have some period of time to work our way back up again,'' Mudd said today in an interview in Washington.

Mudd's prediction is more bearish than that of the National Association of Realtors, which this month predicted new home sales will stop falling in the first quarter of 2008. Pessimism about the housing market is growing as prices fall and demand declines. Purchases of new homes in the U.S. dropped more than forecast in August and prices plunged by the most in almost four decades, the Commerce Department said today in Washington.

Roubini: I Was Way Too Optimistic on the Housing Recession...

When this author first spoke of a fall in home prices of 20% people replied skeptically that home prices had never fallen nationally year over year since the Great Depression; thus, there was no chance of a 20% fall, the consensus claimed. Now that home prices are starting to fall sharply Goldman Sachs is predicting a fall of 15% in home prices. While Bob Shiller is now – correctly – arguing that to bring back the price to rental ratio to its long terms average home prices may have to fall as much as 50%, not just 15-20%, in some areas.

So what was considered a year ago or even six months ago as dire pessimist about housing is becoming now a consensus view.

Lennar results plunge as housing woes worsen

"Heavy discounting by builders, and now the existing home market as well, has continued to drive pricing downward," Lennar Chief Executive Stuart Miller said in a statement.

"Consumer confidence in housing has remained low, while the mortgage market has continued to redefine itself, creating higher cancellation rates," he added.

The U.S. housing market has been suffering from a steep downturn for nearly two years as high prices and climbing interest rates have deterred prospective buyers. Problems in the credit market, stemming from defaults of mortgages to those with the riskiest credit histories, have exacerbated the situation as even those with good credit ratings have found mortgages more difficult to obtain.

"They're dealing with a lot of excess capacity still," Thomas Leritz, portfolio manager with Argent Capital Management, which does not own home-building shares but follows the stocks.

"In addition to that, you have foreclosures, so there's excess supply coming back into the market from foreclosures as well," he said. "What we're looking for is some sense that there's no additional inventories going into the market."

S&P: US Home Price Decline Accelerates

U.S. Homes Post Steepest Price Drop in 16 Years

The decline in U.S. home prices accelerated nationwide in July, posting the steepest drop in 16 years, according to the S&P/Case-Shiller home price index released Tuesday.

Home prices have fallen by more every month since the beginning of the year....

....Shiller, an economist at Yale University, told lawmakers in written comments last week that the loss of a boom mentality among consumers poses a "significant risk" of a recession within the next year.

They Cried Wolf. They Were Right.

In a replay of the years before the tech-stock bubble burst in 2000, housing market skeptics have spent much of this decade being tarred as the boys who cried wolf. Their predictions were proved wrong year after year as people continued to bid up the price of condos in Miami and new houses in suburban Phoenix.

Academics and economists like Mr. Baker came across as gloomy sourpusses who did not want Americans to have fun and grow rich by flipping second homes on the New Jersey or Florida coasts.

“The naysayers simply look silly at the end of the bubble,” said Mark Zandi, chief economist for Moody’s Economy.com who was among the experts raising questions about the underpinnings of the housing boom. “They are completely discounted and discredited because they have been saying things are askew for a year or two. It’s when the naysayers’ views have been completely discarded and discredited that the bubble inflates to its apex.”

That's why Joseph Vineyard needs to start thinking about Joe Six-Pack. So far, Joe has coped quite well. If old enough, he has retired and enjoyed a tax-free check that rises faster than his old paycheck most of the time. That's a lot better than working, and it tells us a lot about why people retire at 62.

If younger, he has refinanced his house to provide the spending power he couldn't find in his paycheck, no matter how hard he worked.

But the easy borrowed money just ended for everyone.

US economy kills American middle class

The middle class is surely being kicked while down. The alluring home market has fallen flat for the struggling middle class. The number of Americans without health insurance has risen by 2.2 million. There are a total of 47 million people without this insurance. The poor are still poor and the middle class is struggling to stay middle class. The claim is other sections of the economy are healthy.

Then who and what are the reports referring to? Before 1990 the Forbes 400 had a combined worth of $221 billion combined. By June 2006 they were worth 1.3 trillion. The median household income has held at about $ 44,000. What this means is if the lower to middle class incomes are stagnate while inflation is rising, the healthy economy exists for the rich.

CPI's Lie on Household Inflation Doesn't Wash

The U.S. consumer price index continues to be a testament to the art of economic spin.

Since wages, Social Security cost-of-living increases and some agency budgets are tied to it, the government has a vested interest in keeping it as low as possible.

Yet your real cost of living -- what you keep after taxes, medical bills, college expenses and other household costs -- is probably much higher than the 2 percent annual rate the government reported in July, showing a slight decline.

Millions are falling behind inflation because wage increases aren't keeping pace with the cost of medical care, lost employment benefits, homeownership expenses, energy and transportation.

And there's also a goliath looming in the U.S. economy that makes the government's consumer gauge more deceptive. Even with the stinging reality that housing values are dropping in many markets, homeownership costs such as taxes, maintenance and financing are still rising much faster than the index.

Credit crunch to hit hardest in 2008

Most of the impact of the global credit crunch will be felt in 2008 and the United States will be hardest hit, International Monetary Fund Managing Director Rodrigo Rato said on Monday.

Global currency market balloons to $3.2-trillion a day

Trade on global currency markets has jumped a record 71 per cent over the past three years and is now worth more than $3.2-trillion (U.S.) a day — roughly equal to the entire annual economic output of the world's third largest economy, Germany.

Daily turnover has soared from $1.9-trillion in 2004, partly due to greater activity by hedge funds and “black box” computer trading, the Bank for International Settlements said on Tuesday in a benchmark survey which it conducts every three years.

Pentagon seeks 190 billion dollars for Iraq, Afghanistan

US Defense Secretary Robert Gates is seeking nearly 190 billion dollars to fund the wars in Iraq and Afghanistan in 2008, the largest war funding request ever in the six-year-old "war on terror," the Pentagon said Wednesday.

Gates was scheduled to testify later before a Senate committee on the request, which was 42.3 billion dollars greater than the administration's estimate when it presented its 2008 budget request in February.

Daniel Ellsberg: 'A Coup Has Occurred'

I think nothing has higher priority than averting an attack on Iran, which I think will be accompanied by a further change in our way of governing here that in effect will convert us into what I would call a police state.

Big Brother USA: Homeland Security's Domestic Travel Permits

Your government (meaning the Department of Homeland Security) is up to no good.

Beginning in February 2008, U.S. Customs and Border Protection (CBP) will implement their ¨Advance Passenger Information System (APIS),¨ the gist of which is that you will need permission from the United States Government to travel on any air or sea vessel that goes to, from or through the U.S. The travel companies will not be able to issue a boarding pass until you are cleared by DHS. This applies to ALL passengers, US citizens and visitors alike. And how do you get said permission to travel? That´s for your government to know and you to never find out.

Now TSA proposes to do for domestic travel what APIS will do for international routes. That´s what I said: the new TSA rule would require that you obtain PERMISSION to travel within the U.S.

Satire: Israel asks U.S. foreign aid be paid in Euros

Secretary of State Rice has acknowledged a communique from Israeli foreign minister Tzipi Levni which requests that all foreign aid payments and loans from the United States be made in Euros rather than in Dollars. Foreign Minister Levni cited the rapidly declining dollar and it's disfavor as a world currency as reasons for the request.

Re: Northern Rock

Reading the general press it would seem that Northern Rock pulled its expected dividend. But not so, they actually paid out £40m in dividends whilst also borrowing a further £5b from the Bank of England:

Northern Rock debt to Bank now £8bn

http://www.ft.com/cms/s/0/f1bb99f8-6d42-11dc-ab19-0000779fd2ac.html

Thanks for posting that Burgundy. All too often, bailouts only serve to pay off the well-connected when problems emerge, leaving the rest holding the empty bag. IMF country bailouts are a case in point (see for instance And the Money Kept Rolling In (And Out) by Paul Blustein in relation to the financial crisis in Argentina).

Northern Rock's bailout is becoming increasingly bizarre and the Bank of England trashing its own reputation even more so. I can only assume that the situation is so bad that the BOE has no alternative but risk itself and the entire financial system in a reckless effort to avoid meltdown:

Northern Rock refuses to tighten lending rules

http://business.guardian.co.uk/markets/story/0,,2179625,00.html

"By Jove we're still afloat. Full steam ahead and try not to hit any more icebergs!"

It's a mess down there on the isles, I'd say. All this stuff came about when new PM Gordon Brown handled finance. There's rumours that the government overruled the Bank of England, but I find that hard to believe.

Instead, as we saw in the last Round-Up, it's the government that now guarantees $200,000 of each person's bank deposits. The weirdest thing for me is that Northern Rock, while paying dividend with taxpayers' money, still hands out bigger and riskier mortgages than any other UK bank.

We're sort of counting down Europe now. Financial trouble in the UK, in France (see articles above), and in Spain:

Than there's Germany where banks are certainly shaking, Dresdner needed a bailout, Deutsche Bank has a hard time staying upright, with $40 billion in loans it can't sell off.

These 4 countries are Europe's largest economies, and have half the 500 million EU population. It doesn't take much imagination to figure how the smaller ones are doing. Don't sleep next to an elephant.

Still, just like in Canada, the official word remains: "don't worry, we're fine, we don't have subprime mortgages", and people swallow that. But it's not the mortgages, it's the toxic paper that has been issued with the mortgages as collateral, that is the problem. And both the EU and Canada have bought tons of it, plus created more of their own.

"It doesn't take much imagination to figure how the smaller ones are doing"

ICELAND FACES MELTDOWN

http://findarticles.com/p/articles/mi_qn4156/is_20060409/ai_n16179446

And that could all come crahing down on Canada.

Looks like the whole system could lock-up with no one being able to make a move without bringing the roof down. Meanwhile, the foundations of the financial system are also eroding away beneath their feet forcing them into ever more risky manoeuvres.

Nail biting stuff :)

The whole thing locking up is indeed on the cards, and the desperate actions taken to keep things going only postpone (and aggravate) the inevitable. IMO the logjam that's forming will burst once we see asset firesales, as that means marking those assets to market rather than to model. Even one such sale - with assets going for pennies on the dollar, or worse, with no bids at all - would call whole asset classes into question virtually overnight, leading to an every-man-for-himself rush for the exits. We live in dangerous times.

Great round up ilargi. I thought of you when I caught Mish's piece "made in Canada".

The Ellsberg speach is important and I recommend it to all.

thanks

I agree regarding the Ellsberg speech. You don't have to read very much between the lines to conclude that he regards an attack on Iran and another 9/11 event to have the same genesis, i.e. promulgated/caused by/allowed by the U.S. executive branch. I also think he is spot-on with regard to the Democratic party being so focused on political gains that they fail to notice the Constitution they were sworn to uphold being dismantled bit by bit in front of their eyes.

Looks interesting out there today, noticed that gold had spiked sharply to about 744 up aprox 10$ , looked at the DOW and it was rapidly heading south because of oil price rises and that old standby culprit, profit taking;)

When reading that news at Yahoo I noticed this comment in a minyanville article,

http://www.minyanville.com/articles/1929-crash-Great+Depression-1987-Ben...

-------

This should stir things up a bit. Is is the securities commission that has to assure transparency or is that some delusion I have?

http://globaleconomicanalysis.blogspot.com/

------

From this article above: Stalemate threatens Montreal rescue plan for ABC

What would the govt need to do here? Pass the hat?

Amazingly, there was a turn around late in the day. The DOW only down 17.31; WTI, Brent, and Gasoline plunged from their highs.

So what is today? The last day of the 3rd QTR. This is called "shoring" things up to make a play for the 4th QTR which starts on Monday. Got to end on as positive a note as possible or the top retail season is sunk.

Do I hear any doubters?

Funny when the bloodsucking beggars want foreign aid in Euros.

There shouldn't be one cent of foreign aid to anyone.

[a communique from Israeli foreign minister Tzipi Levni which requests that all foreign aid payments and loans from the United States be made in Euros rather than in Dollars]

That has to be the most impressive act of ingratitude I have ever seen. I think it might strengthen the dollar to cut out a few billion in aid, and I can think of a place we can make such a cut.

On the site the link above references (http://www.wakeupfromyourslumber.com) the story is tagged as a satire. It seems to have fooled a lot of the commenters.

The site is dedicated to anti-zionist commentary.

I have flagged it as satire above in order to remove the confusion.

Two weeks ago, Greenspan said: "I really didn't get it until very late in 2005 and 2006."

Now he admits he did know, but attempts to claim that hedge funds are more powerful than the Federal Reserve or the Bank of England, which have no control over 'real' interest rates?! Huh?

Lots of good articles! Thanks for posting them.

In spite of all of these problems (plus high oil prices), the stock market remains at a high level. I presume that a lot of our overseas spending is still getting recycled into the stock market, helping to keep the level up.

I wonder what the new quarter will bring. A person would think that eventually banks and hedge funds would need to start using more realistic valuations of their assets--causing more problems to come to light.

The stock market remains high, the Dow is even approaching 14000 again (?!) after all the noise, because there very simply is so much "money" around, and it has to go somewhere. Since many investors get out of other investments these days, it's surprising somehow that the market isn't even higher.

Also, there are tons of people left who either think the troubles are a passing fad, or who are too addicted to making more money to stop. This will only stop when investors leave en masse, and sudden, it would seem, as in an old-fashioned crash. It's almost October? Interesting.

But that still leaves the fact that all that money has been borrowed, and mostly highly leveraged. Gambling with other people's money, nice job. You have to wonder how much longer the hedgers can keep finding their credit drug. These guys are in so deep that they die when they stand still, they have to keep moving, like sharks. A hedge fund that doesn't grow enough stands to lose all it has, and that can go very fast. Barings lost $1.4 billion in a day, Amaranth $6 billion.

The non-bank ABCP problems in Canada could very well be a good example of what's in store all over the world. There were no buyers left, so the whole $40 billion of it was frozen. And that is where eventually the real value will be revealed. The comments on that, both from the commission and from other sources, don't stem very hopeful.

And how could they be worth much of anything? If they were valuable, these problems wouldn't exist in the first place. There's a pension fund out there, Québec's Caisse, that owns $20 billion of it. You bet that they own other commercial paper as well, both Canada bank ABCP and non-domestic paper. It's impossible to say how deep they are in, but a handful big boys there are sweating through life these days, praying that they don't have to reveal their other paper, and have that rated as well.

There are lots of funds and banks that have leveraged much of what they have 10-20 times. And down the line that might mean that losing 10% equals losing everything, while good assets get sold to cover the losses on bad ones, trying to halt the inevitable. The world economy of the past 10 years has been a true Ponzi scheme, and those can end only one way. In the meantime, the more central banks and governments interfere in the process, the more value each monetary unit loses. Can't win.

The ABCP story has revealed one thing already: lots of major private companies have parked cash in that paper as well, probably borrowed money to buy more. Air Transat and Canada Post have admitted they own dozens of millions worth, and rest assured, there's many others.

This can completely wreck entire national economies. There's some $500 trillion in derivatives out there. Say 2,5% of it is in Canadian hands, that'd be about equal to Canada's share of annual world GDP. 2,5% of $500 trillion is $12.5 trillion. If the value drops by just 10%, you'd lose Canada's entire GDP for a year. It would be like the US losing $12 trillion. Over a mere 10% loss of value in commercial paper.

It may already have happened, but the stuff is still in the vaults. What has surfaced, like in the Bear Stearns funds, lost over 90%. Get the picture? To quote Mish:

One financial column I read has postulated that the DOW is going up in lockstep with the dollar going down. In other words, the DOW is being repriced in increasingly worthless dollars. To validate this, he has looked at the DOW in Euros, and in the recent price movements of the DOW, the dollar, oil, and gold. While it is not a perfect fit, it is an interesting theory and may account for at least some of the climb in value of the DOW.

Of course, thus far we are not seeing deflation play out at all. This is primarily inflationary action thus far which makes an increasing DOW make sense (in ever cheaper dollars). The liquidity actions, the bailouts, and the monetization of mortgage debt all strongly suggest inflation thus far and the market is reacting exactly as if that is what is happening. In discussions with my father-in-law, he pointed out that the Fed surely knows exactly what they are doing and that the market wants to contract to flush out the bad paper. He pointed out that the Fed is basically just trying to stretch out the collapse over a long period so it is not sudden and excessively disruptive. He is also unsure whether they can pull this off and he too fears a deflationary followup but he grew up in the deflationary environment of the Great Depression and so has memories that color his perspective. But so far, despite my disagreements with him, Don Sailorman's inflationary mechanic seems to be winning out.

What we are undergoing right now bears an uncanny resemblance to the Itulip.com "Ka-Poom" Theory. I strongly recommend reading that document as ITulip.com called both the dot-com bust and the mortgage bust years in advance of each. The Ka-Poom theory still does leave us with a wrecked economy at the end of the process. It's just that how we get there is different than expected. I have made the observation that the Fed is "fighting the last war", Maginot Line style, and will be ultimately surprised by what transpires. The recent words of Greenspan reinforce that, expressing some surprise at exactly how things are playing out. Perhaps we will all be surprised at the road taken though not at the final chaos.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

You need to take a better look, and not be fooled by what seems to be happening. Our entire society is based on make-believe.

Where do you see inflation?

The US dollar, and with it the value of all domestic assets held by Americans, has taken a pretty brutal beating from the Fed rate cut. How that is inflationary, I don't know.

Yes, some commodities go up, and stocks do too. That's just money shifting from one thing to another: the lucky few who did get their cash out of commercial paper could explain all of it. Canada has $40 billion worth of not-so-lucky.

Oil went up? Gold? Simply look at it from a Euro or $Can point of view, and it looks very different. There's a small increase, explained simply by capital flight out of USD-denominated assets. As I said, it's amazing the Dow isn't higher. That indicates a filght out of the entire US economy.

When food prices rise, as they have and will far more soon, is that inflation? No, it's not, at least not in this case. There is simply less food available. Ethanol, drought, for a number of reasons we see scarcity occurring. Nothing to do with inflation.

Inflation reflects an increase in money supply. As Mish has repeatedly stated the past weeks, the increase in M', his own standard, or even M3, has not been that large lately, maybe 2%. But even if it had, the points I made in the post you comment on have only one possible outcome. Money is vanishing back into the nowhere it came from.

When this unwinding mechanism inevitably accelerates, there's no way central banks can print enough new supply. The Fed cannot print $12 trillion of new anything within a year. But, assuming Americans hold a share of ABCP, CDO's etc, proportional to their share of world GDP, that is what the US will lose when credit instruments lose just 10$ of their value. And a 10% loss is a ridiculously low loss estimate.

If there's a Fed toothlessness it's due to the fact that these same central banks didn't originate all the credit in the first place. The Canadian problem is in non-bank ABCP. That paper got issued by my pet hamster on the back of the promise that whatever it was leveraged on (a mortgaged cage), would continue to rise in value. And investors believed my hamster. That's all it takes

That, also, is Pure Ponzi. It now has ceased to rise, and there is no conceivable way left that the process can be recharged, not for real. The losses are too formidable for any central bank to balance. There's just too many hamsters in the world.

We've seen, this summer, the Fed and ECB throw over half a $trillion dollars at the wolves. It has served as a temporary sedative, but no cure has been provided. There is no cure, the disease will have to work itself out of the system, and leave it dead or alive.

The heavily inflated money, or credit, supply, of the past decade will need to contract. We have been fooled by the Fed's manipulation of the interest rates, which has hidden the true inflation that would without interference show up when so much extra dough is put on the table.

There lies the crux: there will not be -additional- inflation, it's already passed, unnoticed. Now all that la-la money-credit-debt will go back to la-la-land, and we will have deflation, if not the total collapse of national economies.

As I said, Canada Post, Air Transat and many others are drowning in the frozen debt paper on their balances. That's where we move from abstract to practical: a society that loses its postal services, airlines, and who knows what else. No laughing matter. Imagine taking 100 of these firms out of your society.

And why would anyone believe Greenspan is surprised at what happens? He's seen the numbers on his desk every morning for years, he had a better view than anyone else. Saying that you think he is surprised is the same as calling him a demented drooling imbecile. He's not. Yet. The Fed isn't trying to save the US economy, they're gutting it.

Whoa, Ilargi! That is inflation - more dollars chasing the same goods so prices rise to compensate. But when we look at another currency (the euro) we find prices have not risen much at all in comparison. So that fall of the dollar is inflation - each dollar is worth less. In a deflationary situation, there are fewer dollars chasing the same goods so each dollar is worth more and prices drop. Your point, that the money being thrown at the problem is disappearing, is not one I would dispute but for the moment, the Fed has managed to inflate sufficiently (thrown open the liquidity gates) to avoid a collapse. Secondly, you cannot say the dollar is crashing (meaning it is losing value and thus takes more dollars to buy goods) and then turn around and claim that all commodity price increases are independent of this. The truth is that both factors are at work. Food production is down but it's not down by the 20-30% that some prices have shot up. Oil production is down but as even you note, it's price has not risen by the same percentage in Euros. If it was strictly geology, then the price rise would be just about universal. Instead, part of the price increase is geology but part is the cheaper, falling dollar.

Now, in my opinion, they cannot do this forever so the longer they have to do this, the more likely it is that they will crash. Go to the Federal Reserve Bank of New York's Temporary Open Market Operations Historical Search page and pull up all the transactions since the beginning of August this year. Please observe the injections of cash that the Fed has been throwing at the market. Of particular note, to me at least, are the regular Thursday massive injections. For the last 5 consecutive Thursdays, the Fed has injected extraordinarily large sums into the market compared to their normal mode of operation. Each Thursday has given the market a small "bounce" but for each successive Thursday it appears that the bounce grows weaker and weaker. You might also look at the total amount of money loaned out by the Fed since August 1. These are digi-dollars and don't directly show up in M1 as I understand it. (This is also why so many people follow the reconstructed M3 numbers.) I, for one, am going to closely watch this coming Thursday's Fed injection and see how the market reacts. If we get a flat or declining market on a large Fed injection (more than $20 billion), then we may be very close to where the Fed's "pushing on a string" strategy runs out of steam.

Now please note that I fully qualified what I said before. I said "But so far, despite my disagreements with him, Don Sailorman's inflationary mechanic seems to be winning out." That's so far but it doesn't mean it must stay that way. Further, as I have said elsewhere, I am not convinced that this financial implosion is going to be like the Great Depression. No two financial collapses are identical though they may share a number of features. This one is likely to surprise us as well. That doesn't mean there won't be a collapse, just that the exact nature and timing of the collapse is very likely to be unique compared to other financial collapses.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Buy as much physical gold and silver as you can, your cash and other paper securities are worthless, the majority of the people out there just don’t know it yet, but now you do!and so does your central banker...