The Finance Round-Up: November 23rd 2007

Posted by ilargi on November 24, 2007 - 11:00am in The Oil Drum: Canada

People increasingly ask us what they should do in face of the financial quicksand we’re in. Unfortunately, as with all of today’s global riddles, there are no easy answers. The views we quote here vary from inflation to deflation, from buying gold to buying goats. The writers we link to often make their living tracking markets, and still there is nothing remotely resembling consensus.

I think it’s best to focus on what we can foresee with a reasonable degree of certainty, and take it from there. Don’t buy real estate with a mortgage is a good one (unless you plan to sell next week). Get out of debt as much as you can is good. Prepare to lose your job, be as ready as you can in case you do. Learn practical skills, grow food, get closer to your neighbors and family.

Above all, don’t be alone, have people around you to share with, both the gains and the losses. Man is a social animal. Get less stuff and more connections. Be human. A man, a woman, and two kids is not a family, in most parts of the world, and for good reasons.

And get informed, make up your own mind, don’t let others do it for you. Stoneleigh and I do the Finance Round-Ups as a news compilation, not an opinion soap-box. They’re here so you don’t have to read 1001 sources, we do that, and try to choose the best. But even we don’t agree on everything, it’s a dialogue, always. And that’s probably what it needs to be, between all of us, perhaps that’s the biggest gain any of us get from this.

Our mass media, in finance as in energy matters, can no longer be trusted to provide adequate information. TV and newspaper coverage borders on criminal negligence. So we use the Web to learn. We read 10 articles on a topic, not just one. We don’t trust that single one, and we are by no means alone in that. That’s why you are here, too, a gnawing feeling that things, as they are presented in media, politics, high-schools and universities, don’t add up. If they did, there would be no reason for an Oil Drum, or a Finance Round-Up.

Want an opinion after all? Here goes: We don’t see how this finance pyramid can be left upright for much longer. We realize there’s players out there with plenty of clout to squeeze some more out of it. Still, it’s an ex-pyramid. It’s not just sleeping. It’s a goner.

Keyword until New Year’s: Freeze. ABCP in Canada, covered bonds in Europe, teaser rates in California, bank loans in China, they’re all as frozen as the turkey.

And, happy Black Friday to you too.

All of a sudden, it just fell off a cliff

Redfern at Thomason Autogroup said he expects sales to continue slipping for the next six to eight months. But, like many area businesspeople, he's convinced Fairfield will pull through tough times and that its long-term prospects are bright.

"You would think there would be more depression and despair," he said, noting that his own house has lost about $140,000 in appraised value in a year. "But in this market here, there's still some strange optimism. People haven't thrown in the towel. ... People are still moving into this market. We remain optimistic."

Mish says: We cannot possibly bottom as long as people remain optimistic. A necessary but not sufficient ingredient of a lasting bottom is despair.

My advice over the last two years has not changed. Raise cash, be prepared for a layoff, and cut back on needless purchases. Unemployment has bottomed with only one way to go and that way is up. Be prepared for it.

Forecast: U.S. dollar could plunge 90 percent

A financial crisis will likely send the U.S. dollar into a free fall of as much as 90 percent and gold soaring to $2,000 an ounce, a trends researcher said. "We are going to see economic times the likes of which no living person has seen," Trends Research Institute Director Gerald Celente said, forecasting a "Panic of 2008." "The bigger they are, the harder they'll fall," he said in an interview with New York's Hudson Valley Business Journal.

Celente -- who forecast the subprime mortgage financial crisis and the dollar's decline a year ago and gold's current rise in May -- told the newspaper the subprime mortgage meltdown was just the first "small, high-risk segment of the market" to collapse. Derivative dealers, hedge funds, buyout firms and other market players will also unravel, he said.

Massive corporate losses, such as those recently posted by Citigroup Inc. and General Motors Corp., will also be fairly common "for some time to come," he said. He said he would not "be surprised if giants tumble to their deaths," Celente said. The Panic of 2008 will lead to a lower U.S. standard of living, he said.

A result will be a drop in holiday spending a year from now, followed by a permanent end of the "retail holiday frenzy" that has driven the U.S. economy since the 1940s, he said.

Shiller: Global crash imminent

A sharp downward correction is due in the global markets as real estate, stocks and energy soar to record highs, warned a leading expert on the opening day at this year's Dubai International Financial Centre (DIFC) Week.

Even as emerging markets like China, India and Brazil careen ahead at voracious growth rates, the speculative "bubbles" arising in the markets could cause a major global recession, cautioned Robert Shiller, the Stanley B. Resor Professor of Economics at Yale University, at yesterday's event.

"Perhaps we have gotten a little too confident in the global economic growth," said Shiller. "The problem is high oil, stock and real estate prices. I believe that a substantial part is speculative bubble thinking. We have gotten too confident of the prices in these markets," he said.

Credit "heart attack" engulfs China and Korea

The global credit crisis has hit Asia with a vengeance for the first time, triggering a massive flight to safety as investors across the region pull out of risky assets. Yields on three-month deposits in China and Korea have plummeted to near 1pc in a spectacular fall over recent days, caused by panic withdrawls from money market funds and credit derivatives.

"This is a severe warning sign," said Hans Redeker, currency chief at BNP Paribas. "Asia ignored the credit crunch in August but now we're seeing the poison beginning to paralyse the whole global economy," he said.

Mr Redeker said the flight from risk has led to a sudden unwinding of the $1,200bn yen "carry trade" as hedge funds and Japanese investors close risky positions. The yen has snapped back violently from yen118 to yen108 against the dollar since early October, with similar moves against other Anglo-Saxon currencies.

"We're seeing a liquidation of the carry trade. For years it created liquidity for global equities in an upward spiral, but this has now turned into a downward spiral. Base metal prices are falling, which that tells us that Asia may not be as strong as we thought," he said.

Jerry Lou, China analyst for Morgan Stanley, said the Shanghai bourse -- already down 15pc -- was now the world's "biggest valuation bubble". "Lessons from Japan in the late 1980s show that once the stock market starts to head down, earnings and multiple contraction can together crush the market like a market rolling downhill," he said.

Lombard Street Research: credit crunch grinding ever finer

The opaque black hole of losses at the heart of the dollar markets can not be penetrated by the outsider’s gaze, but the signs are that conditions are worsening fast. While the publicly quoted financial institutions have gone quite a long way down the road of acknowledging mortgage derivative losses, not a squeak has been heard from hedge funds, though they have massive exposure.

Hedge fund investors know that the devil will take the hindermost: to the extent they can cash out before the hedge funds have disclosed their losses on CDOs, etc., they may escape their share of them – leaving their share of the losses to the guys left holding the baby. Meanwhile, hedge funds are no doubt sliding out of as much exposure as possible – and selling anything else they can get value for.

The most toxic of the BBB-minus abx indices was 07-1 (with prices from January) and that is now off more than 80%; at which level it seems to have settled for the past two weeks, after a rocky early October in which it fell by a third. The AA 07-2 issue (starting July) also fell by a third during that period, from 90 to 60, but has carried on down by another third to below 40 now. As this started life after the late-June Bear Stearns fiasco, for supposedly AA prices to take such a beating is extraordinary.

Are we heading into 1982 – the worst recession since the war – or the revivalist, highly leveraged boom-bust of 1988- 91?

The deflationary alternative looks more probable.

Europe Suspends Mortgage Bond Trading Between Banks

European banks agreed to suspend trading in the $2.8 trillion market for mortgage debt known as covered bonds to halt a slump that has closed the region's main source of financing for home lenders.

The European Covered Bond Council, an industry group that represents securities firms and borrowers, recommended banks withdraw from trades for the first time in its three-year history until Nov. 26. Banks are still obliged to provide prices to investors, according to the statement today.

Banks including Barclays Capital, HSBC Holdings Plc and UniCredit SpA took the step as investors shun bank debt on concern lenders face more mortgage-related losses than the $50 billion disclosed. Abbey National Plc, the U.K. lender owned by Banco Santander SA, became the third financial company to cancel a sale of covered bonds in a week as investors demanded banks pay the highest interest premiums on covered bonds in five years.

"We are in a deteriorating situation,'' Patrick Amat, chairman of the Brussels-based ECBC and chief financial officer of mortgage lender Credit Immobilier de France, said in a telephone interview. "A single sale can be like a hot potato. If repeated, this can lead to an unacceptable spread widening and you end up with an absurd situation.''

Mish:

Renewed credit turmoil and volatility led the European Covered Bond Council (ECBC) on Wednesday to suspend inter-bank market-making in covered bonds until Monday, Nov. 26. The move is a sign of the stress in the covered bond market, which is dominated by German institutions that have almost a trillion euros of covered bonds outstanding.This is a very serious step. No, it's not priced in.

"Quite a substantial part of the recent spread widening, particularly in the last three to four days, was driven by the mechanics of the inter-dealer market making obligation," he said. "There is even some evidence that those bonds that are of high liquidity have been more heavily penalised than those which are less liquid."

Penalized is not the right word for it. Institutions are short on cash. The only way to raise cash is to sell something that has value. Perhaps what is not selling simply has little value.

"Covered bonds are securities backed by mortgages or loans to public sector institutions. The notes offer more protection to bondholders than asset-backed debt because the issuing bank is liable for repayments. They typically have the highest credit ratings."

$2 trillion lending crunch seen

The mortgage wipeout could result in a $2 trillion cutback in lending and have dramatic implications for the U.S. economy, according to Wall Street investment bank Goldman Sachs.

The housing slump is expected to end up costing banks, hedge funds and other lenders an estimated $400 billion as defaults on home loans rise, according to Goldman economist Jan Hatzius. A $400 billion loss is equal to just about 2.5 percent of U.S. stock market capitalization - or a bad day on Wall Street, he wrote in a commentary on Thursday.

But most stock investors don't react aggressively to capital losses the way banks and other lenders do. A bank that aims to maintain a capital ratio of 10 percent would need to shrink its balance sheet by $10 for every $1 in credit losses, the note said.

That means that if lenders end up suffering just half of the $400 billion in potential credit losses, they could be forced to reduce the amount they loan by $2 trillion. Such a drastic credit crunch could have dire consequences for the economy.

Public School Funds Hit by SIV Debts Hidden in Investment Pools

When the subprime debt market blew up in August, investors stopped buying SIV commercial paper. As a result, in September and October, SIVs didn't have the cash to pay debt holders of more than $8 billion of their paper.

The banks had also peddled SIV paper to their clients, including state officials who oversee pools of taxpayer funds like Florida's. The $27 billion Florida pool, the largest in the U.S., has invested $2 billion in SIVs and other subprime-tainted debt, state records show. About $725 million of these holdings have already defaulted.

State pool losses may hit taxpayers in places like Jefferson County in the form of reduced services or higher taxes. Jefferson County's Wilson says he still trusts the Florida pool managers and will keep the school's money in the fund. ''I really hope this isn't any worse than we know today,'' he said after the Nov. 14 meeting. ''If something happened to that investment, our county would be devastated.''

State officials have no business putting taxpayer money into debt investments that have baffled even the most seasoned Wall Street executives, says Joseph Mason, finance professor at Drexel University in Philadelphia and a former economist at the U.S. Treasury Department.

''Municipalities shouldn't be playing like they're expert investors, squeezing the last penny out of SIVs,'' Mason says. ''They're making a giant jump into a new product area which has unknown, unforeseen risks.''

SIV Debts A Disaster For Public School Funds- Mish

The Asset Backed Commercial Paper parade just keeps on rolling as Public School Funds across the country are Hit by SIV Debts Hidden in Investment Pools.

Thousands of school, fire, water and other local districts across the U.S. keep their cash in state- and county-run pools. These public accounts, modeled after private money market funds, are supposed to invest in safe, liquid, short-term debt such as U.S. Treasuries and certificates of deposit.

The people managing those pools absolutely had no idea what they were buying. No doubt they all thought they were geniuses too even as every single one of the blindly bought anything top top rated as if there was no risk to the extra yield they were receiving.

Norway: Townships caught up in international credit crisis

Several small townships in northern Norway went along with a securities firm's advice and invested as much as NOK 4 billion in complicated American commercial paper sold by Citibank. They now risk losing it all.

The township politicians are both embarrassed and angry at the financial advisers who they now claim led them astray. "They think we're a bunch of small-town fools," one local mayor told newspaper Dagens Næringsliv. The politicians remain ultimately reponsible, though, and voters aren't particularly happy as news emerges about what's become of a large chunk of their public funds.

Officials in four northern Norwegian townships (Narvik, Rana, Hemnes and Hattfjelldal) went along with an alleged recommendation by Terra Securities to invest a total of NOK 451 million in what they're now calling "high-risk structured products" offered by Citibank and sold for Citibank by Terra.

The American commercial paper was also tied to bonds issued by local governments in the US, and Norwegian Broadcasting (NRK) reported that hedge funds were involved. To boost returns, the Norwegian townships also borrowed NOK 3.5 billion to invest in Citibank's products, which later lost as much as 50 percent of their value because of the US credit crunch.

News started leaking out about the troubled investments when the townships were ordered to pay in millions more, to satisfy guarantee requirements. Mayor Asgeir Almås in Hattfjelldal feels cheated.

New era of defaults on horizon as CDO cuts mount

A wave of recent ratings cuts may mark the start of nearly half a trillion dollars in losses for banks and pension funds , as complex securities bring the U.S. subprime mortgage crisis crashing back to Wall Street.

Derivatives once heralded for spreading risk and underpinning the resilience of financial institutions are rapidly deteriorating, threatening to choke lending and driving up the risk of a U.S. recession.

The latest concerns come from collateralized debt obligations, essentially giant bonds that can be backed by subprime mortgages, which are now seeing a trickle of technical defaults.

In the past two weeks ago, more than a dozen such CDOs have suffered a technical default, triggered when the underlying collateral pool falls below a certain ratio, according rating agencies. Now there's increasing worry that default notices may lead to liquidations, pushing down prices of underlying assets and unleashing a cascade of losses.

The figures alone are staggering, and increasingly hard to track. Losses to banks and investors from the subprime mortgage crisis may rise to $480 billion in coming years from souring mortgages, according to UBS AG.

Shadow Mortgage Bailout Already in Progress

Securities were key sources of money during the housing boom. Now that investors have stopped buying, many institutions have been forced to seek out alternative sources of mortgage funding. A number of banks have turned to the Federal Home Loan Bank (FHLB) system. The 12 FHLBs are cooperatives first created during the Great Depression to boost mortgage lending and revive the struggling housing market.

In August and September, lenders borrowed an unprecedented amount of money. During September alone, loans made to banks from the FHLB system increased nearly 30 percent since the beginning of this year. In order to meet the demand from lenders who were teetering on the edge of financial ruin, the FHLBs sold $143 million worth of short term debt, pushing outstanding debt up to $1.15 trillion--half of which comes due before the end of 2008.

The concern is that the FHLBs are taking on too much debt in their attempt to bail out lenders. If investors lose confidence and begin to get rid of FHLB debt (in the same way they dumped mortgage securities), one or more banks could collapse and leave taxpayers with the financial burden.

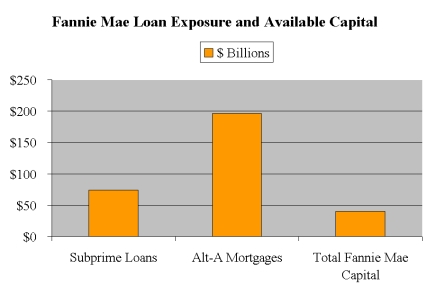

As of September 30, Fannie Mae had $40 billion in capital. The company also had exposure to $196 billion in Alt-A loans and $74 billion in subprime loans (loans with a FICO score under 620). Altogether, Fannie holds $2.7 trillion worth of mortgages. If a high percentage of the risky loans go bad - and there is no reason to think they won't - Fannie Mae could quickly lose the capital they have and be left without a financial leg to stand on.

Although neither Fannie Mae nor Freddie Mac are technically government agencies, it is a given that the government (i.e. taxpayers) would bail out both companies out if necessary. The potential cost could range into the hundreds of billions of dollars according to a recent Senate report.

Central banks weigh up dollar problem

The sliding dollar has presented custodians of the world's massive foreign exchange reserves with a conundrum.

Countries such as China and those in the Gulf, which peg their currencies to the dollar, risk inflationary pressure that has the potential to trigger serious economic and social problems. But any move to cut their links to the dollar could spark a run on the currency that would undermine the value of their reserves.

Global currency reserves have soared from $2,000bn in the second quarter of 2002 to $5,700bn (€3,885bn, £2,780bn) in the corresponding period this year, according to the International Monetary Fund. Furthermore, two-thirds of the world's reserves are in the hands of six countries: China, Japan, Taiwan, South Korea, Russia and Singapore.

But China tops the league, with the latest official figures showing the value of its reserves at $1,443.6bn in July. Many of China's trading partners argue that this stockpile - which grew at $40bn-$50bn a month in the first half of the year - has been caused by what they believe to be an undervalued renminbi.

Most analysts say that the country's reserves have accumulated rapidly since July and that this explains the growing concern about the dollar expressed by Chinese officials.

Dollar to fade, not fly, from scene as Gulf reforms

While it should be no surprise that the curtain is coming down on U.S. currency's reign over Gulf economies and investments, that is a long-term shift linked more to the rise of Asia than the diminishing stature of the United States.

The Kuwait Investment Authority, which said it had at least $213 billion in assets on March 31, decided in 2005 to double its allocation for Asia to 20 percent of its portfolio. The $650 billion Abu Dhabi Investment Authority is seeking to invest more in emerging markets to get higher returns than from its European and U.S. assets, according to HSBC.

Qatar's $60 billion sovereign wealth fund, the Qatar Investment Authority, has cut its exposure to the dollar by more than half to around 40 percent of its portfolio. Qatar says it wants to invest in the customers of its energy exports.

"The U.S. is still the largest consumer of oil but the relative importance of the U.S. is declining because China and other emerging countries are creating new demand," said Giyas Gokkent, head of research at National Bank of Abu Dhabi.

"Eventually the status of the U.S. dollar as a reserve currency will be called into question."

Fear of more huge losses hits markets

Fears that Citigroup and UBS will have to make writedowns of billions of pounds and a credit crunch-related hit from Swiss Re, the world's largest reinsurer, of $1.1bn (£524m) pushed the Dow Jones industrial average down 218 points.

In London fears of contagion pushed the FTSE 100 back below the level it began the year, down 170.4 points to 6120.8. The FTSE 250 slumped 361.7 points to a 12-month low of 10404. European markets also fell, with the DAX in Germany and the CAC index in France down 100 and 91 points respectively.

Citigroup fell more than 5pc on Wall Street after a Goldman Sachs analyst estimated the investment bank will make a $15bn (£7.3bn) writedown and the research firm CreditSights said UBS could take a further $9bn in writedowns. The heads of Germany's biggest banks, Deutsche Bank and Commerzbank, added to the gloomy sentiment with warnings that the US sub-prime crisis was far from over.

General Motors was the biggest faller on the Dow Jones index, shedding 6.7pc to an 18-month low of $27.32, over concerns about credit issues at its financing arm, GMAC.

17 reasons America needs a recession

To begin with, recession may be an understatement. Jeremy Grantham's GMO firm manages $150 billion. In his midyear report before the credit crisis hit he predicted: "In 5 years I expect that at least one major 'bank' (broadly defined) will have failed and that up to half the hedge funds and a substantial percentage of the private-equity firms in existence today will have simply ceased to exist." He was "watching a very slow motion train wreck." By October, it was accelerating: "Train hits end of track at full speed."

Also back in August, The Economist took a hard look at the then emerging subprime/credit crisis: "The policy dilemma facing the Fed may not be a choice of recession or no recession. It may be between a mild recession now, and a nastier one later."

However, the publication did admit that "even if a recession were in America's long-term economic interest, it would be political suicide" for Fed Chairman Ben Bernanke and Treasury Secretary Henry Paulson to suggest it. Then The Economist posed the big question: Yes, "central banks must stop recessions from turning into deep depressions. But it may be wrong to prevent them altogether."

Wrong to prevent a recession? Why? Because recessions are a natural and necessary part of the business cycle. Remember legendary economist Joseph Schumpeter, champion of innovation and entrepreneurship? Economists love Schumpeter's "creative destruction:" Obsolete firms get destroyed and capital released, making way for new technologies, new businesses, like Google. And yet, nobody's willing to apply Schumpeter's theory to the entire economy ... and admit recessions are a natural part of the business cycle.

iTulip comments on 17 reasons America needs a recession

8/ Force the energy and auto industries to get serious about emission standards and reducing oil dependency.

Recession will have the opposite result unless Farrell is expecting, as we are, that the dollar will fall even faster than oil demand. That means the U.S. may find itself with 2/3 of pre-recession oil import demand but each unit of demand will be inflated by another 50% reduction in the value of the monetary unit, the dollar.As energy prices rise and the energy purchasing power of income falls, cars will get a whole lot smaller. The same result is achieved in Europe via taxation; dollar depreciation acts as a politically expedient regressive domestic tax on energy consumption.

[..]

A major recession that follows on the heels of widespread financial system abuses, preferential taxation, and lack of enforcement of regulations inevitably causes the political system to gear up to throw the baby out with the bathwater.The U.S. economy has built up not only historic wealth inequality since 2001 but massive disparities of liquid net worth and debt. In a recession, these will create a political nightmare as unemployment rises and credit tightens. A recession will be bad for the rich and middle class, but will hammer the poor and push segments of the middle class into the ranks of the poor.

We've long expected a political reflex to these circumstances in our Ka-Poom Theory. If the U.S. ever gets a populist, socialistic president it will follow from of the kind of recession Farrell is hoping for.

[..]"Did you guys know, the bankrupcy laws changed? You cannot declare bankruptcy anymore. In the near future, we may have debtors prisons. When we have a war with Iran, Syria, Russia, and China, you know who will be recruited. They will give you a choice, pay off your debts or we will throw you in prison. If you don't want to go to jail, you join the military for 8 years."

British government bailout for Northern Rock may continue forever

British taxpayers face the prospect of propping up Northern Rock for months to come amid signs that the Government has caved in to pressure from the ailing mortgage bank and its advisers.

The Sunday Telegraph has learned that advisers to Alistair Darling, the Chancellor, are working on plans that would allow all or part of the L25 billion lifeline that has already been extended to Northern Rock by the Bank of England to continue indefinitely.

Although European Union rules block the bank from receiving state aid beyond February 17, lawyers are drafting documents that could change the status of the funding to "restructuring aid." This would allow the Bank of England to continue providing funding to Northern Rock -- and aid any takeover of the bank.

Darling is expected to lay out a "statement of principles" detailing the Government's views on the future of Northern Rock in the next 10 days.

Northern Rock has also been investigating the possibility of using loans from the European Central Bank to refinance its borrowings from the Bank of England -- a move which would be hugely embarassing to the Chancellor, who has already come under fire over his role in the crisis.

Libor soars as credit crunch returns

The credit crunch is returning in a virulent form to money markets, experts warned, after City banks raised their wholesale lending rates to the highest level in two months.

Morgan Stanley said that the recent jump in the benchmark London Interbank Offered Rate, which yesterday rose to just under 6.45pc, was not merely a seasonal blip but a major warning sign of pain ahead.

It came amid further jitters in the banking sector, where many smaller, more indebted banks are struggling to find lenders to keep them afloat.

Libor rates, which indicate how willing banks are to lend to each other, have risen sharply during the past week, after spending almost two months close to the 6.3pc level - a worrying sign since it was Libor's increase in August that signalled the initial impact of the credit crunch.

Goldman on Citi - SELL before the next $15bn hits

The golden child of the banking world has turned on the prodigal son.

Goldman Sachs - which will not, repeat not, be making significant write-downs - has had it with the cult of the disappearing dollars elsewhere on Wall Street. The bank’s analysts have slapped a sell order on Citigroup, downgraded their estimates, and lowered their target price to $33. US futures fell on the back of the note. Citi were down 2.6 per cent at $33.11 a share in premarket trading.

Citi’s down 40 per cent this year, and 28 per cent over the past three months, but the team at Goldman believe that the rudderless banking behemoth has further to fall.

We see four factors driving underperformance: (1) additional write-offs on its remaining $43 billion of CDO exposure, (2) pressure on the firm to shore up Tier-1 capital ratios which may need to come from an equity infusion, asset sales, or a reduction in the dividend, (3) deteriorating consumer credit trends and higher corresponding provisions and charge-offs, and (4) no clear leadership at the firm.

Goldman Sachs Rakes In Profit in Credit Crisis

For more than three months, as turmoil in the credit market has swept wildly through Wall Street, one mighty investment bank after another has been brought to its knees, leveled by multibillion-dollar blows to their bottom lines.

And then there is Goldman Sachs.

Rarely on Wall Street, where money travels in herds, has one firm gotten it so right when nearly everyone else was getting it so wrong. So far, three banking chief executives have been forced to resign after the debacle, and the pay for nearly all the survivors is expected to be cut deeply.

But for Goldman’s chief executive, Lloyd C. Blankfein, this is turning out to be a very good year. He will surely earn more than the $54.3 million he made last year. If he gets a 20 percent raise — in line with the growth of Goldman’s compensation pool — he will take home at least $65 million. Some expect his pay, which is directly tied to the firm’s performance, to climb as high as $75 million.

Goldman’s good fortune cannot be explained by luck alone. Late last year, as the markets roared along, David A. Viniar, Goldman’s chief financial officer, called a “mortgage risk" meeting in his meticulous 30th-floor office in Lower Manhattan.

At that point, the holdings of Goldman’s mortgage desk were down somewhat, but the notoriously nervous Mr. Viniar was worried about bigger problems. After reviewing the full portfolio with other executives, his message was clear: the bank should reduce its stockpile of mortgages and mortgage-related securities and buy expensive insurance as protection against further losses, a person briefed on the meeting said.

MBIA, Ambac shares sink on further write-down fears

The shares of MBIA and Ambac dropped on Monday amid concerns the two largest stand-alone bond insurers would have to write down assets further after Swiss Re, the world's biggest reinsurer, wrote down similar assets to zero.

MBIA Inc and Ambac Financial Group Inc have recorded considerably lower declines in the value of similar securities -- repackaged consumer debt known as collateralized debt obligations.

"Every time you get a write-down to a new level, people's concerns about the bond insurers' exposure get renewed," said Geoffrey Dunn, an analyst at Keefe, Bruyette & Woods in Hartford, which rates the bond insurers "outperform."

MBIA shares fell 7.3 percent to close at $34.49, while Ambac declined by 7 percent to $25.53 on the New York Stock Exchange. Swiss Re said it was writing down collateralized debt obligations supported by asset-backed securities to zero.

In contrast, MBIA said last month it recorded unrealized losses of $342 million on its synthetic collateralized debt obligations, or about a 1 percent write-down of its multi- sector CDOs.

$2 billion loss at Freddie Mac rattles housing industry

Turmoil in the U.S. housing sector reverberated across the industry Tuesday, reinforcing the mood among investors that the downturn has not yet reached bottom.

Freddie Mac, the big mortgage finance company, posted a $2 billion loss for the third quarter and warned that it might not have enough capital on hand to cover the mandatory reserves for its mortgage commitments. It had a $715 million loss a year earlier.

The company has been battered by a rising wave of foreclosures tied to subprime mortgage defaults and is now "seriously considering" cutting its stock dividend.

Freddie Mac's misfortune is particularly rattling because the company is considered to be protected by an implied government guarantee. There was no mention in Tuesday's earnings report about an infusion of government capital, though the company said that it would seek counsel from Goldman Sachs and Lehman Brothers for its short-term efforts to shore up its reserves.

Shares of the company had plummeted $12.37, or 33 percent, in afternoon trading Tuesday to $25.13, its lowest level in 11 years. Shares of its sister firm, Fannie Mae, had dropped $9.48, or 25 percent, at $28.10.

Freddie Mac's subprime losses may hit $5 billion

Freddie Mac may report a loss of between $1 billion to $5 billion on its subprime AAA portfolio, Credit Suisse said on Monday, sending shares in the second-largest U.S. mortgage finance company sharply lower.

"While Freddie's AAA subprime securities likely have substantial subordination, if the recent credit spread widening does not reverse over the coming quarters, we believe that Freddie could recognize an other-than-temporary impairment of between $1-5 billion," the brokerage said in a research note.

The losses may force Freddie to sell some of its portfolio holdings or raise capital by issuing preferred stock, the note added.

With a generalized credit crunch threatening, it's suddenly essential to search for signs of it in such arcana as interest rate spreads between risky and less risky securities. Trouble broke out in mid-August when investment banks began to report losses on mortgage-backed securities. The markets appeared to be healing in September and most of October, but they've abruptly worsened since.

Market insiders are alarmed by evidence that banks don't trust each other. The London interbank offered rate (Libor) for dollars, which is for short-term loans between big, healthy banks, usually perks along at less than one-tenth of a percent above the risk-free interest rate. But the gap widened abruptly to seven-tenths of a percent in mid-August and, after briefly narrowing, stands at around six-tenths, according to broker Tullett Prebon. Says Lena Komileva, Tullett Prebon's G7 market economist: "The crisis never went away. It just got concealed."

What's so scary about a credit crunch is that everyone—from banks to corporations to households— retrenches simultaneously, and an excess of caution kills growth. That hasn't happened yet, but there are hints we could be near a tipping point. The Federal Reserve reported on Nov. 5 that banks said they tightened lending standards in October, and equally unsettling, demand for loans from both business and consumers has decreased.

Chief financial officers' gloominess is the worst since surveying began during the 2001 recession, according to Duke University's Fuqua School of Business and CFO magazine. Pessimists outnumbered optimists by about 4 to 1 in September. And consumer spending, the longtime engine of U.S. economic growth, might be flattening. The Conference Board's index of consumer confidence dropped sharply from nearly 112 in July to less than 96 in October.

It's been a glorious run for the consumer. In the past 25 years, Americans have kept shopping through good times and bad. In every quarter except one since 1981, consumer spending rose over the previous year, adjusted for inflation. The exception was the first quarter of 1991, and even then the decrease was a mild 0.4% dip.

The main fuel for the spending was easy access to credit. Banks and other financial institutions were willing to lend households ever increasing amounts of money. Any particular individual might default, but in the aggregate, loans to consumers were viewed as low-risk and profitable.

The subprime crisis, however, marks the beginning of the end for the long consumer borrow-and-buy boom. The financial sector, wrestling with hundreds of billions in losses, can no longer treat consumers as a safe bet. Already, standards for real estate lending have been raised, including those for jumbo mortgages for high-end houses. Credit cards are still widely available, but it may only be a matter of time before issuers get tougher.

What comes next could be scary—the largest pullback in consumer spending in decades, perhaps as much as $200 billion to $300 billion, or 2%-3% of personal income. Reduced access to credit will combine with falling real estate values to hit poor and rich alike.

[..]

Not everyone thinks American shoppers are tapped out. Consumers have about $4 trillion in unused borrowing capacity on their credit cards, enough to keep spending afloat, points out Stuart A. Feldstein, president of SMR Research in Hackettstown, N.J., which studies consumer loan markets.Ilargi says: We find that last statement both mind-warping and re-assuring. Re-assuring, because it confirms that there is no longer a taboo in the US on admitting that there is no money left. The difference between the money you make and what you borrow has faded and gone. All you have to do to pretend you are a player is pay 15%+ in interest. Mind-warping, because, well, we know where this inevitably goes.

China voices alarm at dollar weakness

China on Monday expressed concern at the decline in the dollar, joining a growing chorus of global policymakers alarmed by the weakness in the world’s main reserve currency.

Wen Jiabao, the premier, told a business audience in Singapore it was becoming difficult to manage China’s $1,430bn foreign exchange reserves, saying their value was under unprecedented pressure. “We have never been experiencing such big pressure," Mr Wen said, according to Reuters. “We are worried about how to preserve the value of our reserves."

China keeps the currency composition of its reserves a state secret, but some analysts believe that more than two-thirds are probably still held in dollars.

The dollar has dropped 16 per cent this year against a basket of major currencies.

The alarm bells begin to ring in China

Who will buy all this stuff? Who will buy the plastic garden furniture, the fridges, the toys, the wall of household junk that is thundering out of shiny new factories in China?

Between January and October, China’s statistical bureau recorded $1.2 trillion (£580 billion) of industrial spending. During the same period, lenders in America were slamming the door on their customers, cancelling credit cards, demanding the keys to homes, apartments and trailers. The message from the banks is clear: the party is over. Still, China’s factory floorspace continues to grow. You have to ask the question: who will buy the stuff?

The Pollyanna economists think it is all different now, a view espoused by the World Bank in its most recent report on East Asian economic growth. China is creating its own demand, “decoupling" from the US economy, it says.

China Freezes Lending to Curb Investing Frenzy

Curbing lending by raising interest rates, as China already has done four times this year, would be more in keeping with Beijing's increasingly market-oriented approach to business. But the lending freeze shows how the slowing U.S. economy may be complicating Chinese policy making. Lower interest rates in the U.S. give Beijing less room to push up rates without creating a ripple effect.

By raising rates further China could risk boosting the value of its currency, the yuan, too much for the comfort of its exporters, a critical part of the Chinese economy. A stronger yuan would make Chinese exports less competitive in world markets.

Bankers say they will honor the lending edict, partly because it comes with threats of financial penalties for noncompliance. "Which commercial bank would dare not obey this?" says Liu Haibin, chairman of the supervisory committee of Shanghai Pudong Development Bank Co.

A Bank of China Ltd. official in Suzhou said over the weekend his branch is pushing big corporate loans into next year. An official of the same bank in central Henan province said the new measure in effect extends existing lending controls on property developers and power producers across the board to all banking clients. The measure could pose a particular challenge for the Chinese units of foreign banks, which have less flexibility than their larger local peers.

The fatal crash for Canadian ABCP investors came from an unexpected angle – the collapse in the U.S. housing market. Through a kind of financial alchemy, investors all around the globe owned chunks of the risk posed by foreclosures and defaults on U.S. subprime home loans to dodgy borrowers.

Banks that made the loans had packaged them into bonds, and some of the bonds were the basis of derivatives contracts like those used by the newest style of ABCP trusts.

As the housing bust made bigger and bigger headlines, Coventree's principals tried to head off any problem. The firm sent out a bulletin in mid-March and held investor meetings to explain that Coventree's trusts had just 7 per cent of their assets invested in subprime-related securities and derivatives.

The housing problem only got worse as summer began, and investors were getting increasingly jittery. Coventree made another attempt to head off a blowup. On July 24, Judi Dalton, a Coventree executive, sent a note to the banks that sold Coventree ABCP in order to update the market on the amount of subprime mortgages backing Coventree's $16-billion of trusts. The total: 4 per cent.

“At Coventree we are committed to furnishing our investors and dealer partners with the information they need to continue to support us through market cycles," Ms. Dalton wrote. “Many thanks for your continued support."

Instead of soothing nerves, the missive had the opposite effect. Nobody wanted to see any subprime at all. That wasn't the only problem. Some dealers felt they were in an awkward situation – Coventree had told them something that the world at large didn't know. Sources said at least two of the banks, RBC and Scotiabank, pushed to have the details made more widely known, perhaps via a press release.

When that didn't happen, RBC went further. On Friday, July 27, representatives of the bank, including RBC's head of fixed income and currencies for Canada, Peter Dymott, called David Allan to say the bank was giving Coventree the required 30 days' notice to resign as a seller of its paper.

National Bank to Take C$365 Million Debt Writedown

National Bank of Canada, the country's sixth-largest bank, plans to take a C$365 million ($374 million) writedown in the fourth quarter for its investments in Canadian asset-backed commercial paper.

The charge is about C$575 million pretax and before compensation adjustments, the Montreal-based lender said today in a statement. National Bank bought back C$2.1 billion of commercial paper in the quarter ended Oct. 31, mainly from its mutual fund clients.

National Bank's writedown is the largest for any Canadian bank, and is higher than the lender's net income last quarter. The other lenders, including Royal Bank of Canada, had combined writedowns of C$807 million on commercial paper and debt tied to the U.S. subprime mortgage market.

''It seems on the high side,'' said CIBC World Markets analyst Darko Mihelic, who expected a pretax charge of about C$300 million from National Bank. ''It either implies they're being conservative or they have a lot of really junky stuff, or a combo of the two.''

Canada's Dollar Falls as Dodge Raises Possibility of Rate Cuts

Canada's dollar fell to an almost six-week low after Bank of Canada Governor David Dodge said an interest rate cut is possible because of ''risks'' to economic growth.

Dodge said growing threats to the global economy and volatility in financial markets may affect the country's benchmark lending rates. Interest-rate futures suggest traders have increased bets the central bank will cut the borrowing cost from 4.5 percent early next year.

''The central bank has started to take note of the downside risk coming from the trade side,'' said David Watt, a senior currency strategist at RBC Capital Markets in Toronto. ''The days of easy gains in the Canadian dollar are gone.''

Canada's dollar weakened 1.1 percent to 98.43 cents per U.S. dollar in Toronto at 4:14 p.m. One Canadian dollar buys $1.0159. The Canadian dollar reached 98.88 Canadian cents per U.S. dollar on Nov. 16, its weakest since Oct. 9.

Canada's trade surplus narrowed more than forecast in September to a nine-year low, as the country's currency soared to parity with the U.S. dollar and hurt exports of machinery and industrial goods, a government report said on Nov. 9.

"Suppose you put US$500,000 into a money market account earning 4% a year back on November 7, 2002. Compounded daily, you'd have US$610,694.69 as of yesterday."

"But wait! Over that same five years, the dollar has lost another 28% of its purchasing power. So, what one dollar bought in 2002, will only buy US$0.72 worth of goods and services today."

"So that US$610,694.69 in savings that you accumulated and thought you protected so wisely in a money market fund? Well it will only purchase US$439,700 worth of goods and services - 28% less than you thought!"

It's a frightening Twilight Zone moment when you realize that you started with US$500,000 in buying power, and you ended up with, after waiting five long years, with only US$439,700 in buying power! That's US$60,300 LESS than what you started with!

And that is before you pay the capital gains/income taxes on the phantom "gains" on that additional US$110,694.69 in account value, turning your total real loss in buying power into a bigger, much bigger net loss! Hahahaha!

Mogambo sez: Everyone has lost their minds in their desperation to keep the markets up until at least December 31, so that taxes are fixed in amount, bonuses are paid, money is made, and end-of-year account statements do not tell a shocking tale of horrifying loss and financial terror to trusting investors.

Chrysler Loan Sale Likely Postponed

The most recent bout of credit-market turmoil will likely claim another victim.

The $4 billion sale of loans connected to Cerberus Capital’s August purchase of Chrysler that was to take place this week will likely be postponed, a person briefed on the matter tells Deal Journal. Orders for the paper were due today, and so far, demand has been sluggish. (The underwriters are J.P. Morgan Chase, Citigroup, Goldman Sachs Group, Morgan Stanley and Bear Stearns.)

This person cautions that a final decision won’t be made until Tuesday morning and that a small portion of the loan sale is a possibility this week. Still, even that is looking increasingly unlikely as the Thanksgiving holiday approaches.

How times have changed. The successful sale of $6 billion of loans tied to Chrysler’s finance arm in late July signaled that the high-yield market was on the mend after investor demand plummeted starting in June. Now the credit market has gone into reverse and the auto industry isn’t faring much better. Chrysler, for example, is grappling with tepid U.S. sales as the housing market sinks and fuel prices soar.

Chrysler’s woes are the latest setback for Cerberus, which went on a buying binge early in the year when the credit markets were booming. Now it faces a rough road at Chrysler and the GMAC auto-finance business it bought from General Motors last year, not to mention its effort to walk away from its pending buyout of United Rentals.

Auto sales could hit 15-year low

Three top investors in the automotive industry painted a grim picture on Sunday for the sector in 2008, with one executive predicting a possible slump in U.S. sales to levels not seen in 15 years.

The weakest forecast is for a possible 9.4 percent decline. But all three -- Jerry York, an adviser to billionaire investor Kirk Kerkorian; financier Wilbur Ross; and Thomas Stallkamp, a former Chrysler president -- were more pessimistic than many in the battered industry.

"While I am very negative on the autos sector over the next 12 to 18 months, I'm just not sure how bad it could be," York, a former board member of General Motors Corp and chief financial officer of Chrysler, said at the Reuters Autos Summit in Detroit. "We all know housing is a debacle."

U.S. light auto sales could slip to 15.5 million or less next year, York said. That would be down from near 16 million this year, a drop of 3 percent to mark the second consecutive annual decline and the lowest tally since 1998.

Alarm at rising US car loan defaults

US car loan delinquencies have climbed markedly, raising another potential red flag for financial institutions and the automotive industry.

“We are beginning to see deterioration in auto asset-backed securities (ABS) credit conditions," Lehman Brothers said in a report on Monday, drawing on data from two of the US’s biggest car finance companies – GMAC, 49 per cent owned by General Motors, and Ford Credit.

Delinquency rates on two GMAC ABS issues from this year reached about 0.75 per cent and 0.6 per cent in September and October, far above the rates on similar securities issued in earlier years.

Tom Webb, chief economist at Manheim Auctions, added that the number of repossessed vehicles at the company’s used-car auctions had risen, reflecting an uptick in delinquencies and a larger number of contracts.

In Europe, weak dollar wrecks Americans' dreams

Those who rely on dollars now need to keep a close eye on their wallets and are finding they might not be able to live so comfortably.

"My grants have basically been cut in half with the dollar-euro exchange rate," said assistant professor Mara Leichtman, who is renting a friend's apartment in Berlin -- and not shopping for clothes -- to cut down costs.

Adding to Americans' woes are laws passed last year which raised the amount some pay in U.S. tax. Monique Luegger, a Berlin-based tax adviser with American clients, said that while the new tax laws mainly affect those in the higher income bracket, the ailing dollar is hurting people who worked in the U.S. but chose to retire in Europe.

"The exchange rate is really hurting pensioners who are trying to live in Europe on a dollar income. Not a week goes by when someone asks me what they can do about the exchange rate. But of course there is nothing I can do."

Spectacular Trial' Is Seen in Case of Liberty Dollar

The monetary gadfly behind the Liberty Dollar, Bernard von NotHaus, declared over the weekend that he expects to be criminally charged over his currency and is vowing "a spectacular trial" that will "put this country's monetary system on trial."

Mr. von NotHaus was interviewed by The New York Sun via telephone on Saturday following disclosures that the Liberty Dollar, a gold- and silver-based currency marketed by anti-government activists as an alternative to the greenback, drew the federal government's scrutiny because the coins resembled official currency produced by the U.S. Mint.

After a two-year undercover investigation of the currency, federal agents last week raided the Idaho mint where the Liberty Dollar was produced and the Indiana offices that served as its marketing headquarters. Tens of thousands of gold, silver, and copper coins were seized, including a special edition bearing the image of a Republican presidential candidate, Rep. Ron Paul, a supporter of the gold standard. It is the standard edition of the Liberty Dollar, which features a profile of a crowned Lady Liberty as well as the lettering USA and "Trust In God," which federal authorities say is illegal.

Fed Forecasts Slower Growth and More Out of Work Next Year

The housing collapse and credit crisis will slow economic growth and nudge up unemployment next year, the Federal Reserve said Tuesday in a first-of-its-kind forecast that some economists believe will lead to interest rate cuts early in 2008.

Don't count on a cut in rates at the Fed's December meeting, however, analysts say. The Fed called its rate reduction in late October a "close call" and hinted that its two cuts this year may be sufficient to energize the economy, according to minutes of the Oct. 31 closed-door meeting made public Tuesday.

Policymakers raised concerns at that meeting that inflation might flare up again in the short term, especially in the face of rising energy prices. But with the Fed's longer-term forecast calling for moderating inflation next year and beyond, economists believe the central bank will have leeway to reduce rates next year.

Black Friday: why this one is especially dark

On Friday, millions of shoppers will descend on malls and box stores where the bells and whistles of credit card transactions will reverberate every few seconds, non-stop for perhaps seventy-two hours.

Those bills will come due for those shoppers in a post-holiday hangover of dollar plummeting hysteria, monumental levels of debt, foreclosure, bankruptcy, unemployment, energy depletion, skyrocketing gas and food prices, illnesses treated without health insurance coverage-or just not treated, unprecedented levels of homelessness, and by all indications, within a few months into 2008, America will be well on the road to a re-run of 1929-or something inconceivably worse.

I want to thank you both ilargi and Stoneleigh. Great job folks. The reason you are doing this IS justified. We ARE being Lied to.

I also read 10 articles on a subject just to make sure I got a better handle on it.

JOhn Carr

...I want to thank you both ilargi and Stoneleigh. Great job folks. The reason you are doing this IS justified...

Yes, I definitely agree. Excellant Roundup. Keep up the great work.

I too offer my sincere gratitude to ilargi and Stoneleigh, you have been very helpful in my economic education.

PLAN, PLANt, PLANet

Errol in Miami

Out here in the wildlands of Kentucky, we sometimes still trade furs down on the river banks, I want to applaud the efforts of the two mentioned above for bringing the news here to this poor farmboy.

I have a question which I will ask further down thread...

I was not out and about on Black Friday. So I can't tell what is happening here in the heartland of the US of A and so I have no clue as to what occurred? Did the many run out to buy the latest fads toys? Or did a lot stay home boiling down turnips outen the garden like I did and frying up corn pones and sipping Wild Turkey stead o eating it baked?

Hard to get a read out when one has no TV(thank goodness for that) so I hew onto the net for my news.

'Pears its always bad new on the Roundup.

Thanks for that anyway. Tell it like it is...is my motto.

Thanks again boyz,

airdale

This

You're welcome :)

(Although actually only one of the two of us is male.)

So, who is male and who is female?

It took me ages to realise Leanan was female ... 'though I don't know why ... most of the really efficient people I have come across are female!

Thanks to you all for your amazing efforts, it makes my daily education so much easier.

Xeroid.

Thanks for the kind words :)

I am female.

Well that makes sense.

"If you want to fix the budget, put a housewife with 3 kids in charge" CM

Great work-you are on my regular reading list.

D

Well, I went out because my mother did and she wanted some company. She was trying to get a laptop for herself for $300 from Circuit City. Big laugh, because even though we got there at 4:00AM, an hour before the store opened, we were #126 in line and they had 10 laptops (and seemingly everyone was there for them). Last year, apparently, there were only 15 or so people ahead of them in line. Most of the people in the front of the line got there between 1:00AM and 2:00AM, and the man in front got there at 9:30 the previous evening. It's getting absolutely insane, and I don't think anyone in my family is going to do it anymore.

Usually the specs on the deeply discounted laptops are very poor. You can get some of the best deals HERE all year long. Depending on where you live, no sales tax.

Good company, I buy computer components from them cheaper then from local wholesalers.

The Real News aka Independent World Television--

http://www.therealnews.com/web/index.php is a new news outlet.

I encourage readers of the Oil Drum to demand they cover the peak oil issue.

The musical version.

Following links, more fun:

http://versusplus.com./dollar.html

Thanks!

I really hesitate to ask this question, but here goes anyway:

If one buys gold to protect themselves against the dollar losing value and in fact the dollar does plummet and the banking “industry” collapses. What then. I have gold but don't know how to use it.

Suppose I wished to go to a local store to buy some items. What do I do? Take a lump of gold with me and have the shopkeeper chisel off a quantity to complete the exchange. How do we agree on how much gold is a fair price. How does the shopkeeper, or anyone for that matter, know that the gold is genuine?

I've traveled a lot and always had to exchange money whenever I arrived in the new location. At those times the exchange rate meant little to me since I was pretty flush and some level of control over how the money exchangers operated was probably in place. So I didn't worry too much about being fleeced.

It seems likely to me that should we enter into a really hectic time period that communications – internet, newspapers, Sirus radio, TV and the like will be interrupted too and if one is poorly informed they are at a disadvantage.

So for me, the advice to buy gold is only a partial answer. What do I do with it once I have it?

mOOse, in my case, I view gold as an inflation hedge for the dollar. In other other words, when the time comes I expect to exchange a Krand for 250,000 Zimbabwean (oops, I meant US) dollars and buy whatever it is I need to buy. Maybe I'm being unrealistic, but I no more expect to pay for purchases with chips of a Krand than I would with chips off one of my Certificates of Deposit.

That said, my safe deposit box is also burdened with circulated US 90% silver coins (so called "junk silver") just in case I need "small change".

PLAN, PLANt, PLANet

Errol in Miami

They were called 'bits', not 'chips', and in days past it was common practice to clip 'two bits worth' from a silver dollar or half dollar. Even bits from gold coins were clipped for larger purchases.

Remember the old school cheer, two bits, four bits, six bits, a dollar, all for _______ stand up and holler!

I think junk silver is a great store of wealth.

Thanks I and S for the great TOD financial roundup.

The "bit" comes from the Spanish "pieces of eight" - a Spanish dollar was cut into 8 pieces. A "bit" is an eighth of a dollar, so two bits is a quarter dollar.

delete. dup of pieces of eight.

In the past, gold has functioned as a store of value and as money. Currently it is not money, and will be money again over the dead bodies of the central banks. It has proven to be an excellent store of value though (up 30% this year alone).

At the moment, you can still sell your gold to coin and bullion dealers at market rates to get "money". It is likely that this will be made illegal at some point soon in an effort to force people to continue using fiat money.

If society breaks down, you may be able to barter your gold for stuff, but dont count on this. In a really severe situation, food, liquor and sigarettes will be of much higher value than gold. Better to have alternate plans for this situation.

Last time we had a financial crises (1933) holding gold for Americans was made illegal for almost 40 years. This may or may not happen again, but you have to be prepared to hold your gold for a very long time before reaping the benefits.

Bottom line: I recommend gold as a store of value for excess wealth after you have taken care of essentials. Do not count on it to be short term liquid in a severe economic or societal crises.

http://www.kitco.com/charts/popup/au1825nyb.html

Francois.

I would essentially agree with this. Gold isn't a hedge against the deflation I am expecting, but it is a long-term insurance policy against economic disruption for those who can afford it after the essentials are addressed. Of course all the practical difficulties mentioned elsewhere in this comment thread are very real and must be taken into consideration when making such decisions. I would think gold would make less sense in rural areas.

I concur with Francois and Stoneleigh. Do not view gold as something that saves you during a crash. View gold as a store of value that can be translated back into whatever the next currency might be after the crash. Do not view gold as an investment. It's not. It's a vessel intended to cross the financial abyss as one currency dies and eventually another currency takes its place. Before you worry about making that transition, you have to be able to make that transition and that takes other preparation. So look to the other issues first and only after you think you are going to make it through, then place some fraction of the remainder of your assets in precious metals.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

A nitpick I suppose but an asset that functions as a store of value during tumultuous times sounds exactly like an investment to me. I think what you intend to convey is that gold may not be a practical choice as a currency - and I agree with that wholeheartedly. It's volatile and subject to large premiums depending on how you buy and sell it. It's also subject to government intervention though I have a hard time believing they will make it illegal to own since it is NOT money. What next? Platinum? Rhodium? Silver? At the time of FDR gold was the basis of money. It remained the basis of money even after FDR made private ownership illegal. As soon as the gold standard was discarded gold again became legal to own. Another important point is that one could always buy and own gold jewelry even when gold coin was illegal.

I'm betting that I'll be able to buy as much or more with the proceeds of selling one ounce of gold five years from now than I can today. That's including the cost of the transaction. I strongly doubt a dollar five years from today will purchase as much of what we need for day to day living. Of course I'm probably dead wrong. Wouldn't be the first time.

Another attractive aspect of gold is that it is portable, venerable and universal. The old saw about it being no one's liability has some merit in that gold is a laissez faire value token. It came into use by consensus that it had the properties of a good money substance. Governments used gold as a basis for currency in order to convey legitimacy to their coinage and not the other way round.

Unless you use that gold to buy some jokers farm to grow rutabagas on and he goes off to the city with the gold to live high hog on the breadline. Large intended future purchases are where holding gold has value in uncertain times.

Ye olde english $ song.

Financial street musicians. Bearish.

How about Clean Tech?

http://versusplus.com./sanjose.html

Some of the political ones are also quite good.

If you like them, you like FIORE

Funny enough to make a conservative laugh.

TOD live v2.0??

Stoneleigh,

...but it is a long-term insurance policy against economic disruption for those who can afford it after the essentials are addressed.

This gold against the law, "confiscation" and such. I don't think it will mean much to average street/rural person.

Right now all drugs can be confiscated by the authorities. But inspite of being illegal, someone could find whatever they wanted easily. I agree with quarts of Liquear, cigerettes, ammo, and drugs will be things of barter.

Gold/Silver will be used whether the gov wants it or not.

In Zimbabwe today, is gold something good to have?

Yes, we may see deflation in many classes(and inflation in others), but, BUT BUT...

There are ONLY so many million oz's for sale at anyone time, what would happen if say, 300 million chinese suddenly decide that they should really at least own 1 oz of gold? Now throw in India and others, what if even a small percentage of the world's population suddenly (because of collapse) to just own ONE ounce of Gold and 10 of Silver?

Different ideas. Remember population sizes now when considering a panic situation.

I think the US will go into default with the $USD, Something like the AMERO will be proposed by the "World Community". Those new currencies WILL be transferable into gold.

Most people, especially rural people, will buy gold either over the internet, with a credit card, check or wire transfer.

They can be found with the click of a mouse if the government wants to.

"and will be money again over the dead bodies of the central banks. "

There is no guarantee over this, except financial speculation (hedge) based on cultoro-historical historicism.

Gold offers today no _true_ intrinsic value above it's industrial use.

Anything else is purely illusory, just as with fiat money.

Again, that illusion may turn out to be more longer lasting than that of toilet paper (USD), but illusion it is nevertheless.

BTW, this is not investment advice. Everybody does what they feel like it and I'm not saying I don't have gold :)

It's intrinsic value is in it's immutability and portability. Or we could collect cowrie shells I guess. Also glad to hear you might have gold ... where did you say you lived? Maybe I'll come up and see you some time bright eyes:)

SamuM, if you will bear with me thru a longish exposition, I will reveal why gold was desired across cultures and across centuries. The reason is seated in some of the deepest (and so least talked-about) motivations of humans.

H sapiens males tend to run contemporary society because they are risk takers in pursuit of dominance. They are competitive with other males, seeking to dominate them. This instinct was designed to allow the dominant males in a tribe to monopolize access to the most desireable females. In contemporary society this is somewhat abstracted and sublimated - channeled by advertisers into support for your sports team dominating a rival team, into accumulating way more money than you could ever spend, etc. Human males act just like Bower Birds; they strive to produce a nice nest (McMansion), clear the area around it (green, close cropped yard), adorn it with shiny trinkets (car, jet skis, etc), and ward away competing males with noise and symbolic violence (that noisy riding mower with that big, swinging....blade) in order to impress females with their reproductive fitness.

Throughout history, when other symbols of status in society are in turmoil or disrepute, nothing says status like gold crowns, chains of office, signet rings, symbolic maces, etc. Gold is soft enough to be easy worked into intricate designs, has a pleasing warm color, doesn't turn your skin green when you sweat, has a satisfying heft to it, and is so incorruptable and immutable that it shouts "permanance" when everything around them is turning to quicksand.

These qualities make gold adornments not just a nice conspicuous status symbol, but make fine gifts for the desireable females mentioned above. They just love how it looks against their tanned skin, and they love how jealous it makes other women.

None of the above is meant to be derogatory to men or women; we are just the products of a long process of selection - most of us are descended from dominant males and desireable females.

Sorry this was kind of long, but I don't have a sound byte to explain the ancient and enduring lust for gold. Or maybe I do: it's mostly about lust.

PLAN, PLANt, PLANet

Errol in Miami

I don't think silver will hold it's value nearly as well as it's an industrial metal. It does seem to correlate a bit w/ gold but I think it has generally been in oversupply since film begin to go away. I sold all my coins on ebay a few mos. when it $15/oz. Pretty sure I got out near the top. I still think ammo is better store of value than either one for truly bad times. Useful, Industrial goods in general should hold their value quite well, but guns and ammo will be the "gold standard.".

Matt

Francois sed:

"In a really severe situation, food, liquor and sigarettes will be of much higher value than gold. Better to have alternate plans for this situation."

In Kaintuck , we grow the baccer(tobacco), we made the whiskey and bourbon, and we got lots of gold in Fort Knox.

Yet its hard to live on any of those. Barter maybe. I will go with turnips, blackeyed peas and canned tomatoes(here its 'maters').

Tonite I am baking some sweet taters, boiling down some turnips, and making a skillet of corn bread.

I got no gold, got some storebrought whiskey, and need to think about planting some tobacco next spring.

I smoke a pipe. Cigarettes here are about $16 per carton. A pound of pipe tobacco is about $8.

Airdale- I don't inhale..it suffuses thru your blood though.

At $16 per carton I would still be smoking.

My friends in Arkansas call the good home made stuff "spring water".

Yes and I forgot liquor. YOu will be able trade a bottle of good hooch for almost anything. A gun will probably cost you a few. I definitely would like to learn to distill.

Matt

If one defines "money" purely as a "currency" (i.e., a system of money in general use) it is largely true that as a *practical* or common form of money gold is not readily money.

Yet, despite this contemporary lack of common usage as a means of exchange, which is what fiat currencies are for, it is still very much a valued unique form of money. What makes it unique is the combination of its long history as a monetary means of exchange/store of wealth, uncompromising durability, and its scarcity (relative to fiat currencies). And despite the efforts to portray these features as worthless by governments peddling fiat, gold has never lost its luster as such a valuable form of money even as its worth to fiat fluctuated (mostly downward) in nominal terms.

However, of late the value of gold has begun to steadily mount, *primarily* as a means of store of worth against all the debasements of the main fiat currencies and the threats looming in the entire financial system borne of our fiat fiascos and other political uncertainties. Based on the wide array of fiscal evidence as compiled here week after week, gold's value and unique properties of monetary worth are largely going to only get a lot stronger and continue to rise in the immediate future.

Despite all the negativism and doubt cast upon gold as money, it continues to behave as it has most always done -- which is to say another, albeit unique, form of money!

As LJR notes: "Governments used gold as a basis for currency in order to convey legitimacy to their coinage and not the other way round." Very true, and it's also worth noting that there are a fair number of governments which are no longer selling their gold and instead are now holding onto or otherwise increasing their reserves of this "barbarous relic." Stored no less in vaults, just like money! Hmmm... while one may not be able to readily exchange gold for goods it still looks like a duck, smells like a duck, and acts like a duck to a lot of people. I guess it just depends upon one's definition of a duck!

In any event, like others have advised above, it may work best as a store of value for any *excess* fiat savings that one hopes to salvage in the fiat based financial train wreck coming that we all are aboard. No one knows exactly what denouement is in store, nor what new arrangement may arise from the wreckage and how gold (& silver) may be revalued in it, but I see no reason not to believe, particularly as an interim measure of hedging one's *excess* asset bound fiscal bets, gold & silver are as good, if not better, as any other.

For everyone without any excess currency, I wouldn't sweat this gold issue. Between PO, Climate Chaos, geo-political shit, over-population and ecological decline, worrying over saving money for a future whose prospects are this dire is wasted intellectual and emotional energy. Far better to get on with one's practical hard-daze-a-coming arrangements as best one can, while enjoying life too. If things get as bad as they might well get, not having any gold will be the least of one's worries.

Still, there's no harm in lining up a few ducks if one can and worrying about how to use them later. ;-)

I have gold but don't know how to use it.

Suppose I wished to go to a local store to buy some items.

You are looking at a little off.

If you hold Oz's or Bars, think of them as $1000+/- Treasury bond or $1000 bill. You would take a $1000 bill to a store for a cup of coffee. You would have broken down a few of your large bills (ie oz's/bars) into 1/10 oz gold coins or Silver Coins.

Every other street corner will be a person who will trade bills of "The day" from gold coins. It happened in the 1070-80 period. Coin dealers, Pawnshop type places.

Gold is "Large Bills" so to speak. You would break one down, not carry it to buy small stuff.

I tend to agree that the liquidity of gold may be a problem in many scenarios. On the other hand, that may be even more true of much other stuff... particularly if you get uprooted.

I see that various governments including canada and the USA are now selling 1/10 oz gold coins. You pay a premium for them versus 1 oz coins, but they really might be more useful for transactions. (actually, I think I've even seen 1/20 oz coins advertised but they must be microscopic). The canadian ones are .9999 gold so would be bendable, which might provide proof it's real; while the US coins are legal US tender (albeit at ridiculously low face values), so it's hard to see how they could be made illegal. Yeah, I know it's happened before.

The other comment which occurs about the 1/10 oz coins is that they seem to be about dime-sized or smaller. If you actually had to carry a roll of them "out of sight" (ahem), I think the smaller diameter would be appreciated.

You do not use gold to buy small items at a store any

more than you would use the deed to a house, or the title

to a car, for that purpose. Gold is a MAJOR ASSET. Other

stuff serves the small-change role, like folding paper

money, clad coins, nickels (75% copper, 25% nickel),

junk silver dimes, quarters, halves, and (worst case)

direct consummables for barter: alcohol, cigs, canned

food, .22 ammo, etc.

Be careful assuming gold is any kind of asset in the USA.

E-gold & 1mdc, electronic gold brokers, were forced out of business by the US government last year. Any American who did business with Neteller.com was shut down too. Now "Liberty Dollars" ...

If you're American and you want to invest in an alternative currency a basket of EUR, CNY & AUD looks like a good bet. If those go wortheless I believe un-milled flax seed will keep indefinitely at room temperature ...

Let me tell you a little tale of what things were like when gold was being used.

My great grandfather was a major contractor to the building of the old Aswan Dam before the First World War. Here is a satellite Picture

The story goes that each pay day the masons (they were Italians and a pasta-making plant had to be built to keep them fed) would be paid in gold sovereigns. The person entrusted with the accounts and with the gold was my great grandmother. She would always keep one coin for herself each pay day. A search would be instituted for the "missing" gold coin when the discrepancy was found. Naturally, no one could voice the possibility that this lady may have had something to do with it. This went on for years and became almost a ritual. Later, she bought a good bit of agricultural land with the proceeds.

Effectively, she made sure that some of her husband's revenues were invested long-term.

As you can see, gold was used to pay foreigners their salaries and to buy land. Anyone who thinks gold is about to go out of fashion needs to have their heads examined.

...would be paid in gold sovereigns.

If you want to hear a neat story, this guy paid his employees with Gold Coins, using their Face value of $50 on their pay stubs so that their employees hardly paid ANY income tax.

A good documented testimony to the dual currency in use in the US. And the worthlessness of fiat money(ie FRNs). Read what the court's rulings were.

Good as Gold

http://www.liberty-watch.com/volume03/issue08/coverstory.php

Holy cow. So what you are saying is that the poor citizens who have contributed to their pension funds religiously, had accumulated NOK 451 Million over the decades, some clever fellow suggests they invest it all AND BORROW 8 times as much to 'boost' it. - And they did..