The Finance Round-Up: November 2nd 2007

Posted by Stoneleigh on November 2, 2007 - 4:33am in The Oil Drum: Canada

The credit crunch that has been unfolding in slow-motion all year appears ready to make headlines again as equities experience a sharp sell-off. As Ambrose Evans Pritchard says, the evidence that something serious is underway is already present in abundance. Losses and writedowns are mounting, and problems seem to be spreading to bond insurers, which will further impact on the value of insured bonds.

Trillions of dollars of off-balance sheet activities are increasingly coming back to haunt the banking system, as downgrades come in thick and fast. 'Discounted' is the new 'contained', but these losses are neither fully discounted nor contained.

Ambrose Evans-Pritchard: The sky has already fallen

If you are a bear, you must accept that you will always be wrong in polite society, and you will continue to be wrong all the way down to the bottom of recession. That is the cross that bears must bear.

Over the last three months we have seen a rolling collapse of speculative debt and real estate across half the global economy, yet friends still come over to my desk at the Telegraph, with that maddening look of commiseration on their faces, and jab: “so when is the sky going to fall then, eh”?

Well, excuse me. The sky has fallen. The median price of new homes in the US has crashed from a peak of $262,6000 in March to $238,000 in September. (Commerce Department). This is a 9pc drop nationwide.

The slide in existing homes is catching up. They have come down from $229,200 to $211,700 in three months. (National Association of Realtors). Yet we have barely begun to see the default hurricane as Teaser rates contracted in 2005 and 2006 on floating mortgages kick up venomously over the winter, peaking around in the Spring of 2008.

Merrill Lynch has just confessed to a $7.9bn write down on CDO subprime debt and assorted follies, nearly double what it suggested three weeks ago....

....It is true that stock markets have once again decoupled from the realities of the debt markets. But they did this in the early summer, when the Bear Stearns debacle was already well under way. They caught up famously in August.

Nobody I talk to in the City credit trenches believes for one moment that the crunch is safely over. Indeed, they think that we are edging back to extreme stress levels, and the longer it goes on, the worse the damage.

Guesstimates Won’t Cut It Anymore

The props holding up the values of risky mortgage securities finally started to give way last week. And that means the $30 billion in losses and write-downs taken by big brokerage firms in the third quarter are not likely to be the last.

Even as developments in the credit markets went from bad to worse this year, investors for the most part have remained upbeat about the values of the mortgage securities they held. One reason that they could keep their heads in the sand was that these complex securities are hard to value in good times, impossible during periods of stress.

Executives of companies with big stakes in mortgages also accentuated the power of positive investor thinking. Emerging periodically from their corner offices, these executives opined that in spite of rocketing delinquencies, most loans continued to perform well. Rating agencies, fending off complaints that they had been slow to downgrade, maintained that they would adjust their ratings only after they saw actual loan failures. Government officials trotted out regularly to contend that upheaval in the mortgage market was a minor scrape.

After last week, however, it was no longer plausible to deny that mortgage loans, and the complex securities derived from them, had crashed — and caused a lot of damage in the process.

Market insight: Prepare for the credit drama sequel

While this summer’s credit turmoil is already several months past, parts of the credit world remain plagued by strikingly high levels of fear and mistrust.

Indeed, in some arenas, such as mortgage-linked securities, sentiment now seems to be getting worse, not better. And that raises the prospect that we are now moving into an entire new phase of this year’s credit squeeze....

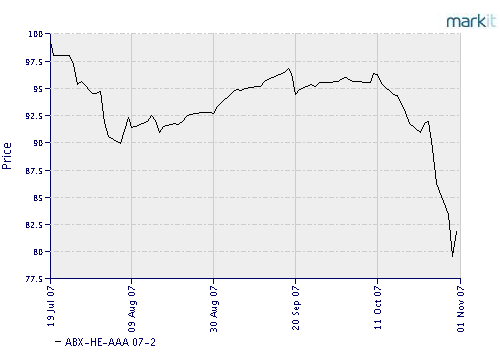

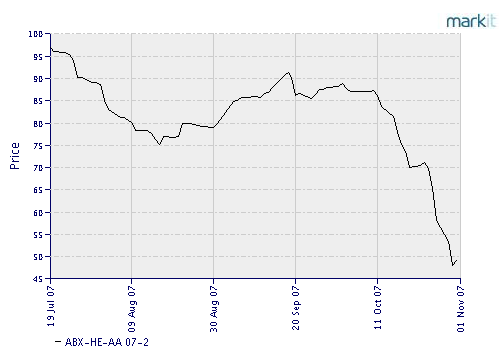

....What is really alarming is that the assets which were supposed to be ultra-safe – namely AAA and AA rated tranches of debt – have collapsed in value by 20 per cent and 50 per cent odd respectively.

This is dangerous, given that financial institutions of all stripes have been merrily leveraging up AAA and AA paper in recent years, precisely because it was supposed to be ultra-safe and thus, er, never lose value.

But the trend also has crucial significance for investment banks. Until quite recently, many Wall Street banks tended to value their subprime linked holdings using models, because they (and their auditors) knew it was hard to get prices for these opaque instruments through real market trades. But I am told that this autumn some banks’ auditors have started to crack down on this approach, particularly in the US, owing to the so-called “Enron factor”.

The rating game: CDOs crash, banks may reveal more writedowns

While the commentariat has spent the summer talking about the subprime crisis and the credit crunch like they’re interchangeable, it would seem that the former is only just coming home to roost.

Having weathered the storm through August and September, October has been disastrous for CDOs. The value of the leading tracker indices has plummeted as the rating agencies have rushed to downgrade senior debt across the CDO spectrum.

It’s all been part of a subprime chain reaction. First there was all that bearish housing news in September - which markets ignored because the Fed had cut rates, equities were rallying and CDS spreads were tightening.

Second, the rating agencies hit mortgage backed securities. That bad housing news - rising subprime delinquencies and a sector which looked like it was heading for a recession fed into the outlook for MBS. On October 8 Fitch downgraded $18.4bn of MBS. Then, on the 11th, Moody’s followed suit with $33.4bn in MBS downgrades. Five days later and Standard & Poor’s joined in - cutting ratings on $23.25bn of subprime securities. And again, three days later, on a further $22bn.

And then, predictably, CDOs - chock full of MBS - came in line for downgrades: On October 22 Standard & Poor’s said it could cut ratings on $21bn of CDOs. Moody’s said it would do the same with $33.4bn on October 26, and on October 29, Fitch said it was reviewing ratings on all $300bn of CDOs out there. Moody’s not wanting to be outdone went one further: saying this Wednesday that it could downgrade 500 CDO deals by tomorrow.

Little wonder then, that the main tracker indices have crashed in the past couple of weeks.

What Do DAP and CDOs Have In Common?

I see that many people are still surprised by the ongoing tumble in the AAA-AA tranches of the ABX indices. I explained why this is happening a week ago in "Remember The Buckets".

Simply put, their terrible performance is not a matter of market psychology but mathematical fact derived from their cascade structure. As borrowers default on monthly payments, the small, lower tranches absorb the losses and leave the much larger AAA-AA portions intact. But once the process inexorably moves to seizure, eviction and auction, loan losses mount exponentially because the hits now come from far larger principal losses, not just interest and amortization. The lower tranches immediately become overwhelmed and spill over the entire losses onto the AAA-AA tranches, which make up 80-85% of the CDO amounts.

Let's look at the 2006-1 series of ABX, which is the oldest and most "seasoned", meaning the loans in the underlying CDOs had the most time to settle down. Think of the following charts as a series of buckets from top to bottom, successively filling up with losses and spilling over into the bucket below: BBB- spills into BBB, then into A, AA and finally AAA. Notice the time lag as the BBB- and BBB buckets first "fill up" with losses and then the "break" in the higher rated A and AA tranches, as the big principal losses suddenly spill over into them.

Bill Fleckenstein: 'Discounted' is the new 'Contained'

Of course, there is no sin of denial on the part of the Lord of the Dark Matter, whose postings on the mortgage-paper unwind will be familiar to my regular readers. The problems continue to worsen, he notes. But people keep giving him the same silly line, that it's all been discounted, which is a variation of "it's contained." He says that there are more dark-matter downgrades to come and that some of the insurers of credit may find themselves in serious trouble as credits go bad. He points out that if the insurers get into trouble, then all of the credits they insure obviously will worsen.

For those who don't know, there is an absolute mountain of paper that trades where it does only because it has insurance. Sort of like the paper that traded where it did because it was supposedly AAA, and that rating turned out to be worthless. Any AAA, AA, A or whatever rating that's based on insurance may not be worth the paper it's written on....

....Memo to nonbelievers: The problem is spreading, it has not been discounted and it has not been contained.

Now the crisis is spreading from Wall Street—which has taken $35 billion in subprime-related write-downs and lost more than $220 billion in stock value—to a less well known corner of the financial world, that of the bond insurers. These firms sell insurance to banks and other major investors for bonds backed by mortgages and the complicated investments that hold the bonds, known as collateralized debt obligations (CDOs). The policies are designed to protect investors in case the securities default. As CDOs grew into a trillion-dollar business, bond policies (called credit default swaps) became a lucrative source of revenue for companies such as American International Group (AIG), MBIA (MBI), and Ambac Financial Group (ABK).

But a flurry of downgrades on mortgage-backed securities and CDOs has started to affect insurers' earnings. Anxiety has focused on ACA Capital (ACA), a small player with big exposure to CDOs.

A New York company with less than $500 million in annual revenue, ACA has just $326 million in BASE capital. The company claims it has $1 billion in capital it could use for potential payouts if the CDOs it insures go bad. Yet it has sold coverage worth nearly $16 billion, with most policies written for CDOs created in the past couple of years. Those are especially problematic vintages because lending standards grew so lax in 2006 and 2007.

Deals With Hedge Funds May Be Helping Merrill Delay Mortgage Losses

At issue with any hedge-fund deals is whether there was an attempt by Merrill to sweep problems under the rug through private transactions kept out of view from investors. Some previous scandals, such as the collapse of Enron Corp. and the troubles of Japan's financial system in the 1990s, involved efforts to hide problems through off-balance-sheet transactions.

Merrill has become ground zero of mortgage problems in the U.S. Last week, the firm announced a $7.9 billion write-down fueled by mortgage-related problems -- one of the largest known Wall Street losses in history -- after projecting just a few weeks earlier that the write-down would be $4.5 billion. Merrill also took a $463 million write-down, net of fees, for deal-related lending commitments, bringing the firm's total third-quarter write-down to $8.4 billion.

Minyan Peter: The Ripple Effect of Collateralized Debt Downgrades

One of the challenges that Moody’s (and the market overall) faces is identifying who holds each downgraded CDO and whether or not those downgraded CDO’s serve as the backing for other rated debt – such as the commercial paper or MTN’s for SIV’s or other structured vehicles – which may in turn need to be downgraded. And with the downgrading of structure debt accelerating, I expect that structured vehicle entities, whose ratings may have previously been stable, may soon be under review.

But beyond the obvious Merrill Lynch (MER)-like portfolio write downs, there are other implications to all of these structured asset write downs. For asset-backed commercial paper issuing vehicles holding downgraded debt, it may mean even greater and greater dependence on their short term liquidity lines provided by banks. (Which in turn puts the banks in the position of further on-balance sheet loans (all requiring loan loss reserves), which in turn requires the banks to issue more debt, which puts further pressure on bank leverage ratios – which ultimately reduces the availability of new credit.)

Also, and I think missed by many, Moody’s put the market on notice today that future structured note downgrades may be immediate, rather than occurring following an announced review period. For holders of structured debt this further raises the risk of a forced sale, rather than orderly liquidation. In addition, given the ratings interdependence of billions of dollars of structured debt, the downgrading of one structured debt security could result in immediate ripples across a far larger universe of financial institutions.

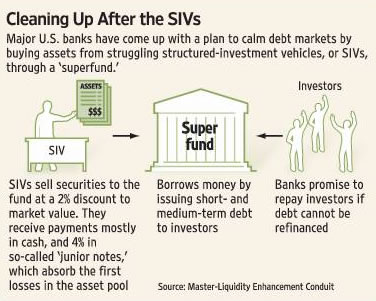

John Maudlin: Taking Out the SIV Garbage

This week we learned that Structured Investment Vehicles or SIVs should more properly be termed SIGs or Structured Investment Garbage. Several SIVs worth over $20 billion are closing shop, and investors will lose money. More SIVs are selling assets to meet loan demands. SIVs had issued at the peak about $400 billion worth of asset-backed commercial paper. The total of asset-backed commercial paper was $1.2 trillion. Since July, that has plummeted, nose-dived, crashed to $888 billion, and is on its way to a small fraction of that. In effect, we are taking a trillion dollars of financing for a wide variety of things we need, like credit cards, autos, homes, and corporate loans out of the credit market. That is going to have an impact.

But I don't want to get ahead of myself. Let's start at the beginning. What is an SIV and where do they come from? Who owns them? Why do they exist?

We can blame the Brits. In 1988, two London bankers left Citigroup to start this industry. Today they run the largest SIV, called Gordian Knot, worth $57 billion. Essentially, a SIV allows a bank to take assets off its books and reduce the bank's capital requirement.

The first structured investment vehicle, or SIV, was created in 1988, and others quickly followed.

SIVs issued debt in the commercial paper market, a short-term financing market. Then they used the proceeds to buy higher-yielding, long-term assets, such as mortgage-backed securities.

The strategy worked as long as money market fund managers and others bought the commercial paper - which was generally considered a safe investment.

This may sound silly, but let me ask you a question. Let's say that I maxed out my credit at Citigroup to speculate on a house whose market price is now less than what I paid. Citi wants its money, but instead I say, "Sorry, the house is selling for less than its true value. As soon as it sells for what it should, I'll send you a check." What do you think Citi's reaction would be? How about "Sir, where should I send the repo man?"

Well, folks, Citi (Charts, Fortune 500) seems to have put itself in just such a fix by borrowing lots of money to buy assets that have dropped in market value. But instead of summoning the repo (as in repossession) man, some of the world's biggest hitters are trying to set up a huge fund to buy time for Citi and some other institutions with similar problems....

....The idea is to set up a $100 billion "master liquidity enhancement conduit" to take some of the $80 billion of suspect securities off Citi's hands so that it doesn't have to sell them in the current market. Other institutions have about $300 billion worth. (This conduit is being called a superfund, to the delight of those of us who live in New Jersey, for whom the term evokes images of toxic industrial waste. But I digress.)

The problem here, as you probably know, involves seven of Citi's "structured investment vehicles," known as SIVs. They borrowed short-term money to buy long-term assets, such as mortgage-backed securities, that have fallen in market value.

Regulators and various big institutions are trying to stabilize things to avoid what we can call SIVilis. That's a financially transmitted disease that could infect the world's financial markets, leading to cascading failures and other consequences too dire to even think about.

According to the Financial Times, "Big U.S. commercial banks have seen $280 billion of new debt come on to their balance sheets since the credit squeeze, threatening to undermine economic growth by inhibiting their ability to make new loans. The banks have been forced to take on to their books large amounts of commercial paper and leveraged loans after investor demand for such assets dried up in the summer."

As you probably know, while these numbers sound quite large, they are only the tip of the iceberg. According to Moody's, the credit rating agency, assets held by bank-sponsored special investment vehicles ("SIVs") were $320 billion in July. Two SIVs announced several days ago that they will be unable to pay their debts. Such moves could force more liabilities onto the balance sheets of banks, further constraining liquidity and possibly even threatening the banks' own solvency.

Through fractional banking and the rules that you set at the Federal Reserve, banks are allowed to have 20 times the amount of liabilities as their net capital. Because SIVs are off-balance sheet, banks can now have even more than 20 times. In addition, many SIVs have their own leverage, sometimes up to 10 times. In other words, only a slight move down in the value of SIV or other assets means that banks could be insolvent.

When Crumbling Credit Meets Deadly Leverage

As Hank Paulson, Secretary of the Treasury, runs around trying to bail out the Structured Investment Vehicles (“SIVs”), it’s become pretty obvious. These SIVs provided a way for huge banks, like Citibank, to hold another $400 billion of assets but conveniently keep them off-balance sheet. Up until a few weeks ago, the financial press hadn't even heard of a SIV. Now, suddenly, they’re threatening the core of the financial system because the loans might have to go back on-balance sheet and tie up precious equity capital!

The big players love derivatives because they allow massive off-balance sheet leverage. However, the hedge funds and mortgage companies that have all blown up recently (along with some Wall Street firms and Bear Stearns) have learned a hard lesson: mixing massive credit losses with high leverage is a formula for quick and definitive financial death. While leverage may be positive to the bottom line on the upside, it can quickly kill on the downside.

While SIVs are continuing to rock the system, they are a mere rounding error compared to Credit Default Swaps (“CDSs”) and other major derivatives. (CDSs are the most widely traded credit product.)

$28 trillion of CDSs is a staggering number! It’s more than double the U.S. GDP, and is more than four times the total of all outstanding corporate debt. The off-balance sheet “shadow world” of credit actually dwarfs the on-balance sheet visible world.

Subprimes were actually the last stanza in a song that described the financialization of the U.S. economy beginning way back in the 1970s. The delinking of the dollar from gold and the deregulation of banking and interest rates via the abolition of Regulation Q were necessary conditions in unleashing the potential for the hedge funds of the 21st millennium.

What really provided the impetus however, were other expansive trends: global deregulation of capital, computer technology, and the birth of potentially speculative instruments that could accommodate leverage and create credit outside the banking system. Financial futures geared towards currencies, stocks, and bonds were followed by options, swaps, credit default securities and a host of anachronistic three-letter conduits that we now know as CDOs, SIVs, and – well, make up your own combination – it’s probably been marketed already.

Some would vehemently argue, although probably not the current Fed Chairman, that the pace of financialization was not matched by the steadying arm of regulation. The sorry state of mortgage origination with its “no docs” and “liar loans” is perhaps the most recent testament to that. In combination, the loose regulation and financial innovation of the past 35 years have spawned what PIMCO’s Paul McCulley has labeled a “shadow banking system” where credit is composed on a keyboard as opposed to a printing press.

Economic historians marvel at the ability of the Weimar Republic in the late 1920s to have printed paper money so fast that workers would lower their afternoon wages in a basket to waiting wives in order to front run rampaging six-digit inflation. Surely they could not have imagined shadow investment bankers and their minions spawning financial derivatives in the hundreds of trillions, far beyond the reach of central bankers and Treasury officials alike. If old-fashioned banking’s pace could be described as a waltz, then their thoroughly modern shadow counterparts would resemble funk, hip-hop, grinding, and then some.

John Maudlin: As the Subprime Turns

But first, let me re-visit last week's letter where I talked about the $80 billion Super SIV fund that is being created by Citigroup, Bank of American and JP Morgan Chase. A lot of commentators have been writing about what a bad idea it is, and a few have taken me to task. They think it is a bad idea to rescue bad investments. They want the market to clean out the bad stuff so we can start functioning again.And I agree, but that is not what the fund is going to do, as I understand it. The Super SIV fund is simply offering to buy only the good assets in failed SIVs. In essence, they (and the US Treasury) are worried that there will be a rush to the exits from failing SIVs (mostly in Europe) that will result in a panic forcing down the prices of good assets far below where they should be. That could seriously affect the capital structure of US banks and create a severe credit crunch. This fund simply sets a floor for the price of good assets at $.94 cents in cash and a 4% note.

They are not going to take the subprime junk. That is going to have to be written off by whoever owns it. This does not seem like a bail-out to me, but self-interested parties in a free market whose interest is in avoiding a panic and also will allow a mark to market price for assets. I think it makes sense.

If I am wrong and any of the toxic subprime assets show up in the Super SIV, then I would agree that it is a very bad idea indeed.

Junk mortgages under the microscope

It's getting hard to wrap your brain around subprime mortgages, Wall Street's fancy name for junk home loans. There's so much subprime stuff floating around - more than $1.5 trillion of loans, maybe $200 billion of losses, thousands of families facing foreclosure, umpteen politicians yapping - that it's like the federal budget: It's just too big to be understandable.

So let's reduce this macro story to human scale. Meet GSAMP Trust 2006-S3, a $494 million drop in the junk-mortgage bucket, part of the more than half-a-trillion dollars of mortgage-backed securities issued last year. We found this issue by asking mortgage mavens to pick the worst deal they knew of that had been floated by a top-tier firm - and this one's pretty bad....

....Goldman peddled the securities in late April 2006. In a matter of months the mathematical models used to assemble and market this issue - and the models that Moody's and S&P used to rate it - proved to be horribly flawed. That's because the models were based on recent performances of junk-mortgage borrowers, who hadn't defaulted much until last year thanks to the housing bubble.

The falloutThrough the end of 2005, if you couldn't make your mortgage payments, you could generally get out from under by selling the house at a profit or refinancing it. But in 2006 we hit an inflection point. House prices began stagnating or falling in many markets. Instead of HPA - industry shorthand for house-price appreciation - we had HPD: house-price depreciation.

Interest rates on mortgages stopped falling. Way too late, as usual, regulators and lenders began imposing higher credit standards. If you had borrowed 99%-plus of the purchase price (as the average GSAMP borrower did) and couldn't make your payments, couldn't refinance, and couldn't sell at a profit, it was over. Lights out.

Vultures eyeing mortgage corpse

Since the subprime crisis erupted earlier this year, vulture investors looking for bargains have been circling battered securities backed by mortgages.

But the feeding has not yet begun in earnest - and that's not a good sign for the housing and credit markets.

While opportunistic investors may be reviled by some, their presence is often an indication that a beaten down market has reached a bottom. The longer they stay away, the more likely it is that turmoil will roil the market....

....These investors face the difficult task of determining when prices for the distressed securities have hit a bottom. Until they're sure they're getting a bargain, they're likely to hold back on investing their money.

"It's not that no one's going to want to touch [subprime securities]. The question is at what price," said Adelson, who used to head structured finance research at Nomura Securities.

Asset-backed commercial paper falls for 12th week

The outstanding level of asset-backed commercial paper fell for the 12th straight week, the Federal Reserve reported Thursday. Asset-backed paper dropped by $9 billion, or 1%, to $875 billion. Asset-backed paper, which are short-term IOUs backed by assets such as mortgages, credit cards or other receivables, has plunged by $308 billion, or 26%, since the crisis of confidence in credit began in early August. The collapse of the market has prompted large banks to seek alternative funding for their special investment vehicles.

For sale: 2 million empty homes

The number of vacant homes for sale rose in the third quarter, according to the latest government reading that casts new harsh light on the weakness of the housing market. The Census Bureau report puts the number of vacant homes for sale at 2.07 million in the period, up about 2 percent from the second quarter, and 7 percent above year ago levels.

The number is down 5 percent from the record high reading reached in the first quarter, though. For purposes of comparison for the current situation, imagine the Detroit metropolitan area, which the Census Bureau estimated had 2.08 million households in its 2000 Census. Now picture virtually every house or condo empty, with a for sale sign in the front yard of every home, from inner-city Detroit to its suburbs, all the way to nearby cities such as Flint and Ann Arbor.

In Cleveland the cost of clearing the human debris come eviction day falls to the Cuyahoga County Sheriff Department.

"I feel like an undertaker," says Jeff, a veteran of neighbourhood policing who has seen evictions in his section jump since he joined the force from 12 a week to over 90 a week. He has to evict families, old people and even, on occasion, his own relatives.

The result is a city blighted by house repossessions - with one in six households in Cleveland have faced eviction proceedings since 2000. Due to a glut of houses on the property market, house prices have crashed. Banks can no longer sell the properties on and they are left derelict and deserted.

"It has ripped the heart out of our neighbourhood," says Toni Brancatelli, a lifelong Cleveland resident. He has seen gangs and squatters move in to the empty homes, fueling crime and social decay.

The majority of those defaulting on their mortgages are people living on the poverty line, tipped into defaulting on their mortgage by rising medical bills, unemployment, utility bills and one of the most contentious elements to this crisis - 'predatory lending'.

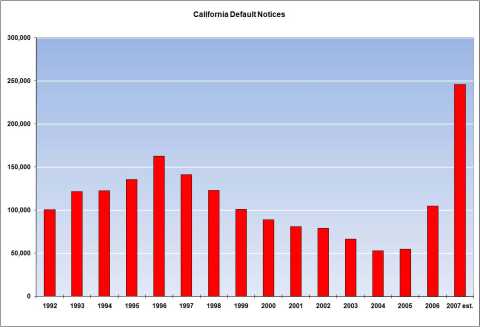

Calculated Risk: Record California Foreclosure Activity

It's hard to imagine, but next year will probably be worse.

U.S. Homeownership Falls in Longest Slide Since 1981

Homeownership in the U.S. dropped for a fourth consecutive quarter, the longest decline since at least 1981, suggesting more Americans will miss their best chance of building wealth.

The proportion of households that own their residences fell to 68.1 percent in the July-September period from 68.3 percent in the prior three months, according to a report today from the Census Bureau in Washington, whose comparable records go back to 1981. The rate has been declining from a peak in 2004, which culminated a decade of gains fueled by easier lending standards and rising home purchases by immigrants and younger households.

``Owning a home in this country has been a principal source of wealth creation for low- and moderate-income people,'' said Nicolas Retsinas, director of Harvard University's Joint Center for Housing Studies in Cambridge, Massachusetts. ``In the absence of home equity, families will inevitably spend less.''

Bank 'lends Northern Rock £23bn'

Northern Rock has borrowed almost £23bn in emergency funding from the Bank of England, the latest figures from the central bank indicate.

That is roughly £730 for every UK taxpayer and marks a rise of £2.2bn from the week ended 31 October.Northern Rock has been in trouble since the global credit crunch hurt its business and led to a run on the bank.

To win back investor confidence, the government has guaranteed all Northern Rock deposits and loans.

The BBC's business editor Robert Peston says this means that the UK taxpayer's exposure to Northern Rock could be much more than currently thought.

"The extent of public sector support goes beyond these direct loans," he said.

"The Treasury has also indemnified a further £20bn odd of retail deposits," he explained.

"So we are talking about total public-sector exposure to the Rock of £40bn - equivalent to around 3% of our entire economy.

"And that exposure could become much bigger, as other loans to the Rock fall due for repayment."

U.K. Housing Market Teeters on Edge of Northern Rock

Britain's expansion has been spurred by a borrowing spree, thanks to interest rates at 40-year lows from 2001 to 2006. By the end of 2006, the British owed 1.37 trillion pounds, or 1.61 times their income -- the highest rate in the Group of Seven nations, according to the London-based National Institute of Economic and Social Research. By June 30, the ratio had grown to 1.66. The U.S. rate remained at 1.42 during that period.

Britons poured the borrowed money into housing -- and then used their new homes as collateral to take on even more debt. Residential property prices soared 189 percent in the past 10 years, almost twice the increase for single-family homes in the U.S., according to HBOS Plc, the U.K.'s biggest mortgage lender, and U.S. government figures.

Consumers have spent some of these gains and loans on goods such as new kitchens and cars they otherwise couldn't afford, said Alan Clarke, a London-based economist for BNP Paribas SA, France's biggest bank.

``The only thing that has been supporting consumer spending growth is wealth gains from house price inflation,'' Clarke says. ``This is about to disappear.''

Treasuries Rise as Bank Downgraded on Expected Mortgage Losses

Treasuries rallied, led by the second-biggest gain in two-year notes this year, after equity analyst downgrades of Citigroup Inc. sparked stock market declines and boosted the appeal of government debt....

.... Yields on two-year notes fell 19 basis points, or 0.19 percentage point, to 3.76 percent at 4:12 p.m. in New York, according to bond broker Cantor Fitzgerald LP. The price of the 3 5/8 percent securities maturing in October 2009 rose 3/8, or $3.75 per $1,000 face amount, to 99 3/4. Yields move inversely to bond prices.

The last time two-year note yields fell more than today was on Aug. 9, when money-market rates surged because banks were reluctant to lend to one another.

Bonds leap in safety bid as stocks plummet

U.S. Treasuries prices leaped on Thursday as steep stock market losses and a resurgence in credit worries spurred demand for safe-haven investments a day after the Federal Reserve lowered interest rates.

Government data showing tame core inflation and weaker consumer spending, together with a private-sector report of slower manufacturing growth, also cut risk appetite and boosted expectations the Fed will lower rates at its December meeting.

"It is all concerns about the implosions in the credit markets and that we are only seeing the beginning of it -- that it is going to hurt the economy and most likely force the Fed's hand again to ease," said Mary Ann Hurley, vice president of fixed income trading at D.A. Davidson & Co. in Seattle.

More on the Emerging Pay Option and Alt A Fiasco

Further these mortgages will be more lethal for recoveries because loan balances are increasing (negative amortization), not decreasing, which of course removes even more equity cushion. Further a large percentage (over half of total home purchases in Bubble markets in 2006) used piggyback home equity loans, leaving them with no equity. Combined with declining home prices, a situation emerges where these debtors are seriously upside down. This illustrates in spades why the 2006 vintages of all sorts (not just subprime) are in jeopardy.

Impact of Mortgage Resets Likely to Be Worse Than Reported

Optional adjustable rate resets will begin in earnest next year, but will not reach their peak until 2011. The same is true of Alt-A loans and agency ARMs....

....As if that was not bad enough, an additional wave of option ARM payment shock is likely to occur before the 2011 peak, as borrowers reach the negative amortization ceilings on their loans (typically 110-125% of principal). At that moment, the pay option ends, and both the principal, interest on the principle, and deferred (higher) interest from the pay option must be paid back. It is impossible to represent this in a chart such as the above, since the exact date of this occuring depends on how much the individual borrower paid over time. However, given that the vast majority of pay option borrowers have made only minimum payments, the neg-am ceiling is a very real hazard for the entire period through 2011.

Banks rethink relationships with mortgage brokers

As loan defaults and foreclosures rise, politicians and consumer groups have directed many of their attacks toward mortgage brokers. They say some brokers steered consumers into loans they couldn't afford to earn a bigger commission.

California's Department of Real Estate is encouraging consumers to report abusive practices by brokers, and at least two members of Congress have introduced separate bills that would expand broker regulation.

Brokers, meanwhile, are firing back and say an entire industry is being blamed for actions of a few bad apples. And banks, not brokers, bear the ultimate responsibility for every single home loan, brokers say.

It remains to be seen if most home buyers and homeowners seeking to refinance have been swayed by the criticism.

But some big banks are paying attention. They're cutting brokers out of some loan deals or applying greater scrutiny to brokers.

Stocks Plunge; Dow Drops More Than 360

Mindful of a warning from the Federal Reserve Wednesday about inflation, the market nervously watched the price of oil, which passed $96 a barrel overnight for the first time before dipping on profit-taking. The Fed, which cut interest rates a quarter point, said in a statement that inflation remained a concern, and oil's ascent to another record raised the possibility not only that the Fed might stop cutting rates, but that it might even consider raising them if inflation accelerates.

Meanwhile, Wall Street also had to contend with concerns about a slowing economy. A report from the Commerce Department indicated consumers scaled back their spending in September as worries mounted about a worsening housing market and further credit market turmoil. And a trade group reported that manufacturing in the U.S. grew in October at the weakest pace since March.

U.S. Stocks Decline; Citigroup Retreats on Dividend Concern

U.S. stocks tumbled, led by the steepest drop in financial companies in five years, after analysts said Citigroup Inc. may be short of capital and advised investors to sell the shares.

Citigroup, the biggest U.S. bank by assets, slid the most since 2002 after CIBC World Markets said its dividend may be cut and Credit Suisse Group reduced its rating. Bank of America Corp., the second largest bank, had its biggest decline in four years. Retailers fell, led by Target Corp., after consumer spending slowed more than economists forecast.

The Standard & Poor's 500 Index lost 40.94, or 2.6 percent, to 1,508.44, erasing about $369 billion of market value from the benchmark for American equities. Financial shares, this year's worst-performing industry, led the slide with a 4.6 percent retreat, the most since September 2002. The Dow Jones Industrial Average decreased 362.14, or 2.6 percent, to 13,567.87. The Nasdaq Composite Index slipped 64.29, or 2.3 percent, to 2,794.83. More than 13 stocks fell for every one that rose.

Citigroup May Cut Dividend, Raise Capital, CIBC Says

Citigroup Inc. may have to cut its dividend, raise cash or sell assets to raise more than $30 billion to shore up its capital, CIBC analysts led by Meredith Whitney wrote in a note to clients dated Oct. 31.

Citigroup, the second-largest U.S. bank, was lowered to ``sector underperform'' from ``sector perform'' by New York-based CIBC World Markets. The ratio of the company's tangible equity to tangible assets fell to 2.8 percent, the lowest in decades and half the average for its peer group, the analysts said.

Question of Solvency at Citigroup

Notice how Bove cleverly pointed out the asset side of the equation while conveniently forgetting about liabilities. Let's rework Bove's statement to see the other side of the story.

"At the end of the third quarter, Citigroup posted $2.227 trillion in liabilities. This was more than any other American bank and possibly more than any bank in the world. A mere 5.4% decline in the value of Citigroup's assets would make Citigroup insolvent."

Citigroup's assets look great in a vacuum. However, those assets do not look so great in relation to liabilities. Leverage has never been greater, and much of that leverage is now in exactly the wrong places: residential and commercial real estate.

Credit Suisse Profit Falls After Debt Market Swings

Chief Executive Officer Brady Dougan, who succeeded Oswald Gruebel six months ago, said ``extreme market conditions'' sparked by record U.S. home foreclosures forced the company to write down fixed-income securities and leveraged loans. UBS AG, the biggest Swiss bank, announced its first quarterly loss since 2002 after erasing $4.4 billion from the value of bond holdings.

Debt-market volatility ``will continue to hang over us like a Damocles sword,'' said Dieter Winet, a fund manager who helps oversee $50 billion, including Credit Suisse shares, at Swissscanto Asset Management in Zurich. ``We don't know whether the money will return.''

Subprime Fallout Continues, Hedge Chiefs Oppetit, Hintze Say

The fallout from the subprime mortgage market collapse in the U.S., which led Merrill Lynch & Co. to post a record loss last week, is set to continue, said hedge-fund managers overseeing more than $17 billion of assets.

Michael Hintze, who runs London-based CQS, Bernard Oppetit, who founded Centaurus Capital Ltd. and Martin Lueck, director of research at Aspect Capital Ltd., said they expect further turmoil after a U.S. housing market slump caused credit market rates to rise in August and September. Investors spurned all but the safest investments, forcing writedowns of fixed-income holdings and a run of redemptions on some hedge funds.

SEC Eyes Goldman Sach's Good Fortune

The Securities & Exchange Commission is looking into whether Goldman Sachs cheated its way to enormous profits - even as the rest of the financial industry was suffering through a massive downturn....

.... During a second quarter that saw most of Wall Street take it on the chin, Goldman scored an 88 percent jump in profits to $2.85 billion.

By comparison, Lehman Brothers' earnings were down 2 percent, Morgan Stanley's profits fell 8 percent and Bear Stearns' net was off 62 percent.

In its quarterly financial statement Goldman said "significant losses in non-prime loans and securities were more than offset by gains on short mortgage positions."

In other words, Goldman made some very lucky trades to avoid the fate of the others.

The same person who spoke with the SEC's New York office said the commission also seemed interested in the relationship between Goldman and The President's Working Group on Financial Markets.

People who follow the actions of The Working Group, which is nicknamed the Plunge Protection Team, assume that it was the organization that rallied the banking industry behind a recent plan to rescue banks endangered by the subprime mess.

They also assume that much of what The Working Group accomplishes is done through Goldman, where Treasury Secretary Hank Paulson had been chairman before heading Treasury.

Moody's to Cut Jobs in Next Two Months as Ratings Demand Slows

Moody's Corp., the second-largest credit-rating company, will begin cutting jobs as soon as next month as the credit-market slump saps demand for its bond-rating services.

Positions will be eliminated and some vacancies won't be filled, Fran Laserson, a spokeswoman for New York-based Moody's, said in an interview. She said the job reductions will be less than the 10 percent reported yesterday by financial news Web site Creditflux.

Moody's, which gets more than 90 percent of revenue from its ratings and research business, doubled its headcount between 2003 and the end of 2006 to about 3,400 employees amid soaring sales of corporate bonds and debt linked to subprime mortgages. The company last week reported its first drop in net income in seven years as revenue from rating residential mortgage securities tumbled 52 percent....

....The company has been criticized by investors and lawmakers for grading subprime-mortgage securities too highly and failing to act when homeowners began defaulting on loans backing the bonds. The U.S. Securities and Exchange Commission is probing whether Moody's and other credit rating companies were ``unduly'' pressured by Wall Street to give inflated ratings.

Fitch May Cut Credit Ratings on $36.8 Billion of CDOs

Fitch Ratings said it may cut rankings on $36.8 billion of collateralized debt obligations linked to residential mortgage securities.

The company placed $32.6 billion of debt on review for a possible downgrade, according to a statement today. The remaining $4.2 billion had already been under review. Almost $24 billion of the debt had AAA ratings, New York-based Fitch said.

Fitch, a unit of Paris-based Fimalac, follows Moody's Investors Service, which last week cut ratings of CDOs linked to $33 billion of subprime mortgage securities. Lower ratings may force owners to either mark down the value of their holdings, or sell the securities. Moody's, Fitch and Standard & Poor's in July began lowering ratings on hundreds of mortgage-linked securities after their value tumbled as much as 80 cents on the dollar.

``The market at this point no longer believes the rating agencies when it comes to mortgage-related products,'' said David Castillo, who trades CDOs in San Francisco at Further Lane Securities. ``It's merely forcing the hand of investors who are ratings-driven from an investment-criteria perspective.''

Countrywide Shareholders Sue Mozilo Over Stock Sales

Countrywide Financial Corp. shareholders sued Chief Executive Officer Angelo Mozilo and 19 other company officers and directors, claiming a stock buyback program allowed them to sell shares at inflated prices.

The defendants sold $842 million in company stock while issuing false and misleading statements about the financial health of Countrywide, the biggest U.S. mortgage lender, the New England Teamsters and Trucking Industry Pension Fund alleged in a complaint filed Oct. 29 in Los Angeles Superior Court.

Countrywide shares have dropped 62 percent this year amid what Mozilo has called the worst housing market since the Great Depression. The company had to tap $11.5 billion in emergency credit in August after cash ran short. Mozilo, who has sold more than $280 million of Countrywide shares over the past two years, has said he's facing an informal Securities and Exchange Commission inquiry into stock sales.

Private Equity's Boom Now Busting?

The recent PE boom reminds me about the junk bond boom in the 80s. With the junk bond market crashing, Savings & Loans under crisis, liquidity suddenly drying up, refinancing becoming a pipe dream, we saw major defaults on loans and many highly leveraged corporations financed by the junk bonds. Currently with the quick widening of credit spread (rating agencies from risk taking to risk averse), drying up of PE funding, lowering corporate profit margin, declining revenue and P/E trend, we can see not only many potential highly leveraged deals being dead, but also more importantly many complete deals will suffer heavy losses in the near future.

Several months ago, all the computer models on this kind of PE deals built in the most optimistic assumptions, not sure they want to show off their models with the new assumptions now. A few months ago every institution was lining up to buy those PE financing rated AA, but now can't wait to dump these bonds to avoid any junks in their portfolio. It is noted that in the 80s one large bank (Drexel) failed and was used to be blamed on the whole junk bond and S&L crisis while public and tax payers were holding the bag and lost billions. This time, it will be very interesting to see whether any major bank and large PE firm would fail. No wonder why partners at major PE firms are competing with time to IPO and cashing out now.

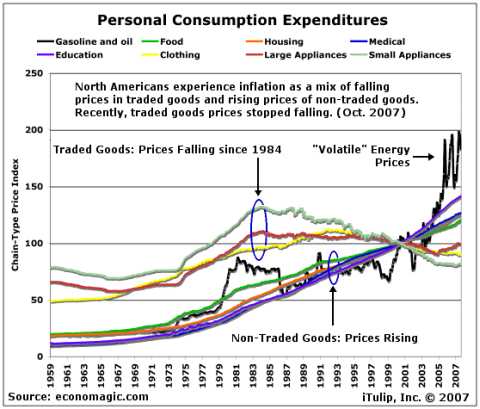

Funhouse Mirrors #1: Personal Savings Rate

In the government funhouse mirrors, the US economy appears to be healthy. Taking away the personal savings rate mirrors reveals a nation of individuals who are not earning enough to offset the rising cost of living, even with cheap imports. Wages may be rising, but not as fast as the prices of goods and services, and you are spending more on items that are rising in price than you are on items that have been falling in price. Wage earners are making up the difference by increasing their borrowing.This describes what you actually experience when you look around you and talk to your friends and neighbors, and what you experience yourself, doesn't it?

The message is this: you are not crazy. The numbers are crazy, the way they are collected and analyzed by the government. You're just fine.

Q&A with Robert Prechter: Remembering Black Monday

Q: How important is the response of the Fed in terms of supplying liquidity and thereby saving the stock market?

A:When it comes to interest rates, the Fed is irrelevant. All it does is adjust its rates to those set by the market. If you plot the yield on T-bills against the discount rate, you will see that the former leads the latter. That’s why the ½-point drop in the discount rate last month was easy to predict. The T-bill yield had already dropped a full point, and the Fed follows the market. Despite all the rhetoric about it, the Fed has not kept rates artificially low, just as it did not make them soar in the 1970s. The market sets the rates, and the Fed follows. Greenspan said exactly that on TV last month, and the charts confirm it.

When the Fed engages in a large volume of repos, it helps banks on the margin avoid immediate disaster. But in doing so, it also delays the inevitable price adjustments and gives bankers a false sense of security, thus encouraging them to create more and more unsound loans. In the end, all this manipulation merely increases both the likelihood of a crash and the size of the decline. But you have to realize that the Fed and the banks could not get away with such activities in the absence of optimism. Society in recent years has had a voracious appetite for credit, and the Fed is merely helping the banking system provide it.

China encourages banks to look overseas for targets

China will push its banks to forge deeper into overseas markets for acquisitions and a global profile, a top bank regulator said on Sunday.

"We will encourage Chinese banks to go abroad to participate in international competition and overseas acquisitions to improve global competitiveness," Wang Zhaoxing, assistant chairman of the China Banking Regulatory Commission, told a financial forum in Xianghe, Hebei province.

Flush with cash after blockbuster share flotations and their books cleaned up thanks to government-led billion-dollar rescue packages, Chinese banks are increasingly opening branches and buying into overseas banks.

Thanks for putting all of the linked articles together StoneLeigh. If you had this one and I missed it, I apologize for the repeat.

Here is a respected investment advisor saying things are not as we are often told. Bill Bonner is not usually a tinfoil hat kind of guy. In the linked article he says flat out that the Fed is understating inflation and overstating US Gross Domestic Product.

" How could so many things be so expensive…while consumer price inflation is so modest? Oil is over $90. Other commodities are soaring…hitting new all-time highs. Labour in China and India is rising at 10% per year. How is it possible that the cost of living remains, according to the feds, under control? In other words, how could the dollar be so weak in the face of every major asset category we read about…but so strong in the face of general, consumer spending?

The answer is simple; the feds are lying. "

http://www.dailyreckoning.co.uk/article/therealusinflationrate0580.html

FINGERS OF INSTABILITY Part 11: Meltdowns

--snip--

--snip--

--snip--

--snip--

Went to the RV resorts office and gave them a site rental check marked to model. I am now homeless sleeping in the Wal Mart parking lot.

What happened?

Citi called a emergency board meeting over the weekend.

Why does the parking spot next to mine say Prince on it?

It is all so confusing. :-)

http://www.ft.com/cms/s/0/a942b328-889f-11dc-84c9-0000779fd2ac.html?ncli...

Thanks Stoneleigh I can always count on you to catch the good bits.

Slightly OT;

Ever since I closed out all my credit cards I have been receiving, two to three offers in the mail every day, both at work and at home.

I always open them and say “nope, 0% is not good enough I want you to PAY me to borrow your damn money”, then I tear it up.

Today I got it.

0% interest + .3% back on select purchases.

I still tore it up.

Thanks Souperman2 :)

Once the credit crunch really gets underway you won't have to worry about getting any solicitations like that anymore. I don't get as many as you apparently do, but when I do they always end up in the round filing cabinet (the bin).

Good job Stoneleigh, for the masses with the 3 kids 2 dogs and a duck crew who are taking it on the chin it is nice to see you framing the data in a way that lends support to that which us duck owners know. And that is weez in big time inflation.

The advice for such a circumstance other than not maxing out 15 new credit cards would be to try to insulate yourself from the price shocks. The things that are getting much more expensive are food,interest related debt, taxes, fuel, hydro. Asian toys soaked in lead however are going down. The c.p.i. has become a joke. When a decrease in the price of yachts signals a .5% drop in the inflation rate then you know who's interest it is serving.

So how do you insulate yourself from such price increases? If you are part of the winners circle you don't bother as the increases represent such a small part of your disposable income that you should concern yourself with other issues. But if you are in the lower to middle income then see if you can burn wood, increase insulation, add solar hot water, put in a big garden and build a root cellar, convert one of your cars to an all electric if your commute is less than 80k. Explore a wind generator if you've got wind but wait on solar. I am guessing that prices will come down with the new producers on the way. At least those are my goals, I will let you know if it proved to be a wise choice.

Cheers

The truth?

You can't handle the truth !!!!

Is this how it went down? :-)

http://safehaven.com/article-8786.htm