The Finance Round-Up: October 12th 2007

Posted by Stoneleigh on October 19, 2007 - 8:55pm

In the US, as one door has closed on subprime lending, another has opened on credit card debt. Actually living within one's means doesn't always seem to be an option, for some due to poverty and for others due to greed. Either way, the debt hole Americans (and Canadians, and the British) are collectively digging themselves into is getting deeper by the day, and they start young.

As losses mount, the role of mortgage fraud, by both borrowers and lenders, and also potential securities fraud, is being revealed. The litigation is only just beginning, but be prepared for a storm of legal action and recriminations. The ratings agencies are looking vulnerable to European action as their ratings enabled the sale of bad loans to European institutions, under conditions of conflict of interest.

Signs of stress are spilling over from the world of high finance to the real economy, where trucking and shipping are feeling the slowdown. Meanwhile Canada (several months behind the US) is still seeing a booming housing market, but for how long?

Americans charge it as Bank of Subprime closes

The automated teller for home loans is empty and Americans are relying increasingly on credit cards to pay their living costs, indicating tough hurdles ahead for U.S. consumer spending and markets.

Federal Reserve data released on Friday showed U.S. consumer borrowing rising by $12.18 billion in August, more than 20 percent more than economists had forecast. Most striking was an 8.1 percent increase in borrowing on revolving credit lines, mostly credit cards, to a record $909 billion. Credit card borrowings rose at the sharpest rate since early 2002.

So what was it that persuaded consumers to rack up more debt during the month?

Was it the increasing press coverage, no doubt reinforced by friends and family, that their houses were worth less than a month or a year ago? Or was it the near meltdown in financial and credit markets that prompted a surge in speculation about an upcoming recession?

Quite possibly, it wasn't because they felt better, but because things had gotten suddenly worse.

Investors Ask Supreme Court to Sanction Claims

There are hundreds of millions of reasons, each with a dollar sign attached, why the University of California, the state of Pennsylvania's pension plan, Merrill Lynch and many more are following StoneRidge v. Scientific-Atlanta. The high court's decision will determine how far legal liability extends in securities fraud cases.

"I actually think this is the most important securities law case since the securities laws were passed," said Patrick Coughlin, a San Diego-based attorney who represents the University of California in a closely related lawsuit....

....When Enron collapsed, investors started suing not only the bankrupt energy company but also the banks, accounting firms and associates that allegedly enabled it to engage in fraudulent business practices....

...."Financial institutions were active, knowing and crucial participants in the Enron fraud; they were not innocent bystanders," Charles Robinson, the University of California's general counsel, declared earlier this year. "For victims of one of the most egregious corporate frauds in history, we are simply asking for our day in court."

US mortgage crisis predicted to get worse as home loan defaults soar

America’s mortgage crisis is likely to get considerably worse because the level of fraudulent lending to unsuitable borrowers was much higher than previously estimated, Standard & Poor’s said yesterday.

David Wyss, the ratings agency’s chief economist, said that defaults on high-risk “sub-prime” mortgages would continue to soar as unqualified mortgage-holders struggled to meet their repayments, tightening the credit markets and dragging down the American economy....

....The level of fraud increased as lenders sought new customers through increasingly dubious means after a surge in sub-prime home loans in recent years that had left most eligible borrowers with mortgages.

Many brokers and mortgage lenders did not require proof of income and others helped borrowers to forge documents that inflated their salaries, enabling them to take out bigger loans than they could repay.

They largely got away with these practices while house prices were rising, since borrowers could remortgage their properties and pay off the loans with the proceeds. As house prices began to stagnate, and in many areas to fall, this option has been largely closed and the number of defaults has surged.

Up to 70 Percent of Defaults Linked to Misrepresentation in Mortgage Applications

Who is to blame for the wave of mortgage defaults weeping the country? Although some say predatory lenders are at fault, an examination of mortgage loans made in 2006 indicates that as many as 70 percent of the defaults can be linked to borrowers misrepresenting themselves on mortgage applications.

Traderview: Fingers of Instability Part VIII

These products were created in conjunction with the ratings agencies such as Standards and Poor’s, Moody’s, and others who were paid big fees so the distributors of the investment products could package and sell these securitized products to the savers of the world. In putting very bad lending decisions into these products, the banks were able to do what ancient alchemists tried to accomplish, turning lead into gold. The biggest dumb money in the world bought the labels based upon their FAITH in the ratings agencies’ traditional fiduciary role as impartial judges of investment quality. Junk was sold as gold.

Now, confidence in the American capital markets is disintegrating in a rapid manner. These securities are illiquid, opaque, quant driven bombshells and they are spread out around the world, hiding in portfolios, and we are waiting for the holders of these products to recognize their losses so we can see the extent of the damage to the world’s financial systems. We are going to look at the US today and what you will see is mirrored around the world in the G7 financial systems.

We are witnessing nothing less than history's first confluence of unsustainable "peaks."

Perhaps, we are incapable of piecing them all, for when crude oil reached an all-time intra-day high of $84.10 per barrel on Sept 20, its entitlement to a front pager screamer was conceded to the tale of a few thousand empty -- or emptying -- American homes.

It was like the Butterfly Effect, with a twist. The flapping rooftops of confiscated homes were now whipping up an economic tsunami worldwide.

Here is how it works.

US mortgage lenders, voracious as ever for "more," had extended loans to the default-income group, who, were in turn hit by bad economic management. Credit card issuers followed suit to bloat consumer fantasies, and banks tightened the noose with additional loans for cars, tuition and businesses.

In the world of finance, debt is ironically regarded as an "asset." Think of the rock-solid house that can be repossessed in the event of a default.

Debts, with the outward promise of a steady cash flow, are regularly pooled, "securitized" and converted into a bewildering array of financial products along an upward chain, where, they are hawked off by fund managers to the global market

This money buys up commodities, stocks, and yes, more "securities and derivatives," along with junk bonds and blue chips.

It was easy come, easy go, wherever the money takes you...a 24/7 electronic casino...a Las Vegas without borders.

Bill Fleckenstein: Market hackers running out of ammo

You have to scratch your head and ask: What is a quant fund doing paying a huge premium for an easily replicated portfolio?

The only logical answer would be that the stock-price characteristics have behaved in a way that makes Renaissance's computer -- which was obviously programmed by someone -- think these funds are a good thing to buy, regardless of the fact that their valuation is beyond absurd. (As an aside, I'm amazed the proprietors of this fund have not sold some shares at that huge premium for the benefit of their shareholders. But that's another topic.)Meanwhile, a well-placed friend in the quant world pointed out that on any given day, 50% to 70% of stock trading is probably done using a quant strategy of some form. He suggested that folks should think about stocks as financial instruments, looking at volatility, correlation to other stocks, membership in an index and other such characteristics that pertain only to price action. That's what the computer-driven models at quantitative funds do, setting aside the fundamental questions of what a company actually makes or does and what that business is really worth.

If all that is the case, it explains why, at the margin, the market seems to have become more of a commodity than it has been in the past.

Obviously, no group of operators can change the market's ultimate direction. But they certainly can distort it for a time.My friend believes we're getting closer and closer to a moment when quants no longer rule daily trading, as their universe is losing participants that underperform. The ones that remain are desperate, trying feverishly to chase what's working. He contends that the higher the market goes and the faster it rallies, the more certain and ugly the collapse will be.

What can hopelessly complexifying a financing system, burying it in legal gobbledygook and wrapping it all up with government guarantees achieve? As a result, financial institutions can engage in predatory lending in residential communities, then pool the mortgages into securities and sell those securities into the retirement plans of the very people whose neighbourhoods are being destroyed. Fool the people closest to home and you can then fool investors around the globe. This is how frauds like the sub-prime mortgage mess happen....

....The absence of financial intimacy is most heartbreaking in communities. As I walk by small retail businesses, I watch a day-to-day flow of choices regarding media attention, bank deposits, purchases, donations and investments – choices which finance the very corporations and organizations that are draining jobs and income from the community. What do you say to a small business owner who is investing her savings in the stocks, bonds and CDs of the banks and corporations financing the franchises which are putting her out of business? Seeing the events emerging in our world as part of a tapestry interwoven with our personal finances and the money in institutions that we support and influence can seem overwhelming....

....My vote for the most significant cause of environmental damage on planet Earth is centralized currency systems that allow a few people to invisibly control and tax the many.

Norway withdraws funds from unethical corporations

Norway is the world's third largest producer of oil, behind Saudi Arabia and Russia. As a result of rising oil prices in the last decade, the small nation of 5 million people has accumulated a surplus of about $300 billion, enough to pay each man, woman, and child a substantial sum. But that's not what the Norwegians did with the surplus. They invested in the nation's future, stashing the oil money in a Government Pension Fund against the day when the oil reserves are depleted. And to avoid overheating their own economy, they decided to invest all the fund's money abroad.

Those are unusual decisions in a get-rich-now world. But in 2004, the Norwegian Parliament followed up with an even more remarkable decision: it unanimously adopted a tough set of ethical guidelines and committed to divesting the fund of stock in companies that didn't meet them.

Of the 21 corporations that have failed to meet the standards so far, 12 are based in the United States....

....As a result, Halvorsen faced criticism from the U.S. ambassador, Benson K. Whitney, who accused her of unfairly singling out U.S. companies in her screening process. But Halvorsen believes the process is working-foreign ambassadors have been asking what they have to do to keep their firms off the list.

Debt Crunch to Pare Asia LBO Deals Until Mid-2008, Bankers Say

Buyout firms such as Kohlberg Kravis Roberts & Co. may have to wait until the second half of next year to fund acquisitions bigger than $4 billion in Asia, as banks pare new loans to recover from subprime losses, bankers said.

Investment banks are demanding tougher terms on debt to fund LBOs, said bankers attending a leveraged finance conference in Hong Kong yesterday.

``There is a lot more focus on fundamentals and the credit approval process has become more stringent,'' Farhan Faruqui, head of Citigroup Inc.'s Asia-Pacific loans business.

Citigroup, JPMorgan Chase & Co. and other banks are offering discounts of as much as 4 percent in the U.S. and Europe to clear about $300 billion of leveraged-buyout financing they promised before losses on subprime mortgages shut down the market for high-risk high-yield debt in July. Write-offs by investment banks on soured leveraged-buyout loans and bonds may total $25 billion, according to estimates by Citigroup analysts.

Acquisitions needing more than $3 billion of debt will have to tap the U.S. and European markets, where fund-raising by collateralized loan obligations and collateralized debt obligations has seized up, according to Michael Tierney, head of Asia-Pacific leveraged finance for Credit Suisse Group....

....CLOs and CDOs had been major buyers of leveraged-finance debt, packaging loans and bonds and using their income to pay investors.

Buyout firms typically acquire companies using the target assets to borrow at least two-thirds of the purchase price to boost the returns of their funds.

The Price of Perpetual Prosperity

We are at a pivotal intersection in the timeline of our economic history as we again further separate our money supply from economic reality. Another credit bubble has been overseen and now patched on-the-fly by the Deus Ex Machina of our time, the Federal Reserve. It may look clever to save the world from a dilemma you helped create, but at what price?

Cutting interest rates reduces the denominator of a fraction that then presumes a higher intrinsic value of the numerator, equities. Money is cheapened and more credit is pushed into the bubble so that it doesn’t look like a bubble. As absurd as it might look in black and white, it sold and illusion has become reality. Al sold it with virtually no derivatives available and it’s even easier for Ben, with an estimated 500 trillion in global derivatives now trading........Creating bubbles to substantiate prior bubbles increases the probability of the deferred pop creating a deflationary accident.

Global Investing: Look Out Below

There are four reasons why investors everywhere should fear the ongoing fallout from the bust in the U.S. housing market. First, U.S. housing-credit problems have spread to other sectors. Not only have several hedge funds suffered or failed as a result of their exposure to U.S. mortgage products, but some banks and insurance companies as far afield as Australia, Germany and Taiwan have also run up large losses. And they are likely just the beginning, with major firms like Goldman Sachs and Bear Stearns announcing in recent days that some of their own investments have been badly hit.

Second, problems in the U.S. housing-credit-market have also spilled over into the world of "leveraged loans," which have been widely used to finance the global boom in mergers and acquisitions. While company balance sheets in most countries are, in general, still in quite good shape, this is no longer true for some of them, not least for the targets of private-equity buyouts and for private-equity houses themselves. As an example of how quickly the sector has fallen out of favor, shares in the Blackstone Group, a private-equity giant in the U.S., have dropped about 20% since its initial public offering just weeks ago, and the firm has warned of a significant slowdown in deals.

Third, it's likely that commercial and investment banks will have to impose tighter credit standards on borrowers, and possibly even start pulling out of deals that are already under way. As credit becomes more expensive, capital spending will slow and companies will have less money available to fund share buybacks — a key prop for the equity markets. These factors, along with weakening consumer and business confidence, could tip an already stalling U.S. economy into recession.

Fourth, the financial-product fads of recent years — collateralized debt obligations in mortgage markets and collateralized loan obligations in loan markets — which made a lot of money for financial-market participants in the upswing of the credit cycle are now proving to be opaque, hard to value accurately and potentially dangerous to both lenders and borrowers if their real worth has to be accounted for at short notice. There's a knock-on effect to disillusionment with these esoteric products: when investors must raise cash quickly, the more liquid and tradable assets tend to go first.

Credit crisis not over yet: International Monetary Fund chief

The global credit squeeze is a "serious crisis" that is not over yet and will have an impact on government budgets, the IMF's outgoing head Rodrigo Rato said in an interview published Monday.

Speaking to the Financial Times from Washington, IMF Managing Director Rato said: "Policymakers should not think that the problems will stay at the desk of the bankers.""Problems are going to come to the real sector, come to the budgets -- that is something we keep telling people."

IMF predicting slowdown in Canada, U.S.

The International Monetary Fund is preparing to slash its 2008 growth forecasts for Canada, the United States and the global economy because of the U.S. housing slump and the subprime mortgage crisis.

Canada's economy is now expected to grow just 2.3 per cent in 2008, down from a previously forecast 2.8 per cent, IMF sources told newswire services yesterday.

That would be the slowest pace of growth since Canada was hit with the SARS outbreak, mad-cow disease and a rising currency in 2003. (Last year, the Canadian economy grew 2.8 per cent, and is expected to expand by about 2.6 per cent in 2007.)....

....The IMF has warned publicly that global growth will take a hit from the U.S. slowdown, and it has also pointed out in the past that, of all the economies in the world, Canada and Mexico are the most vulnerable to a U.S. downturn.

Economists in Canada have also been scaling back their expectations for Canadian growth, as the credit crunch linked to the subprime mortgage crisis has pushed up lending rates and rattled markets in Canada, and as the U.S. housing slump deteriorates further.

The Reason Why The LIBOR Rates Have Been Partially or Completely Inverted

LIBOR stands for London Interbank Offered Rates. The LIBOR Rates are benchmark interest rates set by an organization in the United Kingdom called the British Bankers’ Association (BBA). The LIBOR rates are used chiefly as a set of benchmarks for unsecured, short-term loans between the most creditworthy international banks. There are many different LIBOR rates with many different currency denominations. In the United States, the U.S. dollar-denominated LIBOR rates are published each business day in the Money Rates section of the Eastern print edition of the Wall Street Journal®.

In the American financial marketplace, the LIBOR rates play a key role as the index for many debt instruments and debt securities, including interest-only mortgages and other adjustable-rate loan products, and certain credit cards....

....If you guessed that it has something to do with the subprime lending mess which unfolded this year, then you guessed right. The American subprime mortgage crisis caused financial markets around the world to seize up. Bankers have been, and still are, nervous about lending -- even lending to other banks -- because bank managers aren’t sure which entities have exposure to subprime debt. When bankers get nervous, rates go up. In other words, the reason why the 3 month LIBOR rate is higher than both the 6 and 12 month rates is because banks are charging a premium for what they perceive as the riskier timeframe. In other words, the BBA feels that loans with a term of 3 to 6 months are riskier than loans with a term of 1 month or one year.

Credit crunch will take its toll on U.S.: Greenspan

The credit crunch that has troubled financial markets in recent months will eventually take its toll on the U.S. economy, former Federal Reserve Chairman Alan Greenspan said on Wednesday....

....In a separate appearance, Mr. Greenspan said that demographic shifts will strain U.S. Medicare resources but that financing the Iraq war would have no long-term impact on those resources.

"We do not have the resources in any credible economic scenario to fulfill what is currently on the books as an entitlement 10, 15, 20 years from now," he said in an interview on Canadian Broadcasting Corp. radio.

Mr. Greenspan said the cost of the U.S. war in Iraq would have no long-term impact on funding for Medicare, the health care financing program for the elderly. He said both political parties were afraid to confront the issue of Medicare's long-term solvency because of its political sensitivity.

Fed admits economic perplexity

In widely awaited minutes from its Sept. 18 meeting, U.S. central bankers said they decided to cut the key Fed rate by 50 basis points -- the first time in nearly four years -- to help kickstart an economy bearing the heavy weight of a housing meltdown and credit crunch.

But the Fed governors decided to hold off on forecasts of whether inflation and growth were in or out of balance, as it has in the past. That is usually a clue of where it sees interest rates going in coming months. Instead, it cautioned, any outlook on the balance of risks in the economy "could give the mistaken impression that the committee was more certain about the economic outlook than was in fact the case."

Who's Ben Chatting With About The Economy?

But wait.

The government also said it cut the number of job gains this year by 297,000 in a "benchmark revision." So, none of the job numbers the Labor Department has been announcing all these months is accurate.

Is the economy strong, weak or just piddling along? Should the Federal Reserve be on the lookout for inflation or recession?Answers: Nobody knows.

But the really big question in all this confusion is: Is this any way to run a country?

How can the Fed make reasonable decisions on interest rates and not be the laughingstock of world investors when the economic data it is relying on are so untrustworthy?

Bernanke, Greenspan and the hubris of central bankers

Due to credible competition that has emerged among this year's candidates for the Hubris in Monetary Policy Award, the Award Committee has announced that it is officially deadlocked.

The competition is centered on two candidates. Take, for instance, the submission by Federal Reserve Chairman Ben Bernanke, who provided remarkable testimony to the US House of Representatives' Financial Services Committee last month. In it, he argued that the subprime crisis could be blamed, in part, on the Fed's (and his own) effectiveness. It is not that Fed policies did not contribute to the situation, he said, but that long-term rates, made lower by low inflation expectations, played a greater role.

This is, of course, the old "as the 10-year Treasury yield goes, so goes the mortgage market" argument, and frankly, it made the Hubris Committee take notice. Bernanke was arguing that if the Fed just wasn't so gosh-darn effective, long-term rates would be higher, but since they're not, too many people took out loans that they shouldn't have. It would seem that the trade-off for lowered inflation expectations is increased moral hazard.

We thought we had a winner, especially since everyone in that hearing room knew that Congressional mandates to Fannie and Fred to buy up mortgages up to $417,000 are what caused much of the malinvestment that Congress welcomed as political cover during the last recession. But as if that weren't enough, Bernanke even added to his hubristic credentials by suggesting that the solution to the crisis should involve allowing Fannie and Fred to buy up mortgages of sums greater than $417K, but only temporarily. He didn't give a date for when this "credit surge" should end, but we can safely assume there was agreement among the honorable congressmen for a timeframe ending sometime after November 4, 2008.

Subprime mortgages were initially aimed at lower-income consumers with spotty credit. But the data contradict the conventional wisdom that subprime borrowers are overwhelmingly low-income residents of inner cities. Although the concentration of high-rate loans is higher in poorer communities, the numbers show that high-rate lending also rose sharply in middle-class and wealthier communities.

Banks and other mortgage lenders have long charged higher rates to borrowers considered high-risk, either because of their credit histories or their small down payments. As home prices accelerated across the country over the past decade, more affluent families turned to high-rate loans to buy expensive homes they could not have qualified for under conventional lending standards. High-rate loans are those that carry interest rates of three percentage points or more over U.S. Treasurys of comparable durations.

The Journal's findings reveal that the subprime aftermath is hurting a far broader array of Americans than many realize, cutting across differences in income, race and geography. From investors hoping to strike it rich by speculating on condominiums to the working poor chasing the homeownership dream, subprime loans burrowed into the heart of the American financial system -- and now are bringing deepening woe.

Moody's downgrades $33 bln of subprime mortgage securities

Moody's Investors Service said on Thursday that it cut ratings on $33.4 billion of securities backed by subprime residential mortgages because the underlying home loans are steadily deteriorating in the face of falling home prices and a tight lending environment. The downgraded securities are backed by subprime first-lien mortgages originated in 2006 and represent 7.8% of the original dollar volume of securities that Moody's rated from that year. A further $3.8 billion may be downgraded later. Moody's also said that another $23.8 billion of first-lien residential mortgage-backed securities were put on review for possible downgrades. That includes 48 securities rated Aaa, the highest, and another 529 rated Aa, the agency noted.

The fallout from this summer's mortgage meltdown continued to wreak havoc inside Wall Street's corner offices with UBS showing two senior bond executives the door just a week after taking a $3.42 billion write-down.

UBS fired David Martin, its head of interest-rate trading - which includes the bank's high-profile mortgage and asset-backed trading operations - after the firm posted a quarterly loss due to its massive exposure to several collapsed areas of the bond market. The firm also fired James Stehli, the head of its collateralized debt obligation unit. CDOs, which are bonds made from other bonds, have been devastated in price in the wake of ratings downgrades and the collapse of secondary trading....

....UBS disclosed that it currently holds about $19 billion worth of subprime mortgage-backed securities.

Is Commercial Real Estate The Next Subprime?

Mounting evidence suggests bubble conditions may be emerging in US commercial real estate valuations, CreditSights warns in a new report on the sector.

The recent boom in non-residential construction has almost entirely made up for the slump in residential investment, in turn significantly increasing the economy’s dependence on the commercial real estate sector, CreditSights says in Bubblenomics - Hunting for the Next Subprime in Commercial Real Estate. An even bigger problem may be overinflated commercial real estate prices, the report says.

The extendible paper, which Coventree helped introduce to Canada in 2000 with its Rocket Trust, was pitched to investors as an almost bulletproof short-term investment.

Investors would get a slightly higher return than other short-term notes up front in return for taking the risk that the paper's maturity could be extended for up to a year if there was a market disruption. If that happened, investors would be compensated with a much higher interest rate.

By contrast, more traditional asset-backed commercial paper came with a guarantee that in a market disruption, banks would provide loans to redeem the paper.

Their risk was "very remote" that the paper would ever be extended, Coventree co-founder David Ellins wrote in a 2003 presentation to investors, and if it did happen, "it would likely be of short duration."

Investors were hooked, and as banks tightened up on committing to backup loans on ABCP because of new international lending rules that made doing so less profitable, extendible paper became more popular. Coventree dominated the business with a 42-per-cent market share, according to its 2006 annual report.

But when the credit crunch hit this summer, and investors stopped buying asset-backed commercial paper, the promises of security that Coventree and other non-bank sponsors of ABCP made started to ring hollow. Some banks declined to provide loans to repurchase standard paper, and extensions on extendible paper are now into their third month.

People involved in the discussions say the most likely solution to the extendible issue is to alter the notes' terms to lower the crushing interest burden.

Credit card debt is ready to blow

The next bomb from this chain reaction of bailouts and blowups will be credit-card debt. Hardly anybody is talking about it yet, but banks and consumers are laying the ground for a wave of credit-card defaults, bankruptcies and asset write-offs for 2009 or so.

Regulators and investors have discouraged excessive mortgage lending, so banks are turning to credit cards as the next growth business. They're starting to raise credit limits, lower lending standards and increase recruitment. And now that they can't borrow against homes so easily, consumers are borrowing more against plastic - even to meet higher, adjustable mortgage obligations that they can't handle from their income....

....When mortgages and home-equity loans were all the rage, consumers had no need to crank up credit-card balances and bank salesmen had no need to push plastic. But cards are now the bank growth product and consumer lender of last resort....

....If banks are swallowing hard before issuing asset-backed mortgage loans these days, should they really be increasing unsecured card debt to the same people? Especially since credit-card interest can be three times as high as mortgage rates and isn't tax-deductible?

No - but the Fed is creating money, regulators eyes' are off the ball and the dough will flow along the line of least resistance.

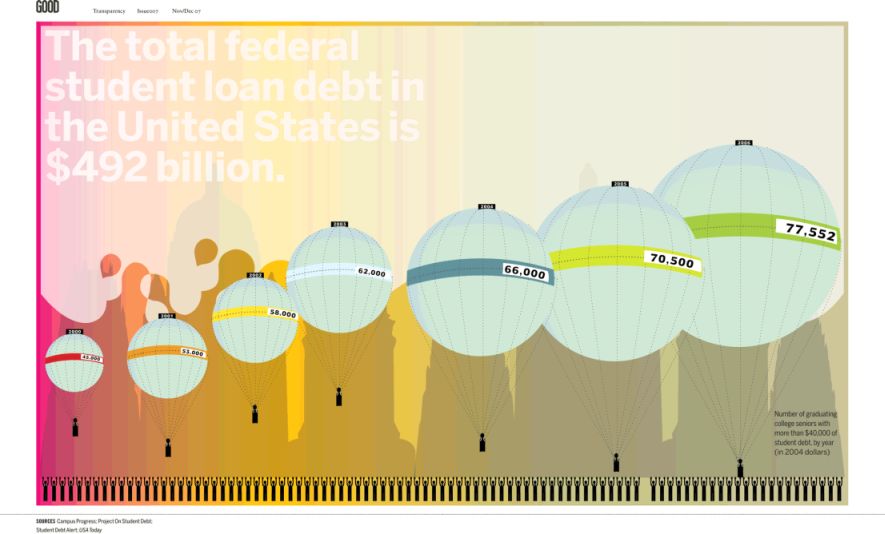

Click to enlarge in new window

According to the College Board, it takes 14 long years before the four-year college grad's income, net of loan payments, starts to beat what the high school grad earns. During all those 14 years, college doesn't pay. High school pays.

The real question is not which choice pays on an annual basis, but which choice pays on a lifetime basis? Which choice permits a higher lifetime living standard? That's a question the board conveniently doesn't ask or answer.

The answer depends on the costs of borrowing and the amount you need to cover. Today's student loan rates are really high if you need to cover the full ride. And the price tag for attending college is astronomical. Over the past 50 years, for instance, the cost of going to the Massachusetts Institute of Technology has increased about 20-fold. That calculates to an annual compound increase of about 6.2%, which, in turn, is about 2 percentage points a year higher than the 4.1% inflation rate over the same period.

That's a big difference when you compound it out for 50 years.

The credit markets were self correcting until the Fed decide to jump in and give the implication that they were the lender of last resort. Now the implication is that we will have a bailout and the market is rejoicing. Yet looking at the mortgage reset charts and mortgage equity withdrawals, it is clear we are only entering the first stage of a multiyear housing bear market bailout or no bailout. And when we look at Real Homes of Genius, we understand that fraud and outright speculation will come crashing down.

You must ask yourself that a large proportion of our population was involved to some extent in producing products that provided no socio-economic benefit to our society. 2/28 loans? Option ARMS? Need we dig into more data of people making $9 hour being put into loans with the assumption they are making $157,000? The only people benefiting from these loans were Wall Street and the lenders. No one else. Initially the claim was these people now have the pride of homeownership but what a crock that was.

Lenders will continue to tighten since risk is now perceived in the market. This will make it more difficult for people to refinance, purchase discretionary items, and in general will put a pause on the consumer spending which greases the wheels of the American economy. We talked about debt being seen as the new form of money. But all this is changing. And Americans with a negative savings rate will have a hard time doing a paradigm shift in which lenders will require a down payment. Even a miniscule down payment like 5 percent will bring the market to a screeching halt. Everything is borrowed.

A Bank Bet on Condos, but Buyers Want Out

Javier Miglin may walk away from an $80,000 down payment on a condominium with water views in Miami. Randal Mills may give up a $130,000 deposit on a 15th floor condo on the Strip in Las Vegas....

....Whether buyers like Mr. Miglin and Mr. Mills close on their condos will be a crucial indicator for Corus. Many condo projects that started during the real estate boom are just being completed, and developers must begin repaying construction loans taken out before the market turned sour. If buyers do not close, and developers struggle, lenders like Corus may be left holding the bag.

“We’re at the riskiest point of the condo lending cycle as these projects are being completed,” Jefferson L. Harralson, a bank analyst at Keefe, Bruyette & Woods, said. “In the coming weeks and months, we’re going to find out what the demand for these condos really is.”

U.S. Existing Home Sales May Drop to Five-Year Low

Existing home sales this year probably will fall to a five-year low, worse than forecast, signaling the U.S. housing market is far from hitting bottom.

New-home sales may decline 24 percent to a 10-year low of 804,000 and existing home sales will fall 11 percent, the National Association of Realtors said in a news release today. It was the 10th time this year the Chicago-based group lowered some part of its monthly housing and economic forecast.

Home resales tumbled to a five-year low in August as prices declined, subprime mortgage defaults soared and lenders such as Countrywide Financial Corp. raised standards even for borrowers with the best credit. Federal Reserve policy makers have said the housing market is ``exceptionally weak'' and some economists think the slump may push the U.S. into a recession.

``The credit tightening is knocking homebuyers out of a market that already was quite weak,'' said Brian Bethune, an economist at Global Insight Inc. in Lexington, Massachusetts.

Another Month, Another NAR Revision

The comedians at the National Association of Realtors (NAR) revised down their forecast today for existing home sales in 2007 again. Their current forecast is for sales to be 5.78 million in 2007, down for 5.92 million last month.

Compare this to their original forecast from Dec '06 of 6.4 million units in 2007. (My forecast was for existing home sales to be between 5.6 and 5.8 million units).

The NAR forecast is still too high, even after eight straight months of negative revisions. Luckily for the NAR, they still have two more downward revisions to go.

To remedy the U.S. mortgage crisis, Congress is considering loosening the regulatory reins on two publicly traded financial behemoths that, not long ago, were mired in accounting scandals and forced to make earnings restatements totaling more than $20 billion -- dwarfing those of Enron and WorldCom combined.

Their top executives have since been replaced, but the two government-sponsored entities, Fannie Mae and Freddie Mac , are still not up to date in their financial reporting, and many "safety and soundness issues" remain unresolved at both companies, according to federal regulators.

But that hasn't stopped Fannie and Freddie from saying they could help clean up the mortgage mess.

Their top executives, with support from the mortgage industry, are prodding lawmakers to loosen restrictions on the size of their lending portfolios and grant them access to the so-called jumbo mortgage market.

Such a move could alleviate some pain for lenders and borrowers suffering a sharp downturn in the housing market. But supporters are overlooking that it would also add to a volcano of risk mounting at Fannie and Freddie that threatens to erupt someday and shake the U.S. financial system.

The portfolios of both Fannie and Freddie have grown steadily over the years thanks to the implicit backing of the federal government, which allows them to issue debt at highly favorable rates and take on more risk. Together, they own or guarantee roughly 45% of all residential mortgages, with combined loan portfolios valued at $4 trillion.

Before this summer's financial turmoil in the credit markets, Fannie and Freddie were under pressure to shrink and face tougher regulations.

Study Says Lenders Lost Money Last Year

Even before surging defaults rattled the mortgage industry, lenders were facing financial troubles and actually lost money on average for every loan they made last year, an industry trade group said Wednesday.

The Mortgage Bankers Association, in a report based on 2006 data collected from 189 companies that make up more than half of total U.S. mortgage lending, said lenders lost an average of $50 per mortgage last year. That was down from a profit of $258 per loan a year earlier.

Throughout last year, banks were under pressure because of a narrow gap between short- and long-term interest rates. That problem combined with staffing levels that remained high as the real estate boom cooled to make lending unprofitable for many companies, the report said.

Mortgage lenders, however, made up for those losses with the still-profitable business of collecting and processing payments from borrowers, also known as servicing loans. On average, firms posted pretax profit of $6.4 million last year, down 75 percent from $26 million a year earlier, the report said.

In addition, lenders tried to make up for declining mortgage volumes by originating mortgages that charged customers higher rates.

Many such loans, including subprime loans made to people with weak credit, have experienced a surge in defaults this year, causing financial troubles for numerous lenders.

Mortgage industry miseries mount

The Khongs are among the growing legions of laid-off mortgage workers in the midst of a major industry shake-out, facing stiff competition for the few remaining jobs.

Employment experts say it's reminiscent of the dot-com crash of the early 2000s, when tech workers found themselves out of work, many for the first time and often for a year or more. And, like then, there is no sign of a turnaround anytime soon.

In Orange County alone, the state Employment Development Department estimates 8,100 people have lost mortgage industry jobs in the past year – and that's just payroll jobs. It doesn't include the mom-and-pop and one-person mortgage shops that folded, or the appraisers, title insurance workers and real estate brokers who also saw business dry up.

Officials say that what began as a trickle of out-of-work people last year turned into a torrent in recent weeks as their job searches prove futile and their six months of unemployment insurance gets close to running out.

Countrywide lending slides, cuts nearly 5,000 jobs

Countrywide Financial Corp (CFC.N: Quote, Profile, Research) funded 44.3 percent fewer mortgage loans in September as it eliminated nearly 5,000 jobs to cope with lower lending volume and increasing delinquencies and defaults, the company said on Thursday.

Mortgage loan fundings totaled $21.2 billion, down from $38.1 billion a year earlier. Fundings of adjustable-rate mortgages slid 76 percent, while nonprime loan fundings, including subprime, tumbled 92 percent. Countrywide Chief Operating Officer David Sambol said volume reflected "current market conditions and more restrictive underwriting."

On Thursday October 11th at 12:00 p.m. at NACA’s headquarters (3593 Washington Street, J.P, MA), a nationwide boycott of Countrywide Financial Corporation will begin. The boycott of the nation’s leading mortgage lender is being led nationally by the Neighborhood Assistance Corporation of America (“NACA”) and locally by the Massachusetts Alliance to Stop Predatory Lenders. NACA is working with other local organizations to take the boycott nationwide.

Thousands of working families are losing their homes to foreclosure because Countrywide has put them in unaffordable mortgages and now refuses to restructure loans to what homeowners can afford. Since Countrywide has become the leader in these predatory practices, NACA has teamed up with the Massachusetts Alliance to kick-off the campaign to get Countrywide to change its practices or be shut down. “Countrywide is the number one example of the abuses in the subprime industry.” states NACA CEO Bruce Marks. “This boycott includes actions at many of Countrywide’s over one thousand offices nationwide.

Demonstrations held outside countrywide branches

The community activist group ACORN, or Association of Community Organizations for Reform Now, demonstrated outside several Countrywide branches on Tuesday, claiming the beleaguered lender was doing little to help homeowners avoid foreclosure.

At a branch in San Bruno, CA, protestors armed with signs marked, “Save Homes, Stop Foreclosures” chanted “Predatory Lender” as they picketed outside.

At one point, the demonstrators knocked on the door to confront employees, but the doors had been locked, and there was no response from staff within.

One former Countrywide customer who was part of the group claimed that the interest rate on the subprime loan she was given three years ago had spiked from 6.5 to 12 percent today, leaving her with few options aside from foreclosure.

“They said I have no options. They want me to put the house for sale or short sell or just leave the house,” said Esthela Baldovinos.

Despite the downturn of the mortgage market, a type of home loan has remained surprisingly sturdy: one extended to illegal immigrants.

Now, the question is whether these loans will continue to hold up. A number of factors -- including a possible government crackdown on illegal workers and a slowdown in job prospects for undocumented laborers -- threaten the ability of these borrowers to keep paying. And there are signs of a slowdown as some lenders have raised the interest rates they charge because of the recent mayhem in the credit markets.

Known as ITIN mortgages because applicants must have an individual taxpayer identification number, the fixed-rate loans are designed for immigrants who can prove they are creditworthy and pay taxes even though they don't have legal permanent residency in the U.S....

....Undocumented workers normally use an invalid Social Security number to obtain work. But they can pay taxes with a nine-digit alternative number that the Internal Revenue Service started issuing in 1997 to foreigners who aren't eligible for a Social Security number.

The objective is to encourage all workers in the U.S. to file an income-tax return, regardless of immigration status. Banks, which normally use Social Security numbers to report income to the government, began accepting the individual taxpayer identification number from mortgage applicants in 2000.

ITIN-mortgage applicants are largely blue-collar, illegal-immigrant workers with only modest incomes. But they undergo more scrutiny -- and provide more documentation -- than candidates for stated-income mortgages and other subprime loans, for example. Most banks also ask applicants to show they have been filing taxes -- with an ITIN -- for at least two years.

Foreclosures Doubled in September as Loan Rates Rise

Foreclosures are deepening the U.S. housing recession by pushing more homes onto a market where sales and prices are dropping. There's a 10-month supply of unsold homes, the highest in at least eight years. As many as half of the 450,000 subprime borrowers whose mortgages will re-set through November may lose their homes because they can't afford the higher payments, according to a report by Credit Suisse Group.

``The truth of the matter is that borrowers are going into default as soon as they hit their adjustments,'' said Rick Sharga, executive vice president of marketing at Irvine, California-based RealtyTrac. The company sells foreclosure information and has a database of more than 1 million properties from 2,500 U.S. counties.

Canada: Housing starts soar in September

Housing starts hit a 29-year high last month amid a flurry of condominium construction, though the torrid pace is expected to taper off.

Starts jumped 19.6 per cent to 278,200 units in September from August, Canada Mortgage and Housing Corp. said yesterday. The volatile condo segment led the way, most notably in Quebec, which is seeing a surge in nursing home construction.

Housing starts have defied expectations all year, and are continuing to support growth in the domestic economy. Condos have proven particularly popular as a more affordable choice for first-time buyers and as baby boomers downsize their living quarters.

Trucking giant sees blue Christmas

As the head of YRC Worldwide (formerly Yellow Roadway), a $10 billion trucking and transportation company with 27,000 trucks and customers in 80 countries, Bill Zollars has a crow's-nest view of the global economy. From the pace of Chinese manufacturing to shipments of holiday retail goods to fluctuations in gas prices, he has the data to grasp what's happening in economic sectors before the rest of us do. Amid rumors of a bid for YRC by German shipping giant Deutsche Post, Zollars tells Fortune's Matthew Boyle it might be a disappointing Christmas unless business perks up in the next few weeks.

Q. From your perspective, how is the overall economy doing?

A. New York and most of the world get fixated on the credit crunch, since there's a tendency to be mesmerized by the financial markets. But underlying that is the real economy, which is the movement of goods. That economy is driven by people making and shipping stuff. They are not making and shipping as much [right now], and we see that every day.

The weakness of the Dow Jones Transportation Average is not merely a technical divergence, however, it is also a fundamental sign that the economy is struggling. As the nearby chart clearly shows, there is a reduced demand for trucking. Coming out of the 2001 recession, shipments increased until 2005, then declined throughout 2006 and so far through 2007.

Supply Chain Digest is also reporting that inbound container volume growth has slowed dramatically at U.S. ports over the past year, with May 2007 traffic down 0.2% from a year earlier. This confirms the slowdown we are seeing in truck tonnage, and also suggests the consumer-led economy is slowing....

....The key thing to remember about avoiding a downturn in stocks is that by the time everyone realizes a bear market has begun, it will be too late to do anything about it -- because stock prices will have already declined. When the Fed began its rate-cutting campaign in January 2001, stocks rallied on the belief that the Fed would rescue the market. But only two months later, the S&P 500 was down 20%, and over the next year and a half, the S&P lost over 40%. You have to prepare ahead of time, when everyone is still convinced that everything is fine.

The falloff "reflects the consumer-demand-driven weakness in the U.S. economy," said Paul Bingham, an economist with Global Insight, a research firm that monitors cargo movements for the nation's top retailers.The slump in oceangoing imports unloaded at the 10 largest U.S. container ports in August was the first drop since Global Insight began its monthly Port Tracker report in 2005. The number stunned some port watchers.

"When I first saw these numbers, I called the researchers and asked them if they had left a column out of the spreadsheet. I thought it was a typo," said Craig Shearman, vice president of the National Retail Federation, which pays Global Insight to conduct the trade research.

In Fountain Valley, Gary Bedrosian wasn't surprised. The owner of Bedrosian Tile & Stone said he had cut orders by about 15% this year compared with 2006 because new-home construction has plummeted.

"Anybody doing business for the housing market has to be off," he said.

Retailers Report Slow September Sales

"Sales are coming in soft, as expected," said Ken Perkins, president of RetailMetrics LLC, a research company in Swampscott, Mass. "It was a perfect storm, a combination of abnormally warm weather, high food and energy prices, a continued sluggish housing marketing and tight credit."

Perkins added that if sales don't pick up, stores will be forced to slash prices to get rid of inventory and make room for holiday merchandise that will start to flow into stores this month. Weak sales are already contributing to the lowered earnings projections.

The news wasn't encouraging as the holiday season fast approaches. Retailers have been struggling with a sales slowdown for most of the year as shoppers contend with higher food and gasoline prices as well as the still weak housing market. But last month, stores also had to deal with warm, muggy weather that wilted consumer demand for fall clothing.

Northern Rock Wins New Guarantee From U.K. Government

Northern Rock Plc, the U.K. mortgage lender bailed out last month by the Bank of England, said the government will guarantee deposits until financial markets become less volatile. The shares rose the most ever.

Chief Executive Officer Adam Applegarth is struggling to keep the company in business as buyout firms including J.C. Flowers & Co. consider bids. A surge in borrowing costs forced the company to seek a rescue from the Bank of England on Sept. 13. Customers withdrew more than 2 billion pounds ($4.1 billion) in the next three days, the first run on a U.K. bank in more than a century.

Northern Rock, based in Newcastle, England, said in a statement today that money deposited after Sept. 19 will now be covered by the Bank of England, the U.K. Treasury and Financial Services Authority. The authorities previously only protected deposits made before then.

``This may make Northern Rock easier to sell,'' said Philip Shaw, chief European economist at Investec Bank in London.

Russia Liquidity Problems and Other Warning Signs

Russia's central bank lowered the interest rate on roubles used to carry out currency swap transactions to an annual 8 pct from 10 pct, effective today, in an effort to stabilise short-term rates on the currency market, Interfax reported.

The central bank also said the move should help regulate the liquidity of the banking system. Banks actively use currency swaps during unstable periods on currency markets and also when experiencing problems with liquidity....

....Liquidity is tight in Moscow and banking problems are also appearing in Lithuania, Latvia and Azerbaijan as well as Romania and Hungary.

Is this important? Not sure, but I did not know the Thai Baht was important until it was. I am keeping an eye on it as the ramifications could roll on.

Republicans Grow Skeptical On Free Trade

By a nearly two-to-one margin, Republican voters believe free trade is bad for the U.S. economy, a shift in opinion that mirrors Democratic views and suggests trade deals could face high hurdles under a new president.

The sign of broadening resistance to globalization came in a new Wall Street Journal-NBC News Poll that showed a fraying of Republican Party orthodoxy on the economy. While 60% of respondents said they want the next president and Congress to continue cutting taxes, 32% said it's time for some tax increases on the wealthiest Americans to reduce the budget deficit and pay for health care.

Six in 10 Republicans in the poll agreed with a statement that free trade has been bad for the U.S. and said they would agree with a Republican candidate who favored tougher regulations to limit foreign imports.

Super Capitalism, Super Imperialism

Hudson, the American heterodox economist, historian of ancient economies and post-WW II international balance-of-payments specialist, advanced in his 1972 book the notion of 20th century super imperialism. Hudson updated Hobson's idea of 19th century imperialism of state industrial policy seeking new markets to invest home-grown excess capital. To Hudson, super imperialism is a state financial strategy to export debt denominated in the state's fiat currency as capital to the new financial colonies to finance the global expansion of a superpower empire. No necessity, or even intention, was entertained by the superpower of ever having to pay off these paper debts after the US dollar was taken off gold in 1971.

Thanks for an excellent round-up Stoneleigh.

The financial crisis seems to be the leading wave of the coming turmoil. Where the unsustainability of the

'sustainable' growth world model first becomes undeniable. I have my family's ongoing interests as my primary concern, we are hopefully protected from the worst elements of exposure to the fall-out from these financial bombs. However I wonder if you have any thoughts on the timing and likely triggers of crashes, bank runs, and other discontinuites to be wary of. I'm thinking of the ARM reset profile, forced mark to market of bank 'assets', end of year statements etc.

Thanks

Records

Debt as we see it today has no real precedent, particularly its reach into the lower classes. The inability of people to live within their means is unprecedented, and does not necessarily reflect economic stagnation. It simply is not true that the problem is solely associated with the gap between rich and poor. The dubious statistics show the gap 'widening' since say 2000 or widest in the past 25 years. The yawning gap of the early 20th century and before to the dawn of human history is the better measure. The developed world is the most egalitarian ever, and the ability for the poor to secure debt is one more example.

The problem is that people have an almost pathalogical need to consume what they have and more. There is no restraint. When someone spends everything they have no matter what the sum, the problem is not 'solvable' systemically or institutionally.

Given my belief that peak oil, and indeed peak everything is around the corner. This problem will be the cornerstone of our getting through this. In eras past, additional wealth simply added to the population and kept living at marginal sustainable levels. The Malthusian Trap. Today it is debt that keeps living at marginal levels, despite rising wages, greater egalitarianism. People put THEMSELVES into a debt from which they cannot escape. Debts are their children now. Rather than breeding into powerty, people today borrow themselves into it.

Gotta love this solution to the oil crisis. Hey and BTW seems that most Americans are carrying their own weight in black gold. It would be funny if it wasn't so sad.

http://www.aftenposten.no/english/local/article1559489.ece

If you have managed to read this entire piece, you might want to relax with a little music: "The Bubble Man" by Scotto. As featured on the FSN Newshour last weekend.

Don't say a word Mriswith but I've been playing hookey and running cord wood in a wheelbarrow up hill but that piece works well after doing that too. BTW where did a guy who looks so young get that rasp? Of course that picture of him looks like he just had a slug of lye, no chaser:)

What is the reasoning behind the banks continuing to lend on unsecured credit cards when it is obvious they will never collect?

No one is going to buy the debt and the fees can never be high enough to make up for loss of the principal.

Or is it just a way for the FED to put free money into the hands of sub prime people behind our back?

My guess would be indentured servitude - permanent indebtedness to the 'company store'. After all, with the new bankruptcy laws, most people are on the hook indefinitely. To speculate wildly for a moment, in the past debt servitude has even become hereditary.

Yes, for some. At the lower end it seems that it would just be too easy for people to drop out of the menial above the table workforce, hide assets and qualify for BK.

Lots of illegals and other minorities play that game already, one member of the group works and shows up on all the paperwork and all the others in the same household claim to be single mothers, destitute, disabled and who knows what.

One of my friends is a mail carrier and he says it is very common to deliver up to a dozen government checks with different names on them each month to houses in halfway decent neighborhoods.

Maybe now everyone wants to play the freeloader game.

Me too,

:)

The graphic reminds me of Wile E Coyote. He's out there against a pale blue background, pedaling the air. And looking at the viewer.

Don't look down, Wiley!

| The problem will solve itself.

| But not in a nice way.

What is the reasoning behind the banks continuing to lend on unsecured credit cards when it is obvious they will never collect?

That was my question as well and it struck me that the answer might be the most important answer you will ever need in regards as to how to protect yourself and prepare for the short term and long term future.

My take.

The FED is dead. They are caught in a catch 22. Lower interest rates and stop foreign purchases of our debt or raise rates and kill our debt based economy.

They are doing what is rational only to a junkie. This is desperation. They are so out of control that it isn't funny.

I was wondering how you would get the money into the hands of people who will actually spend it and still "account" for it. The fed cannot print money. All debt must go through an accounting method. It is not created and given away with out a paper trail. So how do you get people who cannot borrow any more on real estate to take on even more debt?

We have the answer. Funny I remember a note in our latest credit card bill. Our limit was raised to $11,000.00.

This will be the last debt tango.

Looks like we came to similar conclusions, even if mine goes a few steps further, but it isn't something to discuss in the current political environment.

If the Fed were dead we wouldn't have that much of a problem, the problem is that the Fed has the power to hide the crimes of their people while burying us further. No bank individually would follow this suicidal course of action.

It just seems upsetting that so many useless freeloaders get free money while we get taxed. The only consolation is that they are so stupid they spend it on crack and useless junk.

Maybe the way to play it is if the Hillabeast gets elected we just use our credit lines to the max, buy a wagon load of gold, bury it, flip them the finger, claim to be oppressed and get bailed out.

Can't beat them, join them, sort of thing.

Up to that point we remain debt free in case Ron Paul wins and the rule of law prevails.

It would be priceless to watch the banksters jumping out of windows.

Ya...my credit card company raised my limit to $13,000 recently. Now, how stupid would I have to be to put that much on a card that charges about %17 interest.

Holy smokes...debt servitude indeed.

Miss or be late with a payment or two and see what happens to that interest rate. 30%+ comes sooner than you might think, hehe.

This is the game. They seem to be betting that many will have that problem and then whammo, they have you forevor. Once they crank that interest up that high it becomes nearly impossible to pay the sucker off.

Voila, perpetual income.

Unethical behavior runs rampant on Wall Street. How else can you explain companies that pay outrageous golden parachutes, grant huge numbers of options, fund share buybacks instead of dividends, and generally stick it to the ordinary shareholder?

Companies are mortgaging their future left and right while they continue with huge payouts to crooked boards and shareholders. Why?

Because the average guy is invested in 3 or 4 mutual funds, has no idea what specific companies he's invested in, doesn't vote on shareholder issues (usually the mutual funds retain that right or ask you to vote for their recommendations), and really has no interest. He's seen 10 minutes of Suzy Orman, picks a few selections, and prays.

Companies know this. Banks know this. Everything is focused to boosting revenue this quarter. Sell a few more options. Get another huge bonus. And when things go bad, they just ask the feds for a bailout from taxes paid by the same guy who just lost his 401k.

Perhaps they believe that they will collect on the majority of that debt.

Two things to keep in mind:

I don't know about reasoning, but if great white sharks of bad debt were credit crunching on your stern wouldn't you row as fast as possible?

Goldilocks? Yeah, maybe.

Some people think that they are going to keep sharks as pets in their bath tubs.

Of course they do collect. They would never do it if they didn’t earn substantial amounts. Interest at 5, 17, or often 30 % fills the coffers. (And it’s all done by machines, no real life fuss.) The occasional defaulters (or whatever one calls them) are lovely too - they run around and around and pay and pay - some I guess pay back their debt several times before they go bankrupt.

That’s the short story. The details I don’t know.

To make it a bit more concrete, this article. I'm pretty sure this doesn't include credit card companies.

Sure, but total outstanding debt is about 2.2 trillion and the default rate is just around 5%, so while some pay through the nose 5 times as much in $$ is basically stolen by freeloaders defaulting.

No wonder no one wants to buy the paper with a 5% default rate, eh?

My wife wife and I are a slack lot when it comes to keeping track of bank balances, so for a bit we were having overdraft charges happen quite often. The solution we came up with was to inform the bank, in no uncertain terms, that we did not wish the 'service' of overdraft. It can be embarrassing but does save us a packet. Personal embarrassment is I think what banks bank on I think:)

From this article posted above:

Traderveiw fingers of instability

Why after Bernake lowered the interest rate on the 18 th of Sept shorting as shown above continued. One would think (I would anyway) that it would be obvious to the 'commercials' that the value for the US dollar would drop and the value of gold would increase, why wouldn't they take their profit from rising gold value and leave shorting alone? What am I missing?

The need for cash - the people who short need infusions of it to justify getting more capital to re-short

Dragonfly41 has posted an interesting article on Drumbeat... it integrates analysis of price of crude with the falling dollar and the credit crisis.

http://www.theoildrum.com/node/3082#comment-249020

Its so scary I have to read this one with one eye closed while clutching my teddy bear. Great work to have it gathered all together, but ... yikes!

What is the reasoning behind the banks continuing to lend on unsecured credit cards when it is obvious they will never collect?

Quarterly earnings. They have to make wall street's numbers for this quarter so they can cash out their stock options for two more years. So who's buying bank stocks?

RobertInTucson

I haven't escaped from reality. I have a daypass.

I agree - it's amazing how short their time horizons are. Must make the numbers now, never mind where the larger trend is leading (off a cliff in this case).

I think it works like this. Think videogames.

Banks are magic. Or more specifically, they get magic powerups from the central banks, otherwise known as free money if they run into problems.

But it has to be a "systemic" problem, not just an individual one.

An individual problem means "Foolish bank". A systemic problem---i.e. everybody was foolish at the same time---means that "for the sake of the economy and our financial system blah blah blah."

The not-quite-deadbeat-yet credit card holder is their most profitable one, not the prime holder. They all have strong incentive to go after this---knowing that if everybody blows up at once, they will be put back together.

If any other business goes under all at once---they get no free money.

Great compilation Stoneleigh

I have 2 lines of credit and a mortgage. The mortgage I was able to get a 10 year term and should be able to pay it off

when the term is up. But my 20,000 in 2 lines of credit I need to finance my very successful farm venture (:(). Citybank is

offering a .9% interest for 1 year on transfers to their

card for one year at which point your balance reverts to 21% or whatever.

I have considered taking up this offer as the interest

savings for the year are sizeable. The thought that strikes me is that although I am not expecting rates to rise significantly . When the tightening happens that I could be exposed to the banks altering the terms on my l.o.c.. Does this sound too apprehensive or plausable? What would you do to secure your debt. (i.e. the interest rate and term of loan other than wrapping it up into a new mortgage? Any advice would be appreciated.

I guess we are in for a hell of a ride. What would Grandpa advise?

Cheers

I just closed on a house in Sept. And I have been employed with the same employer for 16 years, my credit scores are in the 750 range, PLUS i put down 20% cash. However the lenders have tightened up their lending standards SO tight I was frustrated with them playing "20 questions". Esp. since I was putting up 20% downpayment.

This is my 4th house since being married, so it's not like it's my first home, yet the lenders treated me as though I had never owned a house before in my life. I am 45 yrs old. They were asking silly questions that had no merit on my borrowing power. I finally told them to stuff it where the sun don't shine! And then I found a lender who actually treated me with a bit of respect. Better rates, and closed in 2 weeks.

One thing I noticed, is that the lenders have gone 180 degrees from 5 yrs ago, now they want me to jump through hoops? I don't think so. I'll save the damn money in a few years and buy the damn property outright with cash. Then I don't need a lender.

Funny you mention this...the last 3 times I've used my credit card in downtown Kansas City, the cashiers asked me to show my driver's license...once to fill up with gas. I've lived here most of my life and this is the first time cashiers have ever done this....odd.

I don't know about Grandpa, but my #1 piece of advice is to carry no debt (although I know this is far easier said than done). I think we're facing deflation at some point in the not too distant future, and debts become a millstone round your neck very quickly under those circumstances. 2008 could be the Year of the Margin Call, where debts may be called in. Credit spreads (the premium over treasuries) should widen dramatically, making existing debt very expensive to service in any case. The Fed will (IMO) cut short term rates substantially (although even zero wouldn't low enough as the Japanese discovered), but I expect long term rates to decouple and rise considerably, reflecting a risk premium.

What kind of farm venture are you undertaking? Is it something depression proof? Peak oil proof? If so it might be worth taking the risk. If not then I wouldn't count on it remaining profitable for long enough to pay off the loans. Best of luck to you though, from one farmer to another.

Regarding margin calls and debts being called in...God...as long as my mortgage isn't called in all in one month, I should be OK. I could pay off the remainder of my mortgage, but would require me to liquidate my retirement. Imagine this scenario multiplied by a million or two.

Forgive a foolish question,

Can they do that? The whole margin call thing I understand. But, if you take out a 30 year fixed rate mortgage is it legal for the bank to demand it one lump sum payment? It's my understanding that the loan is a fixed contract; not subject to renegotiation or instant liquidation. If I am mistaken I would very much like to know.

Tim

Debts can be called in, even if they are not in arrears (although the circumstances may vary depending on where you live). Harold Wilson called in the bank loans in the UK many years ago, leaving people to scramble to make alternative arrangements. Fortunately most managed it, but my in-laws came very close to losing the home they had never missed a payment on. This time is likely to be much worse as credit is likely to be far less readily available and only then at a much higher cost in terms of interest.

Think of debt as an inverted pyramid, with the real value collateral at the narrow bottom and a huge volume of leveraged debt resting upon it - broader and broader as it goes up (representing broader and broader money derivatives, more and more removed through leverage from the underlying real value). The wide, flat top of the inverted pyramid represents wealth claims usually owned by institutions and the very wealthy, while the narrow apex rests on the shoulders of people like ordinary borrowers with real assets as collateral.

As the value of derivatives becomes increasingly questionable, those at the top are very likely to reach down the pyramid to its lower layers and make a grab for their perceived share of the underlying value, but of course there's nowhere near enough to go around, as the base of the inverted pyramid is much narrower. A rush to grab whatever can be grabbed before someone else does is unlikely to involve waiting for ordinary people to pay off their long term debts undisturbed.

It comes down to the distinction between currency inflation and credit expansion. Whereas a currency inflation (eg Weimar Germany or present day Zimbabwe) is a form of forced loss sharing, comparable to cutting a pie into smaller and smaller pieces, a credit expansion, such as we are experiencing, instead creates multiple mutually exclusive claims to the same pieces of pie. Everyone feels wealthy, without realizing that they all think they have a valid claim to the same piece of underlying value. A deflationary debt implosion happens when that realization finally dawns, and an asset grab ensues.

Did you read about the SIV bailout they are trying to put together over the weekend when no one is watching?

It's on Mish's site.

Eliyahu - one thing to watch out for is that if you transfer balances, and then charge to the card again after that, your payments will go towards your earlier debt - i.e. you will pay 21% immediately on any new debt and you can not retire the new debt without paying of the whole outstanding amount.

The only way to win is to transfer the balance, and then not charge to the card after that. Some cards require you to charge a minimum every month - watch out!

Francois.

i have bought two houses financed primarily with lines of credit. in one case i used the "free" money until the rate was set to rise and rolled most of it over. of course i paid as fast as i could. in another case, i started with an adjustable rate home equity loan and eventually transfered the balance to credit card lines of credit with a fixed rate (3.99% up to 6.99%) until paid off. i am paying as fast as i can.

so to answer your ? consider wheather you can pay off the balance in 1 year (or at least roll it over to another card). read the fine print. what is the transaction fee, what is the minimum monthly payment and how long will it take to have access to the money (typically 11 business days if deposited into a checking account).

if your payment is late, they can tack on a hefty fees and possibly cry defalt. send your payments in early. i send my payments as soon as i recieve the statement when i can.

you can build up your borrowing base and lower your rates over time by using your credit cards and lines of credit wisely.

So what would happen if Paul Volcker showed up tomorrow with orders to put an end to this credit crisis.

Could it be done? Or would the whole world implode?

Every credit expansion (ie rediscovery of the powers of leverage by a new generation) that there has ever been has deflated eventually, and there's no reason to think this one will be different. Trying to manage a graceful descent is simply beyond any man or any institution. Raising interest rates now would push the economy off a cliff, but lowering them won't help much either.

In a deflation, real interest rates are very high even if the nominal rate is virtually zero. In addition, lowering the cost of credit does little if the pool of willing borrowers and sellers has dried up (which has not happened yet, but I believe will happen). You can only try to force-feed an economy credit for so long before it chokes, which is why credit expansions are a self-limiting phenomenon.

Stoneleigh,

Concerning willing borrowers. I am familiar with the notion of pushing on a string. But, I am not well versed in the history of The Great Depression.

So if I were a willing borrower with a good plan in a depressionary environment could I get a loan. Say I had some profitable plan for producing biodiesel from algae, would the bank give me loan? Or would the bank clam up? In a credit contraction what conditions need to be met to receive credit?

Thanks in advance,

Tim

PS what time frame do you envision a contraction happening? And, can you convince Gail into doing a part 4? (Economic Impact of Peak Oil Part: alternate economic paradigms)

Stoneleigh

I am in an industry with no future; either from a peak oil POV or from a depression POV - or both. I have a defined-benefit pension plan. A few years ago, the pension plan became under-funded from both a going-concern and solvency basis due to a decline in long term interest rates. Anyone wanting to take a commuted value of his pension ( a 'present value' of the amount of money required today to fund a pension at retirement age), would have found a larger amount of money than he would have otherwise under higher long term interest rates.

My question to you (or anyone elso) is this: will Canada be (relatively) spared from an increase in long-term interest rates given the scenario of a credit implosion? I don't believe I will stay with my employer for much longer for a number of reasons but how closely do I need to watch these interest rates? Every year I stay employed increases my future theoretical pension and, thus, my commuted value - but only if it is greater than the erosion due to increasing interest rates. When you say 'In a deflation, real interest rates are very high even if the nominal rate is virtually zero', do you mean short term interest rates are very high or long term interest rates, or both? Is this the dreaded inverted yield curve.

So many questions...

Nowhere would be spared from higher interest rates as the financial system is global.

The real rate of interest is the nominal rate minus inflation (ie the increase in the money supply), hence during inflationary times, the real rate is lower than the nominal rate (even at time when the nominal rate is high, high inflation can mean the real rate is low, or even negative).

If inflation is negative (ie deflation) then the nominal rate minus negative inflation yields a larger, rather than a smaller number. Even if the nominal rate were essentially zero, negative inflation could yield a substantial real interest rate.

I would expect the nominal rate for short term debt to decrease essentially to zero over time, as it did after the dotcom crash. Longer term debt is a different story. Longer term rates could go up even as short-term rates on the safest debt instruments (ie short term treasuries) go down. In real terms under conditions of negative inflation, short term rates could be substantial, and long term rates would be going through the roof (ie an increase in rates against a backdrop of a contracting money supply means a very high real rates indeed - hence a credit crunch).

I wouldn't count on pension funds being there in several decades time. Pension funds have already been sold many worthless 'assets' in the form of high yield derivatives, which are often referred to as 'toxic waste'. It probably varies substantially between schemes, but it might be a good idea to find out what your fund has done with its assets.

I'm surprised you used the term 'decades' rather than years, like maybe 5-10. Look at United Airlines http://www.wsws.org/articles/2005/may2005/unit-m13.shtml