Canadian Oil Sands Production Update

Posted by Sam Foucher on October 30, 2006 - 11:51am in The Oil Drum: Canada

Oil Sands Production in a Nutshell

I won't go into too much detail about oil sands. I invite people to read the excellent stories previously posted on TOD by Dave and Heading Out:

Oh, Canada -- Natural Gas and the Future of Tar Sands ProductionMining Canadian Oil Sands into the future

The raw material of the oil sands industry is crude bitumen:

Crude bitumen means a naturally occurring viscous mixture, mainly of hydrocarbons heavier than pentane, that may contain sulphur compounds and that, in its naturally occurring viscous state, will not flow to a well.

The raw crude bitumen is recovered either by surface mining or by In-Situ technologies for deeper deposits (THAI, SAGD, etc.). The crude bitumen is not the final product and has to go through Upgrading:

Bitumen is deficient in hydrogen, compared with typical crude oils, which contain approximately 14 percent hydrogen. To make it an acceptable feedstock for conventional refineries, it must be upgraded into higher quality synthetic crude oil (SCO), through the addition of hydrogen or the rejection of carbon, or both. (National Energy Board, 2000) Upgrading bitumen utilizes natural gas as a source of heat and steam for processing, and also as a source of hydrogen for hydroprocessing.In the following I will only consider two crude oil categories:

- Non Upgraded Bitumen (NUB).

- Upgraded Bitumen or Synthetic Crude Oil (SCO).

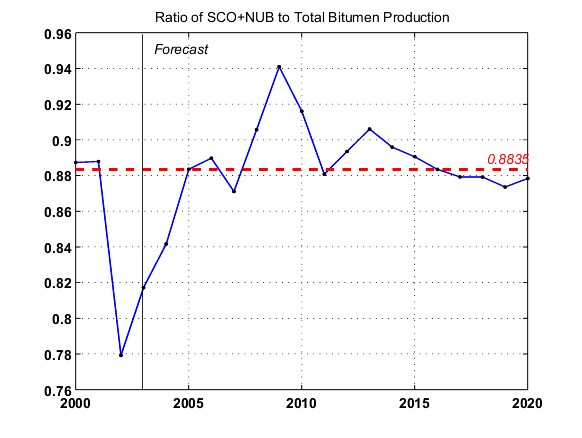

The main reason for this choice is that more data is available for these two categories, which is not the case if you consider the total raw bitumen production usually split into In-Situ and Mining productions. There is also a loss factor when upgrading Bitumen to SCO of about 30%, hence one has to be careful when comparing total production figures of bitumen and SCO+NUB. According to the Canadian Energy Research Institute, the average ratio of SCO to bitumen input for upgrading has varied between 0.69 to 0.75 between 2000-2004. From the same report, I derived a correction factor of 0.8835 to account for both the partial upgrading of the crude bitumen production and the losses during upgrading.

Fig. 1- Observed and predicted ratio of SCO+NUB production to the total Bitumen production (derived from CERI document). Click to enlarge.

Production Data

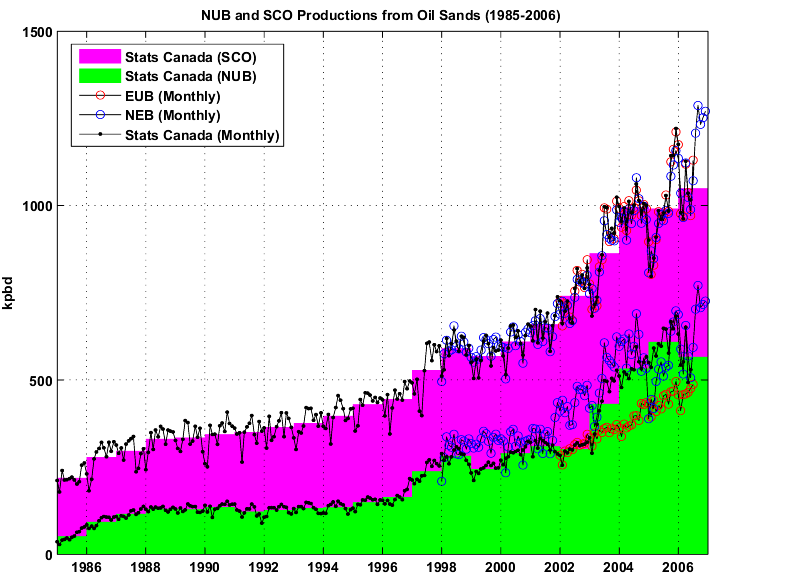

There are several data providers available:- Statistics Canada has monthly time series for NUB and SCO production up to 1985 (not free, CA$3.42 per dataset, financing kindly provided by TOD).

- Monthly data from the National Energy Board (NEB) up to 1998

- The (EUB) also publishes monthly estimates up to 2001.

Most of the data are in Cubic Meters and the conversion factor I used to convert production figures in barrels is 1M3= 6.2929 barrels. The different datasets are shown on Fig. 2, we can observe that they all agree on the total production (SCO+NUB) but that there are some discrepancies on the SCO production levels (I don't have a definitive answer on why).

Fig. 2- Various monthly production estimates for Synthetic Crude Oil (SCO) and Non-Upgraded Bitumen (NUB). Click to enlarge.

Forecasts

There are a lot of forecasts out there on oil sands production, most of them being for the total bitumen production. For now, I considered only the following references:

- National Energy Board of Canada (NEB):

- Alberta Energy and Utilities Board (EUB):

Alberta's Reserves 2004 and Supply/Demand Outlook 2005-2014

Alberta's Reserves 2003 and Supply/Demand Outlook 2004-2013

- Canadian Association of Petroleum Producers (CAPP):

Canadian Crude Oil Production and Supply Forecast, 2005 - 2015

Canadian Crude Oil Production and Supply Forecast, 2004 - 2015

- Canadian Energy Research Institute (CERI):

- Uppsala University (Professor Kjell Aleklett, member of the ASPO):

Söderbergh et al., A Crash Program Scenario for the Canadian Oil Sands Industry, to appear in Energy Policy, 2006

- Purely for the fun of it, I fitted a Logistic curve on the young oil sands production history assuming prior knowledge of the URR at 179 Gb. Of course, it gives me an unrealistic production profile peaking in 2050 at more than 9.7 mbpd.

Fig. 3- Various forecasts for Synthetic Oil Crude (SCO) and Non-Upgraded Bitumen (NUB) derived from oil sands.

| Forecast | 2005 | 2006 | 2007 | 2010 | 2015 | Peak Date | Peak Value |

|---|---|---|---|---|---|---|---|

| Observed (Statistic Canada) | 991.28 | 1048.88 | NA | NA | NA | 2005-11 | 1220.77 |

| CAPP* (2006) | NA | 1074.30 | 1260.71 | 1900.34 | 3087.73 | 2020 | 3531.23 |

| CAPP constrained* (2005) | 877.29 | 1104.34 | 1230.67 | 1559.33 | 2139.76 | 2015 | 2139.76 |

| CAPP moderate* (2005) | 877.29 | 1119.36 | 1248.34 | 1664.46 | 2378.30 | 2015 | 2378.30 |

| CAPP* (2004) | 972.70 | 1178.55 | 1323.44 | 1772.24 | 2281.12 | 2015 | 2281.12 |

| NEB* (2006) | 974.60 | 1077.45 | 1252.58 | 1742.38 | 2636.36 | 2015 | 2636.36 |

| CERI* (2004) | 951.24 | 1120.68 | 1307.05 | 2333.33 | 3383.81 | 2020 | 3746.88 |

| EUB (2006) | 979.80 | 1157.89 | 1277.46 | 1824.94 | 2573.80 | 2015 | 2573.80 |

| EUB (2005) | 925.06 | 1195.65 | 1315.22 | 1755.72 | NA | 2014 | 2322.08 |

| EUB (2004) | 1050.91 | 1227.12 | 1327.80 | 1636.15 | NA | 2013 | 2076.66 |

| Logistic (URR= 179Gb) | 969.61 | 1045.51 | 1126.98 | 1408.21 | 2021.70 | 2050 | 9731.72 |

| ASPO* (2006) | NA | 1251.37 | 1534.73 | 2427.70 | 3082.43 | 2018-01 | 3178.40 |

Table I. Production estimates (in thousands of barrels per day (kbpd)) for SCO+NUB derived from different forecasts (* indicates forecasts that were originally for total bitumen production and that have been corrected using the factor 0.88 explained earlier).

In summary, we can see that most forecasts are in agreement with each other and are predicting a doubling of the current production within 6 years. However, we can observe than the older forecasts have a tendency to be a little bit over optimistic and have been revised downward afterward (see for instance EUB-2006 and EUB-2004).

This is a first draft and there is a lot of work to do. Many important aspects have not been addressed here, for instance: 1) How the decline in conventional oil production will affect the total Canadian production; 2) How domestic demand will evolve; 3) The dependence on Natural Gas. I will attempt to explore these different problems in my future posts.

The different datasets used in this post will be put together in a public spreadsheet, probably next month.

I meant to ask David Hughes at ASPO that if the price per BTU differential gets high enough if there would be a switchover in policy to save the NG (gold) and curtail production of tarsands (lead). Clearly at some price this would happen.

But using the CAPP forecast of 3500kpd in 2020, how much nat gas will that use, assuming no nuclear plants have been built in the meantime and that the US miraculously can meet their NG needs from LNG and allow canada to use her gas to steam tar sands to turn into oil to sell to the US.

Based on your charts; laundry, poker rooms, and liquor stores are still great investments in Fort McMurray (and brothels, but those require assets other than dollars)

I guess my basic question about bitumen production is economics. What does it cost per bbl to set up the production facilities? Is it still around $500k per barrel per day? How much does it cost per bbl for raw materials and energy to process the bitumen? Is this still around $30/bbl not counting amortisation of the capital costs? How does this stack up with coal to liquids? With redrilling and using tertiary development of depleted fields? With, perish the thought, conservation?

My best arguement for dealing with the cornucopians is agree with them that the oil is there, its just uneconomic compared with nuclear, wind and other renewables and conservation. This allows them the dignity of being right, just there are more practical solutions for our country and the planet.

I think its of the utmost urgency for all of us to begin dealing with the problems now so that our society can survive and prosper and we need to convince as many folks as possible that their own actions will make a difference.

Your cost numbers look high. At the ASPO conference David Hughes pegged the NG use as 3/4 mcf per barrel of oil produced from mining operations. His 2006 capital cost estimate was $131,000 per bbl/d up from $78,000 in 2004. His EROI estimate is 2. Others peg EROI at 4 or 5 which looks more accurate to me. Look at Canadian Oil Sands Trust latest financial results. For the third quarter operating costs were $19.68 per barrrel of syncrude produced. This is a very profitable enterprise. I think it is a mistake for people to say it is uneconomic or it is turning gold into lead from an energy balance standpoint. For natural gas use you are getting 8 x more energy back than you put in. The real problems with tar sands are they waste gas on heat instead of using it solely for hydrogen production, they produce large amounts of CO2 and the regional environmental degradation. The reason they aren't a long term energy solution to peak oil is the limits of production based on water and natural gas availability.

There are a few things that would be interesting to look at vis a vis Alberta oil sands production forecast reliability:

In effect, they value multicriteria analysis POST-investment, not PRE-investment.

_Joe Hill, Industrial Workers of the World song writer , organiser and martyr.

For some reason it is an American characteristic to act without any forethought and with a strong denial of all evidence, sort of like a religeous crusade.

Let's burn the mothership first and ask questions later.

I know that the production of these stats and charts are the work of a dedicated creator of charts and stats, perhaps a scientist, and certainly one who believes that science will lead us all from the dark cave to the brilliant light of reason.

And I understand the mantra of the scientific community that we must know what we are facing before we can fix it, but I fear this slow moving beast, which stomps blindly on people with impunity, consoling itself with the platitude that it is helping people in the short term.

That's the problem. Short-term thinking. Everyone seems to only be concerned with keeping the oil flowing, no matter the cost. And the scientists who are putatively trumpeting the concerns of the peak oil crowd are unwittingly contributing to the downfall of humanity by advocating the go-slow approach. They would have us try to find other destructive methods to fuel our anti-nature lifestyle, to create dubious technologies to mitigate our short-sighted ruinous rush to embrace technology (think CO2 sequestration, Methane Clathrate mining and other potentially disastrous technologies), and finally they would have us believe that this is the only way, asking us not to look too far into the future.

The basis for our technological civilization is flawed at its core: perpetual growth and the injection of human values into a non-humancentric natural system. Therefore, I have come to the conclusion that nature will strike the balance, effectively killing off all but a few hundred million humans in the next two hundred years. No amount of rational thinking, strident pleading, careful individual preparation, or scientific humbug will stop this immense catastrophe.

This site has become like a club of Aeronautical Engineers holding court on the Hindenberg. While they head for their doom, they debate and trade memos and laud each other their efforts, inscribing beautiful colored charts that in fact describe their doom, but at the same time counseling calm, letting us know that they take certain measures to keep the balloon aloft. Though we all know it will all end in tears and recriminations.

You will undoubtedly ask, "So, what do you want us to do?"

Fair enough.

Make peace with your invisible sky being of choice.

All your base are belong to us.

There is nothing you can do. You are a mere 6.8 billionth of the social mass on this planet. You are but a speck on the backside of a massive survival engine that has evolved to seek the way of Paleolithic man, to survive day to day, no matter how destructive that short-term survival impulse coupled with high tech may be to future generations. Our natural inclination is to put individual over family, family over clan, clan over tribe, tribe over nation, nation over humanity. We are the selfish, thinking species and think we do. Witness this page.

So...Go on thinking. Go on chatting. Go on drawing charts. I'm going to trade my Prius for a Hummer and start drag-racing through the wilderness preserves. I hope, by speeding up the destruction of the environment, we can kill off this most perniciously self-centered species post haste.

The smoldering ruin that will mark post oil earth will be barren and wounded, its species decimated, the remnants of humanity doomed to live on the polar margins, scraping a living, learning to forget and forgetting to learn, and, with luck, the polar bears will eat those last survivors.

Homo sapiens is no different from yeast or any other organism, it will reproduce and consume its environment to the point of overshoot and collapse. If space aliens had beamed all the inhabitants of the OECD (developed) nations away, the end result would be the same. If all monotheists were raptured away, it would make no difference. The great majority of people everywhere love having children and love a motor. On Rarotonga, where it never drops below 20C, and the only road is just 32km in circumference (no place is more than 16km away), no adult will walk or ride a bicycle. In Shanghai, bicycles are banned from the CBD to make room for cars.

People will not powerdown willingly. Only collapse and dieoff can humble humanity. Therefore, both are inevitable because people will keep on with their monkey business (tar sands, oil palm plantations) until Gaia stops them.

Here I think a mini-collapse and a mini-dieoff might cause people to be aware of the situation in time to mitigate a total collapse and dieoff, and choose a better path. Then they will choose the powerdown path because they will have internalized (by learning) that that path is better for them. Powering down, and being happy and healthy about it, will be a new target for relative fitness. But not from being told that, only from experiencing it. At our DC conference Governor Schweitzer offered the challenge to be 'cool' about energy conservation with the slogan "How low can you go?" This might work in the framework of our evolved neural pathways, but not while profligate energy users still have more access to better mates and more stuff.

Hard times for sure, but end of times I doubt.

Of note, Niue and the Cook Islands have only avoided collapse by exporting their excess population growth to New Zealand and importing food. If the planes and boats stopped coming, they would have to revert to the old method of sustainability - warfare.

As long as someone is allowed to make money mining tar sands or destroying rainforests to grow biofuels, it will continue. I just can't see nature lovers ever outnumbering auto lovers or becoming more powerful.

Of course, just by being alive I am part of the problem. How else could it be? I am a self serving yeast just as is Jay Hanson, James Lovelock, Al Gore, and David Suzuki, none of them has committed suicide either. The only non yeasty thing I ever did was decide not to have children. Beyond that, I am following the AMPOD path of not trying to save the world, but just trying to use the mechanisms of our society to build a lifeboat for extended family and friends so I can finish my days as a (relatively) comfortable yeast while the world continues to burn up.

= www.lifeaftertheoilcrash.net

If someone wants to make a difference then use all your resources to burn as much fossil fuel as possible. The growth of food production must be halted to limit the human race to its current numbers. :-)

There is still too much slack in the system and vastly higher numbers could be supported by all 6.5 billion becoming vegetarians for example. So eat as much meat and dairy as possible.

BTW I do not blame the poor countries for their problems; these countries and great civilizations were destroyed by the two destructive "Semitic Religions" Islam and Christianity.

- 3 - Judaism, Christianity, Islam

(you can't have Christianity and Islam without Judaism, a point explicitly recognised by Islam 'people of the book' to describe Christians and Jews)

- human beings of other religions (see various Chinese civil wars since 500 BC, Genghis Khan etc.) have contrived to destroy each other without help from Christianity

What you can say is the explosion of Christianity across the face of the planet 1500-1900 was an absolute ecological and human disaster for the peoples of the New World, Australia, Polynesia. Population collapses of as much as 90% and enormous loss of life. Let's not mention the Slave Trade (international, there already was one from Africa to the Arabs), the Opium Wars, the Indian Wars etc.

But I am only 50% inclined to blame Christianity. it wasn't the religion of Northern Europeans, it was a combination of technological revolution (that gave them a decisive military and political advantage), demographic explosion and a transformation of the economy.

And of course, our old friend the smallpox virus, which did more for the domination of the planet by Western Europeans than anything else.

That's 0.75%, or, as reported earlier this year: 50 cents in tax per $70 barrel of oil.

How long will that last? Even Albertans down the line are smart enough to see they're being ripped off royally.

And if the tax becomes 25%, how will that affect investment and production?

The whole scheme feels like ethanol subsidies: the taxpayer pays.

I still feel the most likely option for the oilsands is implosion. Hard to predict which factor will be the decisive one, but there's plenty choice. The pressure to develop too fast is enormous.

PS Nuclear has far too long a run-up time to mitigate the sharp drop in available natural gas, so much seems clear. Where oh where will the power come from?

Before ASPO, I spent the last 5 months traveling around Canada looking for land, hiking etc. Given global warming, increase in energy prices, decrease in energy availability, increase in societal special interest chaos, etc, my thought was canadian land and canadian girlfriend(wife) would be good long term thinking. During this search, I witnessed 2 VERY passionate rallies against local coal bed methane developments - as we pass the best first spots for fossil fuels, the places left are increasingly on native lands, or environmentally valuable areas and the public animosity towards increasing energy supply will be high. My guess is that oil companies are underestimating this, among other things.

Of course, 99% of those opposed to these projects arent doing much to reduce their own usage, they just want their cake and be able to eat it too.

And 'on average', I have found Canadian women prefer Canadian men (though on the value scale, I am probably more Canadian than American)

Did you know that Canadians use more fossil fuels than their US counterparts? I guess it makes sense given colder winters, and further distance between cities.

Canada is relatively highly industrialised compared to the whole of the US. Particularly in the area of raw materials: pulp and paper, mining, basic chemicals, oil sands, etc.

An example, California only uses 40% more electricity at peak than Ontario-- 50GW v. 30ish GW. But California has 30 million people (plus say 2 million illegals?). Ontario has about 11 million people. GDP per head in California is 50% higher than Ontario (roughly).

California summers are a lot hotter (but less humid, generally). Most people in Ontario heat with gas, so the winter peak is less relevant.

I think the main difference is Ontario is a major manufacturing centre: mining, automobile manufacture, basic industries like chemicals (the Sarnia belt opposite Detroit), pulp and paper. Also California electricity prices are a lot higher whereas Ontario has had perverse incentives to consume power.

Canadian women? Complex subject. The analogy to California is apt. Canadian women tend to be feminist (in both a small f and a Capital F sense). There are some quite good books out there about Canadians (Mondo Canuck, The Xenophobes Guide to Canadians, etc.)-- Canadians are in some ways very like Australians by which I mean very egalitarian, very 'PC' (perhaps that is less like Australians ;-), and tend to be quite collectivist relative to Yanks-- standing out is admired but also criticised. Also fairly straightforward.

And a Newfoundlander is not a Bluenoser (Halifax) is (of course) not a Quebecoise is not a Torontonian is not an Ontarian is not a Prairie Dog (Winnipeg) is not a Calgarian is not an Edmontonian is not a Vancouverite... regional differences matter in a country that is 3000 miles wide.

The Economist put it well (travel guide to Toronto)-- 'Canadians have a complex inferiority and superiority complex with regard to Americans. Tread carefully'.

As an American woman once said 'I would have had a lot easier time in Canada if someone had told me at the beginning that to a Canadian, I am YELLING every time I speak' ;-).

Your best route to living in Canada is actually the Immigration Canada points system. Trying to marry a Canadian, if you don't have a permanent work permit, is hard work.

Calgary is the destination du choix of the ambitious Peak Oiler. Edmonton is closer to the production, but oil industry HQ is Calgary. Sadly the city itself is absolutely not geared up for PO etc. A big urban sprawl of very large homes, spreading up the highways into the mountains. Traffic jams everywhere. Think Denver North.

I could never live in Calgary. Dead ecosystem from my perspective - I need contrast, water, and trees.

I know Eastern Canada much better than Western. Vancouver is a fantastic place, but expensive (not enough land for housing) and the career opportunities can be surprisingly restricted (big companies tend to HQ in Toronto, Montreal, Calgary). Also it rains pretty solidly from November through to April-- much more than London, say.

Toronto is urban sprawl personified and quite ugly for that-- the 401 Highway has 22 lanes at one point (11 each way) and at 4pm they are completely blocked with traffic. I love the place (because it is home) but I have heard it described by outsiders as 'cold, insular, smug, New York without the class'-- socially a very hard city to break into (quite London-like in that regard). Some of the downtown neighbourhoods are really cool.

Montreal is about learning French-- there are lots of successful immigrants in Montreal, but only the dying Anglo old guard doesn't speak French well enough to do business there. Probably the most European city in North America, though.

Edmonton is a nice place but is cold and comparatively bleak. Mountains and forests not so far away. And 'entertainment' can be as meaningful as spending time in the West Edmonton Mall (the world's second largest indoor mall, with its own fleet of submarines). Nice people, though. Taxes are way lower in Alberta than anywhere else in Canada.

Ottawa is a somewhat dull national capital. A great place for outdoors (skating on the canals, skiing in Quebec, cycling in summer etc.) and for families. Main industries are government and some hi tech (Nortel has seen tough times though).

As for 'implosion' of the sector - I highly doubt it.

Royalty/subsidy redress, NatGas usage, plus growth and environmental concerns are all factors that will culminate in a call for a moratorium on further production as has already been proposed.

I agree with you -the natives are restless- however so are the farmers and the latter represents a disproportionate chunk of the electorate and if they mobilize on water... watch out.

Farmers scream a lot, but they are driven by money like everyone else. My cousins lived their life selling off bits of the family farm to become new subdivisions in the fastest growing entity in Canada (Barrie, Ontario)-- such was Toronto urban sprawl.

Sure hope the folks at Alberta Sulphur Research Ltd. in Calgary are right in suggestinging that all of that stranded sulfur will be used for non carbon based energy before it is sequestered as liquid sulfur dioxide in sour gas fields along the Alberta foothills. The advantage will be that the SO2 will react with the H2S in situ to reform sulfur and water. The economically problematic sour gas field will be sweetened. Of course, the means of transporting that sulfur from the oil sands to the sour gas fields without using economically and environmentally inefficient unit trains and non existant rail lines has to be worked out.

The folks at SPI, LLC (www.freeflowingsulfur.com) urge that elemental sulfur should be transported from remote points of production to advantageous points of use or sequestration in liquid sulfur dioxide slurries by pipeline at ambient temperature without plugging and corrosion of prior art. The synergy of that solution will be an enhances utility and market value for sulfur dioxide coupled with production of hydrogen, sulfur dioxide, sulfur, and heat from mineral resource hydrogen sulfide now burdened with the necessity to avoid production of excess sulfur dioxide.

By the way, harvest of energy from one metric ton of sulfur

avoids emission of one metric ton of CO2 to the atmosphere. I would be pretty neat if the process is actually put to good use to manage energy intensity, sulfur and GHG production from Alberta's oil sands and sour gas production industry, eh?

Regards to all, 'Mud

Source: Alberta Advisory Cttee on Water, 2004

The figure breaks down the combined allocations for surface water (98% of the total allocation) and groundwater (2%). This is not to diminish the situation in locations without ready access to surface water, where adequate supply is a problem.

The technical deliberations of a large, multistakeholder monitoring committee do not indicate much impact on either surface water quality or quantity downstream of oil sands operations.

As I understand it an early stage in the oil sands upgrading process is, to heat the newly extracted bitumen, usually with natural gas. I have wondered, why not situate a refinery near the upgrader? That way one could heat the bitumen with resid produced by the refinery, and sell the lighter and high value products for profit. It seems so simple to me, there has to be a reason why no one does this.

Do you or or one of the other members who works in the industry, know the answer to this one?

The other problem is the long lead time between the start of construction and a project coming online. If anything has the potential to stop this work next to water shortage it is any potential carbon regulation coming in over the next twenty years.

The following quote from this article is a key factor in understanding some of the problems of the tar sands development.

"Bitumen is deficient in hydrogen, compared with typical crude oils, which contain approximately 14 percent hydrogen. To make it an acceptable feedstock for conventional refineries, it must be upgraded into higher quality synthetic crude oil (SCO), through the addition of hydrogen or the rejection of carbon, or both. (National Energy Board, 2000) Upgrading bitumen utilizes natural gas as a source of heat and steam for processing, and also as a source of hydrogen for hydroprocessing."

It takes at least energy and water to produce the required hydrogen. Using current technology for hydrogen production it also takes NG. Using NG for this purpose is definitely sub-optimal.

Given the current political environment in Alberta I expect that some steps will be taken in fairly short order to generate energy. Probably part of the solution will be to build several nuclear plants, primarily to generate steam to heat the bitumin and secondarily to make hydrogen using electrolysis for upgrading purposes. The electricity used to generate hydrogen would also provide "on demand" electric power to balance the fluctuations in generation from green power sources, especially wind. Check the link below from the Toronto Globe and Mail for a discussion of problems in balancing wind power generation and how these fluctuations limit the amount of wind power that can be added to a power system.

http://www.theglobeandmail.com/servlet/story/RTGAM.20061029.wwindd1029/BNStory/Business/home

If the wind drops, the shortfall in power generation could be replaced by diverting power from electrolysis to serving power customers.

The main points are that the Tar Sands are difficult, but doable and that it is unlikely that they will be enough to prevent Peak Oil.

So the relative effect on Oil Sands production will be there, but other forms of energy will also be more expensive (to a lesser degree as they are less CO2 intense).

I cannot see with Canadian politics (neither party can form a majority without Alberta unless there is a complete shutout in the East) that any Federal Government will do anything which will meaningfully retard oil sands development.

In addition, Alberta is gaining population, so I would assume it picks up Parliamentary seats (I don't remember how often they do the redistricting, but I think before the 2010 election?). At the expense of the Maritime Provinces, usually.

I also think Tom Harper is in for a very long run as Canadian PM-- this is a Canadian viewpoint in London watching events. I quite suspect he will be PM in 2015. The Liberals can't get their act together.

Tom Harper doesn't believe in Global Warming.

Actually it's "Steve" Harper according to Dr. Evil.

Urkhhh. Spot the ex-pat, seriously ex-pat.

I have met 2 Canadian Prime Ministers (not bragging here! just right place, right time), one after his retirement, one as a cabinet minister. Of the two, one from each party, Paul Martin was by far the most impressive,

oil/ bitumen / kerogen in the ground.

And the coal.

This planet is headed for an abrupt climate

change event on a scale that most people simply

cannot magine, and everything we do to try to

maintain business as usual brings that abrupt

climate change event another day closer.

Anyone who has any doubts about this should look

at what is happening in Australia right now.

There is talk of a 60% or 80% reduction in

agricultural production in the worst affected

regions (which also happens to be where the bulk

of the Australian population lives).

Do we really want to induce planetary meltdown

so we can keep driving to shopping, malls

for a few more years?

And summer has not even arrived yet!

Far-out, solid and right-on man, I look forward to your comments in drumbeat pointing out reality to us nerds.

You mean the Australian Ministry of Truth! I would not bother looking at any Aussie press (except maybe the Australian Financial Review as they have to tell business some truths but you have to cross-reference everything to find the important 15% bullshit factor for the benefactors' benefit). Everything is a lie in Australia and everybody knows it, nobody believes anyone and the smart ones are just shutting it all off. If you peak under the nice facade it's just too horrible to go on collecting that fiat paper they are throwing at us (i'm in resource rich Western Australia, it's going off) a carpenter who was working on a building site with me last week walked off without finishing as $1200/day was not enough.

We've got denial in Aussie but no water.

And the wheat harvest numbers will be for PR/spin only.

One last thing, we had a very interesting, possible peak oil related I think, thing happen politically recently. Our West Australian state premier Geoff Gallop suddenly resigned due to depression and to spend ........

He was reasonably popular, had no public scandals was a Rhodes scholar and very close friend of Tony Blair. And I want to know what he was told that freaked him out.

Bigcahunaau

It is dry here and the weather patterns have changed considerably (it's actually a bit nicer, though the ozone hole is creating a skin cancer nightmare this year) over the last decade, I'm a yachtie so take a lot of notice

But we don't have to worry about water, we're getting desal plants and nuclear power stations (and some bombs too if they really tell the truth).

bigcahunaau

Australia has cycled between being a lush rainforest and an entire desert over the past few hundred thousand years. No one seems to recognise that even without global warming, that climatic cyclicality is likely to continue.

Remember the hoopla when it was suggested a NSW (Queensland?) town was going to have to start recycling sewage water for drinking? No way Jose.

In fact one Liberal Senator was quoted as saying that 'realistically, some of these farms should never have been settled. We have to move these farmers to the new frontiers in Queensland and the Northern Territory'.

Note the pattern of this:

- recognition of a problem

- solution is to repeat the mistake - plough under another bit of the remaining Australian wilderness, to sustain low economic value added activities at untold cost to the environment, wildlife and habitability

It's a wonderful lesson in how humans repeat patterns and cope with problems by repeat behaviours and attitude (the Middle East, anyone?).Jared Diamond pointed out that the aborigines, with 30,000 years of adaptation to Australia's harsh (and oscillating) climate, managed a stable population of about 500,000 on the whole continent, pre white man.

What makes us think we can do any differently? I mean 20 times different, yes (10 million people), assuming continued access to cheap energy. But official Australian government policy is to grow Australia's population (from 20 million or so now?). And there seems to be no recognition that if there is water, using it to irrigate wheat fields is a poor use of it.

Not a promising start.

they are supposed to be using a lot less NG than on prior oil sands projects. Most of the posts seem to ignore this.

Unfortunately, there is a lot of hype in a bunch of the presentations by various people of many different technologies. And the figures are pretty fuzzy. Exxon-Mobil seems to be including bitumen in its oil reserve figures "proving" that we aren't running out of oil, while bitumen is a product that seems very much like the BS&W (bottom sediment and water) that we have to clean out of tank bottoms then pay to have hauled away in the oil field.

So I'll reserve judgement on this process until I see some figures, but it seems too good to be true. Like ethanol. Like biodiesel. Like the secret carberator that makes a car run on water, the tooth fairy and Conservative principles.

If oil goes to $100/barrel what will copper be? How about concrete? And steel? And clean water? And labor in Fort McMurray? And avocados in Edmonton? And a new helicopter to fly in Nexens board of directors?

If there is no inflation, then an increase in the price of one commodity or input is matched by decreases in the price of others (and some loss of output or investment).

Energy is 4% of world GDP. Say the price of energy in its raw form, doubled, to 8% of world GDP.

In practice, the world would make economies in other areas.

In particular, I suspect, consumer goods would be made to last longer: people would keep their cars and appliances another couple of years, they would trade up on their houses less often, they would take shorter or fewer holidays.

Businesses would adjust similarly.

The difficulty is the speed at which such adjustment might take place. A really big sudden oil price rise could lead to mass unemployment and financial crises.

It looks like they are taking a fraction of the Bitumen input to generate the energy required for the SAGD/Upgrader. As the NG cost is rising, the combustion/gasification of upgrading residue as a energy source will become more attractive. One issue is that these techniques increase CO2 emission significantly.

Of course these are off the top of my head figures and come from a guy who is a lot more familiar with art and poetry than tar sands. But those are the questions I have with the process, and with any other solution. Personally, investment in personal energy conservation looks like a sure thing compared to this stuff.

Its not comparable to wind or solar. Those produce electricity while synthetic diesel produces fuel.

The high labor cost has killed them financially.

I wasn't trying to suggest that electricity from wind and solar could do exactly the same tasks, but rather look at payback periods. The Long Lake operators were projecting an 8 year period to payout if oil prices rise again to 7$0,/bbl and this is far too long for comfort in a new technology.

THAI promises much lower capital costs and uses much less water and natural gas which are needed only in the pre-ignition warming stage of production. If this technology is successful it will result in a radical change in the economics of oil sand production.

From Petrobank's site:

What is the THAI technology?

THAI is a revolutionary new combustion process, that combines a vertical air injection well with a horizontal production well. During the process a combustion front is created where part of the oil in the reservoir is burned, generating heat which reduces the viscosity of the oil allowing it to flow by gravity to the horizontal production well. The combustion front sweeps the oil from the toe to the heel of the horizontal producing well recovering an estimated 80 percent of the original oil-in-place while partially upgrading the crude oil in-situ.

Colleagues of mine head up Klean Industries and they have a similar platform here: http://www.kleanindustries.com/s/Liquefaction.asp?ReportID=127918

If anyone has pertinent questions, I would be happy to submit them.

With the apparent peak of North American natural gas where are we going to get hydrogen? Composting the bull manure composing tar sands projects?

I suspect this is another pointless and futile effort to preserve the internal combustion automobile engine

There are many solutions avaliable.

The oil sands projects going over budget is nothing new. Large projects using unproven technology are always prone to going over budget. I can remember when they tried to used a drag line system on the tar sands. The damn thing seemed to break whenever it hit a rock embedded in the sand.

However, they haven't stopped building tar sands projects and making a significant profit on them because there is ample room for improving the efficiencies of the projects and oil prices keep going up. Once the project gets built, the cost overruns stop.

In particular, slide 6 shows the "mineable" area and slide 35 compares oil sands production costs to conventional oil production costs. On the latter topic, let's not forget the skyrocketing costs of deepwater Gulf of Mexico - $100 million per well, maybe hit something/maybe not, maybe a hurricane hits you! 10 wells = $1 billion.

tinyurl.com/yyz6rr

points to the above address

Thanks. A very interesting presentation.

A couple of things emerged:

- all tar sands deposits are not created equal. Athabaska, Great Canadian Oil Sands and Syncrude seemed to have grabbed a lot of the territory in the centre of those slides

Accordingly, one would expect lower quality deposits/ higher extraction costs for the later entrants

As to oil falling below $40, which is highly unlikely but not impossible, I suspect it would be temporary because either demand would pick up or supply would fall due to new projects being shelved. A mere blip in the 50 year lifespan of a tar sands project.

The biggest threats I see to tar sands development are environmental - global warming, water consumption, and the large scale land destruction caused by the mining operations.

Ft. McMurray city council has called for a moratorium on further development until they can sort their civic issues such as housing and utility delivery.

65,000 people living in a town built for 40,000 is a bit of a dilemma.

The problem is with uncertainty in that oil price whether those investments will be made.

Fort McMurray has been through booms and busts before. I had a friend who bought a house in a similar situation (Quesnel BC when the pulp price was high) and sold it at a loss many years later (when the pulp price was on its back).

that would make me very reluctant to invest in anything like permanent housing in FM.

There used to be a bumper sticker in mid 80s Calgary 'Please God give me one more oil boom-- and I won't blow it this time!'

Therefore price swings, even down below $40, are quite possible, even likely. Even in an environment of long run growing scarcity.

A 5% drop in world demand (proximate to a sudden recession, an outbreak of human avian flu, or a major unexpected war) would easily cause oil prices to fall below $40/bl.

On costs, yes, rising worldwide but because construction costs are such a large part of the cost of tar sands oil, they are disproportionately vulnerable.

Ontario alone is 40% of the Canadian economy.

The Bank of Canada would act to prevent any such extreme appreciation. In the first instance by cutting interest rates, in the second by such extreme measures as merging the Canadian and US dollar ('dollarization' as it is known in Central America).

Said differently, the tar sands is turning labor, land, clean water, natural gas and bitumen into crude oil, dirty water, and greenhouse gas emissions. Energy out relative to energy in doesnt quite capture this situation, but whether 6:1 or 3:2, it is low and will likely decline over time

(I do know the Pembina Institute has run the numbers on this, but remember all EROI analyses are snapshot in time combinations of a latent energy source married with an energy technology that harnesses it. Both the energy source and the technology will change over time.

I see a wide variation on maximum production, ranging from under 2 MBPD to 4MBPD. What will truly determine the tar sands oil/bitumen output is incremental capital cost per barrel versus projected market price.

About two years ago I recall the promoters of Alberta's tar sands saying that the oil could be produced for under $25 per barrel. Recently Shell has projected the cost of new production in the $40 to 45 per barrel range. With water problems unsolved and developement costs rising, the $40 cost may be too low. Commodity prices and labor costs continue to rise at a rate of several times inflation. If these drivers cause production cost to approach the projected price of oil (some say may fall to $40 per barrel and some say will hover at $60 per barrel for the near future), then I would doubt we will ever see more than 2 MBPD. The peak in that case would be way out, maybe 2040.

July 2006 Corporate Presentation

Oil sands: questions over rising costs

Once again I am in awe not only of your analysis of the subject but your ability on the whole as it may pertain to the subject of future oil production. A couple of questions pertaining to the analysis presented herein: 1. What is your "gut reaction" to the exponentional curves in the first graph as presented. Does this gut reaction tend toward skepticism? 2. As resources gravitate to the zero sum game of less exploitable energy will the competition of available resources slow the growth of the Tar sands as a whole.???? And lastly 3. Did you ever get that linerar data from USGS pertaining to geographical distance and probability of existance with regard to Saudi total country OOIP.

Regards TG80 sends

If the US government (or Canadian for that matter) was seriously committed to developing alternative transportation fuels in the timeframe allotted us vis-a-vis Peak decline; research, direction and funding commitment levels would reflect the prioritization needed for the task at hand - as is the case in Sweden.

We know what the consequences of Peak Oil will be.

Our governments know what the consequences of Peak Oil will be.

The Swedes know what the consequences of Peak Oil will be and their government is actively engaged in preparing the country for it.

Why aren't we?

Can anyone post this?

PO is a hypothesis (a hypothesis that most certainly will come true, but no one knows the true date).

GW is an immediate and present reality, with a truly unpleasant set of potential outcomes.

But dealing with GW is in the 'too difficult' category and the 'we can't do anything until the Chinese do something' category (aka blame the other guy for our own inaction).

you have a given amount of oil in the ground (except you don't know how much, but it must be somewhat less than the volume of our globe)

the sum of al the daily amounts of oil produced is finite, the daily amount increases up to a curtain point, but than the math starts kicking in: you can't keep increasing a sum with a finite limit.

So PO is just a discription of what will happen at some unkown point in the future, period.

As for China, the Committee would lose much face insofar as Chinese stewardship of the environment is concerned if and only if, the US were to prioritize GW mitigation as a national if not global cause; throwing her full industrial, scientific and technological might behind the endeavor.

Furthermore... I assert such an endeavor to be the only hope that America has for redeeming her honor.

By the way, a tiny nitpick on the article. Professor Kjell Aleklett is President of ASPO, not just a member.

The government recognizes and prioritizes the problem and is now actively encouraging the populace to participate.

This is called good governance and the endeavor is supported by both public and private entities including:

Royal Swedish Academy of Sciences

Ministry of Sustainable Development

Ministry of Energy

Tullverket

Saab

Volvo

SvenskBiogas

Gröna Bilister (among others)

I find it hard to believe that only 1% of the people are aware of such a large undertaking or why. Perhaps you could shed some light on the subject.

So while quite a lot of people are aware of the report, it has been framed more like a general environment thing. Peak Oil was not even mentioned by the media IIRC. This obviously shows the weakness and lack of focus in the report, which is also rather badly written.

Also there is no goal to replace all Swedish oil use until 2020, and even less replacing all fossil fuel use.

The goal is that there should be an alternative for the consumer to oil in all applications where it is used today.

The thing with this goal as that it had been reached long before the work of the Oil Commission began.

Heating: use biofuels or electricity or electrical heat pumps instead.

Industry: Same as above.

Electricity: Nuclear and hydro make up 95 % of Swedish power.

Transportation: use ethanol. That there isn't enough ethanol to replace oil is not relevant to the Commission as they didn't try to replace oil fully but only to make sure there are alternatives for the consumer.

http://www.eurotrib.com/story/2006/6/28/121437/097

And anyway we have a new government since the election in September. But I know from very reliable sources that the minister of schools is Peak Oil aware, and so are many CEO's in Swedish industry. For example Volvo have stated that they believe Peak Oil will happen in the next decade.

From this post and subsequent comments Tar Sands looks a lot like an energy sink. I hope that the next series including Natural Gas will shed more light on this.