The Energy and Environment Round-Up: October 21st 2007

Posted by Stoneleigh on October 21, 2007 - 3:42am in The Oil Drum: Canada

We have seen much attention paid lately to the potential for large sea level rises due to climate change, but global warming also has other effects on water systems - most significantly a potentially substantial reduction in the amount of fresh water available to sustain human populations.

In Australia, Tim Flannery pointed out some time ago that a 10% drop in rainfall resulted in a 70% drop in available water due to increased evaporation from warmer temperatures, which is why Australia is currently experiencing such severe water shortages. Other areas could be set to experience something similar, especially if the glaciers supplying major river systems in populous regions melt. In a world of falling water tables, and less energy available for pumping water from ever-increasing depths, this is a trend to watch, and not just for the purpose of making money from scarcity as investment newsletters would have you believe.

Also in this Energy & Environment Round-Up, we follow the on-going resource royalty debate in Alberta, the row over equalization payments and resource ownership in the Maritimes, and the opening of a token hydrogen refueling station in Ottawa. On the international stage, we look at China's tidal wave of growth and increasing energy demand, and the developing geopolitical tensions that are combining with rampant speculation to push the price of oil to record highs.

Finally, check out the October 2007 Special Tar Sands Issue of The Dominion.

This 'bath-tub ring' is 100 feet high.

Scientists sometimes refer to the effect a hotter world will have on this country’s fresh water as the other water problem, because global warming more commonly evokes the specter of rising oceans submerging our great coastal cities. By comparison, the steady decrease in mountain snowpack — the loss of the deep accumulation of high-altitude winter snow that melts each spring to provide the American West with most of its water — seems to be a more modest worry. But not all researchers agree with this ranking of dangers.Last May, for instance, Steven Chu, a Nobel laureate and the director of the Lawrence Berkeley National Laboratory, one of the United States government’s pre-eminent research facilities, remarked that diminished supplies of fresh water might prove a far more serious problem than slowly rising seas. When I met with Chu last summer in Berkeley, the snowpack in the Sierra Nevada, which provides most of the water for Northern California, was at its lowest level in 20 years. Chu noted that even the most optimistic climate models for the second half of this century suggest that 30 to 70 percent of the snowpack will disappear. “There’s a two-thirds chance there will be a disaster,” Chu said, “and that’s in the best scenario.”

Scientists Warns Of Climate Change's Impact On Global River Flow

The projections indicate that every populated basin in the world will experience changes in river discharge - some are expected to have large increases in flood flows while other basins will experience water stress such that there is not enough water to meet human needs. For example, by the 2050's, mean annual river discharge is expected to increase by about 20 percent in the Potomac and Hudson River basins but to decrease by about 20 percent in Oregon's Klamath River and California's Sacramento River.

The magnitude of the changes is used to identify basins likely and almost certain to require proactive or reactive management intervention. The study also finds that nearly one billion people live in areas likely to require action and approximately 365 million people live in basins almost certain to require action.

With the South in the grip of an epic drought and one of its largest cities holding less than a 90-day supply of water, officials are scrambling to deal with the worst-case scenario: What if Atlanta's faucets do go dry?

So far, no real backup plan exists. There are no quick fixes among suggested solutions, which include piping water in from rivers in neighboring states, building more regional reservoirs, setting up a statewide recycling system, or even desalinating water from the Atlantic Ocean.

"It's amazing that things have come to this," said Ray Wiedman, owner of a landscaping business. "Everybody knew the growth was coming. We haven't had a plan for all the people coming here?"

Georgia Gov. Sonny Perdue is pinning his hopes on a two-pronged approach: urging water conservation and reducing water flowing out of federally controlled lakes.

Perdue's office yesterday asked a federal judge in Florida to force the Army Corps of Engineers to curb the amount of water draining from Georgia reservoirs into Florida and Alabama. Georgia's environmental protection director is drafting proposals for more water restrictions. That might not be enough to stave off the water crisis. More than a quarter of the Southeast is covered by an "exceptional" drought - the National Weather Service's worst drought category.

Water whets the appetite of commodity traders with an eye to the next fortune

Global shortages of water could lead to the precious liquid being exchanged in a similar way to permission schemes used by countries for carbon dioxide, the head of one of the world’s leading exchanges said yesterday.Craig Donohue, chief executive of the Chicago Mercantile Exchange (CME), said that water could become a commodity as droughts and demand place huge pressures on river systems and water tables.

Trading water as a commodity would, it is argued, put financial pressure on users to keep consumption down, in the same way that carbon emission trading schemes penalise the biggest polluters.

- A water future would be an agreement to buy or sell a certain number of litres of water at a pre-agreed price on a certain date

- Futures are priced, like shares, with a bid and an offer price — bid being the price at which a trader is willing to buy a futures contract and offer being the price at which they are willing to sell

- They are used to hedge against risk. In the case of water, risk that water would not be available

- They are also used for speculating. A speculator might invest in water futures in the hope that farmers would need it in the summer and be prepared to pay more

- If a farmer wanted to protect himself against rising water prices, he would buy futures to cover the amount he is likely to need

- Information on the availability of water in local storage facilities would help buyers and sellers to determine the risk of water shortages — and therefore the price of the asset

Canada's air, water getting worse: survey

Canada's air quality is getting worse, and many of its waterways are so polluted they don't meet minimum standards for supporting aquatic life, says a new report released Monday from Canada's national statistical agency.

The Statistics Canada survey, which reviewed key environmental indicators from 1990 to 2005, showed a 12-per-cent increase in ground level ozone -- a key component of smog -- over the 15-year period.

Meantime, freshwater quality was rated as "marginal" or "poor" in 23 per cent of the 359 monitored sites in southern Canada and 14 per cent of the 36 sites tested in northern Canada. No trends were noted over time, as the data were only collected over a two-year period.

"Manufacturing and service industries, institutions and households discharge hundreds of different substances, directly or indirectly, into rivers and lakes, says the report. "At least 115,000 tonnes of pollutants were directly discharged to Canada's surface waters (both freshwater and coastal) in 2005."

The Tar Sands and Canada's Food System

Tar sands opponents point out that burning natural gas, a relatively clean fuel, to extract oil will result in massive increases in greenhouse gas emissions. Yet, some experts say the implications of using natural gas go far beyond global warming.

North American agriculture is deeply dependent on natural gas. Nitrogen fertilizer is chemically produced using a process that -- currently -- cannot be conducted efficiently without large amounts of natural gas. This fertilizer, in turn, is an essential nutrient in North America's food production system. "In a fairly direct way," says Darrin Qualman, Director of Research at the National Farmers Union, "natural gas is a primary feedstock for our food supply."

While "peak oil," the point at which global production of oil begins to decline, is subject to speculation, natural gas peaked in North America in 2003. Since then, more wells have been added, but production has declined slowly, while prices have increased sharply.

As a result, says Qualman, fertilizer companies are closing up shop and are moving their operations to places like Qatar, Egypt and Trinidad, where natural gas is cheap and plentiful, for now.

For additional coverage of important tar sands related issues, see the October 2007 Special Tar Sands Issue of The Dominion.

- Harper's Index

- Passing Out in Upgrader Alley

- Gateway to Solidarity? - Pipelines and Indigenous communities in Northern BC

- Tar Sands and the American Automobile

- Working Full-Time - The work camps of Fort McMurray

- Oil Versus Water - Toxic water poses threat to Alberta's Indigenous communities

It may sound a little odd that the Premier of one of Canada’s smallest and poorest provinces, one with only 7 federal seats, might somehow be able to throw a monkey wrench into the PM’s chances for re-election, but odd or not, the possibility exists and Stephen Harper is not giving that possibility the attention it deserves. It’s an oversight that could prove far more expensive than he knows.

Williams has already verbally attacked the PM over back peddling on equalization promises and for making unilateral changes to the bi-lateral Atlantic Accord agreement. At the time of those changes Williams complaints were easily brushed aside as those of a premier with limited political experience, but my how times have changed.

Today the Premier is viewed in many parts of Canada as a bit of a giant killer, a leader who isn’t afraid to fight with anyone standing in the way of his province’s future. Simply put, he’s a street fighter that Stephen Harper has just poked with a very big stick.

Williams has already told the people of Canada that the PM can’t be trusted to keep his word. He warned them that by breaking a written promise to Newfoundland and Labrador, Harper proved he was not above doing the same thing to them. Now, with the Nova Scotia agreement in place, Harper has done just that.

The cult of personality meets political hegemony

Williams came to office claiming and he continues to claim that his goal is to make the province economically self-reliant. In the recent provincial election, Williams and his team members proudly declared that the province will become a "have" one within two years.

At the same time, Williams major achievement from his first administration was to secure - wait for it - an additional $2.0 billion in federal transfer payments. His feud with Harper is about - wait for it - continuing federal transfer payments to the provincial government, potentially as he originally sought in 2004 after the province no longer qualifies for Equalization. In other words, after the province becomes "have", which by definition means no longer qualifying for Equalization, Williams has been looking for ways to keep the federal hand-outs flowing. So obvious is this logical contradiction in Williams' argument that Bond Papers noted it in 2005 in a post titled "The Independence of Dependence."

A quagmire in Alberta over royalties

The question of higher energy royalties has divided Alberta, a province that for years was a place of happy and quiet consensus where political debates were muted—if they occurred at all.

Now, Premier Ed Stelmach is poised to make a call this week on how much to raise royalties, the most important economic decision to be made in Canada this year. “The status quo is not an option,” a spokesman for the premier says.

But “how much” is no easy question and the debate has been divisive and deeply emotional. A report issued in mid-September concluded Alberta has been missing out on billions of dollars of energy revenues and called for significantly higher royalties on oil, natural gas and oil sands.

In office less than a year, Alberta Premier Ed Stelmach is confronted with three of the toughest decisions any premier of Canada's most prosperous province has ever had to make.

The first and most obvious, expected within days, is whether to hike royalty rates on oil and gas producers by 20 per cent, as recommended by a controversial report Stelmach himself commissioned.

But that's not Stelmach's biggest challenge. While no expert panel is urging him to do so, Stelmach must decide whether to revive Alberta's pitifully small Heritage Fund so that it can one day serve Albertans as a rainy day fund in a way that similar "sovereignty funds" in Norway and Alaska are set to do.

Third, there is the man-made ecological disaster that has become the Athabasca oil sands, prominently featured in An Inconvenient Truth, Al Gore's Oscar-winning documentary about the global warming crisis. With an estimated additional $100 billion (all figures U.S.) in oil-sands projects on the drawing board, the already damaged ecosystem of northeast Alberta will be in still greater peril without political action.

Of course, there is a problem. The winter drilling season is going to be a bust. And the summer one was nothing to brag about either.

Big Oil has already pulled back their big budgets. Rigs are racked and trucks haven't turned a wheel all summer, especially in Stelmach's rural heartland.

Big Oil invented the storm. Now they want to pin the blame on Stelmach, as rig moving king pin Murray Mullen tried to do last week when he announced the "temporary layoff" of 100 truck drivers and swampers.

"Many oil and gas customers have made it clear that they intend on reducing their capital investments in Alberta if Our Fair Share is implemented," Mullen shrugged.

Mullen - who last year got a $320,000 salary and $1-million bonus as securities documents show - is just getting ahead of the game.

He said his "hard-working employees" will bear an "unfair burden" if Stelmach doesn't back down. Although, I suspect, Mullen won't.

The premier already told the Sun he's studying "options" and "there will be changes" from what Our Fair Share recommended.

Premier to talk about oilpatch taxes in TV address on Wednesday

Alberta's Premier has given himself more breathing room before announcing the details of changes to oil and gas royalties in the province, but he promised predictability and stability for investors, who have been fretting at the prospect of big hikes. Ed Stelmach, right, whose government is preparing a response to a report urging a $2-billion, or 20%, jump in royalties and taxes, said yesterday he will offer some "principles" behind coming changes during a TV address on Wednesday. "It will be full-text by the end of the month," Mr. Stelmach told reporters. "It's such a complex issue. It will require breaking it down into manageable pieces." Mr. Stelmach had initially said he expected to give a formal response by the middle of this month to a controversial panel report.

Although he never mentioned Klein by name, Lougheed said it was "a big mistake" for that government to allow more than one or two oilsands projects to proceed at the same time.

The province should have staggered development of oilsands operations to reduce the cost pressures in Fort McMurray, he said.

"The consequence was that costs have gone through the damn roof and there's a price to be paid with regard to that," he said.

"The inflationary costs are hurting the whole economy of the province." He added that his youngest grandson will be going to university before Albertans realize any real revenue from the projects.

But Stelmach, who has said he won't "touch the brakes" on oilsands development, responded Friday by pointing out that global demand for Alberta's oilsands bitumen has increased dramatically.

"With the world events that were unpredictable in the Middle East, Venezuela and other countries, we are without a doubt the most stable, safe supplier of energy not only to North America but to the world," he said in Calgary. "Today the demand for fossil fuels is 1,000 barrels a second. That just gives us an indication where the demand will be (decades) from now." Lougheed issued a warning at the beginning of his speech that some in the audience wouldn't like what they were about to hear.

"I am a pretty blunt, straightforward kind of guy and I am going to say it my way. I am going to distress some of you." He went on to criticize the waste of water and natural gas in the production of oilsands bitumen and the failure of the government to improve Highway 63 as oilsands development progressed.

Royalty review panel attacked from within

Economist Judith Dwarkin has managed to do in four pages what the energy industry has been trying to do for four weeks.

She has shaken the credibility of Alberta's royalty review panel. She did it quickly and succinctly in a mini-report she wrote for her employer, an energy consulting firm called the Ross Smith Energy Group (RSEG).

Her four-page report accuses the panel of making "overly aggressive recommendations" and encouraging "dumb resource management." Yet, Dwarkin insists she didn't mean to debase the royalty panel's work. In fact, she even wrote a letter to the panel on Friday apologizing for the trouble she's caused.

If Judith Dwarkin seems conflicted, it's because she herself is a panel member. That's why her four-page mini- report is creating such a stink.

Dwarkin signed the 104-page royalty review panel report released by the government on Sept. 18 and she stood by its controversial recommendations that include a 20-per-cent hike in royalty rates worth about $2 billion a year to the province.

However, this week she co-authored the RSEG report that criticizes her own panel's work. It's entitled Looking for Rent in All the Wrong Places and despite its humourous heading there's nothing funny about the document that says the review panel "lacked the requisite industry expertise" in one area and used a "flawed estimation" in another.

The royalty panel's proposals for gas royalties will discourage drilling for bigger targets in favour of shallow wells, says the company report written by Dwarkin and colleagues. "This is dumb resource management," it insists, adding that the government-appointed panel "lacked the industry expertise and time" to do the proper job -- expertise that Dwarkin herself was supposed to have provided.

Many Albertans will be taken aback by this sudden shift -- as were other panel members when they were told about it. Many will also reasonably wonder what kind of pressure the industry applied when it didn't get the report it wanted from the independent panel.

Dwarkin has downplayed the differences between the two reports, and she flatly rejects any notion her new approach was developed under duress. The company report reflects her personal views, she says, and is "not at odds with the framework and theme" of the review panel. The company's call to factor well-depth into royalty payments is just a refinement, she argues.

Unfortunately, Dwarkin's protestations may only further undermine her credibility. If she truly disagreed with the panel's position on gas royalties when it was written, a more honourable option might have been to issue a minority report at the time.

Higher Alberta Levies Threaten Oil Sands Pipeline Plans

Raising Alberta's oil and gas royalty rates could threaten at least C$15 billion in proposed oil sands pipelines, as producers delay or cancel projects to develop the resource, a report said late Tuesday.

Calgary-based brokerage First Energy Capital added that higher royalties also would speed up the decline in conventional oil production, as well as stymieing efforts to develop carbon sequestration in the province.

Last month, a government-appointed panel recommended increasing Alberta's annual take from oil and gas revenues by a fifth or C$2 billion, which sparked a barrage of criticism from energy executives and analysts.The C$15 billion investment is planned for 2011-2015, on expectations that oil sands output will triple by the end of that time. The majority of the new pipelines or expansions would transport raw bitumen or upgraded synthetic crude oil to refining hubs in the U.S. Midwest. Although, Enbridge Inc. (ENB), ExxonMobil Corp. (XOM) and Altex Energy are looking at pipelines to the Gulf Coast. About C$6 billion of this future investment is earmarked for Alberta.

Report author Steven Paget said producers would also face higher shipping costs since pipelines are most efficient when used at maximum capacity.

"Declining production results in higher costs for each barrel of oil or each cubic foot of natural gas that is shipped," Paget said. "If royalty changes serve to increase declines, shipping costs will increase."

Gas junior wins deal on pipeline project

MGM Energy Corp., a junior explorer, has a deal to move natural gas through part of the proposed Mackenzie Valley pipeline, the first such contract signed by a company outside the main consortium behind the northern infrastructure project.

The small Calgary company said yesterday it signed a deal early to secure capacity to get ahead of potentially stiff competition from larger firms if the struggling pipeline project proceeds.

MGM already controls natural gas in the Mackenzie Delta and is exploring for more, aiming to drill three wells this winter.

"The reason we did this now essentially comes down to one thing: We're going to spend a lot of money this winter to find gas. People need to know if we find it that we'll deliver it," MGM Energy president Henry Sykes said.

MGM's deal is significant because it is the first company outside the Mackenzie project ownership group to make a formal commitment to the struggling project.

Weak natural gas prices, fuelled in part by unseasonably warm fall weather, are undermining some of the biggest energy trusts. Profits are also hurt by Canada's strong dollar. Also, many of these companies are heavily in debt, and must spend money on drilling programs and upgrades to their oil and gas properties as reserves are used up.

Energy trusts are paying out an unsustainable 112-per-cent of the cash they are expected to generate in the coming year, according to survey results released last week by TD Securities Inc. The investment dealer has revised its commodity price forecasts, calling for a 16-per-cent drop in natural gas prices in 2008, but a 17-per-cent rise in the price of oil.

Four energy trusts have slashed cash distributions since July, with the price of their units slumping by between 5 and 23 per cent in the month leading up to the cut. As a rule, energy trusts will cut distributions in order to maintain the exploration and capital spending needed to sustain oil and gas production.

With new discoveries offshore Canada’s east coast and in the South China Sea, and with an aggressive oilsands profile in western Canada, Husky Energy emerged as our readers’ choice for Oilweek’s 2007 Producer of the Year.

Oilsands' newest project: a greener image

The Alberta government is expected to do a final inspection this month of Gateway Hill, formerly 106 hectares of muskeg that now rear up as high as 40 metres above Highway 63. The oilsands giant used this land north of Fort McMurray, but has now cleaned it up and considers it restored.

If the land passes inspection, Syncrude will be the first oilsands company to get a reclamation certificate.

It's a critical step, because the industry already has approval to mine 95,000 hectares of land, an area almost 13 times the size of Edmonton's entire river valley parks system. The fact that none of the 33,000 hectares used so far has been reclaimed to the government's satisfaction is seen by conservationists as a sure sign of an unsustainable, environmentally hostile industry.

If Syncrude gets the stamp of approval, it will be the result of a long process -- and one criticized for its lack of transparency.

Weighted with the responsibility of setting a precedent for the rest of the industry, Syncrude's small piece of land has gone through the certification process at a sluggish pace. A freedom-of-information request by The Journal shows the process started 10 years ago.

Canada-Mexico Energy Deal Signals Deeper Bilateral Ties

In 2004, then-prime minister Paul Martin and then-president Vicente Fox established the Canada-Mexico Partnership, which set up a number of working groups that would focus on a number of areas, and foster closer working relations between the two countries.

A working group on energy was established the following year, and some projects have begun. There is also a trilateral energy working group that includes the United States in the North America Security and Prosperity Partnership.

However, Mexico's constitution places severe restrictions on outside involvement in the country's energy sector, which has all but prevented foreign companies from paying much attention to the country–until now.

With the Mexican government using Pemex as a cash cow, taking money to pay for government programs and failing to re-invest in the company, production within the country has been steadily declining.

This has prompted a search for not only ways in which new capital can be put back in into Pemex, but also an effort to modernize the company's operations, which is where foreign companies see new potential.

Environment Minister Baird Opens Ottawa's First Hydrogen Fuelling Station

The Honourable John Baird, Minister of the Environment, on behalf of the Honourable Gary Lunn, Minister of Natural Resources, and Pierre Gauthier, Air Liquide Director, Hydrogen Energy, North America, presided over the official opening of the first permanent hydrogen fuelling station in Ottawa as part of the "Hydrogen on the Hill" project launched last year.

The new station's first customers will be three hydrogen-powered buses operated by the Senate of Canada.

"These buses have racked up more than 6,000 trouble-free kilometres over the past year. They're proving that hydrogen is not just a clean alternative - it's also a realistic alternative," said Minister Baird. "Our government is leading by example with initiatives such as Hydrogen on the Hill. This is another demonstration of our government's commitment to achieving tangible results for the reduction of greenhouse gases and air pollution that we set out in our Turning the Corner Plan."

The new station, at the Natural Resources Canada Booth Street campus in Ottawa, is the fifth permanent hydrogen fuelling station in Ontario and the tenth currently operating in Canada. Natural Resources Canada, through the Canadian Transportation Fuel Cell Alliance, and Air Liquide Canada each contributed $800,000 toward the $1.6-million station.

China's drive for wealth means end of our low-carbon dreams

The president needs more copper, iron ore, zinc and natural gas. Above all, he needs more coal to keep the power stations humming nicely and more oil for Chinese cars and lorries. China accounts for more than a third of world demand for coal and the price in Australia soared this year as the People's Republic switched from being an exporter to being an importer. If Mr Hu had a message for the world in his address to the Communist Party National Congress, it was this: we will burn our coal and, if we have to, we will burn yours, too.

What does this mean? Put bluntly, it means that the Kyoto treaty on greenhouse gas emissions is dead and so is any prospect of persuading Beijing to bind itself to other curbs on carbon emissions. We can stop kidding ourselves that China will sign up to any green thingy that hinders his party's ten-year plan to get rich quick. Instead, the ravenous demand for minerals and metals will continue and the desperate land grab by Chinese state companies in their pursuit of resources in Central Asia, Africa and Canada will become more politically embarrassing.

Until now, we in the West have been able to sit back and watch the global energy game passively on our Chinese-made flatscreen television sets. We could pretend that wind farms and wave machines could really make substantial contributions, that carbon trading could somehow make the cost of green energy disappear. We did not understand that the real cost of our affluent, energy-intensive lifestyles was being defrayed by sweated labour in a Chinese factory. While the price of clothes, fridges, TVs and toys was plummeting, we could ignore that petrol, transport and even bread and milk were in the grip of an inflationary spiral.

Caterpillar dump trucks are the enemy of the human race

According to the Christian Science Monitor, "China accounted for two-thirds of the more than 560 coal-fired power units built in 26 nations between 2002 and 2006." If coal is the enemy of the human race, then the 797B is the Dark Lord's preferred means of transportation and China is his playground. With China boosting imports of coal even as it expands domestic production, mining companies around the world seem more likely to be happy dancing their way through the next few decades than environmentalists.

Like Roberts, I am encouraged when I see U.S. regulators making strong statements about air quality. But the question remains, how long will it take China to make the same transition? Is it even possible for China to make that transition without a democratic system that enables the masses to make their clearly growing dismay at widespread environmental pillage politically potent? At the ongoing national congress of the Communist Party of China, President Hu Jintao constantly referenced the importance of ensuring that future economic growth is environmentally sustainable. Meanwhile, Caterpillar's sales in Asia of earth-moving equipment, diesel generators and giant trucks are up 35 percent over last year. According to the Wall Street Journal, Caterpillar sold more than $1 billion of goods in China in 2006, and hopes to quadruple that number by 2010.

A Classic Tale of Overshoot: Island proved no paradise for reindeer

When Klein returned in summer 1966, he, another biologist and a botanist found the island covered with skeletons. They counted only 42 live reindeer, no fawns, 41 females and one male with abnormal antlers that probably wasn't able to reproduce. During a few months, the reindeer population had dropped by 99 percent.

Klein figured that thousands of reindeer starved during the winter after his last visit.

With no breeding population, the reindeer of St. Matthew Island died off by the 1980s. The unintended experiment in population dynamics and range ecology ended as it began -- with winds howling over a place where arctic foxes are once again the largest mammals roaming the tundra.

Global warming an urgent problem

“The reason so much (of the Arctic ice) went suddenly is that it is hitting a tipping point that we have been warning about for the past few years,” said James Hansen, director of NASA’s Goddard Institute for Space Studies.

In the last six months estimates of when the North Pole ice cap will completely melt have been revised to 2023.

At least one climate scientist, Wieslaw Maslowski of the Naval Postgraduate School, projects a blue, ice-free Arctic Ocean in summers by 2013, an event that has never occurred before, as long as human beings have inhabited our planet.

In the last year estimates of when climate change will cause widespread famine have been revised to 2020.

The September report from the Intergovernmental Panel on Climate Change includes estimates that food production in Africa is now expected to be cut in half by 2020 and that some crops, like wheat, will eventually disappear there completely.

Africa has trouble producing enough food to feed its 680 million people today.

It is hard to imagine how it can feed an estimated 990 million Africans in 2020 when that continent’s food production is halved.

Record oil price boosts demand for biofuels but critics question the cost

Record oil prices have boosted demand for biofuels as consumers and companies look for cheaper and cleaner energy sources, but there are growing concerns that the various substitutes for gasoline and diesel may be doing more harm than good.

Biofuels like ethanol and biodiesel have been widely viewed as the answer to reducing greenhouse gas emissions but critics warn that a reliance on them could lead to higher food prices, deforestation and ultimately, do more damage to the environment than the fossil fuels they are supposed to replace.

'The use of food as a source of fuel may have serious implications for the demand for food if the expansion of biofuels continues,' the International Monetary Fund said Thursday.

"The price I paid last year to feed these birds with specialized organic corn was $200 a ton," he said. "This year I'm paying $400 a ton, a 100 percent increase. My cost of production has just about doubled, and this year the price of my turkeys will have to go up at least $1 per pound."Ironically, the huge increase in the corn crop this year - American farmers planted 90.5 million acres in 2007, compared with 78.6 million acres in 2006 - only begat more corn on Purtill's acres. Last winter, when he saw corn futures prices climbing in anticipation of the ethanol boom, Purtill realized that the specialty organic corn he feeds to his turkeys probably would be sold instead to ethanol distilling plants. So, he decided to plant 13 acres, usually devoted to highly profitable vegetables, with his own certified organic corn.

"In a year when we shouldn't have had to grow any corn, we were forced to convert valuable vegetable acreage into grain that we would consume ourselves," Purtill says. "There's the impact of the ethanol boom right there."

- Half of the world's population rely on rice

- Rice production will have to double in 40 years

- Five countries grow 98 percent of the world's GM rice

- Rice contamination scare in 2006 a setback for GM industry

For proponents of GM rice, GM food is the obvious solution to the ongoing problems of population growth, changing climate conditions and malnutrition. For its opponents, it's an unnecessary and potentially catastrophic exercise which only feeds corporate interests and does little to solve the real problems of global food supply, malnutrition and farming practices....

....Because of population growth, the rice industry will have 1 billion new customers annually requiring 200 million tons more of rice than there is today. To meet the nutritional needs of all of these people -- in addition to the 800 million presently starving -- food production will have to "more than double" in under 40 years, it says.

Trees with rabbit genes accelerate cleaning of soil

Genetically modified plants that can break down pollutants may be an effective way to clean soil contaminated by industrial chemicals and explosives used by the military, according to scientists.

Tests on six-inch tall GM poplar cuttings which had a gene from a rabbit inserted into them showed that they could remove up to 91% of a chemical called trichloroethylene from the water used in their feed. This chemical, used as an industrial degreaser and one of the most common contaminants of ground water, was broken down by the plants into harmless byproducts more than 100 times faster than by unaltered plants.

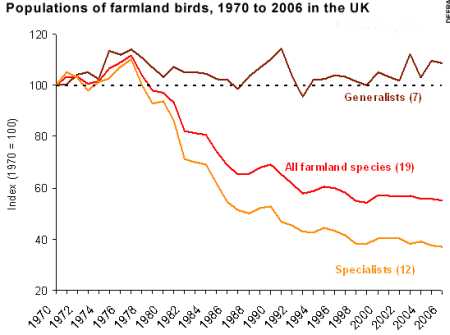

Farmland bird numbers 'at lowest ever level'

In the UK generally, species such as the goldfinch had recovered from large declines in the 1980s while the woodpigeon had maintained its population. But the farmland specialists - such as the skylark - had fared badly.The decline in farmland birds had coincided with more intensive farming, the switch to autumn sowing of cereals, increasing use of agro-chemicals and the loss of field margins and hedges....

....Dr Sue Armstrong-Brown, the RSPB's head of countryside policy, said: "Farmland birds are the barometer by which the Government measures the health of the countryside. We wish there was a better story to tell - but the farmland bird index reaching its lowest point is extremely depressing news."

The other Nobels

A Canadian farm couple brings attention to the dangers of patenting life

The Schmeisers were chosen after a legal tussle with Monsanto led them to become farm rights advocates. In 1998, Monsanto informed the couple that they had sown the company's "Roundup Ready" seeds in 1997 without a license. The Schmeisers claimed they never bought nor planted the seeds, which are genetically modified to withstand Monsanto's Roundup brand weed killer. The Monsanto seeds simply had migrated to the Schmeisers' fields from a neighboring farm or passing trucks.

Based on its ownership of the patent on the seeds' bioengineered genes, Monsanto sued the Schmeisers. In a pattern critics say is widely employed, Monsanto offered to drop the suit if the couple agreed to buy Monsanto seeds and pay a technology use fee. The Schmeisers declined and lost in the Canadian Supreme Court.

Now the Schmeisers have turned the tables, claiming in a countersuit that the Monsanto genes contaminated their field. Even after shifting out of canola production to avoid future run-ins with the aggressive seed company, Monsanto plants continued to "volunteer" in their fields. A trial on that lawsuit is set for January.

Science's Worst Enemy: Corporate Funding

Earlier this year, former FDA commissioner Jane Henney remarked that “it’s getting much more difficult to get that pure person with no conflicts at all. . . . The question becomes both one of disclosure and how much of a conflict you can have and still be seen as an objective and knowledgeable reviewer of information.” More than half the scientists at the U.S. Fish and Wildlife Service who responded to a survey conducted by the Union of Concerned Scientists in 2005 agreed that “commercial interests have inappropriately induced the reversal or withdrawal of scientific conclusions or decisions through political intervention.”

Merrill Goozner argues that the danger runs deeper. “In many precincts of the scientific enterprise, the needs of industry have become paramount,” he says, turning science into “a contested terrain” where facts are increasingly contingent on who is funding the research. “The whole scientific revolution, which was a product of the Enlightenment, is threatened when you commercialize science,” he warns.

Sharon Astyk: 100% Emissions Reduction

The good news is that the informal economy is significantly more robust in many ways than the formal economy, and doesn't require massive inputs of fossil fuels. It was the informal economy that kept people in the Soviet Union and Cuba alive during their social crisis - the gardens they grew, the things they bartered and sold, the local economies they produced. We have an informal economy too, but we don't rely on it very much - or at least, most middle class Americans don't. Many of my neighbors do - they cut a little firewood, sell some pumpkins around Halloween, barter some labor, do a little handyman work in the winter, babysit a neighbor's kids - all under the table. And they tend to make a passable living doing so, enough to pay the taxes, buy beer and supplement the deer and wild turkey they hunt with food.

Now there are problems in imagining 300 million Americans and 6.7 billion human beings all relying primarily on the informal economy and such informal methods of feeding their families - except that 3/4 of us actually *do* rely on that. That is, according to Teodor Shanin, the founder of Peasant Economics, only 1/4 of the world's total economy exists in the formal sector, with formally paid, documented work. The rest of us do other things. 2 billion people live by subsistence farming. Another billion survives entirely by selling off-book to their neighbors.

Denial, Deception, And Delusion, American Politics Vs. Reality

Consider that America is a national political economy that is nested within a global political economy. This global political economy is in turn nested within the Earth’s geological and biological web of life and matter. Human civilization in general and American society in particular, is wholly dependent upon these non-human inputs for their very existence. Yet these are either taken for granted entirely (the Republicans), or are accorded lip service but otherwise ignored (the Democrats).

Industrial civilization runs on oil. Yet production of oil and other hydrocarbon liquids has peaked, or nearly reached its peak. See the graphs compiled from the United Nations International Energy Information Agency (IEA) and the US government’s Energy Information Agency (EIA) here.

A good and brief primer on “peak oil” for those who are not familiar with this concept can be found here at The Oil Drum.

Iraq is ‘unwinnable’, a ‘quagmire’, a ‘fiasco’: so goes the received opinion. But there is good reason to think that, from the Bush-Cheney perspective, it is none of these things. Indeed, the US may be ‘stuck’ precisely where Bush et al want it to be, which is why there is no ‘exit strategy’.

Iraq has 115 billion barrels of known oil reserves. That is more than five times the total in the United States. And, because of its long isolation, it is the least explored of the world’s oil-rich nations. A mere two thousand wells have been drilled across the entire country; in Texas alone there are a million. It has been estimated, by the Council on Foreign Relations, that Iraq may have a further 220 billion barrels of undiscovered oil; another study puts the figure at 300 billion. If these estimates are anywhere close to the mark, US forces are now sitting on one quarter of the world’s oil resources. The value of Iraqi oil, largely light crude with low production costs, would be of the order of $30 trillion at today’s prices. For purposes of comparison, the projected total cost of the US invasion/occupation is around $1 trillion.

Iraq oil flow could fall, expert says

With investment in Iraq’s oil sector lagging, a top analyst says oil production is likely to fall.

Muhammad-Ali Zainy, senior energy economist and analyst at the London-based Center for Global Energy Studies, said Iraq will need to work hard to maintain the current 2 million barrels per day production.

“There is an urgent need for maintenance,” Zainy, an Iraqi-born oil expert, told Azzaman. “Lack of security is another reason. Corruption and chaotic policies and lack of enthusiasm are other factors.”

Kurd rebels say may hit Turk pipelines if attacked

"We have no specific policy on pipelines but we are now waging a defensive war... Since pipelines that cross Kurdistan provide the economic resources for the Turkish army's aggression, it is possible the guerrillas target them," the Firat news agency quoted PKK commander Murat Karayilan saying.

Firat, which is based in Europe, often carries statements from the PKK leadership. The PKK has threatened to hit Turkish economic targets in the past, but its threats have acquired a new urgency following the parliamentary vote.

Turkey's tough stance has helped propel global oil prices to new historic highs this week. Pipelines from Iraq and from Azerbaijan cross eastern Turkey, which hopes to become a major energy bridge between producer countries and Western markets.

Analysis: Oil price not only due to Turkey

But politics are not solely to blame for high oil prices. According to Alhajji, there were at least nine recent events across the globe that have tightened the oil market as well.

A fire at a BP oil facility in Prudhoe Bay, Alaska, caused a slump of 30,000 barrels a day for two weeks in early October. On the other side of the world, Nigerian oil workers called a strike briefly last week, causing some concern in oil markets. Also, separate reports indicated winter oil consumption in the United States, as well as U.S. economic growth, would be unexpectedly up over the winter.

Supplies may also be down due to a potential royalty increases on oil sands projects in the Canadian province of Alberta, while demand from the U.S. Strategic Petroleum Reserve is up and the International Energy Agency continues to project international demand increases, according to Alhajji.

Fear and greed take a stranglehold on the oil market

Since oil prices began their surprising march toward $90 (U.S.) a barrel - a level breached briefly yesterday - energy watchers have trotted out a host of explanations as to why so many of them had been so far off the mark.

Some have even made sense.

The usual suspects? Speculators, tight supplies, flat production, strong demand and geopolitical threats. The latter includes not only a suddenly belligerent Turkey, but peace-loving Canada, of all places, where a debate in Alberta over higher royalties has sparked concerns about production growth....

....Stephen Schork, who publishes an influential energy futures newsletter from his base in Villanova, Pa., is familiar with all the rationales. But there's only one that he's buying: rampant speculation fuelled by fear and greed.

The Secret History of the Impending War with Iran That the White House Doesn't Want You to Know

In the years after 9/11, Flynt Leverett and Hillary Mann worked at the highest levels of the Bush administration as Middle East policy experts for the National Security Council. Mann conducted secret negotiations with Iran. Leverett traveled with Colin Powell and advised Condoleezza Rice. They each played crucial roles in formulating policy for the region leading up to the war in Iraq. But when they left the White House, they left with a growing sense of alarm -- not only was the Bush administration headed straight for war with Iran, it had been set on this course for years. That was what people didn't realize. It was just like Iraq, when the White House was so eager for war it couldn't wait for the UN inspectors to leave. The steps have been many and steady and all in the same direction. And now things are getting much worse. We are getting closer and closer to the tripline, they say.

Clinton bucks the trend and rakes in cash from the US weapons industry

The US arms industry is backing Hillary Clinton for President and has all but abandoned its traditional allies in the Republican party. Mrs Clinton has also emerged as Wall Street's favourite. Investment bankers have opened their wallets in unprecedented numbers for the New York senator over the past three months and, in the process, dumped their earlier favourite, Barack Obama.

Mrs Clinton's wooing of the defence industry is all the more remarkable given the frosty relations between Bill Clinton and the military during his presidency. An analysis of campaign contributions shows senior defence industry employees are pouring money into her war chest in the belief that their generosity will be repaid many times over with future defence contracts.

Employees of the top five US arms manufacturers – Lockheed Martin, Boeing, Northrop-Grumman, General Dynamics and Raytheon – gave Democratic presidential candidates $103,900, with only $86,800 going to the Republicans. "The contributions clearly suggest the arms industry has reached the conclusion that Democratic prospects for 2008 are very good indeed," said Thomas Edsall, an academic at Columbia University in New York.

Republican administrations are by tradition much stronger supporters of US armaments programmes and Pentagon spending plans than Democratic governments. Relations between the arms industry and Bill Clinton soured when he slimmed down the military after the end of the Cold War. His wife, however, has been careful not to make the same mistake.

After her election to the Senate, she became the first New York senator on the armed services committee, where she revealed her hawkish tendencies by supporting the invasion of Iraq. Although she now favours a withdrawal of US troops, her position on Iran is among the most warlike of all the candidates – Democrat or Republican.

This week, she said that, if elected president, she would not rule out military strikes to destroy Tehran's nuclear weapons facilities.

Eurasia Strikes Back: No War With Iran Likely

The result of Vladimir Putin’s meeting with Mahmoud Ahmadinejad at the Caspian Summit in Iran earlier this week is that there will be no “Operation Iranian Freedom” (or some equivalent thereof) in the remaining 15 months of this administration. A powerful Euro-Asian bloc, based on the Moscow-Peking axis that opposes American challenges along the Continental Heartland’s outer perimeter, is now preempting threats to the existing balance in real time. Mr. Putin is effectively helping President George W. Bush avoid an adventure that would bring ruin to all involved, save the promoters of an Islamic end-times scenario.

The Declaration signed at the end of the summit commits the littoral states to a de facto non-aggression pact. It warns the outside powers to refrain from using the Caspian region for military operations or interfering in any other way, and supports the right of Iran to pursue nuclear technology for peaceful purposes. Articles 14 and 15 of the Declaration specifically state that the littoral states would not use their armed forces against each other, and—more importantly—that they would not allow any other state to use their territory for military operations against any of the littoral states. Regional commentators are in no doubt that this agreement has thrown a decisive wrench into any plans the Bush Administration may have against Iran:

The entire Caspian region, including the convenient territory of Azerbaijan, is suddenly out of bounds for American military.

If the market thinks $88 for a barrel of oil is high, it should wait a little longer. By year-end 2008, some economists say that it will hit $100 a barrel as global demand surges ahead of available supplies. When boiled down, the basic choices involve conservation, drilling for more oil or identifying and deploying more alternative fuels.

The time to start preparing for higher oil prices and possible oil shortages is right now. Not only will western nations continue to advance, but the developing countries will also do so and at rapid rates. Meanwhile, the oil producing countries of the Middle East (OPEC), Mexico and Russia are also growing. They will first and foremost attend to their own domestic needs before parceling out fewer barrels of oil to other nations.

"Domestic demand growth of as much as 5 percent per year in key oil

producing countries is already beginning to cannibalize exports and will increasingly do so in the future as production plateaus or declines in many of these countries," says Jeff Rubin, chief economist for CIBC WorldMarkets, an investment banking firm. "At current rates of domestic consumption the future export capacity of OPEC, Russia and Mexico must be increasingly called into question. These trends are likely to result in a sharp escalation in world oil prices over the next few years."

Britain Set to Stake Claim for Antarctica Sovereignty

Britian is researching a claim for sovereignty over a large area of the seabed off Antarctica, it was confirmed last night.

The bid for an area around British Antarctica is one of several that are being prepared by the Foreign Office, a spokeswoman said.

Sovereignty over such areas brings with it the rights to tap resources such as oil and gas reserves....

....Last month, The Scotsman revealed negotiations in Reykjavik between the UK, Ireland, Iceland and Denmark (on behalf of the Faroe Islands) to forge an agreement to exploit the resources around Rockall.

The nations hope eventually to divide up territorial rights to the vast area, some 422,000sq km, and exploit its rich reserves. The countries have until May 2009 to reach agreement.

"As long as the Sun shines, the grass grows and the waters flow"

Boy those First Nations guys really had some prescient lawyer to draw up a tough treaty to break. No grass there and the water running low but still the sun is there as backup.

Today is Oct 21...the 22nd is the average date of the first killing frost for Ky.

Today was quite warm..maybe in the low 80s here on my farm in western Ky.

To date I have yet to see any frost on the ground in the morning and many annuals are nowhere near dying back..

I am patiently waiting for the grass in my garden to be killed so I can burn the seed heads to prevent them reaching the soil. Then I can mulch for the winter.

This winter will be important IMO to observe as to the effects of CC. So far its been very dry and long periods of very very hot weather. The crops did ok but not as good as it could have been.

We have plenty of water..no problems there.

The wheat got killed this last spring by some very very late spring frost and below freezing weather.

Being somewhat close to the largest river in the USA means our aquifer should stay charged. The river was very low..and still is yet the barge traffic has continued but slower.

When it rains up river then of course its reflected down river...but the worst problem is the river rising way too high and flooding crop lands. No problems there this year.

And we always get a spring 'rise' and a fall 'rise' but not a sure thing..it just happens. I don't think there will be a fall rise this year.

We are IMO about 15-18 inches in deficit on our annual rainfall. I was finally able to drive a stell fence post in the ground today. Before last week it was very very hard to do so.

My turnips are flourishing as well as the Florida Large Leaf Mustard. Will be eating boiled turnips soon.

airdale-whats happening here

PS. I have been posting on TOD about use of hairy vetch to add N to the soil. I coulnd't find any seeds today in any areas where I usually find it but next year I intend to sow it in half my garden..and expand that garden twice over.

If a good N fixer can add 250 lbs of N to an acre that is way beyond what I thought they were capable of.

Thanks Airdale - I always appreciate your posts. I didn't know vetch fixed nitrogen (learn something every day!), but I'm glad to say I have plenty of it on my farm - in patches wherever it feels like growing. We call it alpaca dessert as it's my alpacas favourite food. There's none of it at all in their paddock because it hasn't got a chance, so I sometimes get the kids to 'harvest' a patch and pass it over the fence.

I have no idea what variety it might be, but it's obviously hardy in our area. I'll see about planting some in my orchard next year. I already have a nitrogen fixing tree in there (Robina pseudoacacia), but growing vetch might help as well.

Airdale, Weatherunderground says Paducah's about 8" below normal for the year so far. This month you're catching up a bit. Of course, that's just the rainfall, that doesn't measure soil moisture, which is probably what you're seeing.

We put down ladino clover on our new field, since I couldn't get any other good green manure for a decent price. I'll have to find a good supplier that I can talk into stocking something in the fall each year.

Stoneleigh - I have fifty black locust in tree pots in my back yard waiting to go into the perimeter of that field I just talked about. Black locust rocks. Vetch, alfalfa, clover, are all nitrogen fixers, but they all need inoculating bacteria in the soil to do their best. You probably already have it in your soil.

I was really happy to see that Toby Hemingway's "Gaia's Garden" recommends putting black locust between walnuts and other trees. There are already black walnut trees on this land, and we're planning to put in fruit trees next spring along with the locust.