The Round-Up: June 19th 2007

Posted by Stoneleigh on June 19, 2007 - 8:02am in The Oil Drum: Canada

Royal Dutch Shell Inherits Explosive BC Conflict

When Royal Dutch Shell's directors took the reins of Shell Canada earlier this month, they inherited a brewing resource conflict in a remote corner of British Columbia that bears a striking resemblance to Royal Dutch's difficulties in other parts of the world.

The setting is a remote alpine basin southeast of Dease Lake, where the shared origin of the Nass, Stikine and Skeena Rivers gives the area its local name: the Sacred Headwaters. A stunning, expansive wilderness, it is the territory of the Tahltan people, who have hunted and trapped there for generations. It also happens to be underlain by one of British Columbia's largest potential coalbed methane deposits, to which Shell Canada -- and now Royal Dutch Shell -- holds drilling rights.

Customers pay more for B.C. energy plan: study

British Columbia's pursuit of energy independence is backfiring on BC Hydro customers who are being forced to buy expensive domestic electricity even when cheap import power is available as an alternative, according to a study paper obtained by The Vancouver Sun.

Economist Marvin Shaffer says the B.C. government's energy plan, launched in 2002, cost BC Hydro customers an additional $60 million last year -- and that will balloon to $160 million per year, equivalent to a 5.5-per-cent rate increase, by 2016.

Federal committee gets in standby power mode

The use of standby power has been identified as an emerging issue by the Group of Eight, the world's wealthiest nations.

Japan, Australia and California have started to regulate the amount of power a device can use in standby mode, Wilkins said.

Canada may follow suit, starting with consumer electronics in 2012, she added.

Ontario unveils greenhouse gas targets

The Ontario government plans to reduce the province's greenhouse gas emissions to six per cent below 1990 levels by 2014, Liberal Premier Dalton McGuinty announced Monday.

The province is counting on the planned shutdown of its coal-fired power plants that year and the use of more renewable energy to take it halfway to its target, McGuinty said at the annual Shared Air Summit in Toronto.

A new generation of reactors, for instance, may not be up and running until at least 2020, by which time catastrophic climate change will be upon us. Nor is the "safe" disposal heralded by Lunn likely to become a reality for a decade or more. Meanwhile, as some provinces retrofit old reactors and other governments contemplate new ones, the existing stockpile of 36,000 metric tonnes of deadly waste will continue to grow. It is now stored at nine nuclear facilities, most in Ontario, but also in New Brunswick, Quebec and Manitoba. It sits mostly in concrete containers in metal sheds at ground level.

Atlantica will harm Canadian economy says Maude Barlow

Maude Barlow, chairperson of the Council of Canadians, is speaking in Halifax today to warn Atlantic Canadians of the dangers of Atlantica – a proposal by the Atlantic Provinces Chamber of Commerce (APCC) and the Atlantic Institute for Market Studies (AIMS) to integrate the easternmost provinces with northeastern United States.

“This scheme will give the United States greater access to Canadian resources without benefiting Canadians,” says Barlow.

Local union representatives have stated that there is no advantage to the local economy when unrefined oil, gas and other materials are sent to the United States to be refined by American workers.

U.S. business interests will be central to this agenda given that just this week the Atlantic Provinces Chamber of Commerce appointed American business executive Jonathan Daniels as its chairman.

The Council of Canadians warns that Atlantica is part of a larger agenda led by corporations to integrate the economies of Canada, the United States and Mexico known as the Security and Prosperity Partnership of Canada (SPP). All three governments have confirmed that they will be using the SPP to further the Atlantica agenda.

There's money to be made if you are on the right side of the deal. The premium prices paid by the out-of-country raiders average 20 per cent and approach 40 per cent in the mining sector.

But the document also warned of a "growing concern" that mergers will "hollow out corporate Canada."

A recent Ipsos Reid poll found 56 per cent of Canadians surveyed felt foreign ownership is "definitely a problem" and something "we should be watching carefully."

When the provincial numbers are broken out, 60 per cent of Ontarians said takeovers were becoming an issue, while in Alberta -- where foreign companies have run the oil patch from the early days -- a surprising 51 per cent raised a red flag.

Sellers to need energy audits in U.K.

Energy audits similar to those in John Tory's election platform are part of a plan scheduled to go into effect Aug. 1 in England and Wales forcing home sellers to provide buyers with information packages.

The leader of the Ontario Progressive Conservatives has promised that, if elected, his party will require homeowners to provide an energy audit before selling a home.

Shell shelves oil-shale application to refine its research

The front-runner energy company in the effort to unlock oil shale in northwest Colorado has slowed down its research by withdrawing an application for a state mining permit.

Shell spokeswoman Jill Davis said the withdrawal of a permit on one of its three oil-shale research and demonstration leases was done for economic reasons: Costs for building an underground wall of frozen water to contain melted shale have "significantly escalated."

"We are being more cautious and more prudent," Davis said. "Because of the nature of research you have challenges. With that in mind, it is taking a little longer to build a freeze wall than we planned."

The nation's unquenchable thirst for gasoline -- and finding an alternative to what's been called our addiction to oil -- has produced an unintended consequence: The cost of the foods that fuel our bodies has jumped.

Beef prices are up. So are the costs of milk, cereal, eggs, chicken and pork.

And corn is getting the blame. President Bush's call for the nation to cure its addiction to oil stoked a growing demand for ethanol, which is mostly made from corn. Greater demand for corn has inflated prices from a historically stable $2 per bushel to about $4.

That means cattle ranchers have to pay more for animal feed that contains corn. Those costs are reflected in cattle prices, which have gone from about $82.50 per 100 pounds a year ago to $91.15 today.

The corn price increases flow like gravy down the food chain, to grocery stores and menus.

How curious that so many in the financial community should remain blissfully oblivious to live grenades scattered around the high-yield playing field. Amid all the asset bubbles that we've seen in recent years -- emerging markets in 1997, Internet and telecoms stocks in 2000, perhaps emerging markets or commercial real estate again today -- the current inflated pricing of high-yield loans will eventually earn quite an imposing tombstone in the graveyard of other great past manias....

....Like past bubbles, the current ahistorical performance of high-yield markets has led seers and prognosticators to proclaim yet another new paradigm, one in which (to their thinking) the likelihood of bankruptcy has diminished so much that lenders need not demand the same added yield over the Treasury or "risk-free" rate that they did in the past.....

....Perhaps the mispricing of high-yield debt has been exacerbated by the surge in derivatives, a generally useful lubricant of the financial markets. Banks hold far fewer loans these days; mostly, they resell them, often to hedge funds, which frequently layer on still more leverage, thereby exacerbating the risks.

Another popular destination is in new classes of securities where the loans have been resliced to (theoretically) tailor the risk to specific investor tastes. But in the case of subprime mortgages, this securitization process went awry, as buyers and rating agencies alike misunderstood the nature of the gamble inherent in certain instruments.

Assessing the likely consequences of a correction is more daunting than merely predicting its inevitability. The array of lenders with wounds to lick is likely to be far broader than we might imagine, a result of how widely our increasingly efficient capital markets have spread these loans. No one should be surprised to find his wallet lightened, whether out of retirement savings, an investment pool or even the earnings on their insurance policy.

The Foreclosure "Rescue" Racket

With the housing bust in full force and millions of homeowners facing foreclosure, the sketchier side of the real estate industry is coming into view. Although there are plenty of legitimate, mostly nonprofit, operations that help distressed homeowners, there's also a growing army of deceptive outfits that prey on and profit from this troubled group. While statistics on these schemes are hard to come by, law enforcement authorities confirm that foreclosure scams are rising sharplyso sharply that more than 10 states have recently enacted laws aimed at protecting homeowners.

Merrill reportedly seizes $400M from fund

Merrill Lynch has seized $400 million of its assets from a troubled hedge fund managed by Bear Stearns, the Wall Street Journal reported in its online edition.

Last week, Bear Stearns' (Charts, Fortune 500) High-Grade Structured Credit Strategies Enhanced Leveraged Fund scrambled to sell-off $4 billion in bonds backed by risky subprime mortgages to raise cash and assets for creditors and avoid liquidation, the Journal reported.

The report said the investment bank Merrill Lynch (Charts, Fortune 500) will auction the seized assets Monday at noon, in a move that could spur other lenders to seize funds.

When Does a Housing Slump Become a Bust?

Think about it for a moment. How far do housing prices have to fall before a slump becomes a bust? In the stock market, we have a pretty good idea what a crash is. Among stock market experts, there is a consensus that a 10 percent decline in a major index is a correction while a 20 percent decline is more significant: a crash or a bear market, depending on the time involved. For the macro economy, there is also agreed-upon terminology. For example, a recession means two consecutive quarters of declining gross domestic product.

But when it comes to declines in housing prices, there is no such framework. As experts debate whether were headed for a housing bust, youd think that we should at least be able to define it.

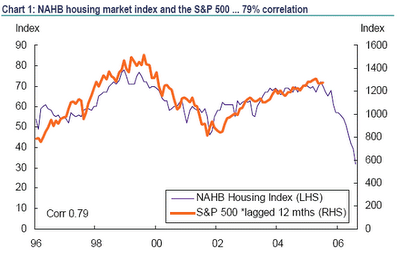

Home builders' confidence falls to 16-year low

The outlook for U.S. home building is the worst in 16 years, the National Association of Home Builders reported Monday. The builders' housing market index fell by two points to 28 in June, the lowest since February 1991.

The market probably won't turn around until next year, said David Seiders, chief economist for the builders. "We expect housing to exert a drag on economic growth during the balance of 2007."

America's codependence on housing

Now that housing is trending down what impact will this have on the overall economy? Weve heard countless times from housing pundits that a diverse economy like ours can withstand a real estate down turn. I point to the first graph above showing 29% of added jobs directly related to real estate. So let us do some math:

Housing down = loss of jobs in real estate (big portion of current economy) = BIG impact on economy

And besides this, 70% of Americans own their home. The wealth effect will be multiplied because losing a large portion of your equity does not bode well for spending. This may have gone on longer but the credit spigot is being turned off and we are witnessing early withdrawal symptoms in the public.

In the past job losses have led to recessions in real estate. This made sense because if you lost your job you werent mister sunshine ready to commit to a 30 year mortgage. However this time we are swimming in a different sewer system because jobs connected to real estate dominate a large portion of society; these jobs depended highly on real estate continuing to go up into perpetuity. As witnessed by the major decline in remittances to Mexico from construction workers, we are seeing that those in the trenches are feeling the pain quickly of a depreciating market.

Dwindling of Rare Metals Imperils Innovation

The world may soon find itself running out of rare metals used to form key components in high-tech devices from cell phones to semiconductors to solar panels, according to a report in New Scientist magazine.

In the respected British publication's audit of "Earth's natural wealth," David Cohen writes that reserves of elements from platinum (used not only in every pollution-reducing automobile catalytic converter in use today but also in fuel cells) to indium (used in flat-screen TVs and computer monitors) and tantalum (used in mobile phones) are "being used up at an alarming rate." These metals are chemical elements -- no synthetic replacement can be developed.

Even more common metals like zinc and copper are in increasingly short supply as they are used in rapidly developing economies like India and China. Over the last year thefts of copper from power lines and electrical substations have soared, as has the price of copper.

Nuclear doesn't have power to halt global warming

Nuclear power would only curb climate change by expanding worldwide at the rate it grew from 1981 to 1990, its busiest decade, and keep up that rate for half a century, a report said this week.

That would require adding on average 14 plants each year for the next 50 years, all the while building an average of 7.4 plants to replace those that will be retired, the report by environmental leaders, industry executives and academics said.

The inconvenient truth about the carbon offset industry

It is 20 months now since British Airways proudly announced a new scheme to deal with climate change: for the first time, passengers could offset their share of the carbon produced by any flight by paying for the same amount of carbon to be taken out of the atmosphere elsewhere. "I welcome warmly this move from BA," said the then environment minister, Elliot Morley.

And how much carbon has BA offset from the estimated 27m tonnes which its planes have fired into the air since that high-profile moment in September 2005? The answer is less than 3,000 tonnes, less than 0.01% of its emissions - substantially less than the carbon dispersed by a single day of its flights between London and New York. The scheme has been, as BA's company secretary, Alan Buchanan, put it to a House of Commons select committee earlier this year, "disappointing".

The project has failed, according to one well-placed BA executive, because one part of the company wanted to improve its image by going green while another part wanted to protect its image by saying nothing at all about the impact of air travel on global warming. The result was that the scheme was launched and then banished to a dark corner of BA's website.

That tension - between the demands of the planet and the imperatives of commerce - lies at the heart of the global response to climate change and, in particular, of carbon offsetting. The idea that we might cancel our own greenhouse gases by paying for projects that reduce the gases elsewhere was born in the early years of climate politics. It was adopted by the corporate lobby at the Kyoto summit in 1997 and has grown into a large but deeply troubled adolescent - confused, unpredictable, and difficult to trust.Separately from the "compliance market" on which nations and corporations trade carbon credits in an attempt to hit their Kyoto targets, there has grown a smaller, voluntary market in which airlines, banks, car makers and energy companies queue up to offset their carbon and to encourage their customers to do the same. A Guardian investigation suggests that many of the schemes on offer here are well-meaning but thoroughly unreliable.

Wildfire, Walleyes, and Wine - Latest predictions for life in North America's changing climate

In North America, the IPCC says, "moderate change in the early decades of the century is projected to increase aggregate yields of rain-fed agriculture by 5 to 20 percent but with important variability among regions." But the summary warns that results will vary by region, especially for crops that depend on fought-over water supplies.

That mixed message is for mid-and-higher latitudes only. The summary says that nearer the equator, rises of even 1 to 2C are expected to decrease crop productivity.

Lowest Food Supplies in 50 or 100 Years: Global Food Crisis Emerging

Today, the United States Department of Agriculture (USDA) released its first projections of world grain supply and demand for the coming crop year: 2007/08. USDA predicts supplies will plunge to a 53-day equivalent-their lowest level in the 47-year period for which data exists.

"The USDA projects global grain supplies will drop to their lowest levels on record. Further, it is likely that, outside of wartime, global grain supplies have not been this low in a century, perhaps longer," said NFU Director of Research Darrin Qualman.

Most important, 2007/08 will mark the seventh year out of the past eight in which global grain production has fallen short of demand. This consistent shortfall has cut supplies in half-down from a 115-day supply in 1999/00 to the current level of 53 days. "The world is consistently failing to produce as much grain as it uses," said Qualman. He continued: "The current low supply levels are not the result of a transient weather event or an isolated production problem: low supplies are the result of a persistent drawdown trend."

"In 1960, when the world population numbered only 3 billion, approximately 0.5 hectare of cropland per capita was available, the minimum area considered essential for the production of a diverse, healthy, nutritious diet of plant and animal products like that enjoyed widely in the United States and Europe."3

Increases in grain production brought about by irrigation and synthetic fertilizer-pesticide inputs have peaked and begun declining. As consumption surpasses production, the world's stocks of stored grain have been falling relative to each year's use. When supply can no longer meet demand, free market price competition may starve the poor.

Drought in Midwest Could Drive Grain Prices Higher

John Person, president of National Futures.com, told CNBC’s “Power Lunch” that drought could drive grain prices to record highs this summer.

About 90 million acres – the highest since 1944 – have been planted to corn this year, driven by increased demand for ethanol. Much of the new acreage has come from soybeans and decreased supply could drive the price of soybeans higher.

Parched Southeast Suffers Through 'Unprecedented' Drought

The choking dryness that's killing crops and turning streams into dusty trails across the Southeast is getting worse, with the government saying Thursday the nation's most extreme drought has expanded from Alabama into three neighboring states.

Previously contained in the northern half of Alabama, the area of most severe drought has grown like a brown ink blot to extend from eastern Mississippi across Alabama into southeastern Tennessee and northwestern Georgia.

Government meteorologists classify conditions in the region - roughly shaped like an oval on maps - as being worse even than those in southern Florida, where Lake Okeechobee is drying up, and the perennially dry West.

Overall, the entire Southeast is in at least a moderate drought, save for the southern tips of Florida and Louisiana, the northern reaches of North Carolina and Virginia and parts of Arkansas and West Virginia.

"Seeing the effects this early in the year shows we are in a really unprecedented situation," said John Christy, a professor at the University of Alabama in Huntsville and the state climatologist for Alabama.

The arid conditions mean the atmosphere will heat up more than normal as summer approaches, making triple-digit temperatures more common across the region, he said.

Ukraine farmers suffer in worst drought for century

The $20,000 (10,000 pound) investment made by four village families, the sowing and care in applying fertiliser, all appear to be in vain as the region endures its worst drought in more than a century.

"Some people from the city ask God not to send rain to keep things dry. We do the opposite. We keep asking: 'Give us rain!'" she said while collecting some withered shoots.

"If you don't want to have mercy on us, then have mercy on our children. We have had no more than 10 minutes of rain."

With a snap parliamentary election due in September, drought and the prospect of further, hugely unpopular rises in bread prices are high on the political agenda -- and surely the last thing Prime Minister Viktor Yanukovich wanted.

Bread prices have gone up in a number of regions. The increases are by no means uniform but in general prices have risen by up to 10 percent with the biggest increases in central and western Ukraine.

China plants trees to hold back desertification

Seven years ago, with the desert creeping south at the rate of 3 km (2 miles) a year and the dust storms getting worse, the Chinese government decided to act and the solution was typical of a country where the Great Wall stands as the ultimate grand project.

It began building a "Green Great Wall," a 700-km (435 mile) barrier of trees and enclosed grassland which will stretch across Inner Mongolia, Hebei and Shanxi provinces by 2010.

Deng's entire village -- whose 478 residents are all Han Chinese -- were relocated by the government to make room for the green barrier which Beijing hopes will hold back the desert.

"In our hearts we were reluctant to move because we were nostalgic. It's not easy to leave the place I was born and grew up," said the 50-year-old, standing in the living room of the four-room brick house where he now lives.

"But it was getting very hard to earn a living. The government came again and again over half a year to try and convince us," he told reporters on a government-organized trip for foreign media.

Desertification is no longer just a problem for China and the thick yellow dust of the sand storms now reaches as far as South Korea, Japan and at times even the United States and Canada.

The award of the 2008 Olympics to Beijing in 2001 gave further impetus to the project, officials said, even if dust storms never hit the capital in August when the Games will be held.

North China drought highlights need for water diversion scheme

A rare forest fire on the outskirts of Beijing has renewed concerns about the capital's crippling water shortages as an enduring drought deepens and temperatures hit record highs.

The fire swept through a stand of pine trees in western Beijing early last month during the hottest May in northern China in decades, torching a forest that was planted to restore green to the city's dry barren mountains.

"We had no water here to fight the fire, we haven't had any rain all year so the whole forest was dry," said a worker surnamed Lin at the Malan forest plantation in Beijing's Mentougou district.

"The authorities called in more than 1,000 soldiers who used fire extinguishers and fire retardant bombs to control the blaze.

"We were lucky the winds were blowing in the right direction, otherwise it would have destroyed more forest."

The blaze occurred only several kilometres (miles) from the dry bed of a major tributary to Beijing's Yongding river, which has itself been reduced to a trickle as it descends from the nearly empty Guanting reservoir, a major supplier of water to the capital.

Northern China has been fighting a drought that has lasted nearly 10 years, sapping rivers of water and leaving reservoirs at near record lows.

China Slows Coal-Liquids, Ethanol Push on Water Fear

Beijing is trying to slow the push on water-intensive alternative energy on mounting signs that China might face a serious water shortage in the future.

This may stymie the second-largest energy consumer's plans to turn its huge coal reserves and agricultural land into transport fuel, and lead it to continue relying on greater imports to fuel its booming economy, a bullish factor for global oil markets.

Australia Turns to Desalination Amid Water Shortage

Turnbull calls Perth the "canary in the climate change coalmine," a city scrambling to find other sources of water for a growing population. The city is riding a wave of economic prosperity fueled by China's insatiable appetite for Western Australia's natural resources.

Perth, with a population of about 1.7 million, is growing 3 percent a year about 750 families a week move to the city, says Gary Crisp of the Western Australia Water Corp.

"We need more water," he says. "We're absolutely running out."

The Water Corp. turned to the nearby Indian Ocean to help solve the problem.

The Kwinana Desalination Plant south of the city opened two months ago. The facility, the first of its kind in Australia, covers just a few acres in an industrial park next to the ocean.

Australia farmers feel drought strain

But people in the city are not so worried. They turn on the tap and there's water coming. People in the countryside see things differently.

I don't know if this is a sustainable city. I don't think the politicians know either. I have been saying something was afoot for a while but people thought I was a strange "greenie". People will not alter their lifestyle until they are forced to. And I think the time has come.

There was a river once in New South Wales called the Lochlan River. I remember that you needed a barge to cross it. Now it is no longer there. It has disappeared.

Bangladesh Faces "Unusual" Monsoon, Fears Flooding

Flood-prone Bangladesh is bracing for an unusual and unpredictable monsoon this year, with environment experts and officials blaming global warming, melting Himalayan glaciers, silted rivers and unplanned roads.

Climate change behind Darfur killing

UN Secretary General Ban Ki-moon said that the slaughter in Darfur was triggered by global climate change and that more such conflicts may be on the horizon, in an article published Saturday.

"The Darfur conflict began as an ecological crisis, arising at least in part from climate change," Ban said in a Washington Post opinion column.

UN statistics showed that rainfall declined some 40 percent over the past two decades, he said, as a rise in Indian Ocean temperatures disrupted monsoons.

"This suggests that the drying of sub-Saharan Africa derives, to some degree, from man-made global warming," the South Korean diplomat wrote.

"It is no accident that the violence in Darfur erupted during the drought," Ban said in the Washington daily.

When Darfur's land was rich, he said, black farmers welcomed Arab herders and shared their water, he said.

With the drought, however, farmers fenced in their land to prevent overgrazing."For the first time in memory, there was no longer enough food and water for all. Fighting broke out," he said.

Zimbabwe: Slavery Has Been 'Legalised' Say Rights Advocates

The farm Bauleni works on was taken over by a senior government official of the ruling ZANU-PF party in 2001. He is still living in a shack and the family survives on two meals of maizemeal porridge per day, sometimes supplemented by fish caught in the farm's dams or streams by his children.

Bauleni said his employer had told them he would not adopt the May wage increases because of the drought. "But that is a lie. His crops are irrigated and the dam is half full, despite the poor rains. Besides, we have helped him get high maize and wheat yields, and there is evidence that he is getting lots of money from our sweat, since he has bought a new car and two tractors."

On a nearby farm, Joyce Muzondo, 30 and a single mother, said they worked long hours but were not paid overtime and sometimes went for months without receiving any wages.

The workers got no sick or maternity leave and many were leaving farms in search of better paying activities, such as illegal gold panning, beer brewing and prostitution.

Samual Rundori, a tobacco and maize farmer in Mashonaland Central Province, who was given 400 acres by the government in 2003, admitted that some new farmers were treating their workers like captives, but defended the low wages he was giving his employees.

Bigfoot science

Read that earlier, unbelievable nonsense. Mr. Corcoran gets paid too, I'm guessing. But not enough to actually read about the subject he writes about. I bet he spent less than 10 minutes on it, and had his article right there. He thinks it's smartness, we know it's just a short attention span.

But how Kellogg cereals are connected to ecological footprints, he fails to explain. I think people want low-fat breakfast not for their footprint, or even their feet, but because they think they are (2) fat. What do I know, I am not, and that's perhaps because I don't eat Kellogg.

Corcoran: fatty boy? Hmm.... there's a bowel movement issue there, for sure.

Kellog promotes cereals with less fat, sugar and calories. To children!! And Terence doesn't like that (now we know he was a fat kid):

Ok, now it gets ridicullous, what proof is there that cereals with more fat, sugar and calories are "healthier"?

But in the meantime I still don't know why low-fat cereals would have a lower footprint.

And he does us one better: he knows more about the best way to do business at Kellogg and Air Canada than the companies do themselves. That they simply do what sells best and most, a pretty established business idea, seems to escape Corcoran, or perhaps merely irritate his lofty neurons. Or his burning nervous sphincter, which probably bugs him every time he reads the word ECO. And every time he eats breakfast.

Kellogg, don't listen to what your consumers want, listen to Terence. He needs attention, badly. I think it's a sugar thing.

Ontario offers carmakers cash to go green

Never read more empty words in all my life, or more blatant lies, but we all develop resistance at some point, don't we? Soothing numbness.

EnCana cuts gas output projections

Thanks for the contributions - much appreciated.

http://realtimenews.slb.com/news/story.cfm?storyid=642821

This seems like a good summation of the risk, cost and guesswork involved in the last oil frontier.

I wish we could afford the life we are living.