A Yuletide Finance Round-Up

Posted by ilargi on December 24, 2007 - 9:20am in The Oil Drum: Canada

With economic uncertainty steadily increasing as 2008 approaches, we would like to offer best hopes for peace and a Merry Christmas to all our readers.

The United States is deep in its worst housing slump since the Great Depression, and according to a new report, it's not going to get better any time soon.In a new survey, Moody's Economy.com says many metro areas will record losses of 20 percent or more during the downturn, with the national median price for single-family homes dropping 13 percent through early 2009. Factoring in discount offers from sellers, the actual price decline would be well over 15 percent....

...."There has been a sea change in seller psychology since the subprime shock this summer," he said. "Sellers now realize they have to drop their prices to make a sale and prices are coming down very rapidly in some markets."

Crisis may make 1929 look like a 'walk in the park'

The Bank of England knows the risk. Markets director Paul Tucker says the crisis has moved beyond the collapse of mortgage securities, and is now eating into the bedrock of banking capital. "We must try to avoid the vicious circle in which tighter liquidity conditions, lower asset values, impaired capital resources, reduced credit supply, and slower aggregate demand feed back on each other," he says.

New York's Federal Reserve chief Tim Geithner echoed the words, warning of an "adverse self-reinforcing dynamic", banker-speak for a downward spiral. The Fed has broken decades of practice by inviting all US depositary banks to its lending window, bringing dodgy mortgage securities as collateral.

Quietly, insiders are perusing an obscure paper by Fed staffers David Small and Jim Clouse. It explores what can be done under the Federal Reserve Act when all else fails. Section 13 (3) allows the Fed to take emergency action when banks become "unwilling or very reluctant to provide credit". A vote by five governors can - in "exigent circumstances" - authorise the bank to lend money to anybody, and take upon itself the credit risk. This clause has not been evoked since the Slump.

Yet still the central banks shrink from seriously grasping the rate-cut nettle. Understandably so. They are caught between the Scylla of the debt crunch and the Charybdis of inflation. It is not yet certain which is the more powerful force.[..]

Citigroup, Merrill Lynch, UBS, HSBC and others have stepped forward to reveal their losses. At some point, enough of the dirty linen will be on the line to let markets discern the shape of the debacle. We are not there yet.

Goldman Sachs caused shock last month when it predicted that total crunch losses would reach $500bn, leading to a $2 trillion contraction in lending as bank multiples kick into reverse. This already seems humdrum.

"Our counterparties are telling us that losses may reach $700bn," says Rob McAdie, head of credit at Barclays Capital. Where will it end? The big banks face a further $200bn of defaults in commercial property. On it goes.

The collapse of the modern day banking system

Economists are beginning to publicly acknowledge what many market analysts have suspected for months; the nation's economy is going into a tailspin.

Morgan Stanley's Asia Chairman, Stephen Roach, made this observation in a New York Times op-ed on Sunday: "This recession will be deeper than the shallow contraction earlier in this decade. The dot-com-led downturn was set off by a collapse in business capital spending, which at its peak in 2000 accounted for only 13 percent of the country's gross domestic product. The current recession is all about the coming capitulation of the American consumer -- whose spending now accounts for a record 72 percent of G.D.P."

Most people have no idea how grave the present situation is or the disaster the country will face if trillions of dollars of over-leveraged bonds and equities begin to unwind. There's a widespread belief that the stewards of the system -- Bernanke and Paulson -- can somehow steer the economy through this "rough patch" into calm waters. But they cannot, and the presumption shows a basic misunderstanding of how markets work. The Fed has no magical powers and will not allow itself to be crushed by standing in the path of a market avalanche. As foreclosures and bankruptcies increase; stocks will crash and the Fed will step aside to safety.

In the last few weeks, Bernanke and Paulson have tried a number of strategies that have failed. Paulson concocted a plan to help the major investment banks consolidate and repackage their nonperforming mortgage-backed junk into a "Super SIV" to give them another chance to unload their bad investments on the public. The plan was nothing more than a public relations ploy which has already been abandoned by most of the key participants. Paulson's involvement is a real black eye for the Dept. of the Treasury. It makes it look as if he's willing to dupe investors as long as it helps his d Wall Street buddies.

Unfortunately, the Fed bailout has achieved nothing. Libor rates -- which are presently at seven-year highs -- have not come down at all. This is causing growing concern among the leaders of the central banks around the world, but there's really nothing they can do about it. The banks are hoarding cash to meet their capital requirements. They are trying to compensate for the loss of value to their (mortgage-backed) assets by increasing their reserves. At the same time, the system is clogged with trillions of dollars of bad paper which has brought lending to a halt. The huge injections of liquidity from the Fed have done nothing to improve lending or lower interbank rates. It's been a flop. The market is driving interest rates now. If the situation persists, the stock market will crash.

Little Surprise: Oil Prices Will Rise

Forecasts, Often Low, See Gas Increase of 10%

Oil-price prognosticators, bruised after an unusually volatile spell in the oil patch, have reached a rough consensus on next year: Oil will be even costlier, even if the economy cools.

Consumers are likely to pay a lot more at the pump, too. The Energy Department predicts that far higher average oil prices will force gasoline prices to even out at $3.11 next year, up 10% from the average price of $2.81 this year.

World crude prices have long tracked the thirst for oil in the U.S., which consumes about a quarter of the world's oil output. But recent months have shown how decoupled the oil market is becoming from the economic ups and downs of the world's largest energy consumer.

Even amid fears that the U.S. could slip into recession next year, world-wide consumption is expected to strengthen, driven mostly by more demand from Asia as well as from Middle Eastern economies awash in oil revenue. That, of course, will further tighten global supplies.

Forecasters are notching other lessons from 2007 in looking toward next year. One is that the almost irrational uncertainty that sent prices soaring to more than $98 in November from $69 in late August will last well into 2008."If I had to describe [2007] in one image, it would be dancing on thin ice," says Fatih Birol, chief economist at the International Energy Agency, which serves as an energy watchdog for rich countries. Global spare capacity is so thin, he says, "that any little thing now can influence price."

Financial firms have already been drenched by mortgage-related losses. Now a wave of litigation threatens to assail them. According to RiskMetrics, a consulting firm, between August and October federal securities class-action lawsuits were filed in America at an annualised pace of around 270—more than double last year's total and well above the historical average. At this rate, claims could easily exceed those of the dotcom bust and options-backdating scandal combined.At most risk are banks that peddled mortgages or mortgage-backed securities. Investors have handed several writs to Citigroup and Merrill Lynch. Bear Stearns has received dozens over the collapse of two leveraged hedge funds. A typical complaint accuses it of failing to make adequate reserves or to explain the risks of its subprime investments, and of dubious related-party transactions with the funds. Several firms, including E*Trade, a discount broker with a banking arm sitting on a radioactive pile of mortgage debt, are being sued for allegedly failing to disclose problems as they became apparent to managers.

But one thing that sets the subprime litigation wave apart from that of the 2001-03 bear market is its breadth. After the collapses of Enron and WorldCom, lawsuits were targeted at a fairly narrow range of parties: bust internet firms, their accountants and some banks. This time, investors are aiming not only at mortgage lenders, brokers and investment banks but also insurers (American International Group), bond funds (State Street, Morgan Keegan), rating agencies (Moody's and Standard & Poor's) and homebuilders (Beazer Homes, Toll Brothers et al).

Borrowers, too, are suing both their lenders and the Wall Street firms that wrapped up their loans. Several groups of employees and pension-fund participants have filed so-called ERISA/401(k) suits against their own firms. Local councils in Australia are threatening to sue a subsidiary of Lehman Brothers over the sale of collateralised-debt obligations (CDOs), the Financial Times has reported. Lenders are even turning on each other; Deutsche Bank has filed large numbers of lawsuits against mortgage firms, claiming they owe money for failing to buy back loans that soured within months of being made.

Pricing Probes On Wall Street Gather Steam

Regulatory investigations into mortgage-securities pricing are examining whether financial firms should have told the public earlier about the declining value of such securities and how they priced them on their books, people close to the matter say.

The regulators, led by the Securities and Exchange Commission, also are delving into whether Wall Street firms placed higher values on their own securities than those they placed on customer holdings, the people say.

"As in most investigations, the issue comes down to what did people know and when did they know it," said Mark Schonfeld, director of the SEC's New York office.

During the past several months, financial firms have announced more than $80 billion in write-downs on mortgage-related assets. This includes a $9.4 billion write-down by Morgan Stanley on Wednesday stemming from bad bets on such securities. Last week, UBS AG took a $10 billion write-down bringing its total for the year to $13.7 billion; Merrill Lynch & Co. has had write-downs of $7.9 billion, and more are expected. In all three cases, the firms added to the write-downs they initially announced.

One thing you can be sure of as this unraveling unfolds is that those who have been agrieved in one way or another will be looking to punish the guilty (as well as anyone else they feel is responsible, whether justified or not).

Moreover, the media will redirect its sights towards blameworthy acts and characters they had previously ignored, regulators will become increasingly focused on the interests of angry citizens (instead of the coddled industries they allegedly oversee), and growing numbers of prosecutors will look to capitalize on the career-enhancing prospects associated with bringing about a steady parade of white-collar perp walks.

As far as the legal profession goes, all I can say is: I'm bullish.

Lehman Faces Lawsuit by Australian Municipal Councils

Lehman Brothers Holdings Inc., the largest U.S. underwriter of mortgage-backed bonds, faces legal action by Australian municipal governments after the value of their subprime-related investments dropped as much as 86 percent.

Wingecarribee Shire Council, in the Southern Highlands in New South Wales state, is suing Lehman for "deceptive and misleading conduct'' in selling A$3 million ($2.6 million) of subprime-linked collateralized debt obligations, the council's managing director Mike Hyde said in a media statement today.

New York-based Lehman, which manages up to A$1 billion on behalf of 35 councils in New South Wales and Western Australia states, may face further action as the assets in its U.S. mortgage-linked product have declined amid a shakeout in global credit markets.

"We strongly deny the claims made in the press statement that we have not acted in their best interests, or that we have engaged in any misleading or deceptive conduct,'' Sinead Taylor, a spokeswoman for Lehman said, in an e-mailed note. "We have, however, not yet received any notification of any legal claims.''

SEC probing three dozen subprime cases: source

U.S. securities regulators have opened about three dozen investigations, including into such firms as UBS AG, related to the subprime market collapse, a person familiar with the matter said on Friday.

Among the issues the U.S. Securities and Exchange Commission is looking into is how financial firms priced mortgage-backed securities and whether they should have told investors earlier about the declining value of those securities, the source said.

Earlier, the Wall Street Journal, which first reported the news, said the SEC was also examining Morgan Stanley in addition to previously reported investigations of Merrill Lynch & Co Inc and Bear Stearns Co Inc.

The former chief executive officer of Fannie Mae says the Bush administration helped orchestrate an accounting scandal that cost him his job and that he wants to use White House documents to defend himself in a shareholder lawsuit.

Franklin Raines, who served as President Clinton's budget director, argues in court documents that the Bush administration felt the government-chartered agency wielded too much power in the mortgage industry. His attorneys say the White House pushed regulators to weaken Fannie Mae and triggered a $6 billion accounting scandal.

Raines subpoenaed the White House for documents in July. Justice Department lawyers will go before a federal judge Thursday to fight it.

Relying primarily on articles by financial journalists and the testimony of industry analysts, Raines describes in court documents an unofficial task force dubbed "Noriega" that was formed to weaken Fannie Mae and drive down its stock price.

Fannie Mae is the largest U.S. buyer and backer of home loans. It was created by Congress but is publicly traded. Raines says the Bush administration wanted to undermine confidence in the agency so it could push for tighter government controls.

Bear Fund Manager Probed on Withdrawal

Federal criminal prosecutors investigating the collapse of two internal hedge funds at Wall Street firm Bear Stearns Cos. are examining whether a Bear executive improperly withdrew money he had invested in one of the funds while making optimistic forecasts about the portfolio's prospects, people familiar with the matter say.

Weeks before the two funds began imploding in April, fund manager Ralph Cioffi moved about $2 million of his own money from the riskier of the two hedge funds into another internal fund with a separate investment strategy, these people say.

Mr. Cioffi's move effectively lowered his exposure to the riskier of the two failed funds when it was on the brink of significant declines, these people say. No other senior Bear executive invested in the funds, according to people familiar with the matter. A spokeswoman for Bear declined to comment.

Speaking to fund investors not long after the money transfer, Mr. Cioffi and a fellow fund manager still were publicly bullish about their two main funds, High-Grade Structured Credit Strategies Fund and a riskier sister fund.

As late as April 25, when they held an investor conference call, the two managers were telling investors that the amount of money investors were attempting to withdraw was lower than the amount of new money coming in, according to a lawyer representing investors who lost money in the funds.

Fraud Seen as a Driver In Wave of Foreclosures

Skyrocketing foreclosures are a testament to how easy it was to borrow from mortgage lenders in recent years.

It may also have been easy to steal from them, to judge from a multimillion-dollar fraud scheme that federal prosecutors unraveled here in Atlanta. The criminals obtained $6.8 million in mortgages from Bear Stearns Cos., including a $1.8 million mortgage to Calvin Wright, a New Yorker who told the investment bank that he and his wife earned more than $50,000 a month as the top officers of a marketing firm. Mr. Wright submitted statements showing assets of $3 million, a federal indictment alleged.

In fact, Mr. Wright was a phone technician earning only $105,000 a year, with assets of only $35,000, and his wife was a homemaker. The palm-tree-lined mansion they purchased with Bear Stearns's $1.8 million recently sold out of foreclosure for just $1.1 million. Bear Stearns, meanwhile, posted the first quarterly loss in its 84-year history as it wrote down $1.9 billion of mortgage assets yesterday.

Swiss banking watchdog snaps at heels of UBS

The leading Swiss banking regulator is preparing to investigate how UBS, the country’s biggest bank and the world’s largest wealth manager, ran up vast losses in the global credit crisis.

Alain Bichsel, a spokesman for the Federal Banking Commission, told the Swiss weekly Sonntag.CH that the regulator “will investigate how these enormous writedowns” arose, including “who was responsible for it”.He said that the commission was also increasing the pressure on the Swiss banking giant to bolster its capital base to overcome the credit crisis quickly. UBS said this month that it had been forced to raise its writedowns to about $14 billion (£7 billion) from a previously reported figure of $10 billion, making it one of the worst-hit victims of the global credit crunch. UBS, which had no immediate comment yesterday, already is the subject of an investigation by the US Securities and Exchange Commission into the mis-selling of sub-prime mortgage debt and the liquidity crisis that followed.

It was a painful lesson. In May – months before the words credit crunch became common currency – China’s fledgling sovereign wealth fund, China Investment Corporation (CIC), backed the flotation of the Blackstone private-equity group to the tune of $3 billion (£1.5 billion). The investment bought it a stake of almost 10%.

The timing was disastrous. As the summer unfolded and the credit crunch took hold, the value of private-equity funds slumped. Blackstone’s share price tumbled. CIC has made a paper loss of more than 20%.

But last week, the news that CIC is putting $5 billion into Morgan Stanley gave a new perspective to Chinese involvement in the West’s largest financial institutions. The sheer scale of the Morgan Stanley deal was striking. And over the past few months, investment from the Far East has become almost commonplace.China Development Bank and Temasek of Singapore pumped $4.4 billion into Barclays, securing a 5.2% stake. Citic Securities put $1 billion into Bear Stearns. The deal with Morgan Stanley is only the most recent of agreements to be struck. The Chinese dragon has become a familiar – and surprisingly welcome – presence on Wall Street.

Friday Night, Lights Out — Fitch Downgrades $5.3 Billion in RMBS

Keeping up with the downgrades on various subprime RMBS deals here at HW is turning into a full time job. (And one that requires plenty of coffee.) Here’s a list of the downgrades issued tonight by Fitch alone — remember, these are the downgrades issued just in one night at one rating agency.

Total downgraded dollar value: $5.3 billion.

$783.2 million downgraded from just one WaMu 2007 subprime deal — includes AAA downgrades, mortgages originated entirely by WaMu, 60+ day delinquencies at 9.17 percent. Stunning.

Fed to Offer Special Auctions as 'Long as Necessary'

The Federal Reserve will conduct biweekly emergency auctions of loans as "long as necessary'' as part of a global attempt by central bankers to restore faith in the money markets.

The Fed and European Central Bank loaned $30 billion in 35- day funds today at an interest rate of 4.67 percent, 2 basis points more than the initial special auctions four days ago. The rates are less than the 4.75 percent banks are charged to borrow directly at the Fed's discount window, suggesting the central bank is making progress in alleviating the credit crunch.

"The Fed finally gets it,'' said Andrew Brenner, co-head of structured products in New York at MF Global Ltd. "This allows the Fed to postpone easing, which they prefer due to inflation.''

Banks to abandon 'Super-SIV' fund

Plans to establish the "Super SIV" fund that would bail out battered off-book entities of big financial institutions appear doomed, sources close to the matter told CNNMoney.com Friday.

Banks such as Citigroup, JPMorgan Chase and Bank of America , which announced the creation of the 'Super SIV' in October, are expected to pull the plug on the plan due to difficulties in raising the needed cash.

The news, which was first reported by The Wall Street Journal, comes just days after the investment manager of the fund, BlackRock Inc., said that its launch was just weeks away.

Superfund collapse ‘embarrassing’ to Treasury

The collapse of the plan to create a $75bn “superfund” is embarrassing for the US Treasury, which backed the scheme, but is not likely to have big implications for financial markets, analysts and former officials said.

The idea – to create a fund to support liquidity in the market for housing-related securities – was killed off late on Friday when the banks behind the scheme abandoned it after other financial institutions showed little interest.

The former Goldman Sachs duo of Hank Paulson, the Treasury secretary, and Robert Steel, the under?secretary for domestic finance, helped to broker the original agreement to create the fund. The idea was to allow managers of structured investment vehicles (SIVs) and conduits unable to obtain refinancing from investors to run down holdings in an orderly manner without a fire sale of assets.

Merrill's Writedowns to Top $8 Billion, Analysts Say

Merrill Lynch & Co., the third- biggest U.S. securities firm, may post an additional $8.6 billion in writedowns of subprime-related debt during the fourth quarter, according to an analyst report released today.

The new writedowns would follow a third-quarter $7.9 billion reduction that the firm booked on the value of U.S. subprime home loans and collateralized debt obligations, according to David Trone, an analyst at Fox-Pitt Kelton Cochrane Caronia Waller. Trone's estimate is nearly double the $4.5 billion writedown predicted by Citigroup Inc. analyst Prashant Bhatia on Dec. 5.

Merrill ousted Chief Executive Officer Stan O'Neal in October after the firm reported a third-quarter loss, the first in the firm's 93-year history, after taking a total of $8.4 billion in writedowns, including $463 million on corporate loans. John Thain, the former NYSE Euronext CEO who succeeded O'Neal on Dec. 1, will probably report a second consecutive quarterly loss because of further markdowns, Trone and Credit Suisse Group analyst Susan Roth Katzke said.

U.S. Dollar's Credibility Being 'Stretched,' UBS Economist Says

The U.S. dollar's credibility as the world's benchmark currency will be put to the test as it loses value against other major currencies, said George Magnus, senior economic adviser at UBS Investment Bank in London.

"We're clearly at a point where credibility is being stretched, and we don't really know what comes afterward,'' Magnus said in an interview. Magnus said that while it's unlikely governments and companies in emerging economies in Asia and the Middle East are ready to "ditch the dollar'' and price assets in other currencies in 2008, the dollar is being "severely tested.''

Sovereign wealth funds are one example of institutions that are avoiding the falling dollar in favor of assets that will preserve their wealth, he said.

The dollar has lost value as traders bet the Federal Reserve will continue cutting interest rates to keep the housing slump from triggering a recession. It was down 7 percent against a trade-weighted basket of currencies from its biggest trading partners in the 12 months ended in November, based on Federal Reserve data.

"This is not something which we'll get closure on in three weeks,'' Magnus said. "It takes a long time for reserve currencies to be born and to disappear, but we can see a stretching of credibility.''

Bear Stearns Posts First Loss on Mortgage Writedowns

Bear Stearns Cos., the securities firm that helped trigger the collapse of the subprime market, reported its first-ever loss after writedowns for mortgage holdings and declines in trading and investment banking.

The fourth-quarter loss of $854 million, or $6.90 a share, was almost four times wider than the average estimate of analysts surveyed by Bloomberg. Moody's Investors Service cut the firm's credit rating one level to A2, the lowest since 2003. Bear Stearns, which has fallen almost 44 percent this year in New York Stock Exchange trading, rose 0.9 percent today.

Chief Executive Officer James "Jimmy'' Cayne and senior managers will forgo bonuses for the year after producing "unacceptable results,'' he said today in a statement. The $1.9 billion writedown wiped out the New York-based company's revenue for the three months ended Nov. 30. Lehman Brothers Holdings Inc., Morgan Stanley and Goldman Sachs Group Inc. posted gains for the quarter from trading stocks and advising on mergers.

The World's Largest Banks Are Now Trapped

The subprime mortgage crisis constitutes the worst banking error in my lifetime. Nothing else comes close.

It has visibly begun to unravel. The European Central Bank on Tuesday, December 18, opened a line of credit of $500 billion to commercial banks.

The Federal Reserve System under Greenspan was the prime instigator. It forced down short-term interest rates by supplying the overnight bank-to-bank loan market with sufficient liquidity to drop the rate to 1%. This encouraged banks to make loans at low rates.

These loans were short-term loans. The borrowers then went out and bought long-term assets: bonds and mortgages. This is known as the carry trade. The pioneering central bank in the carry trade was the Bank of Japan. It lowered short-term rates from about 7% in 1990 to just above zero in 1999, where it stayed until mid-2006. But the yen is not the world's reserve currency. The U.S. dollar is.

Through a complex combination of government-licensed monopoly (Federal Reserve System), implied government safety nets for mortgage investors (Fannie Mae and Freddy Mac), creative finance (asset-backed securities), and credit-rating services that were either stunningly naïve or compensated in ways not beneficial to objective analysis, brokers marketed a series of high-commission, fast-sale investment packages that sold like hotcakes until August, 2007. Then, without warning, they stopped selling.

Banks Study Bailing Out Struggling Bond Insurer

Officials from Merrill Lynch, Bear Stearns and other major banks are in talks to bail out a struggling bond insurance company that has guaranteed $26 billion in mortgage securities, according to two people briefed on the situation, because the insurer’s woes could force the banks to take on billions in losses they had insured against.

The insurer, ACA Capital Holdings, which lost $1 billion in the most recent quarter, has been warned by Standard & Poor’s that its financial guarantor subsidiary may soon lose its crucial A rating. If it did, the banks that insured securities with the ACA Financial Guaranty Corporation would have to take back billions in losses from the insurer under the terms of the credit protection they bought from the company.

Big banks seek ways to shore up the bond insurer ACA Capital

Officials from Merrill Lynch, Bear Stearns and other major banks are in talks to bail out a struggling bond insurance company that has guaranteed $26 billion in mortgage securities, according to two people briefed on the situation, because the insurer's woes could force the banks to take on billions in losses they had insured against.

The insurer, ACA Capital Holdings, which lost $1 billion in the most recent quarter, has been warned by Standard & Poor's that its financial guarantor subsidiary may soon lose its crucial A rating. If it did, the major banks that insured their securities with ACA Financial Guaranty would have to take back billions in losses from the insurer under the terms of the credit protection they bought from the company.

The troubles at ACA could also serve as the first real test for credit default swaps, the tradable insurance contracts used by investors to protect, or hedge, against default on bonds. In June, the value of bonds underlying credit default swaps rose to $42.6 trillion, up from just $6.4 trillion at the end of 2004, according to the Bank for International Settlemen

Food prices are climbing and Americans are seeing it on their grocery store shelves.

The price of food and non-alcoholic beverages rose 4.7 percent since the beginning of the year through November, outpacing the 4.3 percent increase in the overall cost-of-living, according to the federal government's Consumer Price Index.

Everyday foods like fruits and vegetables, beef, poultry and cereals are on the rise. The price of milk is the biggest culprit, with a staggering increase of 23.2 percent through November. And with basic foods like dairy and wheat driving up the cost of other groceries, almost everyone is feeling the pinch.

Families with children, who typically go through a couple gallons of milk per week and spend hundreds of dollars on other groceries, are especially vulnerable."Kids need a lot more food than we do," said John Mulhern, a grandfather and one of several shoppers who spoke to CNNMoney.com outside a Key Food grocery in Brooklyn. "So your hearts go out to young families, especially [those who] have multiple children. They're the ones who are hurting the most with the rising prices."

Bush sees 'storm clouds' over US economy

US President George W. Bush on Monday said the US economy was basically strong but warned of "storm clouds" in the form of a credit crunch and what may be a bursting housing bubble.

"This economy is pretty good. There's definitely some storm clouds and concerns, but the underpinning is good, and we'll work our way through this period," Bush said in a town hall-style question and answer session here.

The US president's comments came as part of a defense of his economic policies, especially the giant tax cuts of his first term, which he says stimulated the US economy out of a downturn, while critics note that they have fed a soaring US national debt.

Bush also acknowledged anxiety about a crisis in the once-booming US housing market, saying: "I am concerned, I know you're concerned, about the housing industry -- we all should be."

"We've been building a lot of homes, and all of a sudden fewer buyers are showing up. And it's going to take a while to work through the housing bubble, but we can mitigate some of the issues," he said.

The Commerce Department reported Friday that consumer spending surged by 1.1 percent last month, nearly triple the October gain. The gain reflected various promotional efforts by retailers such as heavy discounting and longer store hours at the start of the holiday shopping season.

The November advance was the biggest one-month jump since a 1.2 percent rise in May 2004 and was significantly above the 0.7 percent analysts had expected. Incomes were also up last month, rising by 0.4 percent, double the October increase but slightly below the advance that had been expected.

An inflation gauge tied to spending showed a 0.6 percent increase in November, the biggest jump in more than two years, reflecting last month's big surge in gasoline prices. Excluding energy and food, prices were up 0.2 percent. Core inflation is up 2.2 percent over the past 12 months, above the upper range of the Federal Reserve's comfort zone of 1 percent to 2 percent.

The big jump in spending came at a critical time for retailers -- the start of the all-important holiday shopping season. But there have been more recent signs that sales slowed in December.

Consumer spending is closely watched because it accounts for two-thirds of total economic activity. Many economists believe that overall economic growth will be at a barely discernible rate of 1 percent in the current quarter, as the country struggles with the fallout from the housing downturn and a spreading credit crisis that has made bank loans harder to get for individuals and businesses.

Feeling Pinch, Stores Woo Lagging Shoppers

Lackluster sales in this holiday season have retailers scrambling to wring a few last dollars from procrastinators by slashing prices, extending hours and wooing customers more persistently than last year.

The moves show that retailers' strategy during this final weekend before Christmas -- when about 10% of holiday sales are expected to take place -- has become increasingly reliant on the same promotions and marathon hours once unique to the "Black Friday" weekend following Thanksgiving. But the discounts also reveal the pinch stores are in this year as the credit crunch, rising gas prices and winter storms have taken a toll on companies dependent on end-of-year sales.

The tough economy has left aisles more empty this year. Total foot traffic at U.S. retail outlets took an 8.9% dive during the second full week of December, compared with the same period last year, according to an estimate from ShopperTrak RCT Corp., which bases its numbers on a formula that involves an electronic count of shoppers in malls and other retail outlets nationwide.

Inflation - China's lost battle

The problem of inflation is more serious than corruption, according to a survey of young Chinese leaders.

While some factors such as a government-mandated increases in diesel prices helped to push up CPI in November, the overall trend of money supply staying out of control is unmistakable. Look at the diesel story for example: the government mandated a price increase in order to reduce demand, a strategy that seems to have failed completely, going by anecdotal evidence from Chinese refiners.

The fault lines go back to another piece of data from China for November, namely surging export surpluses, which hit US$26 billion for the month, another record. A simple way of understanding the picture is to follow the dollars, putting yourself in the shoes of an average manufacturer of widgets in Shenzhen.

Say this seller of widgets makes a profit of $1 per widget sold at $100 each (this is a common manufacturing margin in southern China), total sales of $1 billion for the month would equate to a profit of $10 million. The moment the money comes in, the People's Bank of China, or central bank, would provide him with about 7.5 billion yuan (US$1.017,000,000) or so (assuming some degree of forward selling), of which around 75 million yuan would represent the manufacturer's profits for the month. The other money would be used to repay bank loans, pay for raw materials, electricity, employees and all the good stuff.

Of these, say for example that the money going towards raw materials is around 500 million yuan, and that for wages is 300 million yuan. In any normal economy, the 75 million yuan profit margin (900 million yuan for the year) would represent the new addition of money to the economy, which would contribute to inflation. Not so in China, as we see below.

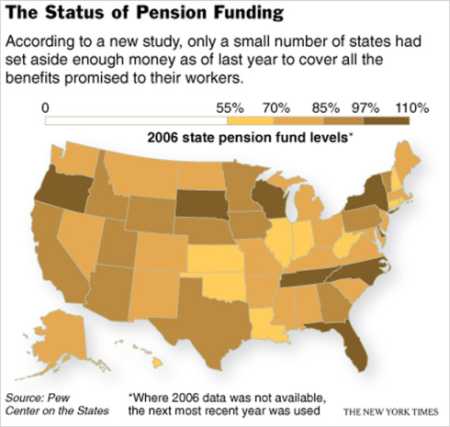

Pension Fund Shortages Create Hard Choices

Almost half of the states have been underfunding their retirement plans for public workers and may have to choose in the years ahead between their pension obligations and other public programs, according to a comprehensive study to be released to the public on Wednesday.All together, the 50 states have promised to pay some $2.7 trillion in pension and retiree health benefits over the next 30 years, according to the Pew Center on the States, which spent more than a year studying the issue.

The amount does not include separate retirement plans run by local governments.

While some states are managing their costs reasonably well, the center found that others, like New Jersey and West Virginia, have made serious mistakes and are now cutting education and health programs as they struggle with costs incurred decades ago.Still more states are at risk of being caught in a similar squeeze, the center said, because they are not setting aside enough money now, as their populations age and more public employees approach retirement.

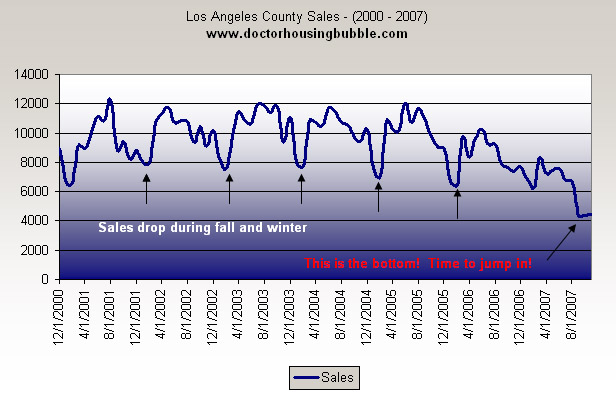

Sexy Bottom: The Naked Truth of the 10 Percent Southern California Housing Drop

I was driving to a meeting today and happened to catch a discussion of the Southern California housing market on NPR. It was a rather long discussion and they had various folks chiming in on the market. To my sheer astonishment, some of these people were asking if we have reached the bottom. Thankfully, it was the middle of the day and not much traffic was on the Los Angeles streets because I swerved a bit when I heard this question presented with a serious tone.

They also had a discussion regarding the Fed’s new proposed mortgage regulations; these are so draconian that you will actually need to verify your income and demonstrate that you can afford the mortgage you are getting. What is the world coming to! You mean people actually have to afford things they purchase without stuntman mortgages? Astounding.

As you may or may not know, DataQuick came out with their monthly Southern California housing report and the numbers are once again abysmal. I love how they titled the article “Southland prices fall again; sales perk up.” I guess this perk up is enough to give headway to a desperate housing complex searching for any semblance of a market bottom.

Top 10 U.S. Housing Markets Expected to Drop Composite 8% in 2008

Using the historical CME/Case-Shiller Median Home Price data and the CME Housing Futures that trade off of them, below we highlight charts of ten major cities with their expected 2008 price changes (% change from most recent actual data to the November 2008 futures contract). The blue lines are actual historical data points, while the red lines are the futures prices.

As shown, Miami home prices are expected to fall the most in 2008 at -14%. Miami is followed by Los Angeles (-12%) and Las Vegas (-9%). Chicago is expected to fall the least at -4%, while San Diego, San Fran, Denver and New York are all expected to fall 6%. The composite index of all 10 cities is expected to see declines of 8% in 2008.

UK: Half of mortgage lenders failed to pass interest cuts on to homebuyers

Half of mortgage lenders have failed to pass on the full benefit of the Bank of England's cut in interest rates to millions of struggling homebuyers.

The Bank's Monetary Policy Committee cut the base rate by a quarter point to 5.5 per cent two weeks ago, apparently throwing a lifeline to those with mortgages.

However, research by the personal finance website Moneyfacts.co.uk reveals that around half of lenders have so far failed to announce any cut.

Muni Insurance Worthless as Borrowers Shun Ambac

State and local borrowers are discovering that buying municipal bond insurance from MBIA Inc. and Ambac Financial Group Inc. is a waste of money.

Wisconsin sold $154.6 million of general obligation bonds last month at interest rates usually available only to borrowers with the highest credit ratings. Wall Street firms didn't require the state to insure the bonds, even though Wisconsin is graded four levels below AAA, amid signs that bond guarantors may lose their own top rankings.

"Either the Street or investors didn't see the underlying value of the insurance,'' Frank Hoadley, Wisconsin's director of capital finance, said in an interview.

Wisconsin, California, New York City and about 300 other municipal issuers sold bonds without buying insurance in recent weeks, avoiding premiums that are as high as half a percentage point of the bond issue, according to data compiled by Bloomberg. The amount of insured bonds sold fell about 15 percent in November from a year earlier, according to Thomson Financial figures cited in the Bond Buyer, an industry trade publication.

Municipal bonds are supposed to be a safe, boring investment for the risk-averse, but the credit crisis has shaken up even this quiet corner of the fixed-income market.

Rising concerns about bond insurers -- also known as financial guaranty firms -- have called into question a key layer of protection for many municipal bonds. That has spooked investors, who wonder if the munis they assumed were ultra-low-risk are still safe.

Bond experts say the vast majority of muni investments are still secure. However, individual investors should scrutinize their holdings carefully. Also, worries about bond insurance may complicate life for institutional investors and for government bodies that issue the bonds.

UK: No exit for Friends property fund

Insurer Friends Provident has told investors in its £1.2bn property fund that they must wait to access their money because of a market downturn. It said it had taken the measure to avoid having to sell commercial property such as shops and office blocks in a hurry at low prices.

Investors must now hold off for six months before being able to take cash.

The BBC's business editor Robert Peston said there has been a "collapse of confidence in commercial property". "The flight from property is a pronounced trend," he explained."Friends is the first fund to prevent retail investors cashing in, but other fund managers, including Schroders and UBS, have put a block on withdrawals by institutional clients," he added. "Their behaviour is rational, if alarming.

"Unless investors' demands for redemptions are stemmed, there would be forced sales of substantial properties," Mr Peston continued. "And such forced sales would precipitate a vicious, self-reinforcing downward spiral in property prices."

Ireland: House prices falling €1,500 a month

New figures show that house prices have fallen by 6% since the start of this year, following another sharp drop in November. The latest house price index, compiled by Permanent TSB and the ESRI, showed that prices fell by 1.1% in November after a 1.3% decline in October.

In the last 12 months, prices have fallen by 5.9%, with the average price of a house in November standing at €292,124, compared with €310,409 a year earlier. This means prices have been declining by an average of €1,500 a month throughout the past year.

End of easy cash: banks must take losses

The combined central bank injection of liquidity last week was impressive. Still, more than five months after the interbank market froze, banks’ thirst for cash seems unquenchable. The central banks have done everything they can to keep financial markets orderly. They took the risk of feeding the moral hazard beast and what did they achieve? So far they have avoided the much-feared “Big Crunch”, but the end of the tunnel is not yet in sight.

The time has come to ask the harder question: do commercial banks get it?

The big commercial banks hold mountains of cash, probably because they still have mountains of sickly off-balance-sheet liabilities that they are unwilling to acknowledge. Or it is because they fear that other banks are in that position and that this could trigger the Big Crunch. Or they just think that other banks think that way. Prudence is a much-needed virtue in banking, the more so because it has been forgotten in recent years.But the further cash injection will not provide the permanent solution: the return of interbank lending. For that to happen, banks need to be reassured about each other. Recapitalisation is the only solution. Three big banks – Citibank, UBS and Morgan Stanley – have shown the way in recent days. They remind us that large losses must be financed by fresh share issuance. It matters little who provides the cash. We should not let concerns about sovereign wealth funds stand in the way of a permanent solution.

Obviously, shareholders do not like the dilution of their stakes, but this is what shareholding is all about. If a company has suffered, or is about to suffer, heavy losses, its shareholders will have to bear part of the trouble. Delaying tactics prolong the misery without solving the problem, which will not go away.

Until all cards are put on the table credit markets will remain frozen

Sir, The financial mess we have faced for more than four months is a crisis of solvency, or solvency confidence, rather than a liquidity crisis. There is no shortage of liquidity in the world. In fact I would argue there is still a surplus.

The problem is that Bank A has balance-sheet problems and it is reluctant to lend to Bank B, which Bank A fears has even worse positions.

The feelings are mutual. No matter how low central banks cut rates or what innovative financing programmes they introduce, until all the cards are placed on the table, the credit markets will remain frozen.

The solution is in the regulators' hands. They should force banks, investment banks and near-banks to take all their sponsored toxic waste programmes onto their own balance sheets and then force them to mark all these types of assets to market. Arriving at a mark-to-market value is difficult.

Although I believe the ABX indices [a series of credit-default swaps based on bonds that consist of subprime mortgages] have been overstating the problem, they are the only thing that represents anything resembling "market value". This will result in the bankruptcy of some players but many more will be absorbed by financially stronger entities.

Crazy crisis may herald the end of new derivative folly

It is far too early to tell how the credit crisis will play out, but the year end is a good time to reflect on the lessons so far.

Most of the follies committed in successive credit cycles are depressingly repetitive. This time, though, there have been some genuinely new ones, which – with luck – ought not to plague us again.

First on the list come complex credit derivatives, of which the collaterised debt obligation, or CDO, is the obvious example. Not all credit derivatives are a bad thing. But if CDOs were abolished, the financial world would be a safer place.

Consider how the crisis is conventionally attributed to US subprime lending. As Alan Greenspan has recently remarked, this is slightly misleading. Subprime was part of the general craziness. If it had not provided the trigger, there were plenty of other candidates.

But in previous cycles, the subprime problem would have been clearly identifiable and thus contained. CDOs made it much worse, through what one might term the sausage effect. If a consignment of tainted meat arrives in the factory and is not spotted in time, the entire stock of sausages must be dumped. So it is with asset-backed CDOs in general.

Chrysler CEO: We're 'operationally' bankrupt

Chrysler Corp., the troubled automaker bought by private equity just four months ago, is scrambling to sell assets amid indications of huge losses, as access to cash becomes increasingly scarce, according to a published report Friday.

"Someone asked me, 'Are we bankrupt?'" the Wall Street Journal quoted Chrysler boss Robert Nardelli telling employees at a meeting earlier this month. "Technically, no. Operationally, yes. The only thing that keeps us from going into bankruptcy is the $10 billion investors entrusted us with."

To raise money, Chrysler is looking to sell over $1 billion in land, old factories, and other holdings, even if it has to let those properties go for under book value, the Journal said.

In an interview with the Journal, Nardelli confirmed the comments and declined to give a financial forecast for 2008, saying only that Chrysler "will make a pretty significant improvement" over the $1.6 billion the company is set to lose this year. The Journal said Nardelli originally hoped to turn a profit in 2008.

UK: Housebuilders dig in for deep freeze in residential property

The slide in house prices is gathering pace, a survey suggests today, amid signs that housebuilders are digging in for a prolonged residential property freeze. Tulloch Homes, a medium-sized Scottish housebuilder, pulled plans yesterday for a £200 million flotation, and Taylor Wimpey is understood to have ordered a halt to any new land acquisitions.

Estate agents across the UK have ended the year bemoaning falling prices, buyers in retreat and the declining chance of a speedy sale. The latest survey by Hometrack, the housing data company, suggests that values have fallen by 0.3 per cent since November, the third consecutive monthly fall and the largest in almost two years.

Year-end rally belies concern over credit outlook

Global equities ended the last full trading week of the year with a flourish, helped by reports that yet another leading US bank had secured investment from overseas to shore up its balance sheet. But the underlying mood remained cautious amid persistent anxiety about the credit outlook, in spite of massive injections of liquidity into the money markets by the world's central banks.

The European Central Bank stunned investors by pumping in €348bn ($500bn) in its two-week operation - twice the amount it had estimated would be needed - and there was strong demand at both of the Federal Reserve's auctions of term funds.

"Central bank action in the past few days has eased year-end funding pressures somewhat, helping money market rates to drop from their elevated levels," said Ben Bennett, credit strategist at Lehman Brothers.

"Despite this year-end easing, however, it is not clear how much conditions will improve going into 2008."

Pound hits record low against euro

The pound dropped to a record low against the euro of Friday as the prospects of a near-term cut in UK interest rates continued to weigh on the currency. This was despite retail sales figures, which came in slightly better than expected in November, showing a 0.4 per cent rise on the month.

However, analysts said the figures were supported by sharp discounting, indicating that retailers were becoming less confident in their pricing power and believed that there was an increasing need to offer incentives for consumers to shop.

Indeed most analysts expected consumer spending to slow markedly in 2008.

Yen Falls to Six-Week Low Versus Dollar as Credit Concern Eases

The yen fell to a six-week low against the dollar and declined versus the euro as concern eased that credit-market losses will deepen, boosting demand for higher-yielding assets funded by loans in Japan.

Japan's yen dropped this week against 14 of the 16 most actively traded currencies as U.S. consumer spending showed resilience and short-term borrowing costs fell. The dollar may extend gains next week against the euro and yen on a report forecast to show durable-goods orders rebounded, suggesting the economy is weathering the worst housing slump in 16 years.

"Conditions are falling into place for a weaker yen,'' said Nick Bennenbroek, head of currency strategy in New York at Wells Fargo Bank. "You are seeing some renewed interest in carry trades.''

In 1994, Congress passed a law requiring the Fed to regulate all mortgage lending. The language is crystal clear: the Fed “by regulation or order, shall prohibit acts or practices in connection with A) mortgage loans that the board finds to be unfair, deceptive, or designed to evade the provisions of this section; and B) refinancing of mortgage loans that the board finds to be associated with abusive lending practices, or that are otherwise not in the interest of the borrower.”

Yet, the Fed did nothing as junk lending proliferated — including loans that were unsustainable unless house prices rose in perpetuity, riddled with hidden fees and made to borrowers who could not repay. Mr. Greenspan has said that the law was too vague about the meaning of “unfair” and “deceptive” to warrant action.

The Fed has also disappointed since the current chairman, Ben Bernanke, took over in early 2006. It was not until the end of June 2007 — after the damage was done — that the Fed and other federal regulators issued official subprime guidance. On Tuesday, the Fed issued another set of proposals. Among those, subprime lenders would have to verify a borrower’s ability to repay and include mandatory tax and insurance costs in the monthly payment. In at least one key respect — enforcing the ability-to-repay standard — the proposal is weaker than earlier Fed guidance. Congress is considering other protections that are stronger in many ways.

When all the truth is out, the Fed will have company in the hall of shame. The Office of the Comptroller of the Currency, for example, blocked states from investigating local affiliates of national banks for abusive lending.

Credit Agricole To Take Further 1.6 Bln Euros Writedowns

French bank Credit Agricole announced late Thursday that it would take an additional write down to the magnitude of 1.6 billion euros. The company joins the list of financial firms that has come public about their bruises from their exposure to the tarnished subprime mortgage market.

The company noted that the write down is related to its super-senior CDOs. Additionally, the company blamed the predicament to the crisis the U.S. mortgage guarantor ACA Financial Guaranty finds itself in. The bank also indicated that the losses stem from stronger general provisions on credit instrument counter party risk. On a before tax basis, the writedowns amounted to 2.5 billion euros.

How to Invest in MBIA and Lose $20 Million a Day

Would that the days of simple leveraged buyouts were back.

The short, unhappy life of Warburg Pincus’ planned investment in bond insurer MBIA shows how difficult it is for LBO firms to make money now that there is no longer a market for the debt they used to use for company takeovers. That cheap debt, of course, not long ago could be counted on to help net such firms returns of 25% a year or more.

Warburg just 10 days ago agreed to invest as much as $1 billion in MBIA, whose stock already had been hammered by the subprime mortgage crisis. As part of the deal, Warburg agreed to spend $500 million for MBIA stock at a price of $31 a share.

The stock has slid steadily since then and is down more than 20% today on news that MBIA’s exposure to risky mortgage debt is much larger than some had realized.

With the stock currently trading at about $21, Warburg is looking at a paper loss of roughly $160 million. Given that there have only been seven full business days since the deal was announced midmorning on Dec. 10, that amounts to more than $20 million a day.

Saudi Arabia aims to take lead in sovereign wealth fund stakes

Saudi Arabia plans to establish a sovereign wealth fund that is expected to dwarf Abu Dhabi's $900bn (£454bn) and become the largest in the world.

The new fund will be a formidable rival for other government-owned investment funds in the Middle East and Asia, which are playing an increasingly active role in channelling capital to western companies, particularly financial companies hard hit by the US mortgage meltdown.

News of the Saudi plan comes as Temasek of Singapore is in "preliminary" talks with Merrill Lynch concerning a multibillion- dollar stake in the ailing investment bank, according to a person familiar with the matter.

"Merrill and Temasek have been talking for a while about this, although there are no indications that a deal is imminent," the person said. Temasek was also approached as a possible investor in UBS and Morgan Stanley, although the investment banks later struck deals with Government of Singapore Investment Corp and China Investment Corp respectively, the person said.

Fed Makes Auctions A Semi-Permanent Thing

The Fed's auction plan may not be a cure-all for the ailing markets, but it has some needed pumped liquidity into the financial markets.

On Friday, the Federal Reserve said its second auction of loans directly to banks was successful, with $20 billion lent at an average interest rate of 4.67%. During the first auction, which started on Monday, the Fed attracted 93 bidders, who were looking for $63.6 billion. In this second sale, demand had weakened somewhat, however, it was still higher than available funds.

The auction attracted 73 bidders, asking for $57.7 billion. Two more auctions are scheduled for January, but the Fed promised to continue holding the sales as long as "necessary."

Goldman's Blankfein collects $68M bonus

Goldman Sachs Chairman and CEO Lloyd Blankfein will take home nearly $68 million in restricted stock, options and cash, making it the largest bonus ever given to a Wall Street CEO.

Blankfein was awarded $26.8 million in cash and $41.1 million in restricted stock and stock options, according to a company filing with the Securities and Exchange Commission issued Friday.

With this year's bonus, Blankfein shatters the record he set a year ago, when he was awarded $54 million.

Subprime: Tentacles of a Crisis

Randall Dodd is a Senior Financial Expert in the IMF's Monetary and Capital Markets Department.

How could a modest increase in seriously delinquent subprime mortgages, which amounted to an additional $34 billion in troubled loans, so disrupt the $57 trillion U.S. financial system last summer that worldwide financial turmoil ensued? Lax, if not fraudulent, underwriting practices in subprime mortgage lending largely explain the rise in the rate of seriously delinquent loans from 6 percent to 9 percent between the second quarter of 2006 and the second quarter of 2007. But the impact on financial markets and economies far exceeds any expected losses from mortgage foreclosures.

The answer lies in the evolution of the structure of the home mortgage market. Over the past 70 years, it has changed radically from one in which local depository institutions make loans to one that is centered in the major Wall Street banks and securities firms, which employ the latest in financial engineering to repackage mortgages into securities through credit derivatives and collateralized debt obligations. Today's mortgage market depends critically on the ability to carve the debt into various risk segments through complex financial instruments and then sell those segments separately—the riskiest segments to high-yield-seeking, and sometimes highly leveraged, buyers such as hedge funds.

To understand how the mortgage market has changed—and to identify where the market broke down, show its structural weaknesses, and explain why the rupture reached across borders to other developed and emerging economies—requires an architectural tour of the U.S. mortgage market.

Debt crisis spreads to plastic

Americans are falling behind on their credit card payments at an alarming rate, sending delinquencies and defaults surging by double-digit percentages in the last year and prompting warnings of worse to come.

An Associated Press analysis of financial data from the country's largest card issuers also found that the greatest rise was among accounts more than 90 days in arrears.

Experts say these signs of the deterioration of finances of many households are partly a byproduct of the subprime mortgage crisis and could spell more trouble ahead for an already sputtering economy. "Debt eventually leaks into other areas, whether it starts with the mortgage and goes to the credit card or vice versa," said Cliff Tan, a visiting scholar at Stanford University and an expert on credit risk. "We're starting to see leaks now."

LATE TIMES

• The value of credit card accounts at least 30 days late jumped 26 percent since October a year earlier to $17.3 billion

• Defaults increased by 18 percent to almost $961 million

• Some of the nation's biggest lenders reported increases of 50 percent in the past year in the value of accounts at least 90 days delinquent.The value of credit card accounts at least 30 days late jumped 26 percent to $17.3 billion in October from a year earlier at 17 large credit card trusts examined by the AP. That represented more than 4 percent of the total outstanding principal balances owed to the trusts on credit cards that were issued by banks such as Bank of America and Capital One and for retailers like Home Depot and Wal-Mart.

At the same time, defaults — when lenders essentially give up hope of ever being repaid and write off the debt — rose 18 percent to almost $961 million in October, according to filings made by the trusts with the Securities and Exchange Commission.

US housing crash set to deepen in 2008 as realtors see record drop

For US homeowners, builders, bankers and realtors, the crash of 2007 will only get worse in 2008.

Everyone from mortgage-finance company Fannie Mae to Lehman Brothers Holdings Inc expects declines next year.

Existing home sales will drop 12% and existing home prices will fall 4.5%, Washington-based Fannie Mae says. Lehman analysts estimate almost 1mn mortgage loans will default in 2008, up from about 300,000 this year.“We’re only halfway through the housing shock,” said Ethan Harris, chief US economist at New York-based Lehman, the fourth-biggest US securities firm by market value. “It’s just a matter of time before the weakness spreads to the rest of the economy.”

The housing market collapse has been anything but the “soft landing” that Federal Reserve Bank of San Francisco President Janet Yellen and David Lereah, former chief economist at the National Association of Realtors in Chicago, predicted for real estate at the start of 2007. [..]

Investment in UK commercial real estate may slump 60% in the fourth quarter as buyers shun large acquisitions of shops and offices, Chicago-based Jones Lang Lasalle Inc, the world’s second-largest property brokerage, said on December 10.

Spending on British commercial real estate, Europe’s largest investment market, may decline in the final three months of the year to £5bn ($10.2bn) from £18.6bn a year earlier, Jones Lang said in a statement. Investment for all of 2007 may fall 24% to about £48bn.

Harper Rejects Debt Bailout, Putting Pressure on Canada Banks

Canadian investors holding $33 billion in short-term debt that plunged in value will have to rely on commercial banks for support after Prime Minister Stephen Harper said he won't bail them out.

"If the government became the day-to-day underwriter of market risk in commercial securities markets, that's a bottomless pit,'' Harper said in an interview in Ottawa. A government rescue wouldn't be "healthy for the long-term growth of the Canadian economy.''

Harper's refusal to shore up the market for asset-backed commercial paper -- 30- to 90-day securities backed by car loans, credit card debts and mortgages -- leaves holders at the mercy of the country's biggest banks. Some banks have already expressed reluctance to provide support and are resisting pressure from the central bank.

When world powers invest like hedge funds

The International Monetary Fund estimates that sovereign funds control as much as $3 trillion in assets, up from $500 million in 1990, and it expects them to grow to $10 trillion by 2012.

While cross-border investments are nothing new, the sovereign funds raise special questions because the investment decisions are controlled by governments rather than individuals or corporations. And, unlike central banks, which tend to invest reserves in assets like U.S. Treasury bonds, the sovereign funds often invest in corporations. This year, the largest target country for such investment has been the United States.

The 20 largest sovereign wealth funds, each worth more than $10 billion, are estimated to control more than $2 trillion in assets, overshadowing the $1.5 trillion thought to be managed by hedge funds, which have been subject to calls for greater regulation because of their market clout. Like hedge funds, most sovereign funds are secretive. There is no comprehensive list of what they own, nor any mandatory reporting of their investment policies.

China Less Willing to Be America’s Piggy Bank

For the last three years, China has been the financier that kept the American government well funded. In 2004, it bought a fifth of the Treasury securities issued, a proportion that rose to 30 percent in 2005 and to 36 percent in 2006.

But according to United States government figures, China reversed course in 2007 and has become a net seller of Treasury securities. The Treasury said this week that China had $388 billion in Treasuries at the end of October, slightly less than it had at the end of 2006.

The sales, if the American estimates are correct, have come in a year when the dollar has been weak against most currencies. The sales would be consistent with China’s diversifying its investments into other currencies. But the figures may be misleading.

For one thing, other Treasury estimates show that the Chinese are still increasing their holdings of bonds issued by quasi-government agencies, like Freddie Mac and Fannie Mae, and by American companies. Even including those purchases, however, the rate of increase of Chinese holdings of dollar-based securities seems to have slowed.

This and Drumbeat are my favorite things on TOD.

Yes. The wide-ranging, thoughtful discussion here is like being with friends before battle. After years of lurking and preparing as best I can (which is not very much), a major benefit of these sites for me now is psychological. Often, I think of Kipling's poem:

In this vein, Kunstler tells this story today:

He continues by discussing Orlov's thesis that:

My wish now is simply to keep my head.... ;-)

The russ expected hardship...expected things to get worse..this is a part of their world view.I have had friends who were russ,and now a Georgian.The Georgian is at a loss...he came to the usa to escape the civil wars that seem to be brewing right below the surface @ any given time.He has children here now and hopes he made the right choice....

I am trying to keep my head.The world is becoming uglier,and more ugly.I am starting to wonder when the axe will start Its chop chop chopping at my place of employment.We are a firm that primarily performs inspection in new,{and old} construction.If there is not a LOT of construction,its hard to keep 90 inspectors busy.... one good thing is I have been here a LONG time {19 yrs}and have a fairly good reputation,and grip on my seat at the table...such as it.We shall see...

We still have a few big projects,and enough work for now....6 months from now,maybe not

And once again,thank you for this "pile of trials".I always look for these posts

ditto

Merry Christmas.

When idiots get elected to office we get outplayed on the international stage. What's even more of a problem is that every potential candidate other then Ron Paul is even worse then what we have now.

LINK

First off thanks to the both of you. You should both hold out until someone gives each of you a raise.

Wait a minute.... how do you get paid for all this work anyhow? Well Please stop in for your free soup and as a bonus a free baguette. It's all I can offer but less than you deserve.

So let me know if I'm even close...

Fiat currency = money for nothing

People figured this out and tapped in, making money without producing anything.

Eventually we reached a point where more than half the population/work force were active in these non-productive activities.

At that point there is not enough productivity to provide the lifesupport elements required to maintain the population at any price and demand destruction kicks in BIG TIME.

Most of what the financial annalisis hash out these days is simply the effects of this reality, not the cause IMO.

If dollars make dollars why would anyone bother to make anything else?

Thanks, and a happy Christmas/New year to all of you

Somebody annually says "this is the best Christmas ever". I feel like this may actually be true this year. I've never felt this way before - It will be interesting to see the state of the world in 12 months.

Well, let's enjoy it while we can! - Thanks and best wishes to all of you who are researching and collating for the rest of us.

Hope for the best, plan for the worst.

Was there ever a more appropriate expression?

Perhaps "May you live in interesting times"!

Bryan

If THIS is true, it will leave a big mark.

The banks at some point have to do this to stay within regulations,

This is a fun website, just to watch the UK contraction:

http://propertysnake.co.uk/

Many property reductions so far are simply pricing errors, but I expect it will get more frantic over time.

Happy New Year - and thanks for the finance round-ups.

Methinks a new greater depression is unavoidable. 2008 will be a very interesting year.

Good Year to you all

from Swede