The Round-Up: June 12th 2007

Posted by Stoneleigh on June 11, 2007 - 7:49pm in The Oil Drum: Canada

N.S. premier urges revolt against federal budget

The 2005 Atlantic Accord, a deal signed by the then-Liberal government between the governments of Nova Scotia and Newfoundland and Labrador, protects those two provinces from having their offshore oil and gas royalties clawed back under the federal equalization plan.

However, to accept an enriched equalization deal, they have to abandon the accord.

PM to N.S.: Take us to court over equalization

Prime Minister Stephen Harper challenged the Nova Scotia government on Monday to take legal action to back up accusations that Ottawa went back on its word and changed past offshore-oil revenue agreements.

"If you're really serious in the allegation that we've broken a contract, then I think you have to follow that allegation up with action," Harper told reporters during a joint press conference with Dutch Prime Minister Jan Peter Balkenende in Ottawa.

Oil companies must justify price hikes

Oil refineries and gas stations across Quebec will have to advise the provincial energy board in writing why their prices are going up, Natural Resources Minister Claude Bechard said yesterday.

Bechard's tough new stance came only two days after he said he would rely on the "goodwill" of oil companies not to pass on to consumers the province's new carbon tax.

Bechard now says Quebec's energy board, the Regie de l'energie, will set a daily minimum price for gasoline before gas stations add their costs and profit margin. The process will allow the government to see whether the 0.8-cents-a-litre carbon tax is being passed on.

Once the Regie establishes the price, the oil refineries will have to justify any increases, in writing, to the Regie.

Open Mackenzie pipeline to other companies, Prentice proposes

Prentice said the current proposal "allows the owners of the anchorfield to get their gas in the system. There has been concerns raised by other people who might find gas in the future, and their ability to access the pipeline."

Companies interested in exploring the Mackenzie Valley have been critical of Imperial Oil, which is leading the consortium, saying the company has been refusing to say how much it would charge them to ship the gas out.

Prentice said everyone has to have access to the pipeline, and the federal government can encourage that to happen without getting directly involved in funding the project.

"The issue of whether we accept a royalty in kind, namely in gas as opposed to dollars, is an issue that we can discuss," he said.

Mackenzie Gas Project must drive exploration: Prentice

Q: Your recent comments sound as though you are asking Imperial Oil Ltd. and its partners to step away from the $8-billion pipeline portion of the Mackenzie Gas Project and let a pipeline company build and operate it.

A: "This project consists of three components: the anchor fields, the gathering system, and the pipeline. The pipeline portion -- being a common carrier, basin-opening pipeline -- would command in the market place a certain rate of return. That rate of return might not be the kind of return that a major oil and gas company might expect from an anchor field. The proponents are going to need to reconsider that issue; of what their expectations are. Certain of the proponents have pipeline experience, and there are other players that have pipeline experience, so they are well acquainted with the types of rates of returns that you achieve on pipelines as compared with anchor-field development."

An interview with Richard Heinberg

Aric McBay: How do you think that those in power will respond to attempts for communities to become more industrially independent, and so, more autonomous and detached from the goals and propagation of the power complex? It's fairly clear that shifting to a more sustainable economic system means bleeding power away from those in power, and having a less centralized system. Historically, those in power have used force and violence to suppress the development of alternatives like that. What can communities do about this?

Richard Heinberg: After a certain point, it will become almost impossible for central powers to offer much in the way of services for local communities; if the latter are able to fend for themselves, they may have a relatively free hand to do so. Look to the Great Depression for precedents: some communities developed their own currencies as a strategy to keep their economies alive. I don't think it would be advisable for communities to aggressively provoke central authorities, but the latter will be overwhelmed with other matters.

Danger of tritium exposure underrated, report says

Releases of radioactive tritium from Canadian nuclear power plants are so elevated that children under 4 and pregnant women shouldn't live within 10 kilometres of an atomic generating station, and those living within five kilometres shouldn't eat food grown in their gardens, Greenpeace says in a controversial study being released Tuesday.

Canadian-style Candu reactors are among the world's largest sources of tritium, producing up to hundreds of times more of the radioactive substance than other reactor designs. The report says high amounts of tritium in the Great Lakes and around the stations indicate nuclear plants routinely emit it into the environment.

The Greenpeace report calls Health Canada's standard for the level of tritium in drinking water “very lax” because it is about 10 times higher than that of the United States and 100 times higher than the level allowed in Europe.

Researchers transfer power without wires

A team of U.S. researchers was able to power a light bulb from a power source more than two metres away, an advance in wireless power transfer that could cut the final cord required by portable technology.

Researchers at the Massachusetts Institute of Technology said the technology they call WiTricity - as in wireless electricity - allows power to cross distances even when there is no physical connection or straight path between the power source and the object to be charged.

The work, led by MIT physics professor Marin Soljacic, is reported in the June 7 issue of Science Express, the advanced online publication of the journal Science.

Surprise: less oxygen could be just the trick

When organic material is burnt with air it is often reduced to white ash. Trapped carbon goes up into the air as carbon dioxide, hence the greenhouse emission problem at coal-fired power stations.

But if heated while starved of oxygen "it just goes black, like a pizza left too long in the oven", says Van Zwieten. Called pyrolysis, the process leaves up to half the carbon trapped in the char.

At Somersby, on the Central Coast, BEST Energies Australia, a company researching clean energy technology, has built a demonstration pyrolysis plant with the capacity to process 300 kilograms of dry green waste, wood waste, rice hulls, cow and poultry manure or paper mill waste every hour.

The material, says Adriana Downie, the company's technical manager, is heated at up to 550 degrees for 40 minutes.

During processing gases are released from the material which are cleaned and burned to produce energy. This gaseous biofuel is called syngas. "Syngas can be used as a replacement for natural gas or LPG in gas-fired boilers or dryers, or to produce electricity," says Downie.

The remaining black carbon-rich biochar can be used on farms.

Van Zwieten says early Department of Primary Industries experiments with biochar have been "extremely encouraging". They show that using 10 tonnes per hectare raises the soil's carbon content by half a percentage point. "That's a huge amount - 75 per cent of Australia's soil has less than 1 per cent."

'Chump Factor' Holding Us Back

Canadians are skeptical of taking what McAllister calls a "shotgun approach" to paying for the climate-change fight -- one where everyone pays the same, no matter how much they contribute to the problem. They believe it's more fair to have those who are most to blame pay the most.

Which brings us to what McAllister calls "the chump factor."

Most Canadians, he said, "think other Canadians don't give a damn about the environment." The feeling is less widespread than it once was, but it's still significant.

So if you're doing your best to reduce your carbon footprint, but everybody else is spewing greenhouse gases all over the place, you're going to feel like a chump when the government suggests you should pay higher taxes to fight global warming.

John Disney is the economic development officer for Old Massett, a Haida village of about 700 on the eastern shore of Masset Inlet. Disney thinks there is money to be made and carbon to be sequestered by cutting the alder out of the long-ago logged riverbanks in the region and replanting the area with conifers. He just needs $4.5 million and access to protected buffer areas on the banks of two rivers to prove it.

Arctic residents may face floods, waterlogged ground, rock slides and a die-off of ocean life, from algae to polar bears, if the melting of snow and ice continues unchecked.

This spring, sea ice break-up is late in Baffin Island and Nunavik's Ungava Bay. But, overall, Arctic sea ice is shrinking and the flow of water from melting ice sheets and glaciers appears to be speeding up.

The loss of ice and snow means the planet may lose its ability to cool itself off, says a grim, new United Nations report on ice and snow.

Diesel shortage could hinder wheat harvest

Ken Peterson with the Kansas Petroleum Council said the problem with supplies are systemwide and are driven by the same forces that sent gasoline prices above $3 earlier this spring.

"Anytime you have a disruption, it ripples through the system," he said. "There have been refinery fires and outages as well as the terminal problems at Great Bend. It all adds up to a short supply."

With the region looking at what appears to be its best wheat harvest in a decade, producers are increasingly concerned about having enough fuel to keep the combines and trucks rolling.

The notion of peak oil has been on lots of people's minds. Books and Web sites are full of the topic. Now a new study from a European organization called the Energy Watch Group proposes another daunting prospect: that the world might soon have to grapple with a peak in the production of coal, too.

This conclusion flies in the face of accepted wisdom on the topic, which is typically based on a comparison of the amount of coal left to be mined (reserves) with the amount used every year (production). The ratio of reserves to production provides a crude measure of how many years are left before the resource runs out, assuming that reserves don't expand and that consumption stays constant. According to the Energy Information Administration, which provides official U.S. government energy statistics, the ratio of world reserves (tons of coal) to production (tons used per year) in 2002 was more than 200. That is to say, we might expect coal to last another 200 years. Considering the United States in isolation yields an even more optimistic number: 240 years.

One problem with such simpleminded assessments is that they ignore the way natural resources are actually depleted. Production does not continue at some constant rate for centuries and then suddenly stop. Rather, it tends to ramp upward to some peak rate, then decline. A reasonable expectation is that the production curve is symmetrical, with the peak taking place when about half of the total resource is used.

While U.S. states, concerned about state rights under an unaccountable "North American Union," are organizing against the scheme, Canadian provinces are either blithely unaware or knowingly complicit in the deal. More Canadians may be aware of TILMA (Trade, Investment and Labour Mobility Agreement) -- the investors' rights agreement between B.C. and Albert -- than they are about the SPP, but in reality they are one and the same.

TILMA is major piece of the deep integration, deregulation imperative and fits hand in glove with the SPP. There is a similar, though more informal, process evolving in the Atlantic provinces, called "Atlantica." And B.C. is now pushing the so-called Gateway Initiative, a kind of regional superhighway project that will see huge and environmentally disastrous expansion of ports, highways and pipelines to further supply the U.S.'s insatiable demand for resources and cheap Asian goods.

The underlying problem is located in an obscure statistic: the import price data published monthly by the Bureau of Labor Statistics (BLS). Because of it, many of the cost cuts and product innovations being made overseas by global companies and foreign suppliers aren't being counted properly. And that spells trouble because, surprisingly, the government uses the erroneous import price data directly and indirectly as part of its calculation for many other major economic statistics, including productivity, the output of the manufacturing sector, and real gross domestic product (GDP), which is supposed to be the inflation-adjusted value of all the goods and services produced inside the U.S.

How Those Deceptive Numbers Creep In

The import price figures also don't record the price cuts, productivity gains, or quality improvements that enabled the Chinese factory to undercut the U.S. producer in the first place. The authority of the BLS stops at the U.S. border. So when a particular new product shows up on the docks, that's the first time the import price trackers know anything about it.

Why does this matter? If import prices don't reflect the big cost savings from offshoring, then measured import-price inflation is higher than it should be. As a result, the real, inflation-adjusted growth rate of imports is reported as lower than it really is. And that's bad because all of the statistics calculated using real imports--including real GDP growth, productivity, and the real value-added of manufacturing industries--are thrown off. In particular, any underestimate of real import growth will lead to an overestimate of domestic production growth. This is how phantom GDP is created.

Housing Bubble Analysis: Interview With Global Economic Trend Analysis (Mish)

Have you ever seen a U.S. bubble that is comparable to this one?

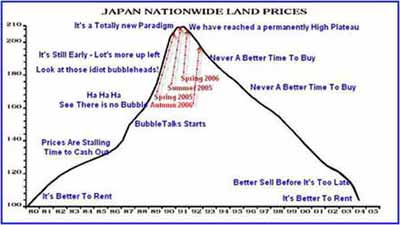

There has never been a housing bubble in the US as big as this one, on a national scale. Perhaps some international bubbles have been as big. Vancouver Canada is going to implode like Florida did. Spain and the UK are huge problem areas right now. The bubble in Japan was arguably bigger and it took 18 years to unwind.

Yes, Real Estate Prices Can Drop in Half--Even in Manhattan

One of the most enduring cliches of the real estate industry is that properties in "prime locations" such as Manhattan and San Francisco "never go down." Nice idea, but wrong.

Ironically enough, the Fed never talks about the expansion of money and credit, runaway borrowing to fund IPOs, debt-financed share buybacks, the war deficit, or the fact that government is spending far more money than it takes in year in and year out. In other words, the Fed talks about anything and everything but inflation (and this is on purpose)!

What Do Stocks Have to do With the Price of Pork in China?

While Chinese concerns over a potentially bursting bubble are legitimate, their attempts to discourage further speculation can be compared to the captain of a sinking ship who dispenses teaspoons to his crew instead of fixing the gaping hole in the hull. The giant hole in the Chinese economy is the currency peg to the dollar. In order to maintain it, China must pursue a highly inflationary monetary policy which fuels the stock bubble. As long as they continue this policy, dispensing teaspoons will have little effect.

The effects of inflation are not limited to stock prices. Pork prices in China, the primary meat in the Chinese diet, rose over 30% in May alone (live hog prices actually rose over 70%)! In order to hedge against such persistent price increases, Chinese savers are being forced into the stock market. The alternative is to watch the value of their savings erode as the government debases the yuan to prevent the U.S. dollar from collapsing.

Initially, a dollar peg brought stability to China. When the dollar was sound, discipline was required to keep a pegged currency from falling. Now that the dollar is weak, inflation is required to keep it from rising. It's analogous to tethering your monetary ship to the Titanic. Failure to cast off the line will inevitably sink the pegged currency along with the dollar.

The Daily Reckoning, June 8th: The Bubbles of a Global Market Hot Tub

The "easiest credit conditions in a generation," as Tim Bond explains it in yesterday's Financial Times, have become a kind of financial "little blue pill" getting everyone hot and bothered. Borrowing money has never been easier. As a result, everything is going up, even old, tired investments that no one thought would ever rise again. Excited investors have forsaken their own homebound treasuries in favor of more exotic...and more risky...fare. When you're eating so many financial oysters, there's hardly an investment target in the world that doesn't seem fair and fetching. Frisky speculators are chasing after sultry Venezuelan bonds, although Hugo Chavez is supposed to be an admirer of Trotsky...and diving into bed with Chinese stocks, just when China's communist rulers are desperately trying to knock down stock prices!

And now they've all come to believe that these ultra-low borrowing rates are eternal. Like the American home speculators - who've bet their solvency on ever rising house prices - professional money managers are making multi-billion dollar gambles based on the fantasy that today's cozy credit rates will last forever...or, at least until a greater fool shows up.

Even so, it is hard to believe that this abrupt and widespread change in mood, coursing as it has through the world of money, politics, social relations, and international affairs, is mere happenstance. Or that a wide range of catalysts with nary a common thread between them all seem to be causing events to turn in the same destabilizing direction.

Instead, it seems likely that we are on the periphery of a dramatic and potentially far-reaching transition to a new, more hostile environment -- one that most people are both unfamiliar with and ill-prepared for. Odds are that it will be a dangerous, costly, divisive, and debilitating period, when all sorts of relationships and assumptions will be severely tested.

Public pension funds take a risky gamble

At the presentation, she likened CDOs to financial institutions in terms of having strict oversight: "The outside agencies that oversee these structures are the rating agencies,'' she said.

However, her comment drew the following from Gloria Aviotti, managing director of global structured finance for rating service Fitch: "It's not accurate. We don't provide any oversight.'' That view was echoed by Yuri Yoshizawa, group managing director of structured finance at another rating service, Moody's Investors Service: "It's a common misperception," he said. "All we're providing is a credit assessment and comments.''

Thus, the ratings agencies are trying to have it both ways: They want to be paid to rate these structures so people will feel good about them. But they're also trying to say: If they blow up, don't blame us, as we're really not doing any work.

Bloomberg's Evans noted the motivation of the buyers: "Many pension funds, facing growing numbers of retirees, are still reeling from investments that went sour after technology stocks peaked in March 2000."

So, because the funds took too much risk or weren't competent, or both, they got themselves into a hole. Now they're attempting to dig themselves out by reaching for yield in the form of debt that's been ginned up and blessed by the ratings agencies. I would not be surprised to find out that these pension funds are the biggest subscribers to high-risk leveraged buyout (LBO) funds, as well.

Sharp price rise for milk, cheese

Market forecasters are warning of a sharp increase in dairy prices this summer.

Prices paid to farmers have increased 50% this year — driven by higher costs of transporting milk to market and increased demand for corn to produce ethanol. U.S. retail milk prices have increased about 3%, or roughly a dime a gallon, this year, according to the U.S. Department of Agriculture.

University of Illinois dairy specialist Michael Hutjens forecasts further increases of up to 40 cents a gallon for milk over the next few months and up to 60 cents for a pound of cheese. Hutjens and others said that higher fuel prices had increased the costs of moving milk from farm to market, and that corn — the primary feed for dairy cattle — was being gobbled up by producers of the fuel additive ethanol.

Top scientist says biofuels are scam

Kemp and Clift point out that the surging global interest in biofuels derives from a “false belief” among politicians that there must be a technical solution to climate change.

Kemp said: ”Underlying all this is the assumption that we have to preserve the mobility and freedom to travel that we now enjoy at all costs.

“However, when you look at the science of climate change it is clear there are no such simple solutions. Humanity has to accept that.”

More ethanol means more corn -- and more water pollution

What is washing off those fields is nitrogen and phosphorus from fertilizers applied in ever-increasing amounts to grow more corn to fuel the ethanol boom.

American farmers intend to plant more corn this year than at any time since the food-shortage years of World War II — 90.5 million acres, according to Agriculture Department estimates.

Farmers in Illinois, second only to Iowa in corn production, planned to plant 1.6 million more acres of corn. Their Missouri counterparts intended to plant corn on an additional 700,000 acres.

That's just this planting season. With the ethanol industry predicting that it will more than double production by 2010 — and with Washington politicians leaping on the biofuels bandwagon — it seems certain than the nation will need more corn in coming years to keep pace.

The robust growth benefits farmers and the Corn Belt economy. It might chip away at energy imports as advertised, even though much of the fertilizer that farmers use is made with imported natural gas. But those successes have one certain cost: more oxygen-stealing chemicals running off farms to choke rivers and lakes with algae.

Is Ethanol Running Out of Gas?

Ethanol from corn has been a mixed blessing for farmers, and those that got in early have done well. In Minnesota, where I grew up, they have 16 ethanol plants and five more under construction. When the ethanol boom started, most ethanol plants were created by a formation of a co-op of farmers in the local area. Many still are run this way. Obviously, each of these farmers has a vested interest in the plant, as it's where they take their grain to be processed into ethanol and taken to market. That all started back when corn was around 2.50.

The new plants that are being built today are mostly not co-ops but "private equity," and the cost of these plants has skyrocketed. Of course, corn is now 4.00 a bushel. Farmers are concerned that simply can't last. The farmer-owned ethanol plants are already moving into other alternatives, like biofuel made from soybeans.

Biofuel boondoggle: US subsidy aids Europe's drivers

Created under the 2004 American Jobs Act, the "blenders tax credit" was supposed to boost US production of biodiesel by encouraging US diesel marketers to blend regular petroleum diesel with fuel made from soybeans or other agricultural products. It succeeded, perhaps too well.

Attracted by the $1-per-gallon subsidy, US diesel-fuel marketers mixed away, setting off a nationwide boom in biodiesel refinery building. But no one anticipated splash-and-dash.

The maneuver begins with a shipload of biodiesel from, say, Malaysia, which pulls into a US port like Houston, says John Baize, an industry consultant in Falls Church, Va. Unlike domestic diesel-biodiesel blends, which typically contain from 1 to 10 percent of biodiesel, the Malaysian fuel starts off as 100 percent biodiesel, typically made from palm oil.

Then, the vessel receives from a dockside diesel supplier a "splash" of US petroleum diesel. It doesn't take much to turn it into a diesel-biodiesel blend that is eligible for US subsidies.

If the ship holds roughly 9 million gallons, it takes only about 9,000 gallons of traditional diesel (0.1 percent of the total) to make the entire load eligible for the blenders tax credit.

The US importer of the load applies to the Internal Revenue Service for the credit – a dollar for each of the 9 million biodiesel gallons, Mr. Baize calculates. The next day the tanker can set sail – dash – for Europe. There, the US importer resells the biodiesel, taking advantage of European fuel-tax credits that, in effect, keep biodiesel prices above US prices.

What Do Subsidized Corn, A Militarized Border, and Finance Reform Have To Do With It?

But why are so many people risking their lives to come into our country now? When did this big rush begin?

It began when Mr. Clinton approved NAFTA – the North American Free Trade Agreement, and when he militarized our southern border at the same time. Prior to these combined actions, families crossed the border very commonly and casually, especially during harvest seasons. After harvest, they would go home to Mexico or Central America because that’s where they lived with their families in quite happy communities.

When the border was militarized, it became too risky to go back and forth. So they stayed.

Why did Mr. Clinton militarize the border? He did so because NAFTA was about to pull the rug out from under Mexico’s small family farms. We flooded Mexico with cheap corn–exports that we now subsidize to the tune of some $25 billion dollars a year. Congress gives that money of ours to a handful of agribusiness giants. Of course, I am not here to tell you why Congress does that, and what might be done to stop it, such as with the public financing of campaigns. But they do it, and Mexican family farmers cannot compete. In the years since NAFTA was signed, half of Mexico’s small farms have failed. The only kind of farming that can now compete in Mexico is big agribusiness, which does not employ as many people. Tortillas in Mexico now contain two-thirds imported corn, and they are three times as expensive at retail level than before NAFTA. The people have less money, and the cost of food is rising. We have done that. Our precious Senators and Congressmen and their corporate cronies have enforced that raw and cruel exploitation in our names.

The result of undermining Mexican farms, as Clinton expected, was a rising flood of poor people moving from rural areas into Mexico’s big cities, which have become so poor and overcrowded that all one can do is dream of going north across the border.

The wrath of 2007: America's great drought

America is facing its worst summer drought since the Dust Bowl years of the Great Depression. Or perhaps worse still.

From the mountains and desert of the West, now into an eighth consecutive dry year, to the wheat farms of Alabama, where crops are failing because of rainfall levels 12 inches lower than usual, to the vast soupy expanse of Lake Okeechobee in southern Florida, which has become so dry it actually caught fire a couple of weeks ago, a continent is crying out for water.

In the south-east, usually a lush, humid region, it is the driest few months since records began in 1895. California and Nevada, where burgeoning population centres co-exist with an often harsh, barren landscape, have seen less rain over the past year than at any time since 1924. The Sierra Nevada range, which straddles the two states, received only 27 per cent of its usual snowfall in winter, with immediate knock-on effects on water supplies for the populations of Las Vegas and Los Angeles.

Putin calls for new economic order

His attack on the 150-member WTO reflected Moscow's frustrations in its struggle for recognition, not only as a rapidly growing economy, but as a major world power.

Mr. Putin charged that "today, the protectionism that the WTO is called on to combat is frequently coming from the economies that created the structure" --an apparent reference to European wariness about Russian investment and what Moscow calls unfair U.S. trade practices.

His message that "a shift has taken place from the major Western powers to the developing world," is undeniable, World Bank Russia office director Klaus Rohland said.

"The days when the G7 countries were the centre of the world economy are over. That's what they're saying here, and for better or for worse, it's true," he said.

Worse than Chernobyl: 'dirty timebomb' ticking in a rusting Russian nuclear dump threatens Europe

A decaying Russian nuclear dump inside the Arctic Circle is threatening to catch fire or explode, turning it into a "dirty bomb" that could impact the whole of northern Europe, including the British Isles.

Experts are warning that sea water and intense cold are corroding a storage facility at Andreeva Bay, on the Kola Peninsula near Murmansk. It contains more than 20,000 discarded fuel rods from nuclear submarines and some nuclear-powered icebreakers. A Norwegian environmental group, Bellona, says it has obtained a copy of a secret report by the Russian nuclear agency, Rosatom, which speaks of an "uncontrolled nuclear reaction".

John Large, an independent British nuclear consultant who has visited the site, told The Independent on Sunday: "The nuclear rods are fixed to the roof and encased in metal to keep them apart and prevent any reactions from occurring. However, sea water has eroded them at their base, and they are falling to the floor of the tanks, where inches of saltwater have collected.

"This water will begin to corrode the rods, a reaction that releases hydrogen, a gas that is highly explosive and could be ignited by any spark. When another rod falls to the floor and generates such a spark, an enormous explosion could occur, scattering radioactive material for hundreds of kilometres."

Hello Stoneleigh,

Thxs much for your work on TOD:Can. With all the energy problems looming up north I am amazed that so few Canadians are not reading and commenting. I would have expected this branch of TOD to be thriving discussion site by now.

Perhaps you need to get a stronger grassroots penetration, but I am unsure how this could be accomplished. Have you tried handing out cards to strangers? Letters to editors of newspapers? Emails to Canadian leaders? Is denial a prevalent trait of Canadians even worse than here in the US?

I wish you the best of luck.

Bob Shaw in Phx,Az Are Humans Smarter than Yeast?

Thanks for the kind words Bob. I think there is a lot of complacency and denial here. Life is just soooo comfortable for many people that problems mostly seem a world away. Of course I would argue that much of our current prosperity is illusory - the result of easy credit and therefore accumulated at the expense of the future (ie there is significant difference between money and credit which people are about to rediscover).

Stephen Harper is on the record as proclaiming that Canada need not worry at all about energy as we are an 'energy superpower'. This is at odds with the reality that half the country exports (although conventional sources are rapidly depleting and unconventional may not scale up very quickly), while the other half imports energy in increasing quantities. This disparity is likely to lead to significant discontent in the future just as it has done in the past. With increasing regionalism in Canadian politics, I am concerned about Canadian unity in the face of a crisis.

Stoneleigh,

Just wanted to say thanks for your good work here - it IS appreciated.

You're welcome :)

Canada strikes back!!

"Canada and the energy sector may want to dust off those plans for an oil pipeline from Alberta to the B.C. Coast aimed at opening new markets in Asia for Canada's oil."

The americans might complain about our dirty energy, but does anyone seriously think they won't keep using it as fast as they can? "Energy independence" is not going to happen in the US in the forseeable future. Even a massive collapse of the economy (that dollar of their's sure is sinking fast...) won't do it...last I read, they were at about 75% energy imports.

It's a given that Americans will blame us for their own environmental failures, just as they blame everyone else in the world for, well, whatever problem shows up. Canada gets to sit next to them and blame the US though, which while having the advantage of being slightly more true in most cases (on a total level, not a per capita level), certainly isn't going to help things here any. Blame games are beyond pointless. You don't launch investigations while still on the sinking ship.

I think the best hope for awakening Canadians to problems is the environmental angle. Most already recognize the major problems there (although personal action hasn't kicked in large scale yet), and since some solutions overlap so well with peak oil mitigation strategies (solar/wind energy, carbon taxes, house isulation, etc...), if one is dealt with, the other at least has a great start.

This is where I see regionalism helping out, although I too fear for Canadian unity. Provincial governments have started to give up on the federal gov't ever doing anything, and are just starting to implement things on their own. Harper can go force himself further into Bush's ass if he wants to. Since long-term planning must necessarily be on a local level anyway, forcing provinces and cities to deal with these things themselves, while unfair given the tax collection distribution, is fine by me if it results in actions being taken. That's going to start picking up steam soon, right?