Oil prices or subprime losses?

Posted by ilargi on December 22, 2007 - 10:57am in The Oil Drum: Canada

On Thursday, Dec 20, the Chicago Tribune published a column by Bill Barnhart that made us think: “oh, really?”

We decided to put the issue before our readers. First, here’s the essence of his argument:

Oil prices will swamp subprime as market driver

Here's my fearless forecast for 2008: The subprime mortgage mess will be far less important to investors next year than the price of oil.

The reason is simple: We don't sell our homes once a week, but that's about how often we fill up our gas tanks.

Lower house prices, widely forecast for next year in the aftermath of the mortgage debacle, sound ominous. Wealth will be lost on paper for many homeowners and in reality for those who sacrifice home equity through sales or foreclosures.

But as a general theme for next year, trends in personal income and spending will be more influential in determining the investment climate than will trends in personal wealth, as represented by home equity. Note: Mr. Barnhart talks about investors, not consumers.

As you may have noticed, TOD:Canada focuses quite a bit on finance issues lately. Many people wonder if that is appropriate on a forum/blog set up primarily to deal with energy issues. We argue that the two cannot be separated at will.

We see a three-pronged problem staring us in the face, which can be defined along the lines of Peak Oil, Peak Climate and Peak Money. And just like people interested in peak oil often also read a lot about climate issues, they increasingly read, and comment, about the credit crisis as well.

Therefore, we thought that Mr. Barnhart’s statement that in 2008 oil prices will trump the credit crunch, is a good way for you to let us know how you feel about all of this. First, about the focus on finance at TOD:Canada, and second, about the statement in question:

The subprime mortgage mess will be far less important to investors next year than the price of oil.

We don’t want to lead you too much, but we did do a little digging to provide a first impression. We restrict ourselves to the US in this case, since that is Mr. Barnhart’s home turf, but we might also have taken Canada, of course. It makes little difference for the overall picture.

To start off with, oil prices. We turned to the Federal Highway Administration for data on US gasoline consumption.

US Department of Transportation: Federal Highway Administration

Passenger cars and other 2-axle 4-tire vehicles

Motor-Vehicle Travel: (millions of vehicle-miles)

- 2005: 2,749,555

- 2004: 2,727,054

Number of motor vehicles registered

- 2005: 231,904,922

- 2004: 228,275,978

Average miles traveled per vehicle

- 2005 11,856

- 2004 11,946

Average fuel consumption per vehicle (gallons)

- 2005 601

- 2004 608

Average miles traveled per gallon of fuel consumed

- 2005 19.7

- 2004 19.6

Let’s put vehicle miles for 2008 at 2.800.000 million, or 2.8 trillion.

We can then calculate:

Total fuel consumption: 240 million vehicles x 600 gallon= 144 billion gallons.

Or, alternatively, 2.8 trillion vehicle miles/19.7 mpg= 142 billion gallons.

Let’s take the “high road” and make it 150 billion gallons.

Average US gasoline prices, as per the EIA, Dec.17, 2007, were pretty much right at $3 per gallon. Which means a total cost of $450 billion.

Now, let’s take a few possible price increases for 2008 and do the math:

| Increase % | Increase $ | New price | Total extra cost |

| 20% | $0.60 | $3.60 | $90 billion |

| 33% | $1.00 | $4.00 | $150 billion |

| 50% | $1.50 | $4.50 | $225 billion |

| 100% | $3.00 | $6.00 | $450 billion |

Since most Americans shiver at the thought of even a $1 price hike per gallon, let’s be kind and take that as our starting point. This means an extra $150 billion will have to be forked over at the pump to keep driving the same way and distance. There will also be effects on food prices and other costs, but they are much harder to calculate, so for the sake of simplicity we have left them out.

The question then is: how does that $150 billion relate to the potential losses in what Mr. Barnhart calls the subprime mortgage mess? NB: we assume he means the overall credit crunch when he says subprime, since it’s becoming clear that subprime mortgages are but a part of the credit problem.

The price of a home a year from now is as hard to foresee as the price of a gallon of oil, and there are many different voices, as expected. So we go to the top, the Fed, and to a few “graphic graphs”.

For data on housing in the US, we turn to the Federal Reserve Economic Symposium in Jackson Hole, Wyoming, Aug-Sep 2007.

Robert Shiller, Yale University Professor of Economics, said in his speech at the symposium:

The examples we have of past cycles indicate that major declines in real home prices — even 50 percent declines in some places — are entirely possible going forward from today or from the not too distant future...

Martin Feldstein, Professor of Economics at Harvard University, referred to Shiller in his speech:

Bob Shiller's analysis began with the striking fact that national indexes of real house prices and real rents moved together until 2000 and that real house prices then surged to a level 80 percent higher than equivalent rents, driven in part by a widespread popular belief that houses were an irresistible investment opportunity. How else could an average American family buy an asset appreciating at 9 percent a year , with 80 percent of that investment financed by a mortgage with a tax deductible interest rate of 6 percent, implying an annual rate of return on the initial equity of more than 25 percent?

But at a certain point home owners recognized that house prices – really the price of land – wouldn't keep rising and may decline. That fall has now begun, with a 3.4 percent decline in the past 12 months and an estimated 9 percent annual rate of decline in the most recent month for which data are available. The decline in house prices accelerates sales and slows home buying, causing a rise in the inventory of unsold homes and a decision by home builders to slow the rate of construction. Home building has now collapsed, down 20 percent from a year ago, to the lowest level in a decade.

[..]If house prices now decline enough to reestablish the traditional price-rent relation – recall Shiller's comment that a 50 percent decline in real house prices is "entirely possible" – there will be serious losses of household wealth and resulting declines in consumer spending. Since housing wealth is now about $21 trillion, even a 20 percent nominal decline would cut wealth by some $4 trillion and might cut consumer spending by $200 billion or about 1.5 percent of GDP. The multiplier consequences of this could easily push the economy into recession.”

A 20 percent national decline would mean smaller declines in some places and larger declines in others. A homeowner with a loan to value ratio today of 80 percent could find himself with a loan that exceeds the value of his house by 20 percent or more.

Robert Shiller is known also for his index of US housing prices, which produced this graph:

click to enlarge

There are more graphs on the same topic, and with similar trends:

This one from Patrick.net, based on New York Times data:

"Why Your House Could be Worth 43% Less by 2011“

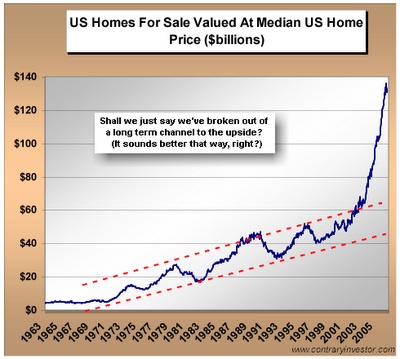

And the starkest of them all, from ContraryInvestor, 2006:

Ed: That is one strong trendline.

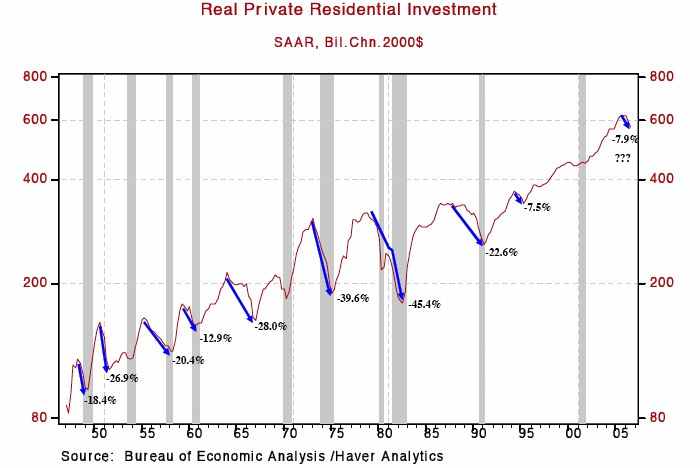

And last, Paul Kasriel, Senior Vice President and Chief Economist for Northern Trust, who produced this graph in Dec 2006:

The “Carry” Trade in U.S. Housing Looks to be Over (PDF)

Click to enlarge

Chart 3 shows the peak-to-trough percentage declines in the GDP line item, real residential investment. In the prior nine housing cycles, the average peak-to-trough decline is 24.6%; the median is 22.6%. The peak-to-trough decline to date in the current housing recession is 7.9%. Unless this turns out to be a more moderate than usual housing recession, unlikely given the amount of speculation and leverage involved in the boom, then we have “miles to go” before we can put this housing recession “to sleep.”

To summarize, we know that IF gas prices at the pump rise by $1 per gallon, the public will have $150 billion less to spend on other purchases. Following Mr. Feldstein’s speech, we see that home prices would have to fall by 15% to cut consumer spending by the same $150 billion. Which of the two is more likely to happen?

That’s what we would like you to respond to.

A tricky side-note: Mr. Barnhart in his column talks about investors. We know that for home prices to cut consumer spending by $150 billion, $3 trillion in “wealth” will disappear. There doesn’t seem to be an equivalent wealth effect from oil prices.

I have found the focus upon the financial problems to have been extremely valuable. It's put the value of ELP into immediate perspective.Additionally, the coverage has given me a handle on what's really happening in the financial world.

That knowledge isn't available at the time in the mainstream press. I only see it there months later when problems predicted in articles linked here appear :)

I agree that peak energy is intimately bound with peak money and therefore the broad financial focus is on topic.

It may well be that these problems end up hiding the peak for some years.

I think the home price fall is more likely than the doubling of oil prices. I think it's likely that the developing US recession will impact upon world demand. Consequently, oil prices are less likely to double than they would be if the economy was going gangbusters.

Well, there is the missing elephant that Barnhardt alludes to -assuming that the $150 billion in lower consumer spending is correct, the 15% drop in home prices equates to over 2 trillion in lower 'wealth', which even if its on paper not only changes peoples spending habits, but corporate investment (on wind, oil, etc) as well. (oh - just noticed your tricky side note.....yes, tricky..)

Conversely, the average person does not undergo lower 'wealth' from higher oil prices, because people don't hold (or maintain short hedges) on oil assets. Unless one does a discounted cash flow analysis of some sort...etc.

Interesting analysis! Thanks.

Whether fuel prices rise or not is not the main issue.

What those prices are based on is.

Everything will adjust around the fuel price.

In other words, fuel price is the index.

It's no accident that GM/Delphi/Delta defaulted at the same time that crude production peaked.

The worry is people giving up their homes to maintain

their credit.

Depression is here.

Tell that to the Nasdaq

Count me on that list. My house sale closed on the 12th. I'm writing checks like mad to pay off all debt. Under the economic circumstances (& prognostications) discussed here on TOD, plus my own intuition, I'm quite happy to be taking these steps.

Already people I've spoken to even casually in the last week about the sale respond with variations on "you're one of the lucky ones."

Count me in also. I first truly learned about Peak Oil back in January of this year. What I learned and was hearing, especially concerning the connection between peak oil and finance, impressed me so much that I put my house up for sale at a discount in August, asked for a job transfer, and moved 1000 miles away to a more favorable city. The sale of my former house closed at the end of September, and I was sweating bullets the whole time. This was during the first explosions in the subprime market, by the way! The real estate lady who sold that house told me afterward that mine was one of the few houses she had been able to sell. I now have a smaller, less expensive house, but it's on a bigger lot. I am preparing to pay off my loan next month, and am sheet-mulching the backyard so I can start a garden.

I believe that in 2008 we will see both increasing failures in American finance and hikes in fuel prices due to declining oil production. I happen to believe that the recent Energy Watch Group peak oil report is correct. And I also happen to believe that we are beginning to see some more advanced signs of failure and collapse in American society. There was a story on either TOD or Energy Bulletin this week about increasing foreclosures and "Hooverville" tent cities springing up to shelter those forced out of their houses. It would be interesting to do a rigorous mathematical analysis of the month-by-month changes in the numbers of foreclosures per thousand houses in various cities, as well as the total percentages of vacant homes in communities on a monthly basis. The analysis could also include the crime statistics on a monthly basis for the communities with higher foreclosure rates. The crime statistics would need to be broken out in categories, such as vandalism, stealing of building materials, squatting, and so forth. Such an analysis would give us a clearer picture of the magnitude and spread of the worsening financial problems in the United States.

http://features.us.reuters.com/cover/news/D8C99CD0-AF35-11DC-9E67-616F0D...

Where are you located now, and for what reasons?

southern Oregon is asking

Southern Oregon seems like a good place to be. I'm a bit farther north, in a city known for its bike culture (you can probably guess where by that clue). I chose the place because my company has an office in a nearby suburb, and I am able to get to work by a combination of bicycle and bus or MAX. Also, house prices were quite a bit cheaper than they were where I was living before. And there seems to be a much more self-reliant, environmentally conscious attitude here compared to where I was before. However, there is also a significant portion of the population which appears to want to turn this place into another Southern California.

By this I mean idiots who drive monster SUV's and trucks and people who want to subdivide their land to build more McMansions. One of the first things I did when I got here is register to vote so that I could vote for Proposition 49, which passed :).

This area also has some long-term challenges. One is the weather (it rains a lot. Also, it rains. By the way, did I mention that it rains?). This poses difficulties in harnessing solar energy to serve cooking and heating needs. I put up a clothesline shortly after moving here and have used it perhaps a dozen times since.

There is also a problem with our mass transit. It seems that policing and enforcement of order on the MAX and on the TriMet buses has been lax lately. There were articles in the local paper about assaults on citizens perpetrated by wanna-be gangbanger teens. But there has also been, encouragingly, increasing public outcry over the lack of law enforcement attention, and I think things are starting to change. Our public transit will be a critical strategic resource over the next few years, and it should be treated as such by our local government.

Where were you before ?

I'm looking to relocate in Dec. '08 from SE Nebraska. Even knowing where not to go would have value to me.

If you are interested in relocating, there are some interesting perspectives from John Michael Greer's "Archdruid Report" blog. A couple of his posts are especially relevant, namely, "Lifeboat Time" on 29 November of this year, and "Cities in the Deindustrial Future" on 8 August. He suggests moving to towns or cities which are compact enough that you could get around to most essential places without a car. He does not advocate moving to a wilderness holdout with a few tons of canned goods, a Winchester and 500 rounds of ammunition. The advantage of a town or small city is that it is already established as a community, with a pre-existing web of order and social services which could survive fairly well in an era of resource shortage. I think there are many viable small towns and cities in the upper Midwest, with fairly low prices for existing homes. In fact, I was looking at North and South Dakota, but my company did not have any offices there.

I used to live in So. California. It is a thoroughly ruined place in my opinion, and will probably be unable to support itself if things get as bad as some say. The same goes for many cities in the Sunbelt, which are terminally dependent on auto transport, crowded to the gills with McMansion developments and strip malls. Most of the farmland and dairys in Los Angeles and Orange counties are now gone, paved over or developed. The nice thing about where I am now is that there are local farms nearby. And the recent passage of our Proposition 49 means these farms will hopefully be saved from the developers' bulldozers.

Ultimately, where a person chooses to relocate depends not only on the place one is considering, but on the person himself. If one is going to relocate because of peak oil and climate change, one must be willing to live lightly in his new place, so that it may not be ruined. I like Jeffrey Brown's perspective on economizing and localizing. I would not want my former neighbor who lived across the street from my old house to move where I am now - he has two full sized Chevy pickups, a Suburban, a motor home, a golf cart, two ATC's and a boat. I don't think he gets the idea of "living lightly."

Thank you for your thoughtful reply.

I have been reading this board about a year. I have seen the “Archdruid Report" report mentioned here before and have visited a few times. I will look in more often.

I like the focus on economics on TOD Canada for numerous reasons.

I am not in agreement with those that predict a surge in oil prices in the second half of '08. Someone on TOD recently posted a link showing that 40% of the US workforce is directly or indirectly involved in the housing industry. If housing falls 30-50%, which I expect that it will in areas where prices have escalated quickly, there will be a lot of demand destruction for gasoline and diesel because a lot of people will be out of work. If people are out of work and lots of 18 wheelers are parked it will definitely put downward pressure on transportation fuel prices in the US.

There has been a lot of speculation recently about how much decoupling has taken place between the US economy and others. I believe that there has been some decoupling but at the same time I believe that the coming recession in the US is going to effect the emerging producers and Europe to some degree. I do not see demand for FF in 'other' markets continuing to rise at the current strong pace while a serious recession occurs in the US.

To sum up...I see economic problems leading FF shortage problems in the second half of '08. Of course, economics is just another 'above ground issue' that will effect ELM.

I think that oil and financial problems are very closely tied together, more closely than a lot of people realize. Part of the reason for the tie is the higher cost of oil being transferred through to people's spending, leaving less for mortgages and other needs. Part of the tie is the fact that we are dealing with a finite world, and infinite credit expansion simply cannot work, even though we have built a system depending on it. There is also some academic work tying the two together, such as the work by Robert Ayres.

I think that TOD needs to have some articles on the link between oil and financial problems. I have written some, and plan to write others next year. I believe what the TOD Canada site is doing is an important part of the education process, and thank the editors for working so diligently on their effort.

In the next year, I expect financial problems will trump the direct oil problems. It is important that readers understand the whole situation, not just the number of additional barrels of oil planned in Saudi Arabia and other countries.

Counterparty Credit Risk Management.

http://us1.institutionalriskanalytics.com/pub/IRAstory.asp?tag=133

This article is from September 21, 2005

.

"The issue of unconfirmed CD trades began to fester earlier this year when Ford (NYSE:F), GM (NYSE:GM) and their key parts suppliers, Visteon (NYSE:VC) and Delphi Corp (NYSE:DPH), were subjected to multiple credit downgrades by the major rating agencies. At the time, we predicted that Detroit's slow-motion progression towards default would eventually destabilize the US financial markets (GM, Ford and Health Care: Was Hillary Right?)

"The next shock to the system came with the bankruptcy filings of Delta and Northwest airlines last week, two events where disputes regarding CD contracts may actually test the legal standing of derivatives generally. So far, the securities industry has managed to conceal the true scale of the legal problems involved with the CD market under the hideous veil of mandatory arbitration, but the growing number of large corporate bankruptcies may eventually force a federal judge to rule on some basic issues, such as when the assignment of a derivatives contract is "final" - even when the trade is in dispute or has not been confirmed or properly documented.

It's no accident that all issues above concern transport industries.

From Day 1 I argued that GM was/is bankrupt.

That GM was still joined at the hip with Delphi.

The parallel with CDO's is eerily similar.

Trying to offload risk while maintaining cash flow.

September 16, 2005 (Sep 05 was a busy month

for the Fed14- 8)

http://www.nytimes.com/2005/09/16/business/16credit.html?_r=1&oref=slogin

"What Mr. Corrigan and bankers at the Federal Reserve are more worried about is what happens in the event of a corporate bond default.

Credit derivatives are bets on whether a company will pay its debts. In the event of a default, the party on the losing side of a trade must compensate the institution that holds the other end of the bet.

The problem is Wall Street has been overwhelmed in keeping track of these trades - and if corporate defaults, which are at an 11-year low, suddenly rise, it could have a mess on its hands.

"From Day 1 I argued that GM was/is bankrupt."

http://finance.yahoo.com/q/bs?s=GM On paper they are $7Billion in the hole. But they have considerable assests including $24B in cash. This would make them a take over target by another automaker that is swimming in wealth (Toyota? http://finance.yahoo.com/q/bs?s=TM&annual). But I don't see them actually disappearing. Many bankrupt companies have come back to life with a White Knight.

See Chrysler/Cerberus for details.

China or the KSA will buy Chrysler.

The other will buy GM.

CalculatedRisk-

"Back in August, when the sale of Chrysler to Cerberus was closed, the investment banks were unable to sell $10 billion in debt and had to take the debt on their balance sheets. This played a role in the credit crunch in early August.

The banks, led by JPMorgan Chase, and including Goldman Sachs Group, Bear Stearns, Morgan Stanley and Citigroup, have tried several times to sell some of these loans, and each time the offering has been postponed."

"Frustrated ECB promises banks infinite money at a discount."

Infinite = death

I second that call for more on the conection between oil and finance.

Consumption is the common denominator IMO.

I have this quote on my wall of worry at the shop;

Cancer requires exponential growth, ultimately consuming the life supporting elements of the host.

Corporate capitalism requires exponential growth, ultimately consuming the life supporting elements of the planet.

IMO, you have to kill your consumption before your consumption kills you.

Killing consumption affects those whose livelihoods depend on that consumption.

"In the next year, I expect financial problems will trump the direct oil problems."

I agree. I'm working on predicting what will happen in 2008. In 2007 we had a rise in oil prices of about 20%, because supply remained stagnant and demand climbed. I suspect supply will remain stagnant in 2008, and if 2008 is a normal year we could see another 20% climb.

Instead I suspect housing will lead us into recession in 2008, and my best guess is that oil prices may only grow 10% because recession driven demand stagnation.

Personally, next year I am expecting to pay [at least] a dollar more for a gallon of gas AND to lose [at least] another 15% of my house value.

:0(

urbangardener, and Delusional below,

You are both referring to the same scenario, and one which I deliberately left out: that both will happen, the oil price hike and the home value depreciation. It looks of course more or less inevitable.

No-one sees home prices go up in 2008, though you should never say no-one, perhaps. All the financial plans that come out of the Fed, Wall Street and DC have one thing in common: they are futile UNLESS the markets rise like Lazarus.

And while oil price moves look a little less certain, the only way most of us could see lower prices is through economic collapse. Much more likely in the short term: higher prices at the pump.

If the dual scenario unfolds, the hurt will be deep and widespread.

ilragi,

I thank you for the work you did here( and other posts as well.

While positioning housing against oil makes for a good debate, there is also the 3rd option.

If you get 1/2 of each scenario, you end up in the same place(roughly). This would look like a slam dunk to me.

If either of them go to 100% (of your bad case) and the other hits 50% then you would get 150%.

:(

a 100% increase in the price of gasoline would take $ 300 billion out of the economy. the interest on the national debt is $430 billion, but not to worry, we will just borrow the money to pay the interest.

Worst case scenario is another great depression where too many people lose jobs/income to pay mortgages and car payments. Then it won't matter to you what your foreclosed house was 'worth' or what it cost to fill the reposessed car.

On the bright side, a dual crisis might allow forward thinking people to buy solar panels on the cheap!

I’ve changed my views thinking that we were on the verge of an economic collapse.

Seems a possible crash from the debt bubble may not happen, or will be allowed to happen as a "soft landing". Deep, very deep, pocketed banks with hundreds of billions in cash are starting to bail out some of the US banks in trouble such as Citi http://www.washingtonpost.com/wp-dyn/content/article/2007/11/27/AR200711....

They would not do this unless they see the handwriting on the wall. A collapse of the US economy would have obvious worldwide implications. So an all out effort to save it will happen, and has started to happen.

These won’t be loans, they will be gifts, life boats, thrown into the water to rescue as many troubled banks as possible. Will it succeed or will it fail? It’s like a conductor trying to get an orchestra of musicians playing their own tunes to get their act together and play properly. There will be an effort on the part of the players to heed to the conductors will, or face the consequences.

Sure, some banks will fail (the smaller ones), many will loose their homes, lots of companies will go belly up, some people will even go to prison. It won't be pretty, but it won't be a disaster.

People with money will buy up these foreclosed homes (they will wait for the dust to settle first). Then rent these homes back to the people who were turfed out (they have to live somewhere). And the economy will dust itself off and onward we will go as before, just a lot less wealthy.

This leaves the price of oil as the wild card again. How ironic it will be as an all out effort is mounted to save the economy just when the lifeblood of that economy, oil, starts to go into terminal decline.

The problem is that these CDO's have no counterparty risk.

-counterpunch-

Jeb Bush left Tallahassee for Miami in January 2007, having served two terms as governor. He incorporated Jeb Bush & Co., and in June was hired as a consultant with Lehman Brothers, the Wall Street investment banking firm.

In July and August, Stipanovich approved the purchase of $842 million in securitized mortgage bonds from Lehman.

bloomberg-

The governor called on the State Board of Administration, which oversees the pool, to hire the lawyers three days after Bloomberg News reported that Lehman Brothers Holdings Inc. sold the fund $842 million of mortgage-backed debt that defaulted within four months.

This CDO collapse started 71707. Lehman knew full well that

they were delivering toxic waste to Florida.

The Credit Agencies are on the hook as well.

We've got trillions to go and we're still just talking

tens of billions.

http://elainemeinelsupkis.typepad.com/money_matters/2007/12/december-21-...

"I must be the only person writing commentary about global economics online who tracks the Bank of Japan both at its source as well as in Japanese news. We are witnessing a historic rift opening in global banking, one that has NEVER happened before. When Britain had its fatal banking crash of 1931 when they had to abandon the gold standard, this was a classic move by the ruling empire of that time. It was a sign that the empire was collapsing and was fatally weakened and could no longer patrol the Seven Seas or enforce trade and exchange rules. When the US had to cease its own gold standards, the world was pitched into not a depression like when Japan went under but hyperinflation as no one was willing to openly attack the US. Indeed, Russia did try to expand its own empire in the wake of the US gold collapse and succeeded only in miring themselves prematurely in a classic imperial over-extension which triggered Russia's bankruptcy and collapse."

It will certainly be interesting to see how far these "super" banks will go. Abi Dhabi is reported to have anywhere from $800B to $1.2T in cash. Same with some other banks in China. Both these countries will stand to loose big time should the US, and then the world, go into depression. Better to loose a hundred billion now than most of the rest later.

The question will be, will they stave off a collapse, allow for a soft landing, or flogging a dead horse? No one knows becuase it's just too complex and too chaotic.

But an effort to save it will happen, and is already happening. In the long run, once oil goes into terminal decline, there won't be any way to save it. I'm just beginning to doubt the economy will fail on it's own, so long as there are banks willing to rescue those in the icy waters.

What exactly, is the meaning of "cash in the bank?" Seems like it is just 1's and 0's on a hard drive some place. If Abu Dhabi bank came to collect on their debt, say by using their "cash" to buy hard assets in the U.S., they would reach some resistance at some point. At first, it would be ever so tactful, but the final "gold" standard seems to be compounds of nitrogen dropped from high altitude, or delivered by cruise missile.

If the banks decide to quit paying out their cash -- as they did in Argentina -- what good is my "cash in the bank?"

Seems to me that capitalism is not based on the notion that the economy will expand exponentially forever -- actually, that is just an illusion created to get unwilling people to play the game -- but is actually based on the more primitive notion that the strong will take from the weak by whatever means possible. Deception if it works, armed force when necessary.

The rulers of the world are not stupid enough to overlook the realities of exponential growth.

The strong (wealthy) of the world fix up the financial system to their advantage. When cascading debt defaults happen, poor schmucks like us are left 'holding the bag' as it were, although our bag is full of dog doodoo while their bag is full of repossessed wealth. If the flow of wealth upward continues to accelerate like it is, some kind of snapping point will be reached. Then the private armies will have to come out to quell the insurrections directed against the obviously wealthy.

rant off

And, up to now, the wealthiest always won. Even apparent victories for the "people"-- such as the American and French Revoltions -- have turned out to be Pyrrhic victories. The folks who financed the revolutions are still calling the shots-- even if the kings are dead or defanged.

Now, there may be a new paradigm. No amount of money or power will help even the richest escape the ravages of nuclear war or global warming.

'The strong (wealthy) of the world fix up the financial system to their advantage.'

Yes, but the wealthy can only take advantage of the less wealthy by consent of the less wealthy. For instance, if the wealthy create 'holidays' and portray the 'all American family' in tv commercials celebrating these holidays (by charging gifts that they cannot afford, using credit) then the less wealthy are playing the 'house game' against very long odds.

If the less wealthy refused to 'conform to the all American family model as portrayed on tv' then they would not be losers in the game...For, they would be refusing to play. Do not attempt to excuse the less wealthy for playing in a game that most know is a losing proposition. The less wealthy are as complicit as those that take advantage of them with outrageous interest charges. 'Keeping up with the Joneses' is a calculated psychological play by the wealthy to insure that capitalisim continues to function for the benefit of the wealthy.

All it takes to win, or, not lose at this game is for the less wealthy to save some of their pay each month and purchase the items that they need with cash. Notice I said NEED, not want...and in a consumer society as large as the US, there are always bargains to be had for the people that have been wise enough to have savings available for them. Once people get into this mind set of not being suckers, and refusing to play against 30% credit card interest, they will find that life is a lot more fun, less hectic, and much less stressful.

Best hopes for all to either throw away the credit cards or pay them off monthly to avoid ruinous credit payments.

Oh I entirely agree that, in principle at least, it is possible to not play the game by not being a 'good consumer.' The big problem is that even those of us not playing the game might easily be dragged down by a collapsing economy like everyone else. I don't think there is any way to know how to avoid the hurt in what might be very bad economic times, things are just too unpredictable.

In some ways a 'soft landing' might even be worse for those who have stayed out of debt, saved and tried to prepare. The wealth we have managed to save, whether it be gold, treasury bonds, or an organic farm, these stores of wealth can all be whittled down by one means or another.

not unlike the junkie and the pusher, they are mutually dependent.

Saving some of your pay each month is still playing in the game. When you do not know how much money is worth and are lied to on the inflation front what good is saving. One may actually be better off in buying real goods.

Argentina....Deception if it works, armed force when necessary.

Or as Naomi Klein puts it: deregulate, privatise and taser. Whether or not the powers that be are deliberately engineering multiple crises so they can find "opportunity", they are certainly engineering responses along those lines. Those who think their game involves preventing disaster are surely missing not only the history but the explicit statements.

I'd argue that readers strip away illusions like public-interest and that they stop thinking that leadership is somehow working for the greater good. It is not. [Or in its own twisted Milton Freidman way, by maximizing greed it does achieve the greater good.] The rules by which we peons must play - pay down debt, maintain contracts - don't apply to the piranha class that will put us in debt and break every social contract to maximize their own gain.

cfm in Gray, ME

so jeb is following in his brother, neil's footsteps ?

I have to disagree, I don't see how we can avoid economic collapse.

Look at the graphs above, the housing bubble is going to pop. We are looking at a downward trend that will continue for sometime. No one has a clue of the bottom, but we all know we have not gotten there yet.

This housing bubble is going to lead to staggering losses. First you have the loss of home equity in the trillions. Then you have the losses on Wall Street in the trillions. Then you have losses to investors in the trillions. This will inevitably lead to a plethora of bankruptcies and layoffs. The construction and financial industries are going to slow to a crawl.

Avoiding a major recession is not possible. Okay, I have to add, in my opinion, but I will be shocked if the recession doesn't deteriorate in 2009.

This major recession will be happening right when energy prices will be rising. Personally, I don't see how demand will slow enough in Asia to stop prices from rising year after year.

While economic collapse of the US economy will not occur over night, it will come with time. My guess is sometime between 2010 and 2012. We have too much debt and no answers. Tax cuts are not going to revive us this time.

We may be able to keep gasoline prices under $3.50 in 2008 because of a recession. But that is little solace in the wake of a deteriorating economy and declinig oil production going forward.

We all know what is going to happen when the recession begins to deteriorate -- mass layoffs. Remember what happened after 9/11? In Colorado, unemployment for high tech workers went from 2% to 10%. It was a meltdown. That's going to happen again.

Once this begins, what industry is going to pull us up? My guess is that for the first time ever, government jobs are going to shrink because of deficits. Ford will likely close their doors. Several airlines will close and others will merge -- driving up the price of tickets. Corporate America is getting ready to have a major restructuring, i.e., downsizing.

Bernanke can give banks money to avoid a financial meltdown, but so far all he has shown is willingness to LOAN them money. We will see if he changes his tune. If he does begin a major bailout, it will be inflationary.

Once the recession begins, the US Govt can issue as much debt as the market will bear (if Bernanke agrees to buy it, this can be unlimited, since he can create money out of thin air). Again, this will inflationary.

As pessimistic as my comments may appear, I am actually optimistic that once the economy falls, we will begin reorganizing society to be much more sustainable and egalitarian. But that's another story.

TOD:Finance

I like the financial wrap-ups here, especially since there is an emphasis on petroleum, and Canada. I say, keep up the good work!

I've used some variation of the following metaphor for a while:

The American consumer is standing at a four way intersection with four 18 wheelers headed his way:

(1) Declining real estate values

(2) Flat to declining income levels

(3) Rising health care costs

(4) Rising food & energy prices

In most cases, is just a question of which 18 wheeler hits you first.

As I have described for some time, IMO ELP is the best way to try to cope with what is happening.

http://graphoilogy.blogspot.com/2007/04/elp-plan-economize-localize-prod...

Back in the summer of 1998, I asked my friend Mitch, who ran a demographic / intelligence service to give me an estimate of how long I could expect to continue my lifestyle of full bore, go anywhere yacht cruising .

Remember that this was when the US was on top of the world. The cold war had been won, democracy was taking over the world and the economy boomed.

Mitch wrote back that the probability was 87.4 % that cruising

would be dead by 2008. His list of problems that could arrise:

Rising anti Americanism

Possible worldwide economic collapse

Possible world wide plague

Possible terrorist act using a yacht

Possible closure of Suez or Panama Canal

Possible world wide oil shortage

Probable rise in cost and difficulty getting visas

Possible world wide monetary failure

So Mitch foresaw many possible linkages long before economic/ oil shortage and its attendant cumulative stresses. I believe that it is impossible to separate these issues.

The economic/ oil difficulties resemble nothing so much as a classic environmental impact report where we find everything is linked to everything else.

God help us all in the future, Dave on MEANDER

Scott Burns has written that one advantage of the cruising and/or RV lifestyle is that (except for mega yachts, marine and land) it forces one to downsize to the essentials.

Beyond the minimum space needed for everyday activities, additional housing space is a consumption item, a want instead of a need. And many people are slowly, but surely, beginning to realize that.

Ask Mitch what he thinks now.

I wish I could contact Mitch at will, but his life has become extremely secretive of late. He did however call me on Thanksgiving and wish me a terrific holiday and posperous New Year. I did ask him that very question. his answer:

Short sell the stock market, prepare for a voyage to New Caledonia, and transfer liquid cash to Canada. First financial meltdown within 3 months, and all hell breaks loose within a year

Dave on MEANDER

Does Mitch have a 900#?

What/where is MEANDER?

I googled New Caledonia because I didnt know where it was:

looks remote - is this vacation planning or something more permanent?

New Caledonia is a French colony with an indigenous resistance movement. It wouldn't be my first choice. Tonga, Niue, and the Cook Islands have better options.

MEANDER is a Westsail 32 cruising yacht. It displaces 20,000 pounds and is 42' overall including bowsprit and pushpit. The style is called Tahiti ketch - it has one mast, two foresails and a mainsail.It is luxurious for two people longterm and squalor for four people longterm. It has a solar array which can oversupply all electrcal needs. Inluding watermaker, Ham , SSB, and refer.

Mitch is my old fraternity Big Brother and currently can't be reached because he often works for security programs. All mention and history and photos of him have disappered from the internet. He calls when he remembers.

New Caledonia is 800 miles NE of Australia, produces an astonishing amount of nickel and is a part of France. (Euros} . I speak adequate French and have been there a few times. My mates that live there have offered me a place to stay - forever. And many lonely ladies. I've got nothing better going in Marin County, Ca.

Dave on MEANDER

Holy crap

That doesn't sound all bad...

How much food can they grow/harvest?

Re food supply; the country as a whole imports food because they have the money, but work in the city. Water and hydro are plentiful. Soil is fertile in most places and many people plant gardens in the Med. - like climate. In general, they could be self sufficient if they wished. Lots of arable land.

Hi Dave

Nice to find another yachtie, though I am back in the 'burbs. I sailed from UK to Australia on a 44' sloop in 2002-2003.

I think the two main problems in maintaining a cruising lifesyle will be maintaining your boat and seamanship. It is likely your boat is a modern boat with lots of electronics, power hungry eqyuipment, diesel engine, diesel genset, maybe a saildrive, aluminium and inox 316 kit on deck, oil derived sails and a whole lot of other "hi-tech" stuff besides.

Possibly the biggest challenge is knowledge. Can you navigate without a GPS? Have you got paper charts for all the places you are likely to want to go?

So in essence the question is this: Is it possible to dumb down the boat and increase the skills of the skipper? The boat needs to be capable of being maintained from stem to stern by natural materials, while the skipper needs astro nav and other traditional skills such as rope and sail making, carpentary etc.

I have been wondering: if there is a deep depression how long will the GPS be maintained? I believe it depends on new satellites being deployed from time to time and global cooperation on system maintenance. What happens if it goes down? The GPS is probably a key dependency nobody has yet thought about.

In reply to two letters: My friends tell me all is peaceful since jobs are plentiful. I was there during the 'insurrection' back in the 80s and the complaint was similar to the deal in Northern Ireland, The French Foreign Legion sorted things out back then. The problems mostly happened on the Islands of Lifu and Mare' which are about 100 miles NE and quite remote.

Saildog . Greeetings, sailor.

Indeed, you have picked out the major problems that I anticipate. I Am buying enuf sail to last 20 years [ two sets ] . Prop zincs also. MEANDER is a full keeler and can be simply careened like the ancients did to clean the bottom.

Re navigation; I started cruising before any form of electronic navigation. My sole instruments were a depthfinder, useless VHF , sextant and chronometer. I used HO 209, Ageton's lifeboat table to reduce sights. One of the proudest moments in my life was raising Hiva Oa by sextant. GPS has stolen that thrill, but made it safer. Along with radar. But I most certainly don't trust any of them in an emergency. I am told I am one of the 10 most experienced cruisers left active. 35 years now.

I quail at the ignorance of many cruisers nowadays. I last resqued a Japanese couple mid Atlantic in 2004. They were dismasted in a Halsey 42 and insisted that the manufacturers would pay for it all. HO HO.

Better men than I have perished along with their families because of inexperience and over confidence. I toast those brave and unlucky souls.

As regards other skills needed, a well found fiberglas yacht is virtually indestructible. Mine has seen numerous reef groundings with only minor scratches, altho one in Chagos was a close call. IT IS INDEED POSSIBLE TO LEARN ALL THAT IS NECESSARY. Forget about rope making. I just threw away the last of my Sampson yacht braid [ 35 years old ] Sail repair is fine, but somebody in the fleet will be able to do it easily. Carrying spares is an excellent idea.

I only carry general large scale charts anymore to avoid bumping into remote islands. I've been most everywhere and I now have a pirated copy [$18,000 and must be replaced every year on commercials ships] of CMAP which has every chart currently published on a CD disc. Commonly available from any hard core cruiser.

Rather than dumbing down, I prefer KISS, keep it simple, stupid. Most quality gear will last your lifetime and beyond.

Dave on MEANDER

you should enlist Jay Hanson as first mate - he solo sailed for over a decade. Kind of a Darwin plus 150 years and lots of modern gear expo....

On second thought, I don't think Jay would be first mate to anyone...

Zincs? Too damned right. Forgot about them when I was penning my reply. Congrats on the astro. I did a course before I left, but couldn't even see the North Star through the sextant when I tried mid Atlantic.

I think NewCal is a great choice. When I first became PO aware a couple of years back I thought NewCal would be a good bolt hole. But I am a bit worried by possible racial tension there. I think the French keep a lid on "local aspirations" with a firly firm fist.

I do like Noumea. I find it amazing how the French manage to export the very essence of France to remote outposts in the Pacific. It feels just like someplace in Provence. I guess Ile des Pins would be the quietest choice in NewCal, with some decent land to cultivate.

One thing cruising does is that you know where power and water come from! It also makes you resilient and resourceful. Interesting that 2008 could be the last year of mass cruising.

My boat was aluminium alloy. Also very tough and light, but I am not sure which will be easist to maintain post PO. I think if a big recession does hit there could be thousands of cheap yachts flooding the market. If I can find a decent Amel/HR/Ovni/Malo or any other good quality boat I might jump at it. Hell, even a Beneteau may tempt me.

(5) An attack on Iran?

We advocate peaceful settlement.

cheers.

A nice analysis overall, but one note:

That's not true; the real estate situation in Canada is sharply different from that in the US, due in large part to a much smaller and less aggressive subprime loan sector in Canada:

"the subprime market share is much smaller in Canada. About 20 per cent of all U.S. mortgages are of the subprime variety in 2007. That compares to just five per cent in Canada, according to industry figures.

All high-ratio mortgages in Canada — those with less than 20 per cent down — must be secured by mortgage insurance, through, for example, the Canada Mortgage and Housing Corporation. In addition, Canadian financial institutions do not finance more than 100 per cent of a home's purchase price, and that value must be verified with a separate appraisal.

...

Overall mortgage arrears in Canada are at just 0.5 per cent, the industry says, near record lows." link

Moreover, Canada has different incentives for buying vs. renting than the US, thanks to the mortgage tax deduction Americans enjoy.

Due to these and other reasons, the housing market in Canada is seeing no crisis. Housing starts are up 3% this year, including a small increase in the most recent month, and housing prices are up 12% since last year; price growth has moderated substantially since early 2007, and is forecast to be 4% next year.

So it really does matter where you're talking about, since only the US has the particular problems that are causing its subprime woes. There are housing bubbles in other places, to be sure - UK, Spain, Australia, and Ireland are often mentioned - but it's certainly not a universal phenomenon.

I think there is another diference between the Canadian and US markets: while US rich may be buying their escape hatches in South America, Asian investors are buying Canadian real estate, especially in the two main english speaking metropolitan areas of Canada. They see Canada as a safe place both to launder their excess of US dollars as well as a welcoming refuge if the economy really does collapse and it gets ugly in their part of the world. Ontario real estate prices have remained firm with building still strong. I would like to see data on the origins of the money buying this property but I am not sure it even exists so I can't support this idea but if it is real prices and building here may be sustained even in the face of US recession or worse. In any event I think the credit crunch, which has its roots in the sub-prime mess has now taken on a life of its own will have far more imnpact in the short term (2008) than oil prices. It is interesting that the Oldevai Theory predicts that world population will begin to decline somewhere in the 2008 - 11 window. This means very ugly news will beging to be told about tragic disasters of one sort or another around the world, likely mostly in the poor world. The theory concentrates on the importance of electricity and the collapse of electrical distribution as the key development and driver. There is an article on the main roundup today concerning Argentina's electric woes. More of these in second tier developed economies might be a clue. This development will be a test of the theory. 2008 may be the nexus of the cursed "Intersting Times".

Jografy: I agree re the Asian influence. Here in Honolulu the RE market looks reasonably strong-no sign of a looming collapse.

is nothing more than a misunderstanding based on statistical sleight of hand.

To see this, note that the world has rich nations and poor nations, and that while the rich use much more energy, the poor have a much higher population growth.

For illustrative purposes, imagine there are 10 rich and 10 poor people. Each rich person uses 100 energy, and each poor person uses 10, so average energy use is (10x100+10x10)/20 = 55 energy per person.

Some time later, populations have increased, so there are 15 rich people and 45 poor people. Each person is now using 50% more energy than before - 150 for the rich and 15 for the poor - so average energy is (15x150+45x15)/60 = (2250+675)/60 = 49 energy per person.

Per capita energy is down 10%, but every person has seen their energy use rise 50%. It's just that there are more poor people than rich people now.

So that's all the "Olduvai Hypothesis" is based on - this simple statistical sleight of hand. Go look at the EIA's data for per capita energy consumption by country, and you'll find the world closely follows the scenario I've outlined above.

Pitt

This particular aspect of Duncans theory would be great guest post - feel free...;)

But declining net energy is a very real phenomenon. Technology has been losing the war with depletion for decades, even despite winning occasional battles (mid 1990s EROI increased, current wind sans battery has high EROI, etc.)

I don't want to defend the theory as i dont necessarily subscribe to it. However I think perhaps your analysis is a mathematical slight of hand as much as the original theory. My point was that if the theory is correct then we will see some evidence begin to appear no mattrer waht arguments are made pro and con. If there are any advocates of the theory out there it would be interesting to see a response.

No - I'm simply showing the sleight of hand that the theory relies on.

The claim is that dropping per capita energy shows the world is unravelling. My analysis shows that per capita energy can drop even while the world is improving for everyone. Ergo, the original claim is false - dropping per capita does not show that, as it could have come about from other scenarios.

We have; the theory's predictions are wrong.

First, the theory predicts that world per capita energy consumption will "continue" to fall; in reality, it's been rising for years, and the last year available is the highest ever. Duncan was even predicting this in 2005, by which time it was already known to be false.

Second, the "new" versions of the theory are typically little more than the same old dire predictions of doom with their dates moved into the near future instead of the recent past. In 2001, for example, Duncan predicted widespread permanent blackouts in the US, and of course that's completely failed to happen. Those blackouts have subsequently been pushed later to 2008-or-so.

His theory was based on statistical sleight of hand, so it's not at all surprising that its predictions were wrong. At this point, the theory has (a) failed to predict reality, and (b) has known flaws underpinning it. There's no reason to continue using a theory like this one that is known to be deficient.

Pitt: The theory is a little far-fetched. Having said that, the link attached shows that the WHO estimated in 1998 (when global life expectancy was 66 years) that life expectancy would be approx 68.3 years in 2007. According to CIA factbook, it is 65.2 (from memory) so global life expectancy does appear to be gradually declining, which is one of the pillars of the theory.Overall, the evidence is indisputable that, at the median, the global standard of living is regressing, contrary to MSM pronouncements. http://www.who.int/whr/1998/media_centre/press_release/en/index.html

Duncan never mentions anything of the sort; what he talks about is energy, and anything else is presented as simply a side-effect of that. The only "life expectancy" he talks about is that of industrial civilization (save for a mention in a caption, where life expectancy of people is listed as one of the things that'll suffer as energy supply drops).

Check out the links I've given to various iterations of his theory if you don't believe me. His theory is wholly about energy. And wrong.

The theory states that industrial civilization will collapse due to declining per capita energy supplies. His latest version estimates widespread blackouts starting 2008-2012 and peak human population ca. 2015 with a rapid decline to about 2 billion in 2050 if memory serves.

You can't say the theory is wrong until it gets tested. If we get to say 2030 and there are 8 billion of us bopping around and the lights are still on then you can say the theory was wrong.

Your numerous posts add nothing of value to this forum.

SolarDude, I have to stick up for Pitt. I have criticized him, but I do think his posts are food for thought, if for no other reason than to challenge the reader to figure out what it is that he is missing.

And it has been tested.

For example, Duncan himself notes:

"The Olduvai theory cannot be overthrown (i.e., scientifically rejected) by outrage or indignation. However, it can be overthrown by either, (1) demonstrating that the four sets of data in Figure 2 are in error, or (2) by gathering additional data over the next few decades and demonstrating that the Olduvai theory cannot explain that data."

That was written in 1996. Over the next decade, more data has come in - in particular, per capita energy consumption has continued to rise after its fall in the 70s and has hit consecutive all-time records - and his theory cannot explain that data.

Ergo, his theory has been overthrown by his own criteria.

That is simply incorrect.

SD, try this Wiki http://www.eia.doe.gov/oiaf/ieo/electricity.html

I would say Pitt is on track, now all we gotta do is find out some way to show him wrong otherwise the world is in bigger trouble putting off it's pest removal to a later date.

Personally this pest would prefer peak oil to hit us in the nose before those lights go out. Hate my car but love electrically provided hot baths.

Nice contemporary example of Simpson's paradox, a problem that pops up pretty frequently when studying two variables. Simpson's paradox can be subtle and nonintuitive

These first two google hits are reasonable summaries:

http://en.wikipedia.org/wiki/Simpson's_paradox

http://intuitor.com/statistics/SimpsonsParadox.html

And something I didn't even know the name of. The links are pretty informative - thanks!

Thanks for the compliment, Pitt.

Now, where do I begin?

First, as I wrote, when Barnhart talks about subprime, I automatically assume he means the overall credit situation, or at least the part that has to do with mortgages in general. And if we allow ourselves that move away from the strict term 'subprime', we first see that enormous amounts of supposedly "lower-risk" mortgages, from Alt-A to big fat prime, are also sinking in large numbers.

The reason is as obvious as it is easy to overlook: cheap easy credit was handed out to everyone, and certainly not first to subprime candidates; indeed, they were the last row of prospects. Their turn came when more solid segments of the buying population had been stuffed and bled dry. And if the subprime group was 100% over what it could afford, so was the richer part. The difference is that their 100% is more money. Many places in the US are full of $500.000 dollar homes inhabited by people who can't afford them. Still, they were not subprime borrowers. They might be now, though.

This same thing has happened in Canada. Housing prices here have risen in pace with those in the US. Sure, there are differences in the sorts of loans, and the insurance and so on. But the bottom line remains the same: loans with low interest rates, probably often of the teaser kind, that are set to go up.

The main difference between the US and Canada, as well as many more countries around the world, is in the timing. The US scenario has simply started to unfold first.

From Wikipedia's Real estate bubble page:

More Eastern European countries should be on that list. We saw Bulgaria earlier this week, and stories have ben reported of mortgages closed in yen throughout the region.

In Canada, people still refuse to believe what's going on, and hang on to the idea that it can't happen here. I've been trying to warn my friends away from mortgages for quite a while now, unless they want to sell within a year (I no longer think they have that year now). But they're not capable of giving up the illusion, no more than Americans were until recently.

It probably cannot be expressed any clearer than through your own quote: housing prices in Canada are up 12% since last year. To me, that is the scariest thing there is in this field. That indicates it's about to blow up. How can anybody look at that and think that's a positive thing? How long does anyone think this will last? And if it stops, where will prices go? Remain stagnant or something?

Canadians would do well to look at the mess that the CIBC finds itself in, with mortgage-related losses and counterparty risk with regards to underwriting of US bond insurers. And if that's not clear enough, look at the still and forever unresolved non-bank ABCP "worth" $40 billion. The latest there now appears to be, as per Bloomberg, that 50% of the face value is lost. I'm saying it'll be more than that. Canada's biggest pension fund just lost $10 billion or more. But they ain't telling yet.

At that rate, there'll be no more consensus building. No SuperSIV for Wall Street, and no soft landing for Canada ABCP. We're staring at cats in a sack.

Not in Canada - as my link said, mortgage defaults in Canada are near record lows.

Not in Canada - as my links said, lending was less aggressive and more cautious, with things like independent valuation estimates required for riskier loans.

You obviously didn't read my links:

"22 per cent of subprime borrowers in Canada use variable rate mortgages — half the rate seen in the U.S."

Remember, that's 22% of 5%, as compared to 44% of 20%. The difference is an order of magnitude.

"Widely believed to exist" runs afoul of wikipedia's "no weasel words" guideline, and should be edited out, largely because it's meaningless - some guy writes that something is widely believed; why should anyone believe him?

Up 4% next year, most likely, which is below the rate of wage growth. Declining affordability is damping housing demand, although housing affordability has been worsening fairly slowly.

Those are the same thing - as your link says, the asset-backed paper is struggling because it's exposed to US subprime mortgages. Essentially, some investments in the US have gone sour.

So?

Per your link, there's $33B of ABCP that may have lost up to 50% of its value. $17B in losses isn't that big of a deal overall - it's about 1% of the Canadian economy. Moreover, since the problem is due to exposure to US investments rather than due to domestic Canadian issues, the problem is not too likely to spread or recur.

Fundamentally, the Canadian housing market simply does not have the problems that the US one does. The core of the US housing decline - subprime ARMs - represent just 1% of the Canadian market, as compared to 9% in the US, and the interest rate in Canada has been far more stable over the last few years. The whole problem with millions of mortgages "resetting" in the US effectively doesn't have a counterpart in Canada.

One of the rippling effects of the housing problems in the US is the collapse of the forest industry in Canada, specifically in British Columbia. The traditional forestry model built on producing large volumes of commodity lumber will probably not survive the current downturn, and this will have major effects on the housing prices in BC. Although this effect probably won't show up for another year or so.

Thousands of forestry workers in Canada have lost their jobs in recent years (I have seen figures as high as 20,000 workers laid off), and a lot of them are not finding work in the Alberta oil patch either. Rural BC is emptying out.

Eventually, this will effect the Vancouver economy, too. What the effects will be remains to be seen, but the BC economy has been underpinned by the US housing boom for the last decade or so. That underpinning is no longer there, and there aren't any ready alternatives.

That's the main reason, although not the only one. Considering the unemployment rate in BC is at historic lows, though, that's not really a big deal overall - there are plenty of jobs for laid-off forestry workers to move into.

Some of them will have to move, but that's nothing new - mill closures have happened in BC for decades, and towns have either reinvented themselves (e.g., Chemainus) or suffered (e.g., Port Alberni). It's by no means new, and it's almost certainly not going to be as jarring as the collapse of the salmon fisheries.

It'll certainly be difficult for some people and some small towns, but the province as a whole is pretty robust at the moment.

Based on what do you say that? Forestry is one of BC's major industries, but even then it's a fairly small part - 7% or so.

It's the major driver in some rural areas, but the province as a whole has quite a number of other industries:

"The province is better placed to counter downturns in the U.S. economy than in past years because of expanding trade to Asia and the strengths in scientific and medical research, the high-tech sector and the film industry"

Just an aside on global warming. When the cold weather doesn't kill the bugs, the forest has a bad year and many trees die. We aren't going to get as many cold winters in the future. The farmers can quit farming within one crop season, or switch crops to something that uses less water. Forests last from twenty to forty years per cutting cycle. Figure on a lot of balks (squared off timbers) being available from trees too small to chop up into boards. We are going to have to replant a lot of forests early in the timber cycle.

Pitt,

You keep focusing on subprime, where I've said twice that is not the problem. I don't know what to answer if you ignore what I say. Cheap credit has been provided all over the place, not just in the US, and not just in housing, let alone not just to those with the worst credit scores.

Talking about low rates of subprime in Canada obfuscates the issue. Investments all over the market, and all over the world, are going sour, because they are bad loans leveraged upon shaky assets of various kinds. That is true in Canada as it is in the US, as it is in the UK, and all over the world. Harking it back to Canadian investments in US subprime does nothing to change that. Besides, I never talked about that, so why do you?

If you want to make a case stating that you disagree with me, and subprime is after all the only real problem here, please do so. But beforehand, do take a good look at the graphs I ended the article with, and tell me what you think they have to do with subprime.

Explain why there's a non-subprime problem in Canada, then. You haven't provided any evidence of that, and most of the claims you've made - that Canadian mortgages were seeing high default rates, or had large numbers of adjustable rates - have been outright false.

Is that true in Canada, despite the links I gave that said lending standards in Canada were not as lax as in the US? If so, please provide some evidence.

Not at all. The US housing sector has been declining and shows no sign of stopping that decline in the near term because it has large numbers of mortgages distressed or defaulting. That is not true in Canada. Ergo, Canada's housing sector is not likely to see the same problems.

If you want to change the subject to "investments overall", do realize that that's not what you or I were originally talking about.

Please provide some evidence that this is happening with non-US-mortgage assets to a greater degree than is normal.

You appear to be claiming that investments are going sour at (a) an unusual rate, and (b) for reasons unrelated to US mortgages. Please provide some evidence for that assertion.

Because that's the source of the problem for the ABCP you mentioned. It's not a made-in-Canada problem, it's an imported-from-America problem, and it's important to distinguish between the two.

I've never said anything of the sort. Indeed, all I initially said was that the housing situation in Canada is not seeing the problems the sector is seeing in the US, for fundamental reasons. Simple, narrow point.

You then argued that the problems were not only subprime mortgages, which is fine, but which does not address the point I was making. You made a variety of assertions in that argument, some of which I have shown to be false (e.g., the rate of defaults and ARMs in Canada). That some of your assertions are false, then, means I can't really take the other ones - such as regarding the lending standards in Canada - on faith.

You're making an argument that Canada has substantial credit-related problems that have nothing to do with the US mortgage problems; back up that argument.

Take a good look at them and tell me what you think they have to do with Canada.

You're assuming I'm arguing that the US does not have problems outside the subprime mess, when in fact I'm not even arguing about the US at all.

I agree, but only because there is no subprime mortgage mess. there is a mortgage and credit mess and it will dwarf oil. the only reason people will care about oil is it's another expense they can't afford because their home values went down and their mortgage payments went up.

I also like this graph, I think it was previously posted in some thread quite recently

Something bad is about to happen in the US economy and probably in the rest of the world too..

Where does this graph come from?

It's one of those pieces of information floating around the internet, the picture cites "Gabelli Mathers Fund" as source, so I found this site,

http://www.gabelli.com/corporate/about.html

A more recent version (Sep. 2007) of that graph can be found in this PDF presentation (181Kb),

http://www.gabelli.com/Gab_pdf/QRep/2007q3/1726.pdf

Thanks. Here it is, from the PDF, graph dated June 30 '07:

I like this graph alot. It tells you why the consumer can continue to spend ... it's on borrowed money, borrowed from the future.

The music is stopping. And as WT notes (from Sixth Sense): 'I see dead people'. They just don't know they're dead.

Perhaps here http://www.kwaves.com/debt.htm

In any case, there a lot of other beauties on the same page!

The charts are fabricated from Federal Reserve Z.1 reports.

http://www.federalreserve.gov/RELEASES/z1/

The chart includes financial sector debt as well as non-financial corporate, household and government debt.

The key point to understand about this graph is that it is a ratio of two variables: debt and GDP, so the ratio goes up if either debt increases and/or GDP declines. The spike in the Thirties was primarily due to GDP collapsing. So, imagine what happens with a GDP collapse now.

Also, consider the nature of the GDP in the Twenties to Thirties. Today, a vastly greater percentage of GDP is the result of largely discretionary spending than in the Twenties to Thirties.

If one could define and quantify Essential GDP, it would be interesting to see a graph of the ratio of total debt to Essential GDP--especially if one defined anything beyond about 250 square feet of housing space per person (or whatever we had in the Thirties) as "non-essential" spending.

Oil is not going to help. But housing is the knife through the heart of the economy.

The war in Iraq isn't helping either which takes well over $300 billion in tax revenues off the table each year.

But the big one is the credit mess. It is going to change behavior.

Is corn-based ethanol likely agriculture's equivalent of sub-prime lending?

FWIW, I attended a recent "state of the science" presentation to plant molecular biologists by the lead scientist for a major corporate biofuels research program. He talked fast for 1.5 hours and had lots of slides with citations, comparing the energetics, the problems and the prospects of many of the current and prospective biofuel options - the different feedstocks, the different pathways, the different products and so on. He gave anyone taking notes a severe case of writer's cramp.

He summarized by clearly stating that the publicly-held energy company's number one goal was maximizing returns to shareholders, that they invested shareholder's dollars into research and production accordingly and that their portfolio did not and would not include corn-based ethanol production. His point to the plant scientists was that they need to be smart about what potential feedstock plants they invest their research efforts in and their research goals. Although he didn't say so directly, a clear implication of his talk for me (not a plant scientist but thinking of TOD threads) was that, based on the science, investment in plants producing ethanol by corn-based fermentation will very likely to become crop agriculture's equivalent of sub-prime lending. FWIW.

I’m on board with the tight tri-peak relationship and the discussion of all and any aspect.

Don’t agree with the points made by the author of the article. First, the high oil prices expected for 08 will impact much like the high prices of 07, that is, most adapt and the economy chugs along. By contrast, while I can’t predict what will come out of the sub-prime mess it is obvious that this Nth scandal, now world wide, is affecting all of finance industry and things are teetering on some kind of knife edge.

Eg. Singapore and an anon. Saudi investor are going to bail out the Union Bank Switz, so has been trumpeted, and all will be fine - but looking only at the published, tip o the iceberg details (the grand picture escapes me but then I am not alone) it is not clear at all that it will actually happen (shareholders and pension funds have objected..shareholder meet is in Feb. 08) and the question Is it enough? hovers implicitly.

The various questions don’t have available answers, and that is worrisome. Where exactly the ‘losses’ are, how much they represent, who will ‘bear’ them, what the general consequences will be, is mysterious.

Second, just on ilargi’s numbers, house prices in the US will fall more, I predict...; some house prices will remain high-ish, others will go to zero and be razed, many will be cut by 50% or 60%, etc. (I realise means were fine for ilargi’s purpose) but they will ‘sink’ back to the low 80’s prices, far more than 15%.

Investors can’t invest if there is nothing to invest in - or nothing they feel is safe. If banks collapse (or remain standing but can’t fulfill their purposes) the news is bad.

About US homeowners, one needs to know, is how many ppl made a down payment, live in their house, maybe have children, and now cannot pay and risk the street? It might be quite low, as compared to the no. of foreclosures (ppl flipping homes; scamming on derelict properties; in deals with banks/gvmt; renting, etc.)

What I am trying to point to here is that social issues (eg families in the street) and financial issues (eg banks failing) while obviously related don’t per se require the same response. To sum up, the original article simply seems to be written from the ‘consumers’ pov, and can be seen as hinting at that housing, with prices sinking, many rentals, deals to be made, etc. etc. is a moveable feast; while high oil prices are relentless, and set to continue. But there is not more to it than that.

Disclaimer: i failed economy 101 as i never went to the exam.

There's more to it than that. The reason why I don't like the term subprime is that it's become a misleading word used to convey the impression that this is a small-scale manageable problem, as if all will turn for the good once those poor overdrawn sods at the bottom of society are kicked out of their homes.

The reality is that investors won't be able to invest because there is no more credit available, at least not, and not nearly, in the same way that it was up for grabs in the past decade. The vast majority of leveraged buy-outs announced early this year have fallen flat on their faces, to name an example.

All that in turn means a whole lot less demand for all sorts of assets, which will sink prices. And just when you think that prices are low enough to go back to buying, you'll find there is no credit left to do that with.

The Law of Receding Horizons, as applied to finance. Now there's a connection between energy and economics.

Just to add my voice to the many who think your financial roundup immensely valuable, not least because we know it is coming from people who view these events with a perspective on PO

Thanks

Personally, I think if we're going to see The End of the World As We Know It (TM), it's going to come through financial collapse. Peak Oil will be slow, playing out over a couple of decades (I believe), thereby giving people some chance to adjust. It may not be fun, a long period of stag-flation, but I think a transition to other energy sources is possible. But a financial meltdown ... the economy has become so large, so complex, and so interconnected, I don't think anyone understands the equations that govern the system. And I'm not at all convinced that it's "stable" in a dynamic systems sense. Roots outside the unit circle? And it's all based on trust in fiat currencies. If it fundamentally breaks, we're fundamentally screwed.

peace,

lilnev

I want to thank the people who do the whole oil drum site and the financial/econ information that is on the TOD: Canada. all the stuff we talk about here is interrelated and valuable information.

I never post here but I've been reading TOD for 3 years come Feb 2008. In the last year it's almost impossible to read everything like I could when I first found the site.

You all do a valuable job please keep it going.

My apologies if this post doesn't end up in the right place in the stream of replies to messages.

Thanks again,

A Reader