The Finance Round-Up: October 2nd 2007

Posted by Stoneleigh on September 30, 2007 - 6:24am in The Oil Drum: Canada

An inflationary future is becoming conventional wisdom, but, as consensus takes time to develop, the stronger the consensus, the later it is in the trend. A consensus is a backward-looking phenomenon of little use - except as a general contrarian indicator - in detecting the inevitable discontinuities that can abruptly and painfully invalidate all one's assumptions.

We have lived through a long period of inflationary credit expansion, and regard it as normal, but credit expansion is a self-limiting condition. Credit bubbles are merely the rediscovery by a new generation of the powers of leverage (see for instance A Short History of Financial Euphoria by Galbraith, Manias, Panics and Crashes by Kindleberger or Financial Armageddon by Michael Panzner). Every credit bubble that ever existed has eventually deflated, and this one will be no different.

We have essentially already reached the limit of debt serviceability that brings an expansion to an end. We are already seeing the tightening of credit standards, the refusal of banks to lend to one another, the frozen commercial paper, the bank runs, the redefinition of what constitutes a store of value, the rejection of financial alchemy, the debt defaults that reduce the money supply, the falling prices in the housing market, the lack of confidence - which together unmistakably herald deflation. Central banks can do nothing more than paper over the cracks for a short time, at the cost of aggravating the eventual impact of deflation.

I salute Wasik for pointing out the sham that the CPI is. However, it is because of the debasement of the dollar and distortions in the CPI that the Fed has practically forced risk down everyone's throat. But one must be cognizant of herding behavior that has nearly everyone thinking exactly like he is and the Fed wants. Aim high. Shoot for the moon. Do or die. You are losing money by saving. Buy assets. Only fools save. In the long term, stocks always go up.

The problem is that aiming high is synonymous with increasing risk. Up till now, risk taking has been rewarded. But what happens when everyone does the same thing? More to the point, what happens when everyone does the same thing for 20 years or longer? Eventually, risk gets so unappreciated that various asset classes go to the moon....

....Essentially, the same advice given for real estate (you cannot buy too much home, home prices always go up) is now being touted for stocks. There is an amazing belief in the Fed's ability right now to control the business cycle, as well as price stability. It's not warranted. At this stage of the cycle in a slowing economy, with rampant overcapacity, a tenuous job climate, and no real reason for businesses to expand, the odds are that aiming high is precisely the wrong thing to do.

Inflation - the meme of the moment. It's even made the pages of Newsweek, the magazine where investment themes go to die, which is not a critique of Newsweek because popular news magazines, by definition, purpose and mission only cover news stories at moments of maximum saturation.

- We write mostly about deflation here and sometimes about stagflation, which is the transition from cyclical inflation to deflation, but mostly about deflation.

- Most of the emails we receive read like this:

- "C'mon man, take your head out of the sand and look around! Inflation is everywhere."

- "Where do your kids go to college? Because tuition for my kids is going through the roof."

- "Do you get free gas or something?"

- "Wake up! The government is purposefully disguising inflation through their bogus numbers."

- We're sympathetic to these views because, believe it or not, because we too have found ourselves paying more for things such as education, healthcare, energy and food.

- But the hysteria over inflation is beginning to tautologize itself.

- The argument is basically becoming this: Inflation is being ignored by the Fed and is making inflation worse, which threatens to make inflation even worse as inflation gets worse.

- To be clear, the cyclical inflation we have been experiencing does not itself sow the seeds for... still more inflation.

- In a weird, geeky way, we kinda wish it did because then we would be on the verge of discovering something akin to perpetual motion.

- Instead, this cyclical inflation is simply sowing the seeds of deflation.

While there is a chicken-and-egg debate about which comes first, historically there has been a strong relationship between economic conditions and the national psyche. In other words, when Main Street is in trouble, people feel troubled and vice versa. That is one reason why, for example, forecasters pay close attention to consumer sentiment. If Americans are uncertain and unsettled, they are inclined to save for a rainy day and less keen to splash out on anything other than the bare necessities.

But in many respects, this relationship has gone awry. For instance, polls clearly show that growing numbers of Americans are worried about the threat of recession, the deteriorating health of their personal finances, and the direction the country seems to be headed in. Just yesterday, in fact, a Gallup survey noted that trust in the federal government, on nearly all issues, had hit a record low. Yet many individuals continue to spend freely, despite low savings, stagnant earnings, and high levels of debt.

At the same time, the stock market, a traditional barometer of the national mood, is trading not far off its record levels. Oil, grains, precious metals, and other commodity markets are roaring amid rampant speculation. Bankers are still keen to do deals, expand balance sheets, and lend money at an aggressive pace despite all the recent turmoil in credit markets. As far as Wall Street is concerned, few seem worried in the least about warning signs that suggest the good times are nearing an end.

Can We Have Inflation And Deflation All At The Same Time?

The curse of electronic dollars

Helicopter Ben has just made a most unpleasant discovery. Earlier he has promised that the Federal Reserve will not stand idly by while the dollar deflates and the economy slides into depression. If need be, he will go as far as having dollars air dropped from helicopters.

Time has come to make good on those promises in August when the subprime crisis erupted. To his chagrin Ben found that electronic dollars, the kind he can create instantaneously at the click of the mouse in unlimited quantities, cannot be air dropped. They just won't drop.

For electronic dollars to work they have to trickle down through the banking system. The trouble is that when bad debt in the economy reaches critical mass, it will start playing hide-and-seek. All of a sudden banks become suspicious of one another. Is the other guy trying to pass his bad penny on to me?....

....Under such circumstances electronic dollars won't trickle down. In effect they could be frozen and, ultimately, they may be demonetized altogether by the market. How awkward for Helicopter Ben. His boasting of air drops is an empty threat....

....The grand old man of the New York Federal Reserve bank's gold department, the last Mohican, John Exter explained the devolution of money (not his term) using the model of an inverted pyramid, delicately balanced on its apex at the bottom consisting of pure gold. The pyramid has many other layers of asset classes graded according to safety, from the safest and least prolific at bottom to the least safe and most prolific asset layer, electronic dollar credits on top....

....In between you find, in decreasing order of safety, as you pass from the lower to the higher layer: silver, FR notes, FR deposits, T-bills, agency paper, T-bonds, other loans and liabilities of the banking system denominated in dollars. In times of financial crisis people scramble downwards in the pyramid trying to get to the next and nearest safer and less prolific layer underneath. But down there the pyramid gets narrower. There is not enough of the safer and less prolific kind of assets to accommodate all who want to "devolve".

Devolution is also called "flight to safety"....We are going to see unprecedented leaps in the market value of T-bills, regardless of face value! You have been warned: the dollar is not a pushover. Electronic dollars, maybe. But T-bills (especially if you can fold them) and FR notes will have enormous staying power. Watch for the discount rate on T-bills morphing into a premium rate!....

....In a few days during the month of August central banks of the world added between $300 and 500 billion in new liquidity in an effort to prevent credit markets from seizing up. The trouble is that all this injection of new funds was in the form of electronic credits, boosting mostly the top layer where there was no shortage at all. Acute shortage occurred precisely in the lower layers.

This goes to show that, ultimately, central banks are pretty helpless in fighting future crises in an effort to prevent scrambling to escalate into a stampede. They think it is a crisis of scarcity whereas it is, in fact, a crisis of overabundance. They are trying to douse insolvency with liquidity.

Broken Record Stupid Dog Tricks

Meanwhile down in Miami it’s starting to look like the thousands of empty condos being built are being auctioned off for half price. Poof, goes the fictitious capital....

....As one might expect more corporate debt is showing up in the distressed category. Poof, goes the fictitious capital. This ought to be the tip of the proverbial iceberg....

....The merger and acquisition arena has shut down fantasy leveraging, and old deals are failing citing fading business conditions (translate not enough income to support Ponzi units). Poof goes the fictitious capital....

The commercial paper continues to disappear. Poof goes the fictitious capital. But that’s Ok, I’m sure nobody in the financial sphere has exposure here either, and even if they did: float a stupid dog trick rumor: Dubai, “the Chinese”, or Warren Buffet.

Getting Ready for the Roof to Fall

Sure enough, all these dicey loans helped bring about what Gundlach now calls "the great margin call of 2007." As home-price appreciation flamed out, subprime borrowers began to default in droves, especially on new mortgages, and mail back the keys to lenders. As a consequence, major subprime mortgage lenders like New Century began hitting the wall. Ultimately more than 100 subprime lenders were forced to close their doors as Spring turned into Summer.

That was followed in June by disclosure that two hedge funds managed by Bear Stearns were in deep trouble because of highly-leveraged subprime-debt bets that had gone bad. Soon a number of hedge funds, banks and other financial institutions from Asia and North America to Europe were reporting heavy losses on subprime debt investments. A number of hedge funds ended up being liquidated, and banking authorities in Germany and England were forced to arrange hasty bail-outs to save various banks.

The financial markets were further shocked in July and August when Moody's and Standard & Poor's and Fitch belatedly took over 5,000 negative ratings actions, decimating prices on all manner of residential mortgage-backed and home equity loan securities. "This was the biggest credit ratings catastrophe that our markets have ever seen," Gundlach observed to Barron's during a lengthy telephone interview.

Soon, the subprime contagion spread to other markets -- from leveraged-buyout debt to asset-backed commercial paper, triggering a full-scale seizing up of global credit markets. Yields on risky debt paper soared. Buyers went on strike. The ascendancy of fear over greed forced central bankers to flood their financial systems with liquidity, and in the case of the Fed two weeks ago, to drop short-term interest rates.

It's the kind of dire situation you would think might grab headlines, but it has raised barely a ripple. In spendthrift America, this is just par for the course. Since the Bush administration took office in 2000, America's national debt has ballooned by more than 50 per cent. Congress has already hiked its limit on how much the U.S. can borrow four times in the last five years. Meanwhile, American consumers, spurred on by low interest rates after 2001, racked up huge debt loads of their own. America's appetite for borrowed money seemed limitless.

Not anymore. As global financial markets seize up, and lenders come calling, alarm bells have begun to ring. Observers are talking seriously about the threat of a punishing recession. America's addiction to cheap and easy money has put the country's economy, not to mention the world's, on shaky ground.

"What we've done as a society is borrowed a tremendous amount of money," says Peter Schiff, president of Euro Pacific Capital in Darien, Conn., nicknamed "Dr. Doom" for his dour outlook. "Now the bills are coming due and we don't have any money to pay it back." Surveying the threat of a crumbling housing market and rising unemployment, Schiff is brutally blunt. "We're screwed," he says. "It's not just going to be a mild recession. It'll be the worst one we've ever had."

The sinking reality of America's dire financial state has sparked a simmering panic in financial markets over the past several weeks, and that has been reflected in the plunging value of the U.S. dollar against virtually all world currencies, including Canada's.

Click to Enlarge in New Window

The industrialisation of China has boosted the world price of Canada's exports of oil, gas, minerals, metals and farm products. But the country has also done its housework: ten years of federal budget surpluses and a current-account surplus contrast with the twin deficits in the United States. In the end it was the “subprime” mortgage woes south of the border that elevated the loonie over the sickly greenback (or should that be the “Yankee lira”?).But a strong loonie is not problem-free for Canada, whose economy, like that of Mexico, is tightly integrated with that of the United States by the North American Free-Trade Agreement. Ontario's carmakers, tied into American supply chains, were already struggling with high energy costs and a weak market across the border; the province's pulp and paper exporters face similar difficulties. According to Jayson Myers, who heads an association of manufacturers and exporters, “the real problem isn't the [exchange] rate, it's the rapid rise”....

....David Dodge, the outgoing governor of the central bank, says he thinks that prices for minerals and energy will remain strong for the foreseeable future.

If he is right, that will help Canada ride out a looming recession south of the border. But Schadenfreude is a dangerous sport. Although Canada has withstood mild American slowdowns in the past, a deeper slump across the border might well bring the loonie, and Canadian pride in it, down to earth with a bump.

Still room for 'exotic' mortgages in Canada despite U.S. meltdown: economist

There's still plenty of room for "exotic" mortgages to grow safely in Canada's real estate sector, despite the U.S. subprime meltdown, says a senior economist.

The U.S. is in a mortgage crisis because of an overuse of atypical mortgage products - many sold to subprime, or high-risk, borrowers - Benjamin Tal of CIBC World Markets said Monday in a report.

Exotic mortgages include those with low introductory interest rates, interest-only payments, and amortizations periods of up to 40 years.

"It's true that the surge in exotic mortgages since 2004 created an artificial demand in the housing market south of the border, and was primarily behind the current mess in the subprime space. A sharp deterioration in underwriting standards in those years and extremely easy ways of passing on the risks were the main catalysts there," said Tal, noting neither of the two latter factors is an issue in Canada.

Canadian Mortgage Market - CBC Radio, The Current, Oct 1st, Part 1

There are those who feel a chill coming on and they're blaming it on loosening rules around the hot housing market. As you know, house prices have been shooting up across Canada. By some estimates up to twice as fast as the rate of inflation. And for some time, those swelling prices have had home buyer wannabes complaining they can't break into the market.

But now, some experts are saying buck up. Mortgages with easy terms and loose lending rules are now making it possible for people to take on 35, 40, and even 50 year amortizations. That's a shift that means people can now finance their homes over terms nearly twice as long as their parents. Sold! say some house hunters but others as old as those parents are cautioning restraint. Last week, Bank of Canada Governor David Dodge said these rules may help to overheat the country's real estate market.

Bank of Canada injects more cash

For the third day in a row, the Bank of Canada has injected about a billion dollars into the country's money markets in order to defend its target interest rate.

The central bank conducted two rounds of liquidity injections worth a total of $890-million.

The special operations came after the central bank injected $985-million last Thursday and $1.087-billion on Friday.

“My sense of the Bank is, they're very conscious about how overnight is trading,” said Ted Carmichael, chief economist for J.P. Morgan Securities Canada Ltd.

The central bank implements monetary policy by influencing the rate at which money trades on a 24-hour – or overnight — basis.

“I think the system is still illiquid. There's a lack of trust in the inter-bank market between counterparties.”

Bank Credit Risk Rises Amid Concern Over Money Market Funding

Bank credit risk rose amid renewed concern lenders are having difficulty raising funds in the money markets, according to traders of credit-default swaps.

Contracts on the iTraxx Financial Index of subordinated debt, a benchmark for the cost of protecting the bonds of 25 European banks and insurers against default, rose 4 basis points to 49 basis points, according to Deutsche Bank AG. The index increases as perceptions of credit quality worsen.

Northern Rock Plc has borrowed 8 billion pounds ($16.4 billion) from the Bank of England since the Newcastle-based mortgage lender sought emergency funding two weeks ago, the Financial Times reported today. Some Canadian lenders are also having difficulty refinancing in the money markets, Bank of Montreal Chief Financial Officer Karen Maidment said yesterday.

``People are watching the money markets closely and are starting to feel a bit uneasy,'' said Hans Peter Lorenzen, a credit analyst at Citigroup Inc. in London. ``Generally, money markets have tightened up in the past few days.''

The cost of borrowing euros for three months stayed at the highest in more than six years today, signaling that banks remain reluctant to lend cash to each other.

Calls grow for ECB intervention to stem rise of euro

The recent rise of the euro has sparked a chorus of disapproval from the region’s exporters and politicians, but analysts say it may now be approaching levels that could even push central banks into action.

The euro has hit a fresh high against the dollar for the last nine trading sessions, touching $1.4281 on Monday. This took the euro’s gains against the dollar so far this year to 7.8 per cent.

The single currency has been boosted by the continued hawkish interest rate stance from the European Central Bank, which has repeatedly indicated that it has no intention of cutting eurozone interest rates. In contrast, US interest rates are expected to continue on their downward path, putting further pressure on the dollar.

The Maestro of Misery - Greenspan's Dark Legacy

After retiring as the Federal Reserve's second longest ever serving chairman, Alan Greenspan is now cashing in big late in life at age 81. He chaired the Fed's Board of Governors from the time he was appointed in August, 1987 to when he stepped down January 31, 2006 amidst a hail of ill-deserved praise for his stewardship during good and perilous times. USA Today noted "the onetime jazz band musician went out on a high note." The Wall Street Journal said "his economic legacy (rests on results) and seems secure." The Washington Post cited his "nearly mythical status."

Stanford Washington Research Group chief strategist Greg Valliere called him a "giant," and Bob Woodward called him "Maestro" in his cloying hagiography (now priced $1.99 used on Alibris and $2.19 on Amazon) that was published in 2000 as the Greenspan-built house of cards was collapsing. The book was an adoring tribute to a man he called a symbol of American economic preeminence, who the Financial Times also praised as "An Activist Unafraid to Depart From the Rule" - by taking from the public and giving to the rich.

Others joined the chorus, too, lauding his steady, disciplined hand on the monetary steering wheel, his success keeping inflation and unemployment low, and his having represented the embodiment of prosperity in compiling a record of achievement his successor will be hard-pressed to match.

In 2004, William Greider in The Nation magazine had a different view. He's the author of "Secrets of the Temple" on "how the Federal Reserve runs the country." He wrote Greenspan "ranks among the most duplicitous figures to serve in modern American government (who used) his exalted status as economic wizard (to) regularly corrupt the political dialogue by sowing outrageously false impressions among gullible members of Congress and adoring financial reporters."

Feeling the pinch

Investment banks are suffering from the effects of the credit crunch

Hopes that the worst of the credit crunch is over took a battering on Monday October 1st. UBS, a Swiss investment bank, announced that it had sustained a third-quarter loss and Citigroup, an American bank, warned that its profits for the quarter would plummet by 60% compared with the same period of 2006. Their travails took the gloss off earlier results from a number of Wall Street banks, which had seemed to indicate that the impact of the subprime-mortgage meltdown on the investment-banking sector was less severe than first feared.

UBS is the worse-hit but its management is better-placed to ride out the storm. The Swiss bank expects to post a loss of between $515m and $690m in the third quarter, thanks largely to a $3.4 billion writedown on its fixed-income assets, many of them securities backed by those notorious subprime mortgages. UBS is the first of the heavyweight banks to suffer losses as a result of the financial turmoil.

Credit crisis strikes UBS, Citi, Credit Suisse

The credit crisis struck at the heart of the global financial industry on Monday as Swiss bank UBS AG said it faced a shock loss in the third quarter and Citigroup warned its profits had collapsed.

UBS's chief domestic rival Credit Suisse Group also said its third quarter results would be "adversely impacted" by the credit market turmoil but said it would remain profitable in the third quarter.

The announcements are the latest from a lengthening queue of banks who have taken hits from a meltdown in U.S. subprime mortgages, which has set off a global liquidity crisis.

Why UBS's pain exceeds Citigroup's

It's worth remembering that the mortgage industry value network is complex. No longer does a mortgage bank issue a mortgage and keep it on its books. What happens now is that a mortgage broker convinces a borrower to sign a mortgage contract. The originating mortgage bank then turns around and sells that mortgage to a Wall Street investment bank that packages the mortgage into a mortgage-backed security (MBS) which it quickly gets off its books -- and onto those of European and Asian investors, like UBS, which are now paying the price for their gullibility.

How big of a price? UBS is taking a $690 million loss and firing 1,500 workers due to the $3.4 billion writedown of the value of its MBSs -- but I think it's curious that it still has $19 billion of MBSs with which it is "comfortable."

Citigroup Gets What It Deserves

Citigroup today announced that its third-quarter earnings dropped 60 percent, in large part because of more than a billion dollars worth of bad subprime loans in its portfolio. But no one, especially not Citigroup, should be surprised that its loan portfolio is a minefield of rotten debt.

For years, Citigroup has preyed on the mentally retarded, the elderly, and the illiterate, particularly in the South, to push predatory subprime loans on people most ill-equipped to pay for them. Reporter Mike Hudson, now at the Wall Street Journal, has been chronicling this story for a decade, and in 2003, Southern Exposure magazine won a George Polk award for his investigative package on Citigroup and its history of assembling some of the country's sleaziest subprime lending companies under one roof. Lots of people who got subprime loans from Citigroup and its subsidiaries ended up losing their homes long before the current foreclosure crisis.

ING takes over Web bank's deposits

ING Direct has acquired 104,000 customers and $1.4 billion in deposits from a failed Internet bank for $14 million, the Wilmington-based online bank announced late Friday.

NetBank of Alpharetta, Ga., the nation's oldest online bank with $2.5 billion in assets and $2.3 billion in deposits, was shut down Friday by the Office of Thrift Supervision due to poor performance and a high level of mortgage defaults.

NetBank sustained significant losses last year "primarily due to early payment defaults on loans sold, weak underwriting, poor documentation, a lack of proper controls, and failed business strategies," the agency said in a statement.

About 1,500 NetBank customers had deposits exceeding the FDIC-insured limit of $100,000.

Upheaval in markets sends confidence in financial services sector plunging to 17-year low, says CBI

The turbulence in credit markets has badly hit the confidence of UK financial institutions and their business expectations are the weakest in almost two decades, according to a survey out today. The credit crunch has prompted banks, building societies and other companies in the financial services sector to predict that business volumes, income and profitability will all fall over the coming three months, according to the latest quarterly report on the industry from the CBI and PricewaterhouseCoopers.

Britain to increase protection for bank deposits

Britain will raise depositors' protection on their savings to £35,000, finance minister Alistair Darling will say on Monday after the country suffered its first bank run in more than a century last month.

Under an industry-funded scheme, the government guarantees the first £2,000 of savings and then 90 per cent of the next £33,000, for a maximum of £31,700.

In a speech at the Reuters headquarters in London, Mr. Darling will say the increased limit is the first step in improving the financial compensation scheme following the Northern Rock crisis last month.

Thousands of panicked savers queued to get their money out of Britain's fifth-biggest mortgage lender after it had to seek emergency funding from the Bank of England. The run only stopped when Darling pledged to guarantee all Northern Rock deposits.

"Savers need to be sure that they can get their money out if they need to. That is why in the current market circumstances we are providing a guarantee for Northern Rock's depositors," Mr. Darling will say, according to Treasury officials.

"But for the future, we now need to put in place a better regime ... Today I can announce the Financial Services Authority has increased the limits of the Financial Services Compensation Scheme so that it covers from today in full the first £35,000 of people's deposits in any institution at 100 per cent."

Rock plunges 20% on break-up fears

Northern Rock's value has collapsed from just short of £2.7 billion shortly before it emerged in mid-September that the lender had sought emergency funding from the Bank of England. Today's share price low values the Rock at just £609 million.

The unfolding financial crisis sparked the first run on a UK bank in more than a century and prompted Alistair Darling, the Chancellor of the Exchequor to guarantee savings held by the bank's 1.5 million account holders.

Todasy, Mr Darling extended the Government's guarantee on individuals' savings to £35,000. He confirmed a story in The Times last week that he aimed to increase the protection to cover as much as £100,000 on deposit at a bank or other financial institution.

The insurance lobby hit out at the move. Stephen Haddrill, director general of the Association of British Insurers, said: "We agree that savers should be offered the possibility of 100 per cent compensation up to a higher limit than at present. That is one of the lessons of Northern Rock. But the Government has now set the limit at the upper end of what is sensible."

Mr Hadrill added that: "A limit of £35,000 will cover well over 98 per cent of all savers and is broadly in line with arrangements for investments and other savings. If the Government pushes the limit further upwards it risks distorting the savings market, providing a guarantee for risky investment strategies and adding to costs for customers," he said.

Bill Bonner: Subprime Economists

Economics has been called the "dismal science." But the epithet is pure flattery. Economics is not science at all. It is more like marriage counseling or homeopathy; if it works at all, it is probably just an accident. The field has more mountebanks than the hedge fund industry. It attracts more imposters than an Elvis convention. And it harbors more dangerous delusions than a national political convention. In fact, there are so many economists on the loose that if they were all laid end to end...it would probably be a good thing.

Economists don't even have a sense of humor...or much curiosity. The Bank of England, the Exchequer, and the U.S. Federal Reserve have all recently made the most absurd announcements; but nobody laughed or asked questions.

On both sides of the Atlantic, investors, speculators, and consumers are getting worried. Lured by economic policies, they've borrowed too much, spent too much, and taken too many risks. So, up to the microphones step the world's leading economists – Ben Bernanke, Mervyn King and Alistair Darling with a solution to a problem that they, more than anyone else, created. In the popular mind, they brought succor...money, that is...to those who needed it; they offered to turn the liquidity crunch into the heady wine of another boom. They offered to bail out everyone.

Americans watch greenback fall

October is the month Americans most closely associate with the season they call fall, so there has always been a certain aptness in its tradition of being the most skittish period on the Wall Street calendar.

Starting today, those October jitters are going to be fed by some $US50 billion ($57 billion) worth of adjustable rate mortgages due to reset at sharply higher rates over the course of the month.

About 75 per cent of the resets will be in the foreclosure-crippled sub-prime sector. Most are 2/28 loans originated in October 2005 with a low, two-year teaser rate.

It means poor households across the US will be faced with increased housing repayments on already heavy debt loads at a time when their houses are declining in value.

Inevitably the resets will see a rise in foreclosures and housing inventory which threaten to be the sternest test so far of the market's ability to weather the turbulence in US housing and credit markets.

The estimated inventory of unsold new homes in the US has now reached 529,000, while the total number of homes for sale is more than 5 million, up 77 per cent from August 2004.

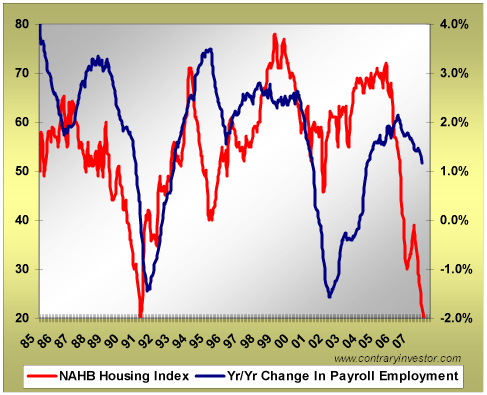

We'll make this quick as the message of the interrelationship between housing and the broad economy is really contained (no pun intended) in the following four charts that cover one heck of a lot of US GDP ground, if you ask us. In fact the bulk of US GDP - consumption, manufacturing, employment and consumer confidence. Influence these areas and you've taken a broad brush to the entire domestic complexion of US GDP. So as you review all of the four charts below, please look for and remember one meaningful item - in each case housing leads. Yes, in every case. We're using the NAHB (National Association of Home Builders Index) as a read on the character of housing, per se. Set against this are payroll employment numbers, real personal consumption expenditures, industrial production and consumer confidence. Broad enough for you? Again, in EACH case, it's clear - housing leads. Let's start with payroll employment. Here you go.

Home "flippers" were following American Dream

Speculators who bought multiple homes like Zenie were once a boon to the U.S. economy when they pushed home prices to record levels over a five-year period. Now their unsold homes are the bane of a sickly housing market.Many are stuck with unoccupied properties they cannot sell and mortgages that are bigger than the appraised value of the home, a situation known as being "upside down."

The glut of unsold homes comes as lenders are making it harder for borrowers to get loans, causing defaults to escalate and home prices to decline further.

"Investors that initially purchased a property with no money down or a very low down payment could now find themselves upside down, and without prospects of selling the property soon may opt to just walk away," says Greg McBride, senior financial analyst, Bankrate Inc in North Palm Beach, Florida.

President Bush has proposed relief for subprime borrowers with weak credit who are at risk of losing homes because their mortgages were poorly suited for them. He refuses, however, to bail out the speculators that many see as high-rollers.

Pimco's Gross Says Housing Will Drive Monetary Policy for Years

Bill Gross, manager of the world's biggest bond fund, said falling home prices will be the main driver of U.S. monetary policy for ``several years,'' and repeated his forecast the Federal Reserve will lower the federal funds rate to at least 3.75 percent in the coming year....

....``The downward path of home prices, however, will dominate Fed policy over the next several years as will the lingering unwind of related financial structures and derivatives that have yet to be discovered by the public, and marked to market'' by their holders, Gross wrote.

Fleckstein: Recession isn't an 'if' but a 'when'

As I think about recent developments on Wall Street, I am struck by the absurdity of the current mentality. By that I mean: The latest run in the stock market, which peaked as the structured-credit problems made themselves known, had been powered by leveraged-buyout madness, which itself had been powered by lunacy in various forms of structured credit.

Nevertheless, when it became clear that the plumbing of structured credit was a disaster -- witness the lines around the block at England's Northern Rock branches and, to a lesser extent, at Countrywide Financial here -- the Federal Reserve felt compelled to cut rates by a surprise half a percentage point. In doing so, Bennie and the Inkjets (thanks to my friend Colin for that moniker) have tanked the bond market and the dollar.Of course, stock bulls responded on cue -- by racing in for more. Apparently, those with the most stock-market votes, i.e., those who run the most money these days, seem to believe in some sort of immutable law of physics that says stocks must go up each and every day.

Recession Concern Spurs U.S. Bond Rally on Fed Ease

For the first time since 1995, the U.S. bond market is rallying on the assumption that the Federal Reserve has relegated inflation to a secondary concern because the central bank views a recession as a much greater threat to the economy.

The bellwether 10-year Treasury note, which depreciated as its yield climbed at least a quarter-percentage point when the Fed began lowering interest rates in 1998 and 2001, won't be recoiling anytime soon after the Fed lowered its benchmark by half a point to 4.75 percent on Sept. 18, the first cut in four years....

....The bond market's unusual buoyancy is a consequence of the worst U.S. housing slump in 16 years, a slowing rate of inflation and the seventh weekly decline in short-term corporate lending to companies.

Bankruptcy 'tweak' could save 600,000 homes

One consumer group estimates that 600,000 foreclosures could be avoided over the next two years by making a simple change to the bankruptcy code.

The Center for Responsible Lending (CRL) calls it a tweak, but it could be a significant change for homeowners and the market for mortgage-backed securities.

CRL's proposal - reflected in a House bill recently introduced - would make changes to the regulations for Chapter 13 bankruptcies, which don't wipe out debts, but rather establish a repayment plan.

Under current law, when a person files for Ch. 13 bankruptcy, judges can not reduce mortgage debt owed on a person's primary residence, although they may modify mortgages on investment property or second homes.

Under the House bill, the bankruptcy judge would have the option of reducing what the homeowner owes the lender. Say a homeowner's property is worth less than what he owes. The judge could reduce the principal to match the home's current market value as well as reduce the loan's interest rate.

The rest of the original principal would then be treated as unsecured. That means it becomes a lower priority for repayment than the borrower's secured debt, such as the newly reduced principal on his home. Unsecured debts may be discharged.

If you look at history, you can see that there is essentially a blueprint for turning an open society into a dictatorship. That blueprint has been used again and again in more and less bloody, more and less terrifying ways. But it is always effective. It is very difficult and arduous to create and sustain a democracy - but history shows that closing one down is much simpler. You simply have to be willing to take the 10 steps....

....Because Americans like me were born in freedom, we have a hard time even considering that it is possible for us to become as unfree - domestically - as many other nations. Because we no longer learn much about our rights or our system of government - the task of being aware of the constitution has been outsourced from citizens’ ownership to being the domain of professionals such as lawyers and professors - we scarcely recognise the checks and balances that the founders put in place, even as they are being systematically dismantled. Because we don’t learn much about European history, the setting up of a department of “homeland” security - remember who else was keen on the word “homeland” - didn’t raise the alarm bells it might have.

Learning to live with Big Brother

It used to be easy to tell whether you were in a free country or a dictatorship. In an old-time police state, the goons are everywhere, both in person and through a web of informers that penetrates every workplace, community and family. They glean whatever they can about your political views, if you are careless enough to express them in public, and your personal foibles. What they fail to pick up in the café or canteen, they learn by reading your letters or tapping your phone. The knowledge thus amassed is then stored on millions of yellowing pieces of paper, typed or handwritten; from an old-time dictator's viewpoint, exclusive access to these files is at least as powerful an instrument of fear as any torture chamber. Only when a regime falls will the files either be destroyed, or thrown open so people can see which of their friends was an informer.

These days, data about people's whereabouts, purchases, behaviour and personal lives are gathered, stored and shared on a scale that no dictator of the old school ever thought possible. Most of the time, there is nothing obviously malign about this. Governments say they need to gather data to ward off terrorism or protect public health; corporations say they do it to deliver goods and services more efficiently. But the ubiquity of electronic data-gathering and processing—and above all, its acceptance by the public—is still astonishing, even compared with a decade ago. Nor is it confined to one region or political system.

Britain 'on board' for US air strikes on Iran after Navy hostage humiliation

Britain is ready to sign up to a bombing campaign on Iran as revenge for the "shame" of the Navy hostage taking, it was claimed today.

According to an investigation by leading American journalist Seymour Hersh, the UK is poised to join any US-led action against the rogue state.

In an in-depth report, numerous American sources are quoted as saying President George Bush is gearing up for "surgical" bombing raids which would target Revolutionary Guard bases and anti-aircraft surface-to-air missiles inside Iran....

....According to Hersh, the US is working on a propaganda campaign to generate popular support for action inside the country after a public relations disaster over Iraq.

Hillary Prods Bush to Go After Iran

The Senate resolution, approved on Sept. 26, recounts allegations that elements of Iran’s Revolutionary Guards have supplied Iraqi Shiite militias with “explosively formed penetrator” bombs that have shattered U.S. armored vehicles and killed American troops.

In response, the Senate resolution calls on President Bush to list the Revolutionary Guards as “specially designated global terrorists.” In opposing the resolution, Sen. James Webb, D-Virginia, warned that the move could be tantamount to a declaration of war.

Despite Webb’s protest, 29 Democrats joined Republicans and neoconservative Independent Sen. Joe Lieberman of Connecticut to pass the “sense of the Senate” resolution....

....But Hillary Clinton, who also voted to grant Bush the authority to go to war with Iraq in 2002 and staunchly supported the war for the next three years before reinventing herself as an Iraq War critic, now has reverted to her old hawkish self, jumping out ahead of Bush in urging a more hostile policy toward Iran.

Besides the extraordinary notion that Bush needs prodding into greater belligerence, there is the dangerous definitional problem of throwing the broad cloak of “terrorism” over Iraqis, who are resisting a U.S. military invasion force, and their alleged Iranian allies.

Russia seems to be taking the threat of a US attack on Iran seriously:

Russians employed at Iran’s Bushehr nuclear reactor suddenly depart

http://www.debka.com/headline.php?hid=4636

I don't know whether it is just me, but watching the markets and the news flow, it seems eerily unreal, like reality's been suspended. We seem to be getting ever closer to the edge of the abyss whilst being told everything is fine, keep going, pay no attention to the void in front.

Triumvirate of collapse - Economy, Ecosystem, Energy

UAW-GM template may not hold, report says

Private equity deals that have hit snags

Pending home sales index hits record low

Dean Foods Reduces Earnings Expectations

Palm swings to first-quarter loss, hopes to regain growth ...

TD Bank Agrees to Buy Commerce Bancorp

Alwaleed Backs Citigroup Chief After Profit `Hiccup' (Update1)

Meat recalls point to possibility threat is growing

UBS to report $3.4 billion subprime hit

Ouch! Acxiom's Painful Breakup

Walgreen's Dose of Bad News

The above is what Google Finance looks like at this hour yet the market continues to hover. This is all basically a CONfidence game but so far Bernanke is maintaining that confidence. I'm not sure how he's managing it but he is pulling it off so far. My wife and I discussed today removing our savings from our bank and storing it at a secure storage facility other than a bank. We've not made that move yet but we are considering it. The loss of extremely low interest would be outweighed by access to our cash. Anyone who lived in Texas during the S&L debacle knows that feeling. I actually expect to see bank runs in the southern US first because of those memories but I could be wrong.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

I think there are more "players" involved here than just Helicopter Ben when it comes to keeping the global finance system aloft and defying gravity.

Dragonfly41 yes I would imagine there are 'others' out there, but barely dead cat hiccups today, let alone bounce. Is there a world wide weariness to that play?

GreyZone, either you and your wife or me and mine are telepathic, up here in Canada we are considering, 'the little tin box stashed in the holler tree' for enough to last three months.

well there is that small crack-up boom in emerging market economies and the attendant financial mania that it has spawned. no wonder the financial impact of the mortgage meltdown in some developed economies is thus far "contained"

There certainly are more players than just Bernanke. The derivatives market is global and a whole range of central bankers have been pumping liquidity into the banking system, trying to stave off a systemic banking crisis. They've managed to paper over the cracks for now, but won't be able to do so for much longer IMO. At some point a firesale of financial 'assets' will be forced by circumstances, marking whole asset-classes to market for everyone who holds them (ie revealing their real market value to be pennies on the dollar at most). Central bankers won't be able to prevent that happening.

The 'hot potatoes' of bad debt have been multiplied through leveraged and spread far and wide in the global banking system, where they're embedded in most balance sheets. The interbank lending problems reflect the fact that no one knows exactly where they ended up and in what quantities - banks have no way to judge each other's exposure and so they don't want to risk making loans to each other. Rolling over short term debt like asset-backed commercial paper (ABCP) then becomes very difficult, if not impossible, which leaves short-term funds frozen. This is already spilling over into the real economy, with companies forced to access emergency lines of credit in order to continue (see the last Finance Round-Up for an arctic example).

Hi GreyZone,

I think what you're considering would be a very good idea under the circumstances. The banking system doesn't actually have your money and everyone else's (as I'm sure you know), so that if everyone wants their money back at once it can't be done (FDIC insurance is only a confidence trick that won't be worth the paper it's written on during widespread bank runs). You can only get your money back if you ask for it before everyone else decides to do the same thing. If you wait you may end up spending many fruitless hours in bank queues, and may still come away empty-handed.

Hi Stoneleigh, You say during widespread bank runs,. Does that mean that at some future point, after the panic, it would be possible to access ones funds in some sort of orderly fashion? Or is it as you say a confidence trick and all bets are off; and on that question, how so?

Canadian deposit insurance is through a Government Corp, which would indicate to me, in my blind faith and trust of our government, that up here we would not fare as poorly as the Texas GreyZones could? If that is so, would they be able to bank with a Canadian bank in Texas for similar security?

It's all about scale, CR. That and the mood.

If 100 people demand their $100.000, there is no problem, though it may take some time to physically gather it.

If 100.000 people demand their $100.000, there is a big problem, and it makes no difference what deposit insurances have been given. If 1 million do so, the doors will be closed. As Stoneleigh says, the money is simply not there. It would have to be created, and that is not going to happen.

At least 95% of our money doesn't exist physically. But in a bank run, that's exactly what people will demand: physical money. A transfer to an account at a different bank will not be accepted.

Waiting till after the bank run panic to access your funds is not useful; chances that the bank will be open for business as usual are slim at best.

Argentina's solution was to limit withdrawal to, I think, about $100 a week, in local currency, and no access at all to USD or other foreign currency (that probably included gold). That still sounds to me like something banks and governments here might consider.

Taking your money out of bank accounts now, before -scores of- others start doing it, looks like a pretty safe thing to do at the moment.

Thanks ilargi, you have brought me most of the way to dock but for the sake of discussion and a bit more clarity, if you have time?

We pay our bills, property taxes, utilities etc. through our bank accounts and never see so much as a silverless dime of it. I have a bit of a hard time understanding why these paperless transactions would be affected. We buy most of what we need, food etc., using electronic transfers (debit card)and other than change for a parking meter (and even there there are is often 'pay by card' metering) why other than for small cash purchases should I need concern myself about throwing my body at the bank doors? (though I do plan on having a couple of months of lolly stashed under the nearest rock, just in case I am completely wrong in my thinking).

I can see mood being a factor here, as well as, if or when, one is in a position where paperless transactions are not available ie no card or bank machine, but after that my thinking gets muddy. Help! help!, so near the jetty of enlightenment yet I flounder in the sea of basic financial ignorance.

If you can only take X$/mo out of your bank accounts, no one will take anything other then cash for many goods and services. Two separate economies develop overnight. The official stuff you do with keystrokes. Food? Gas? that sort of thing, not a chance in hell. About a year ago they had a bit of a gas shortage here locally because of a problem with a pipeline. You had to wait for the tanker to show up or get in line if you found a station that had gas, they only sold you $100.00 worth max and you had to pay cash. I just mention it to preempt the "it can't happen here".

In Argentina in those days the U$S was king, not the Peso/Austral. Here there is no popular culture of having a hard (well it used to be hard then) currency running semi underground in parallel.

In the US maybe 1% of the population knows what a Euro looks like or what it is worth. That's why as a whole we will get hit much harder. Believe it or not, even in a place like Mexico City the people on the street are much more sophisticated then here when it comes to dealing in foreign currency or PM. They had huge currency devaluations there in the 70's.

I have seen the drill personally 3 times, Mexico City, Buenos Aires, Moscow. I know how it worked then, gives one little head start even if it is comparing Copacabana with Fallujah.

Correction, it probably was more like three years ago as I still had the PU truck then.

Thanks for that musashi, The disconnection was just that which you mention of there being two economies, one for the rich and one for the survivors:). Street level hustling, I can dig that. I will have to look into how things went in those crashes you mention. I should also re-read Dimitri Orlov, http://www.fromthewilderness.com/free/ww3/060105_soviet_lessons.shtml http://energybulletin.net/23259.html

I still miss my Toyota pickup after 7 years and it is near impossible to find anything small and useful today, just those beasts so high one needs a stool to stand on to load the manure ....stupid things. The only things I ever see them carrying is beer. Maybe that's the draw there?

For the moment it looks like the Canadian loonie would be a collectible? What do you think will be the currency of future choice? Cowry shells to go with soft summer nights were my pick but with global climate change that market might be flooded.

It isn't two economies, one for the rich and one for the survivors. It is two economies for everyone. The very rich are only able to function for as long as they can hire help as they are too obvious a target. The dumb and the sheep never do well regardless. The activists are cannon fodder. Maybe the trick is to be able to function everywhere while keeping a low profile.

No idea how it plays out, sometimes you get parallel universes and different realities play side by side, all you can do is watch and try to read it.

One thing that doesn't make any sense, but if you consider the lack of main street knowledge re hard currency and PM's, is that maybe even if the U$S is destroyed internationally the U$S still is used internally for lack of anything better.

Forget the guys who preach BS to make a buck or further an agenda. Just like you can have inflation and deflation at the same time depending specifically for what, maybe the dollar is worth more or less depending precisely for what.

That's a question for the smart people here, I'm just thinking loud.

musashi, I really have to watch out how I say things that was supposed to be tongue in cheek about an economy for the rich and one for the poor, that is merely disparity. But I do think that a lot of the poor will fare better than one might think as they have had to depend upon each other closely for survival, they have had practice..

It was nice to know you have no idea how it will all play out as I could use company there. The whole situation is much too massively complex to do other than lend support to those about you and maybe get it when you need it.

Take a look at the Toyota Tacomas, both new and used, depending on whatever you can buy without credit, of course. If you stay away from the jazzed up "macho" versions, you will find that Toyota still also makes a version of the Tacoma that is 4 cylinders, normal height, and has a decent payload capacity. I know that the newer 4 cylinder Tacomas can get as high as 28 mpg, so while it is no Prius, it sure beats driving one of those monster SUVs, especially if you have regular hauling needs. I've been borrowing my son's Chevy Silverado 6 cylinder frequently and it has way more capacity than I've ever needed so I may decide to jump for a used Tacoma soon. Also check out the Nissan Frontier, another nice small truck. You have to sift through all the option packages but it's another truck with potential to be a decent hauler with solid mileage otherwise.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

CR,

You made me laugh there.

It's not that obvious at all why the virtual money system couldn't continue to infinity and beyond. Modern day fractional banking has left very few, if any, reserve requirements in place. However, you are talking perpetual motion here: down the line that would mean anyone can open an internet bank, and everyone can live forever without working an hour in their lives. If I put it like that, it sounds ridiculous. What's even more so, though, is how close we are to that situation.

What kills your devious ideas is that banks still do need to fulfill a number of requirements at the end of every day. That's why there's such a lot of talk about interbank lending practices. But it's the Ponzi part of the scheme that both makes them turn huge profits, and threatens to do them in. That mortgage you signed 5 years ago for $250.000 has been leveraged into a $25 milllion investment windfall for your lender, who sold it to a hedge fund, who sold it back to the lender etc.

There is no problem, it's all smooth sailing, until the growth stops, and/or until you fail to pay the monthly fee. Especially if you do that 6 months in a row. Then the question pops up what that mortgage is really worth, and, moreover, what your home is really worth, if they would have to evict you and sell it.

Say the resale value has dropped to $200.000, then that would mean the whole leveraged charade built on top of it would lose 100 times that amount, or $5 million. Your bank would be required, when trying to make ends meet with interbank loans, to show what its assets are worth. If it has 100 or 1000 no-good CR's in its books, or even commercial paper issued elsewhere hurt by CR's no-goodness, at a certain point the other banks will say: you ain't getting a dime from me today.

Reason: because all this stuff is traded under the table, make that under the floor, no bank knows how much another is invested and exposed to this toxic mold. They have no gaurantee they'll get their dough back.

Short, banks will check if you are good for your money. If you can write a check for your electricity, you can also write me one for 90% of what's in your account. That's fine with the bank, until your whole family and circle of friends start doing the same, and that starts a reverse Ponzi scheme.

Read the book Maxed Out by James Scurlock, forget the movie (it sucks), he lays it all out very plainly. People who pay back their debts in time are called dead-beats. Those who don't, and thus get into higher interest rates, are their favorite clients. Why? Because as long as they're in the books, those debts can be used to borrow 10-100 times what they aree owed to the company.

See Money as Debt, buy a whole bunch of copies, 10 copies $135, the best $13.50 X-mas gift you can give anyone these days, bar none. It's an animated movie, give it to any kid 14 and older.

We're talking about a Christmas special here for it, try and save as many people as we can from ruin.

iligri,

You make me laugh too.

You say... What kills your devious ideas ... and then ...

100 or 1000 no-good CR's in its books ... my wife has enuogh trouble with one no good CR in its cups.

All this because I wish to continue to pay my bills? Help! help! I am floundering at the end of the jetty and iligari is trying to pour water up my nose!!

Seriously iligari I really do not see the difference between a paper banknote and one that is formed on a electronic memory on a harddisk. I go to work I make some lolly and I go to the bank and deposit my check, I then have the choice of taking paper currency out and paying bills or going home and transferring those same dollars electronically to pay my bills.

As far as one being virtual and the other paper and real, I would say that both are virtual as neither are real wealth but merely representations of the same. The Bank may not be able to store enough banknotes to give me mine on request for the sheer physical problem of doing so. As far as giving me my money electronically I do not see the problem there.

About as money being made as ponzi dollars,if someone is clever enough to take his gains that way into the bank and deposit them in an account just like I did with my hard earned bucks then this is a moral problem and not a financial one. The musical chairs at the ponzi party will be removed and eventually that party will end, but I would imagine the dollars on the table that are left while not being real wealth will represent real wealth. The thing is not to be part of something that does not represent real wealth. (room here for elaboration but it is past my bedtime and I flag)

About future wealth creation, after the collapse of that house of cards, I really don't want to think of it (anyway I will be too busy working in my garden I think). I would agree with you guys that the smart move is to move any savings into as close as possible to real wealth and into real wealth itself when dollars euros or pounds begin to loose their savour.

Electronically denominated virtual money is prone to evaporating at inconvenient times once the virtual value that underlies it is shown to be a mirage. With the products of financial alchemy still marked-to-model rather than marked-to-market, that value theoretically still exists, although it is being treated with increasing suspicion (hence the interbank lending problems). Once those assets are marked-to-market at auction anywhere in the world, whole asset classes are likely to be abruptly revalued - drastically downward if such an auction generates only pennies on the dollar.

In contrast, your paper dollars are far less ephemeral and should retain 'moneyness' (act as a store of value or medium of exchange or a standard against which to value other things) for far longer than the electronic variety. The money supply is composed of many levels in an inverted pyramid, in which each successive level is a broader definition of money than the one below (ie has a more tenuous connection with underlying real value).

The products of financial alchemy commonly referred to as derivatives, which make up a large proportion of the effective money supply, are very far removed from underlying real value. In a deflation, investors proceed from the broad top of the pyramid to the narrow bottom, crossing off the list successive levels of broader money - removing the quality of 'moneyness' from different asset classes as they go. At the narrow apex of the inverted pyramid you would find cash, implying that it will hold the quality of 'moneyness' for longer than almost anything else.

Of course eventually fiat currencies all end the same way, but that doesn't mean such as currency cannot first have a value revival because it looks pretty good in comparison with, say, credit default swaps, as a store of value. People understand what cash is and are very inclined to trust it for the time being. I can't tell you exactly to what extent non-cash transactions would be disrupted by what time, but I would say that disruption is to be expected and it's better to be safe than sorry. If banks close their doors it is IMO very unlikely that the balances left behind will be accessible again to any meaningful extent, even if authoritative-sounding assurances to the contrary are given.

Thanks Stoneleigh for putting things so clearly, I will put your comment here into my notebook to pass on. Maybe this will convince my brother and his wife now.

I am retired myself and I would think there are many others in the same boat who have some part of their retirement funds self invested. Making sudden moves can be difficult depending on how they have invested. For instance someone investing in a back loaded mutual fund could face up to an 8% loss to move directly to Cash dollars. With a bit of planning an orderly retreat like moving those funds to a money fund within that mutual fund family. That is no cost would be safer than a market exposure.

My position at the moment has been to move as much to safety as possible (devils are above and as well below) ranging from cash on hand, T-bills and money market. I have made arrangements that would liquidate those money market funds if the weather gets too nippy. My market exposure is limited to one small holding in a wind company and another in a hydroelectric company. I think the hydroelectric company anyway would hold as well as my cash dollar.

I think everyone has to look to their own positions and judge for themselves what is necessary. It does help when there is information like yours to help make those decisions. I would like to hear others talk about how they are preparing for change. The better prepared everyone is for the changes the easier it will be for all when we down shift into a more basic economy.

A different position is the one my brother is in where he is living in a suburb in a major Canadian city with no mortgage and a year from retirement. In his position I would be listing my house and looking for the small holding in the country, planting fruit trees and garnering ducks as quickly as possible. But he so far shows not a smite of interest in that, but as I mentioned above maybe your words will convince him.

Thanks to both you and illargi for the help.

It will be much worse then in Argentina even under the same rules.

In those days in Argentina you could walk the main upscale shopping streets in the city and find individuals openly trading foreign currency on street corners. Just like here they trade drugs in the ghetto, except no one got whacked over their head.

Different places, different times.

What does it mean when the serious guys get off the Red Bull and on to the Sarcanol?

http://www.minyanville.com/articles/index.php?a=14337

Especially #1

LOL - that's hilarious, especially the Greenspan spoof!

In case anyone didn't see this on today's Drumbeat:

Dollar's Double Blow from Vietnam and Qatar

Scary!

For the sixth straight Thursday, the Federal Reserve has pumped double digit money into the economy. Today's was $28 billion. Last Thursday was $38 billion. Prior Thursdays were likewise in the double digits ranging from high teens to the $30 billion range. You can check these values yourself at the New York Federal Reserve Temporary Open Market Operation website, but you will need to look at historical data if you don't check it today (Thursday, Oct. 4th).

One thing that I would urge observers to note is that each successive Thursday injection has met with weaker and weaker market responses. Last Thursday they managed a tepid 30 point rally. Today it was only 6 points. Prior weeks were higher, getting larger the further back you go generally. Also, you need to remember that the market already believes and is factoring in a Fed rate cut from 4.75 clear down to 3.75. Several analysts have stated this and this is one reason (not the only but one) why the DOW has surged back to the 14,000 range. (I personally do not believe the Fed will cut that deeply this quickly and if they do, it's proof positive of pure panic amongst the bankers themselves.) If the Fed does not cut rates by 100 full basis points at the October meeting, I expect the market to crash in inverse proportion to the size of the actual cut. No cut at all could place us back down in the 12,500-13,000 range. A 25 basis point cut would probably see several hundred points off the DOW at least. Anyone else who has become a Fed watcher like myself will want to tune in again next Thursday to see how much money they pull out of their rear ends and how tepidly the market reacts. I believe that will be the last Thursday "pump" day before the Fed meets for October but if someone has the actual date available, I'd love to know it.

"The greatest shortcoming of the human race is our inability to understand the exponential function." -- Dr. Albert Bartlett

Into the Grey Zone

Scheduled meetings are Oct 30 07 and Dec 11 07